Analysis of Copper Mining Enterprises' Growth Sustainability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data and industry research, I will systematically analyze the growth sustainability of copper mining enterprises from three dimensions:

According to brokerage API data and industry research, the global copper market is in a

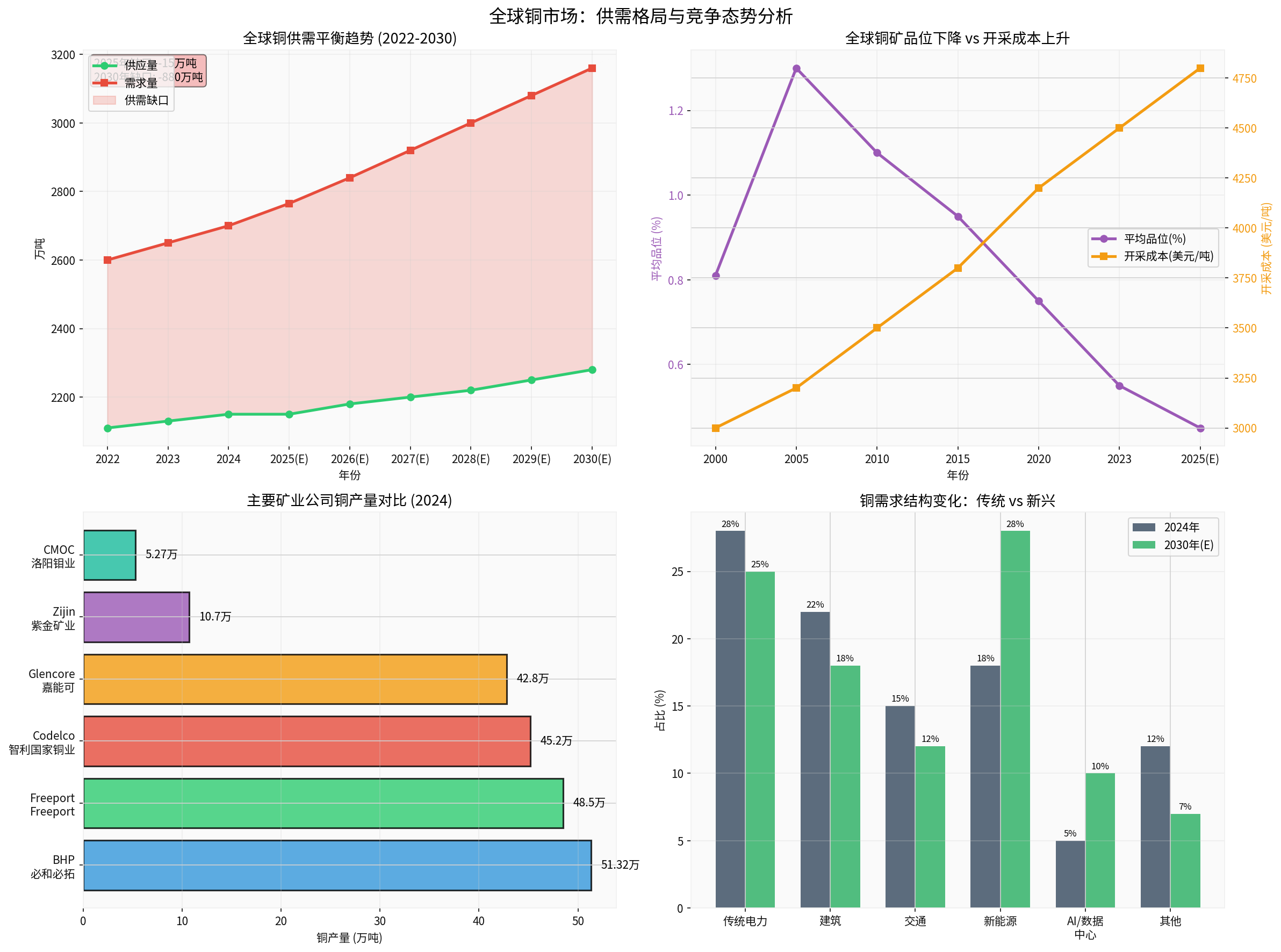

- 2025-2026 Supply-Demand Balance: 2025 supply 21.5 million tons vs demand 27.65 million tons,gap of -150,000 tons; 2026 gap expands to-400,000 tons[1]

- Long-Term Gap Forecast: By 2030, multiple forecasts indicate the global copper gap will be between2-8.9 million tons, with supply-demand conflicts continuing to intensify [2]

