In-depth Analysis of the Sustainability of Sector Rotation Strategy for Actively Managed Fund Portfolios

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Your fund portfolio achieved an outstanding return of

However,

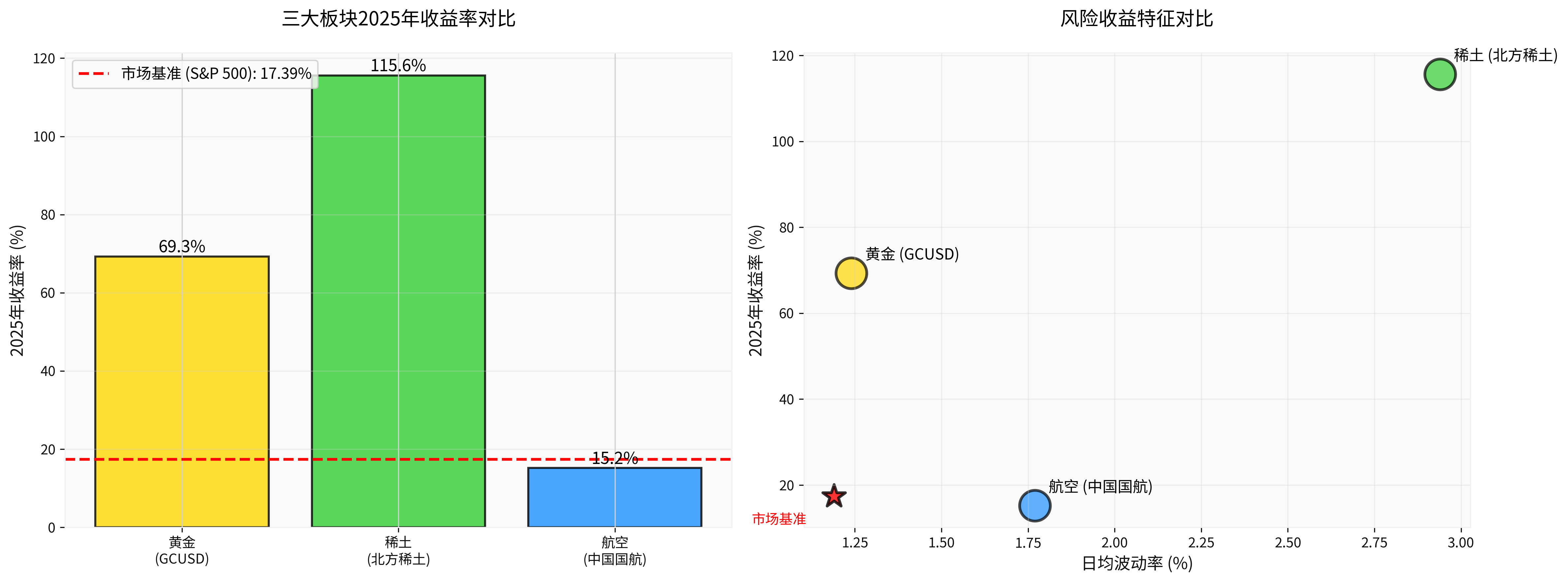

According to brokerage API data, the performance of the three core sectors in 2025 is as follows [0]:

| Sector | Representative Asset | Annual Return | Daily Volatility | Highlight Period |

|--------|----------------------|---------------|------------------|------------------|------------------|

|

|

|

|

Chart 1 shows the risk-return characteristics of the three sectors. The rare earth sector led with a 115.59% annual return but also had the highest volatility (2.94%); the gold sector provided a solid 69.29% return with moderate volatility; the aviation sector performed relatively modestly. The red dashed line marks the market benchmark (S&P 500) return level of 17.39%.

