In-depth Analysis of the Long-Term Growth Logic of Copper Mining Enterprises: Can Zijin Mining Become the King of A-Shares?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Doubled Copper Usage in Electric Vehicles: The copper usage per electric vehicle is 2-3 times that of traditional fuel vehicles. Global electric vehicle sales are expected to exceed 10 million units in 2025, which will significantly drive copper consumption demand [2]

- Accelerated Investment in Power Systems: From January to September 2025, China’s grid infrastructure investment increased by 56% year-on-year, and power source infrastructure investment increased by 21% year-on-year. The construction of new energy power generation facilities continues to accelerate [1]

- Demand from Data Centers: Under the wave of AI computing power, data center construction has entered a fast track, and demand for copper continues to grow

Unlike the traditional cycle which mainly relies on real estate and infrastructure, this round of copper demand growth comes from:

- New energy vehicles and charging facilities

- Renewable energy such as wind power and photovoltaics

- Grid upgrading and transformation

- AI data center construction

This diversified demand structure makes copper demand more resilient and reduces the impact of traditional economic cycles.

According to data from the International Copper Study Group (ICSG) [7]:

- Global copper mine production will only grow by 1.4% in 2025

- The supply-demand gap will reach 150,000 tons in 2025 and expand to 300,000 tons in 2026

- LME copper prices exceeded $11,952 per ton in 2025, hitting a record high

| Constraint Factor | Specific Performance | Impact |

|---|---|---|

| Decline in Mine Grade | The average grade of global copper mines decreased from 4% in 1900 to 1.07% in 2024 [7] | Rising mining costs and limited production growth |

| Long Development Cycle | Greenfield copper projects take an average of 17 years from discovery to production [7] | New supply is difficult to release quickly |

| Frequent Mine Disruptions | In 2025, Peru’s Antamina mine reduced production by 26%, Indonesia’s Grasberg mine suspended production, and Congo’s Kamoa-Kakula mine reduced production by 28% [7] | Increased risk of supply disruptions |

| Resource Protectionism | Policy tightening in countries such as Mexico and Panama [7] | Reduced stability of the global supply chain |

In 2025, the ‘status’ of copper has been significantly upgraded:

- The United Nations Conference on Trade and Development (UNCTAD) described copper as a ‘new strategic raw material’

- LME copper was selected as the ‘Most Promising Strategic Metal of the Year’

- The U.S. Geological Survey included copper in its 2025 critical minerals list [3]

This trend will attract more long-term capital into copper mine exploration and development, but it is difficult to change the supply shortage pattern in the short term.