- Decline in Copper Mine Production: Global copper mine production is expected todrop by 0.12%in 2025, with Q3 production of the top 20 copper mines falling 6.5% YoY [1]

- Sharp Decline in Ore Grade: The average grade of global copper mines has dropped from0.81%in 2000 to0.45%in 2023, a decrease of 44% [2]

- Significant Cost Increase: Mining costs have risen by80%over the past decade, and new mines need copper prices to stay above$10,500 per tonto be profitable [2]

- Severe Underinvestment: BHP estimates that developing new copper mines over the next decade will require$250 billion, but current committed funds are less than 30% [1]

- Long Development Cycle: It takes15-24 yearsfrom discovery to production for a new mine, resulting in extremely low supply elasticity [2]

- New Energy Revolution: An electric vehicle uses80-83 kgof copper, 4 times that of a traditional car; each onshore wind turbine requires 4 tons, while offshore wind turbines require up to12-16 tons[1]

- AI Data Centers: AI computing centers have become a new growth point for copper demand; clean energy accounts for30%of global copper demand in 2024 and will rise to41%by 2030 [1]

- China Grid Investment: Over3 trillion yuanduring the “14th Five-Year Plan” period, with ultra-high voltage lines consuming 8 tons of copper per kilometer [1]

According to the latest industry data, international mining giants are indeed actively expanding production:

- BHP Group (BHP): Q1 2025 copper production513,200 tons, ranking first globally; plans to continue increasing efforts through mergers and acquisitions and expansion [3]

- Freeport-McMoRan: 2024 production485,000 tons, with the Grasberg expansion project in Indonesia underway

- Rio Tinto: Copper production is expected to grow by 30% in 2025, with the Oyu Tolgoi underground mine project fully operational

- Glencore: 2024 copper production428,000 tons, with the Antapaccay mine expansion plan in Peru underway

According to brokerage API data and industry analysis, the core competitive advantages of Zijin Mining Group and CMOC Group include:

- Global Resource Leader: Global copper resource reserves110 million tons, 2024 mined copper1.07 million tons[4]

- Cost Control Advantage: The comprehensive cost of the Kamoa Copper Mine is approximately$1.8 per pound, far lower than the industry average of $2.5 per pound [2]

- Counter-Cyclical M&A Capability: Added2.049 million tonsof copper resources,88.8 tonsof gold, and834,000 tonsof lithium in H1 2025 [5]

- High-Grade Mines: The grade of the Kamoa-Kakula Copper Mine is4.3-6%, 8-12 times the industry average of 0.5% [5]

- Capacity Explosion Period: Target mined copper of1.5-1.6 million tonsby 2028, an increase of 23-31% compared to 2025 [5]

- African Cobalt-Copper Leader: TFM and Kisanfu copper-cobalt mines in the Democratic Republic of Congo (DRC), with equity copper resource reserves34.31 million tons[4]

- Rapid Production Growth: Net profit attributable to shareholders in the first three quarters was14.28 billion yuan, a YoY increase of72.61%[6]

- Accelerated Strategic Transformation: Shifting from “cobalt-copper dual focus” to “copper-gold dual focus”, investing7 billion yuanthis year to expand into South American gold mines [6]

- Cost Advantage: Zijin Mining’s Kamoa cost is only $1.8 per pound, far below the global average

- High-Grade Resources: The ore grades of mines controlled by Chinese enterprises are generally higher than the industry average

- First-Mover Advantage in African Layout: CMOC Group and Zijin Mining control approximately30% of copper productionand50% of cobalt productionin the DRC [7]

- Counter-Cyclical M&A Capability: Chinese enterprises are more willing to conduct mergers and acquisitions during industry downturns

- Limited New Supply: The expansion of international giants mainly focuses on technical transformation of existing mines,new supply is limited