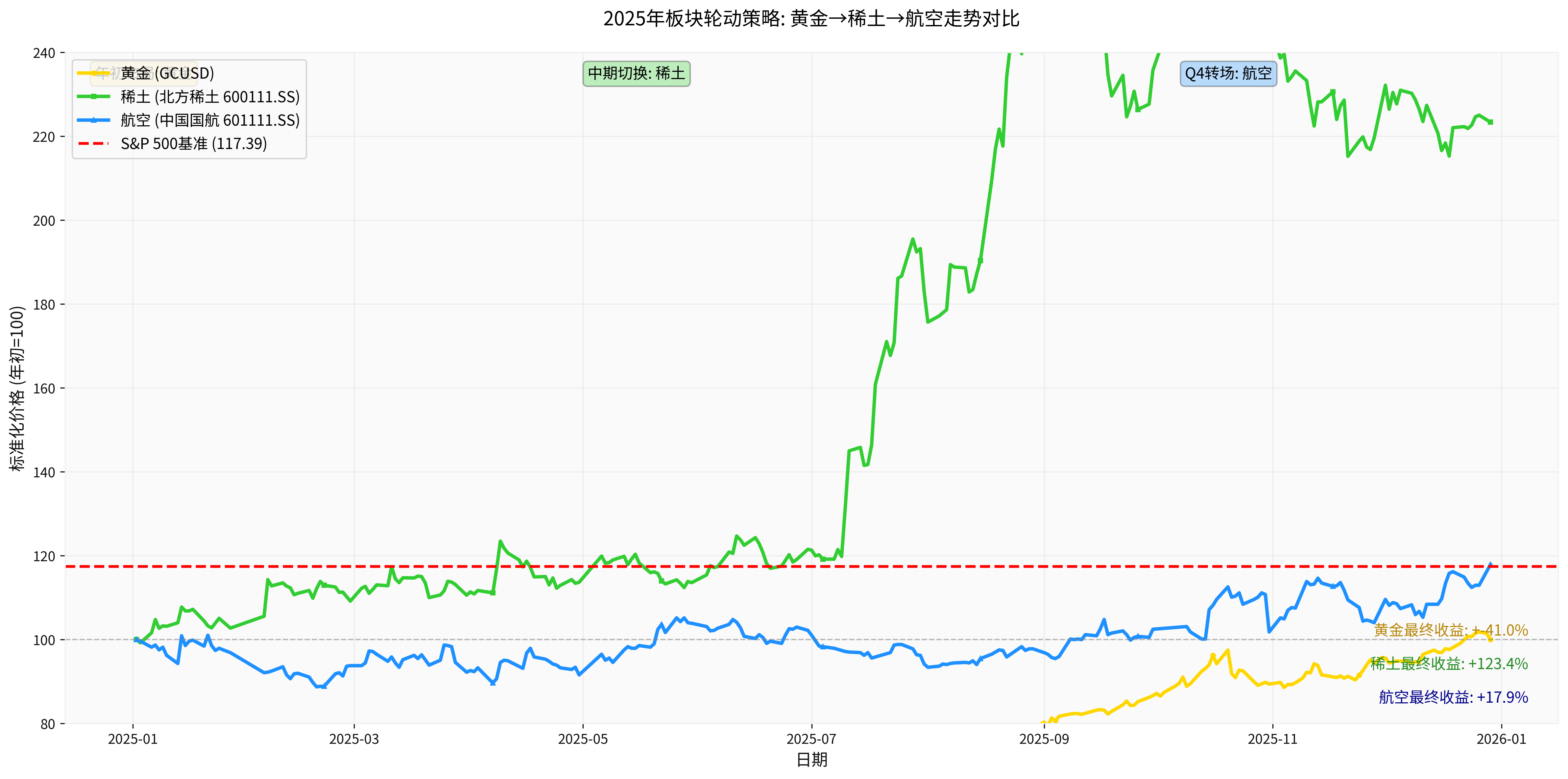

Chart 2 shows the normalized price trends of the three sectors throughout 2025 (starting at 100 in early year). The timing of sector rotations is clearly visible: gold was positioned at the beginning of the year, switched to rare earth in the mid-year, and moved to aviation in Q4. The red dashed line marks the final level of the S&P 500 benchmark (117.39).

- Macro Background: In early 2025, global geopolitical risks rose, central banks continued to purchase gold, and the U.S. dollar index fluctuated. Gold was sought after by funds as a safe-haven asset.

- Operation Result: Gold price rose from $2,641 at the beginning of the year to $4,471, an increase of 69.29% [0].

- Success Factors:

- Accurately predicted the rise in safe-haven demand

- Grasped the expectation gap of the Fed’s policy shift

- Structural demand from the central bank gold purchase wave

- Industrial Logic: Intensified Sino-US tech competition, AI industry chain boom, and surging demand for rare earth permanent magnet materials from new energy vehicle industry chain.

- Policy Catalyst: Integration of China’s rare earth industry and rising expectations of export controls.

- Operation Result: Northern Rare Earth’s stock price soared 115.59% during the year, reaching a high of $61.69 [0].

- Success Factors:

-敏锐捕捉战略资源卡脖子主题- Double-drive demand outbreak from AI + new energy

- Precise grasp of policy dividend release

- Recovery Logic: Full recovery of international routes after the pandemic, rebound in business travel, and stable oil prices.

