Assessment of the Impact of Taiwan Strait Geopolitical Tensions on Hong Kong Stocks and Asia-Pacific Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

At the end of December 2025, the Chinese People’s Liberation Army announced large-scale military exercises around Taiwan, planning to implement air and sea control and conduct live-fire drills on December 30. This military exercise is a direct response to the recent U.S. announcement of selling $11.1 billion worth of weapons to Taiwan, which is the largest U.S. arms sale to Taiwan to date [1].

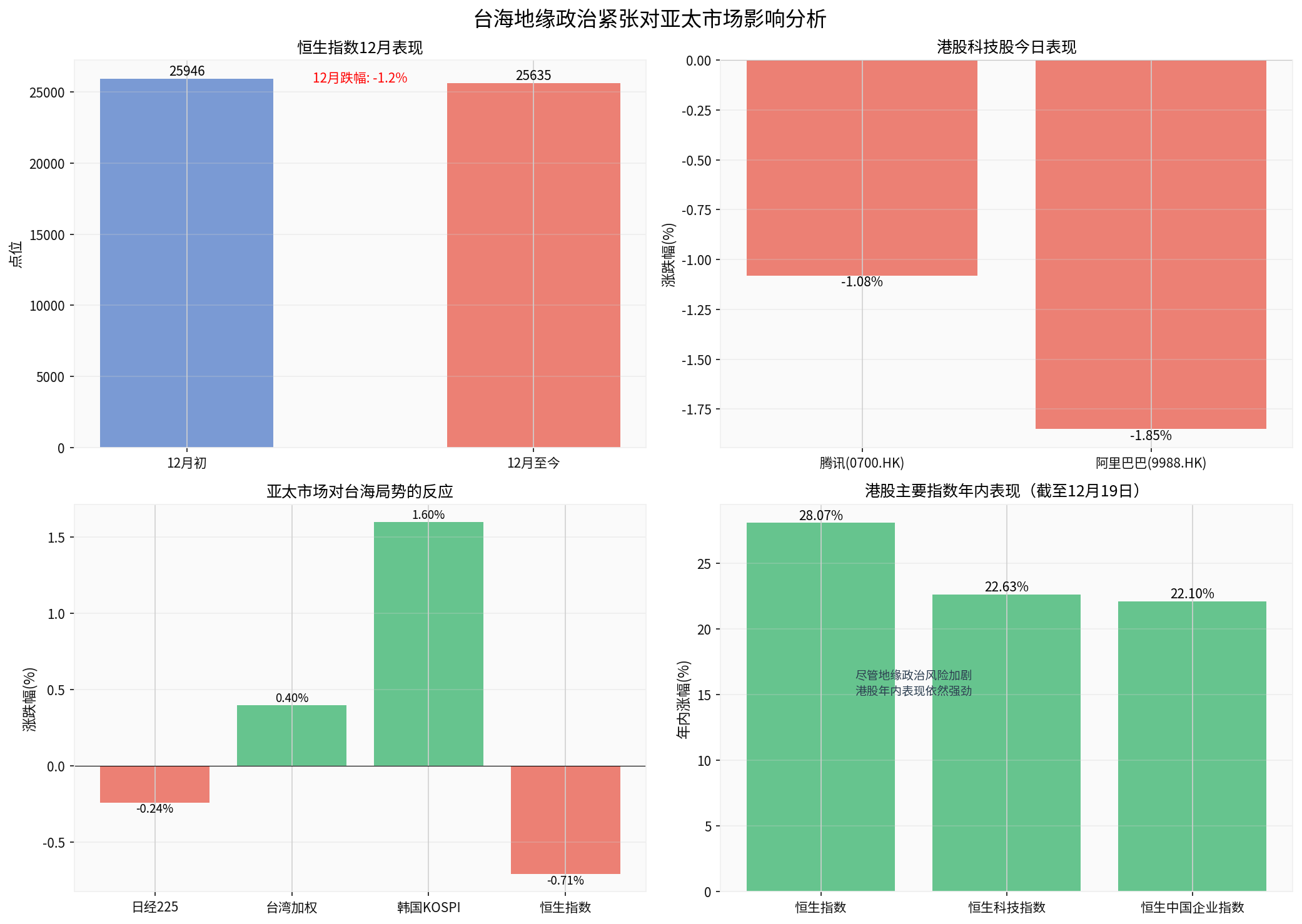

According to the latest data, the reaction of Asia-Pacific financial markets to this military exercise was

- Nikkei 225 Index (Japan): Slightly down 0.24%

- Taiwan Capitalization Weighted Stock Index: Up 0.4%, hitting a new all-time high of 28,786 points

- South Korea KOSPI Index: Up 1.6%

- Hong Kong Hang Seng Index: Down 0.71% to 25,635.24 points [1]

- Period Open: 25,945.87 points

- Period Close: 25,635.24 points

- Period Decline: -310.63 points (-1.20%)