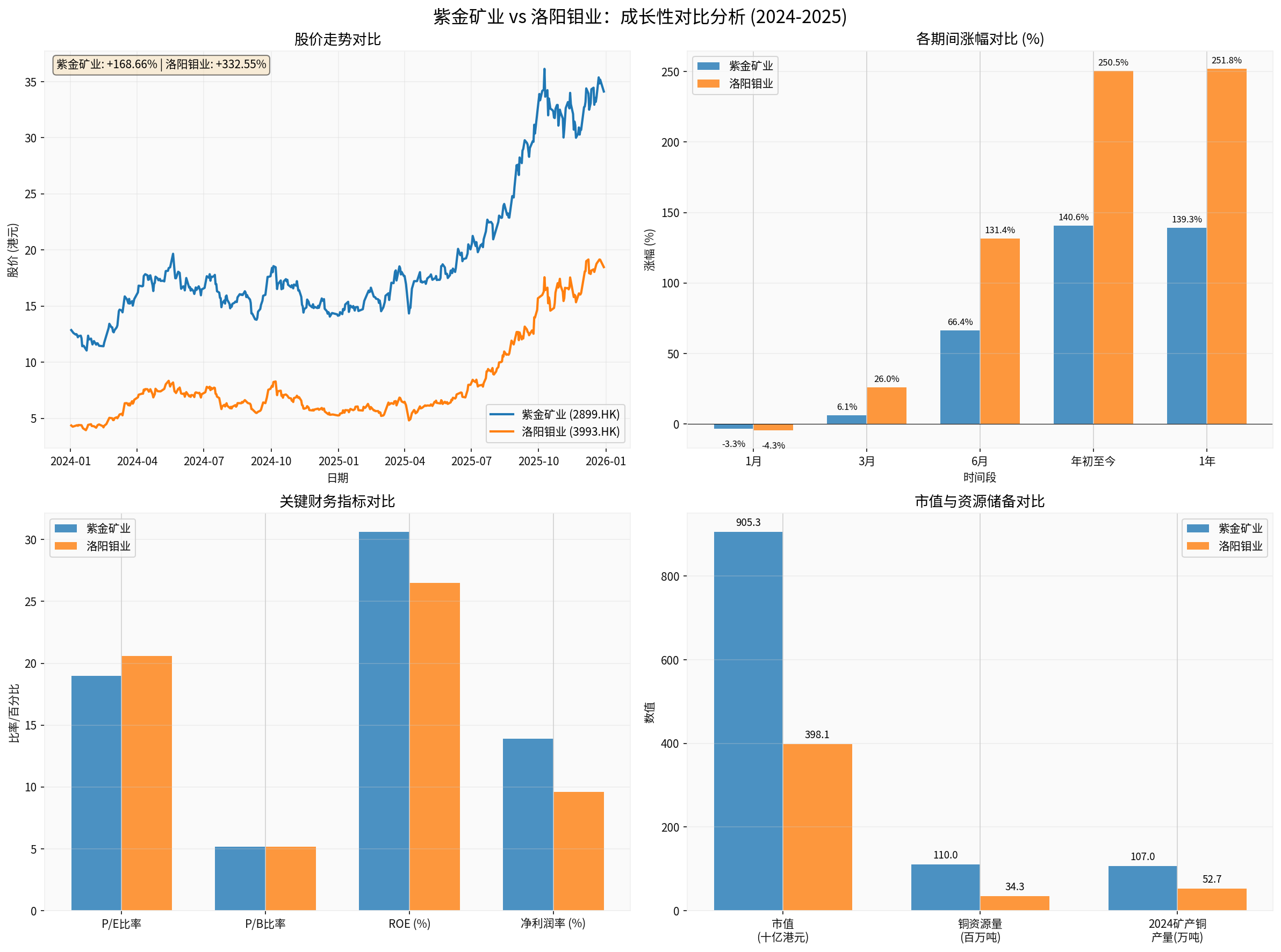

- Faster Growth of Chinese Enterprises: Zijin Mining’s YTD increase is+140.62%, CMOC Group’s is+250.47%, far exceeding international giants [0]

- Sustainable Cost Advantage: The cost advantage of high-grade mines (Kamoa 4.3%+) is difficult to surpass in the short term

- Continuous Expansion of Supply-Demand Gap: By 2030, the gap will reach 2-8.9 million tons,all participants will benefit[2]

- Capacity Release of Chinese Enterprises: Zijin Mining’s target copper production in 2028 is 1.5-1.6 million tons,a 50% increase from current levels[5]

- Resource Control in Africa: Chinese enterprises control 30% of copper production and 50% of cobalt production in Africa,significant geopolitical advantages[7]

- Accelerated M&A by International Giants: If BHP’s acquisition of Anglo American succeeds, it will change the global competitive landscape

- Geopolitical Risks: Rising resource nationalism in Africa may affect the asset safety of Chinese enterprises

- Technology Substitution Risk: “Replacing copper with aluminum” is accelerating in the air conditioning and cable sectors [8]

According to brokerage API data, the financial health of both companies is excellent [0]:

- Zijin Mining Group: ROE30.60%, net profit margin13.91%, market capitalization90.5 billion HKD