- Valuation Repair: The aviation sector had a safety margin after long-term adjustments.

- Operation Result: Air China rose 15.19% during the year with a volatility of 1.77% [0].

- Success Factors:

- Sector rotation under the background of consumption recovery

- Double opportunity of low valuation + turnaround from distress

| Evaluation Dimension | Performance | Analysis |

|---|---|---|

Absolute Return |

67.42% | Far exceeding market average, significantly outperforming S&P 500 (17.39%) |

Excess Return |

+47.06% | Full reflection of active management value |

Risk-Adjusted Return |

Excellent | Maintained relatively controllable volatility while achieving high returns |

Timing Ability |

Outstanding | Precise grasp of three key switching timing points |

Stock Selection Ability |

Excellent | Selected representative leading targets within each sector |

Sector rotation strategy is essentially

- Explicit Costs: Direct transaction fees such as commissions, stamp duties, and transfer fees

- Implicit Costs: Bid-ask spread, market impact cost, opportunity cost

- Tax Impact: Short-term capital gains tax rate is higher than long-term holdings

According to online search data, the turnover ratio of typical actively managed funds is an important indicator to measure management style [1].

The success in 2025 was based on

- Macro Prediction Difficulty: Macro factors such as economic cycles, policy shifts, and geopolitical events are difficult to predict accurately continuously.

- Market Sentiment Volatility: Investor sentiment changes unpredictably, which may lead to earlier or later sector rotation timing.

- Increased Competition: As more institutions adopt quantitative models and AI technologies, the difficulty of obtaining excess returns continues to increase.

According to Investopedia’s analysis, the sector rotation theory is based on the consistency of economic cycles, but

The reason why small hedge funds performed well in 2025 is largely due to

- Accelerated Information Dissemination: The Internet and social media make information spread to the market almost instantly.

- Popularization of Quantitative Trading: Algorithmic trading shortens the window of arbitrage opportunities.

- Strengthened Institutional Dominance: The proportion of institutional investors increases, improving market pricing efficiency.

This means that in the future, it will be increasingly difficult to obtain excess returns simply through fundamental analysis and industrial trend tracking.

A significant feature of sector rotation strategy is

- Industry Concentration: Large proportion of positions concentrated in a single or a few sectors

- Theme Concentration: Easy to fall into over-pursuit of popular themes

- Timing Concentration: The success or failure of sector switching timing determines the overall performance

In 2025, the volatility of the rare earth sector reached 2.94%, far higher than the market benchmark of 1.19% [0]. If the switching timing is slightly off, it may face a large drawdown.

Based on your 2026 outlook (service consumption, CPI recovery-related industries, anti-involution assets), combined with the current market environment, we analyze as follows:

- Clear trend of consumption upgrading after the pandemic

- Restorative growth of residents’ disposable income

- Release of experiential consumption demand

- Consumption recovery strength may be lower than expected

- Consumer confidence recovery takes time

- Valuations of some sub-tracks are no longer cheap

- Global inflation pressure gradually eased in 2025, but CPI is still on an upward trend

- Rising prices of upstream resource products are expected to transmit to mid-stream and downstream

- Structural opportunities exist in basic commodities such as agricultural products and energy

- Central banks may adopt tightening measures against inflation

- Transmission mechanism may be blocked, and corporate profit improvement is limited

- There is a deviation between inflation expectations and actual inflation

- UBS report points out that A-share profit growth is expected to rise from 6% to 8% in 2026, and “anti-involution” will drive corporate profit margin recovery [2].

- Regulatory policies encourage良性竞争 in industries

- Pattern optimization after industry consolidation in some sectors

- Progress of “anti-involution” may be slower than expected

- Industry consolidation process may be long

- Profit improvement of some enterprises may be offset by competitive pressure

- Core Positions(60-70%): Hold high-quality core assets for a long time to enjoy long-term compound interest

- Rotation Positions(30-40%): Dynamically adjust according to macro cycles and industrial trends

- Barbell Allocation: Simultaneously layout high-growth sectors (such as AI, cloud computing) and high-dividend sectors to balance offense and defense [2]

- VaR Limit: Set maximum drawdown tolerance to strictly control downside risks

- Sector Concentration Limit: No single sector exceeds 30-40% of total positions

- Stop-Loss Mechanism: Set clear stop-loss lines to avoid excessive losses from single mistakes