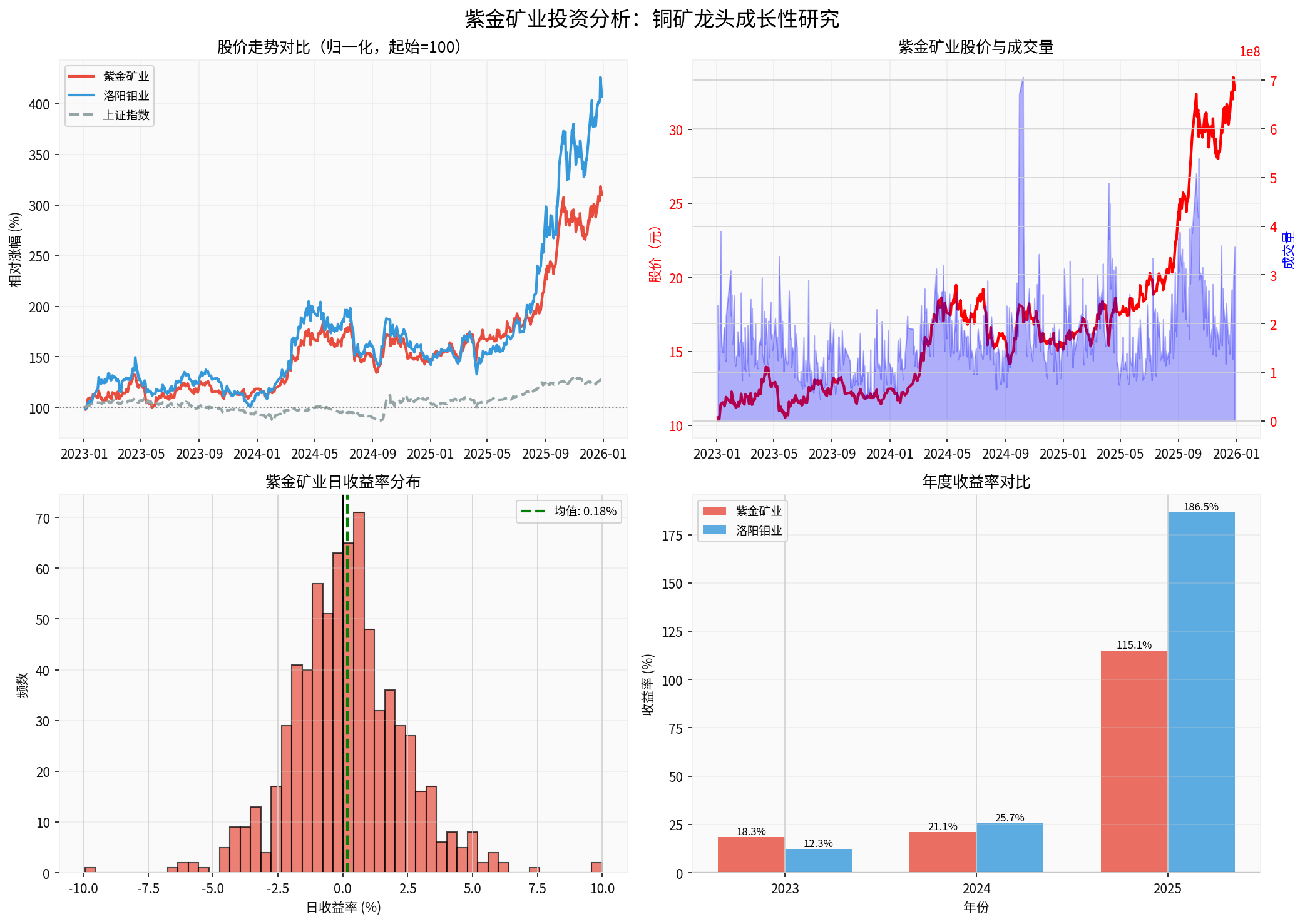

| Time Period | Price Change |

|---|---|

| 1 Month | +14.24% |

| 3 Months | +13.49% |

| 6 Months | +65.07% |

| Year-to-Date (YTD) | +115.09% |

| 1 Year | +110.10% |

| 3 Years | +231.81% |

| 5 Years | +258.79% |

| Indicator | Value | Evaluation |

|---|---|---|

| P/E | 19.00x | Relatively Reasonable |

| P/B | 5.16x | Reflects Market’s High Growth Expectations |

| ROE | 30.60% | Strong Profitability |

| Net Profit Margin | 13.91% | Industry-leading Level |

The current valuation level is still reasonable relative to its growth potential, especially considering its strong profitability with an ROE of up to 30.60%.

| Year | Production (10,000 tons) | YoY Growth | Main Drivers |

|---|---|---|---|

| 2023 | 101 | - | Base Year |

| 2024 | 107 | +6% | Stable Growth of Existing Projects |

| 2025 | 115 | +7.5% | Commissioning of Julong Phase II and Production Increase at Peggy |

| 2026 | 130-135 | +13%~17% | Capacity Release from Three Major Copper Mine Bases |

| 2027 | 145-150 | +11%~15% | Julong Phase III and Kamoa Phase IV |

| 2028 | 150-160 | +3.3%~10% | Full Production + M&A Increment |

-

Tibet Julong Copper Mine:

- Phase II project will be commissioned by the end of 2025, contributing 150,000-160,000 tons

- Phase III project will start in 2027 with a designed annual capacity of 600,000 tons

- Final equity production target is about 400,000 tons

-

Kamoa Copper Mine (DRC):

- World-class high-grade copper mine

- Phase IV project planning for continuous expansion

- Equity production target of over 300,000 tons by 2027

-

Serbia Peggy Copper-Gold Mine:

- Development of the lower ore zone continues to advance

- Equity production target of 350,000-400,000 tons by 2027

- Net profit attributable to shareholders was approximately RMB 37.85 billion (H1: RMB23.29 billion + Q3:RMB14.572 billion)

- A significant year-on-year increase of about55% (net profit attributable to shareholders from Q1-Q3 increased by55.45% YoY)

- Mineral gold and copper production increased by 20% and5% YoY respectively

- The gross profit margin of mining enterprises reached 61.27%, and the comprehensive gross profit margin was27.23%

- Net profit attributable to shareholders was RMB23.29 billion, up54.41% YoY

- Mineral copper, gold, and silver production increased by9%,16%, and6% YoY respectively

- The gross profit margin of mineral products increased by3 percentage points YoY

Performance growth mainly benefited from

- Copper resource volume increased by about5% on an equity basis

- Gold resource volume increased by about7%

- Lithium carbonate resource volume increased by about14%

- Acquired the Raygorodok gold mine project in Kazakhstan

- Added strategic potassium resource reserves through the acquisition of Zangge Mining

This continuous resource acquisition and expansion capability is the core guarantee for Zijin Mining’s long-term growth.