- CMOC Group: ROE26.48%, net profit margin9.59%, market capitalization39.8 billion HKD

- Supply-Demand Gap: Continues to expand from 2025 to 2030, copper prices remain high long-term

- Cost Advantage: Zijin Mining’s Kamoa cost is $1.8 per pound, with a wide moat

- Capacity Release: Zijin’s 2028 target is 1.5-1.6 million tons; CMOC Group’s cobalt and copper production leads globally

- Resource Monopoly: Control of 30% copper production and 50% cobalt production in Africa is difficult to break

- Integration of International Giants: Giants like BHP quickly increase production through mergers and acquisitions

- Geopolitical Risks: Policy changes in Africa affect asset safety

- Demand Fluctuations: China’s new energy policies, global economic recession risks

- Copper Price Uptrend Cycle: Huge performance elasticity, benefiting from both volume and price growth

- Copper Price Downtrend Cycle: Cost advantage becomes a moat, relatively resilient to declines

- Long-Term Dimension: High certainty of new energy and AI demand; copper’s strategic value upgraded [8]

- Zijin Mining Group: PE 19x, ROE 30.6%,has allocation value

- CMOC Group: PE 20.57x, ROE 26.48%,better growth potential

- The underlying logic of strong demand + large reservesstill holds, and is stronger than expected

- International giants’ increased efforts will not changeChinese enterprises’ competitive advantages; instead, they confirm copper’s strategic value

- The competitive landscape will evolve, but Chinese enterprises will remain leading with cost, resource, and location advantages

- Investment logic needs to be upgraded: From “pure growth stocks” to “cyclical growth stocks”, focusing on both volume growth and copper price cycles

Chart1 shows a comprehensive comparison of stock price trends, periodical increases, key financial indicators, market capitalization, and resource reserves between Zijin Mining Group and CMOC Group from 2024 to 2025. It can be seen from the chart that CMOC Group’s stock price increase (YTD +250.47%) is significantly higher than Zijin Mining Group’s (+140.62%), but Zijin Mining Group’s copper resource reserves (110 million tons) far exceed CMOC Group’s (34.31 million tons).

Chart2 shows the global copper market’s supply-demand trends, the relationship between declining ore grades and rising costs, a comparison of copper production among major mining companies, and changes in copper demand structure. It can be seen from the chart that the global copper supply-demand gap will continue to expand from 2025 to 2030; declining ore grades lead to significant increases in mining costs; new energy and AI data centers will become the main growth points for copper demand in the future.

[0] Jinling API Data - Company Overview, Stock Price Data, Financial Indicators of Zijin Mining Group (2899.HK) and CMOC Group (3993.HK)

[1] Sina Finance - “Brief Analysis of Bullish International Copper Prices: Supply Chain Reconstruction, Technological Revolution, and New Price Cycle” (https://finance.sina.com.cn/roll/2025-11-30/doc-infzffqx4269374.shtml)

[2] Investing.com - “Copper Prices Surge, Is the Opportunity Back Again?” (https://cn.investing.com/analysis/article-200496267)

[3] Forbes - “Copper Plot To Thicken At Three Meetings Over The Next Six Days” (https://www.forbes.com/sites/timtreadgold/2025/12/02/copper-plot-to-thicken-at-three-meetings-over-the-next-six-days/)

[4] 36Kr - “Copper Prices Soar, Supply-Demand Resonance Opens Long Bull Market?” (https://m.36kr.com/p/3612166609318408)

[5] Caifuhao - “Zijin Mining Group’s Core Expansion Plan 2025-2028” (https://caifuhao.eastmoney.com/news/20251224100622315257300)

[6] Sina Finance - “A-Share 380 Billion Mining Giant Surges, Investing 7 Billion Yuan to Expand into South American Gold Mines” (https://finance.sina.com.cn/stock/s/2025-12-15/doc-inhawtsc4010247.shtml)

[7] Sina Finance - “Resource Dispute Erupts in Africa, China-US Rivalry Has Reached a Conclusion” (https://finance.sina.com.cn/roll/2025-11-30/doc-infzfwnn4454873.shtml)

[8] Securities Times - “‘Dr. Copper’ on the Wind” (https://www.stcn.com/article/detail/3558833.html)

[9] 21st Century Business Herald - “Betting on the ‘New Oil’ of the AI Era? Resource Transformation of Mining Service Leader JCHX” (https://www.21jingji.com/article/20251223/herald/b4afa8910ccbf24b6abdf8bff1f64b82.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.