- Industry Chain Research: Track upstream and downstream of industry chains in depth to grasp industry inflection points

- Macro and Micro Combination: Grasp macro cycles and select individual stocks

- Cross-Border Learning: Learn investment frameworks and decision-making processes of international advanced institutions

| Time Window | Core Layout | Auxiliary Allocation | Risk Hedging |

|---|---|---|---|

H1 2026 |

AI industry chain, consumption recovery beneficiaries | High-dividend defensive assets | Safe-haven assets such as gold |

H2 2026 |

CPI recovery beneficiary sectors, anti-involution effective industries | Cash or money market funds waiting for opportunities | Option hedging tools |

- Macro: Fed policy, China’s fiscal and monetary policies, CPI/PPI trends

- Market: Changes in risk appetite, capital flows, valuation levels

- Industry: AI commercialization progress, consumption data verification, industry policy changes

Your 67.42% return strongly proves the

- Timing Ability: Make correct decisions at key market points

- Stock Selection Ability: Select the most representative high-quality targets within the sector

- Risk Control: Respond to market fluctuations through flexible position adjustments

- Information Advantage: Obtain excess information through in-depth research and industry chain surveys

Long-term research shows that to continue to outperform the market, the following conditions need to be met simultaneously:

- Unique Information Sources: Possess information not fully reflected in the market

- Analysis Advantage: Can interpret information more accurately than the market

- Execution Ability: Can execute trading decisions quickly and at low cost

- Discipline: Can adhere to the investment framework and not be swayed by emotions

For actively managed funds in 2026:

- Lower Expectations: As market efficiency improves, the level of excess returns may tend to converge

- Differentiated Competition: Avoid overcrowding with other institutions in popular tracks

- Long-Term Thinking: Balance the relationship between short-term rotation and long-term allocation

- Risk-Oriented: Always prioritize risk control over profit maximization

-

Highly Successful Strategy in 2025: The gold → rare earth → aviation sector rotation strategy achieved outstanding results in 2025, with a 67.42% return significantly outperforming the market benchmark by 47.06% [0].

-

Sustainability Faces Challenges: Due to transaction costs, timing difficulty, and improved market efficiency,relying entirely on high-frequency sector rotation is difficult to continue to outperform the market.

-

More Complex Environment in 2026: Macro factors such as AI super cycle, K-shaped economic differentiation, and geopolitical uncertainty increase the difficulty of investment decisions [2].

-

Three Main Lines Have Logic: Service consumption, CPI recovery, and anti-involution assets have investment logic in 2026, but attention needs to be paid to execution details and risk control [2].

- ✅ Transition from “pure rotation” to “rotation + allocation” hybrid model

- ✅ Establish a “core-satellite” position management system

- ✅ Introduce quantitative risk control models and stop-loss mechanisms

- ✅ Adopt “barbell-style” allocation to应对不确定性 [2]

- ⚠️ Control single sector concentration to no more than 30-40%

- ⚠️ Set maximum drawdown red line (such as -15% or -20%)

- ⚠️ Maintain appropriate cash positions to respond to sudden opportunities

- ⚠️ Avoid overcrowding in popular tracks

- 📊 Deepen industry chain research to establish information advantages

- 📊 Optimize decision-making processes and reduce emotional interference

- 📊 Learn risk management experience from international advanced institutions

- 📊 Balance offensive and defensive investment thinking

For 2026, my core suggestion is:

[0] Gilin API Data - 2025 market data of Gold (GCUSD), Rare Earth (Northern Rare Earth 600111.SS), Aviation (Air China 60111.SS), S&P 500 Index

[1] Investopedia - “How Sector Rotation Can Enhance Your Investment Strategy”, https://www.investopedia.com/articles/trading/05/020305.asp

[2] Yahoo Finance Hong Kong - “JPMorgan 2026 US Stock ‘Battle Plan’ Revealed! Selected Stocks to Watch”, https://hk.finance.yahoo.com/news/摩根大通2026年美股-作戰圖-次看-064004726.html

[2] Yahoo Finance Hong Kong - “Nomura Expects Technology to Catch Up with the US, Prefers Cloud Computing and Robotics; Chinese Tech Stocks Are Favored Again, Welcoming DeepSeek Moment”, https://hk.finance.yahoo.com/news/野村料技術追上美國-偏好雲計算機械人-中資科技股受捧-再迎deepseek時刻-190600176.html

[1] Yahoo Finance - “Why small hedge funds ruled in 2025”, https://finance.yahoo.com

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.