###1. Comparison of A-Shares Market Value Pattern

Currently, the top companies in A-Shares by market value are mainly:

- Large banks such as Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China (market value: RMB1.5-2 trillion)

- Kweichow Moutai (about RMB2 trillion)

- Energy giants such as PetroChina and Sinopec

Under an optimistic scenario:

- Mineral copper production of1.5-1.6 million tons in2028, an increase of49% compared to2023 [5]

- Mineral gold production of100-110 tons, an increase of47%-62% compared to2023 [5]

- Copper and gold prices remain high or rise further

- Continuous M&A brings additional increments

Based on the first three quarters of2025 net profit of RMB37.85 billion, the full-year net profit is estimated to be about RMB50 billion. Assuming production grows by50% in2028 and prices remain unchanged, net profit could reach RMB75 billion. Given a 20x PE ratio, the market value could reach RMB1.5 trillion.

2.

3.

###2. Comparison with Other Mining Leaders

- World-class copper-cobalt mine resources (TFM, KFM in DRC)

- More comprehensive layout of new energy metals (cobalt, nickel, lithium)

- Relatively smaller market value, greater elasticity

However, in terms of comprehensive strength and production certainty, Zijin Mining is more stable under the dual drive of copper and gold.

###3. Risk Factors

- If the global economy enters a deep recession, copper prices may correct sharply

- Changes in Fed monetary policy affect financial attributes

2.Overseas Operation Risk: - Main assets are distributed in DRC, Serbia, Colombia, etc.

- Geopolitical, exchange rate fluctuation, policy change risks

3.Project Commissioning Progress Risk: - Impact of Kamoa flooded well incident [6]

- Uncertainty in the construction progress of large projects such as Julong Phase III

4.Valuation Correction Risk: - Current stock price has already priced in high growth expectations

- If performance falls short of expectations, it may face valuation correction

###4. Comprehensive Judgment

| Time Dimension | Possibility | Core Logic |

|---|---|---|

| Short-term (1-2 years) | Low | Needs copper price to exceed expectations or large-scale M&A |

| Medium-term (3-5 years) | Medium | If production targets are met smoothly + copper prices remain high |

| Long-term (5-10 years) | High | Expected to become a world-class mining enterprise through continuous growth |

2.

- Clear production growth path (1.5-1.6 million tons of copper in2028)

- Strong resource acquisition and operation capabilities

- Excellent financial performance (ROE30.60%)

3.Path to Becoming the King of A-Shares: - Medium-term (3-5 years): Needs copper prices to remain high + production targets met + continuous M&A

- Long-term (5-10 years): Expected to rank among the top in A-Shares market value through continuous growth

4.Investment Suggestions: - Short-term focus: Copper price trend, project commissioning progress, overseas policy changes

- Long-term logic: Structural growth in copper demand under the new energy revolution + continuous capacity release of the company

The long-term investment value of Zijin Mining depends on

[0] Jinling API Data - Zijin Mining (601899.SS), China Molybdenum (603993.SS) company overview, real-time quotes, financial analysis, stock price data

[1] Soochow Securities - 《2026 Copper Industry Annual Strategy: Mine-side Shortage Logic Continues, Financial Environment Favors Commodities》

[2] EBC Financial Group - 《How Will Copper Prices Go in the Future? The International Copper Price Chart May Usher in a New Round of Rise!》 (https://www.ebc.com/zh-cn/jinrong/280318.html)

[3] Securities Times - 《Copper Doctor on the Wind》 (https://www.stcn.com/article/detail/3558833.html)

[5] Xueqiu - 《Zijin Mining 2025-2028 Mineral Gold and Copper Equity Production Forecast Analysis》 (https://xueqiu.com/5798578993/353699579)

[6] Zijin Mining - 《2025 Third Quarter Report》

[7] Jiemian News - 《Price Hits Record High,

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.