- Period High: 26,264.13 points

- Period Low: 25,086.54 points

- Daily Volatility: 0.92%

Despite escalating geopolitical risks, Hong Kong stocks

- Hang Seng Index YTD gain: 28.07%

- Hang Seng Tech Index YTD gain: 22.63%

- Hang Seng China Enterprises Index YTD gain: 22.10%

These gains

From the performance of various Asia-Pacific markets, there are obvious

-

Limited Safe-Haven Sentiment: No large-scale panic selling occurred in the market, indicating that investors have gradually adapted to the normalization of Taiwan Strait tensions [1]

-

Unexpected Strength in Taiwan Stock Market: After the military exercise news was announced, Taiwan’s stock market rose instead of falling, and hit a new all-time high driven by semiconductor leaders such as TSMC. TSMC rose 5.55% in December, reflecting market confidence in the tech supply chain [0]

-

South Korea Market Benefited: The KOSPI index rose by 1.6%, partly due to capital flowing from riskier regions to the relatively safer South Korean market [1]

Geopolitical risks significantly boosted demand for safe-haven assets [1]:

- Gold Price: Hit a new all-time high, COMEX gold futures reported $4,562 per ounce, with a cumulative YTD gain of 72%, the highest since 1979

- Silver Price: Soared more than 10% in a single day, with YTD gains surging to 174%

- Platinum and Palladium Prices: Rose 11.84% and 14.04% respectively

As the global semiconductor manufacturing hub, the Taiwan Strait situation has an important impact on the tech supply chain:

- TSMC (TSM) Performance: December stock price rose 5.55% to $302.84, with a period high of $313.98 [0]

- Market Reaction: Taiwan’s semiconductor-related stocks performed actively; TSMC returned to the historical high of NT$1,525, driving Taiwan’s stock market to new highs [1]

Market analysis points out [3]:

- During the pandemic, the risk of excessive U.S. tech supply chain dependence on Taiwan was fully exposed

- The potential risks of the Taiwan Strait situation further intensified the urgency of the U.S. to promote chip manufacturing reshoring

- The U.S. government追加 $9 billion investment to Intel to promote semiconductor manufacturing localization

Multiple institutions still hold

- Compared to the valuation repair-driven market in 2025, the overall valuation of the Hong Kong stock market may rise slightly in 2026

- Improved profit growth may be an important factor driving further market trends

- Under the superposition of liquidity, fundamentals, and sentiment cycles, the rhythm may be high first then low

- Recommend adopting the “barbell allocation strategy”

- Use dividend assets as the base position, focus on low PB central state-owned enterprises, insurance, Hong Kong local utilities, etc.

Institutions believe the main risks the Hong Kong stock market may face in 2026 include [2]:

- Geopolitical Impact: Uncertainties such as Taiwan Strait situation and China-US relations

- Trading Crowding Risk: Trading crowding caused by overly consistent consensus

- Monetary Policy Volatility: Sharp fluctuations in China-US monetary policies and liquidity

- Black Swan Events: Unpredictable unexpected events

- In the short term, the Hang Seng Index may hover in the range of 25,300 to 26,500 points

- Recommend investors to remain cautious and consider reverse operation strategies

- As an offshore financial market, Hong Kong stocks are greatly affected by global liquidity; need to guard against liquidity risks

Based on the current market environment and geopolitical situation, investors are advised to:

-

Maintain Moderate Defensiveness: Increase allocation to safe-haven assets such as gold and silver to hedge against geopolitical risks

-

Focus on Semiconductor Supply Chain: Despite tensions in the Taiwan Strait, semiconductor leading enterprises (such as TSMC) still performed strongly, showing strong industry fundamental support

-

Flexible Operation: Hong Kong stocks may continue to fluctuate in a range in the short term; it is recommended to wait for a clear direction before operating with the trend

Institutions recommend adopting the

- Core Allocation: Dividend assets (low PB central state-owned enterprises, insurance, Hong Kong local utilities)

- Satellite Allocation: Tech and cyclical sectors; innovative drugs are worth attention

- AI infrastructure-related industry chain

- Semiconductor equipment and materials benefiting from supply chain diversification

- Policy-supported industries such as military, electric power, and robotics

Comprehensive analysis shows that the impact of this Taiwan Strait military exercise on Asia-Pacific markets is

- Limited Short-Term Impact: Market reaction was relatively moderate, with no large-scale panic selling

- Structural Differentiation: Different markets reacted differently; Taiwan and South Korea markets even strengthened

- Rising Safe-Haven Demand: Prices of safe-haven assets such as gold hit new all-time highs

- Enhanced Market Resilience: The strong annual performance of Hong Kong stocks proves that the market has a certain ability to withstand geopolitical risks

- Focus on Policy Trends: Need to closely monitor whether there will be more military exercises or stronger official statements

- Profit-Driven Takeover: The driving logic of the Hong Kong stock market in 2026 may shift from valuation repair to profit growth

- Supply Chain Restructuring: Geopolitical risks will accelerate the diversification process of the global tech supply chain

[0] Gilin API Data - Stock Price Data, Index Data

[1] China Business Times - “Stock Market” Search Results (https://www.ctee.com.tw/search/股市)

[2] 21st Century Business Herald - Institutional Outlook on Hong Kong Stocks in 2026: Profit-Driven Takeover, Grasp the “New Supply” Main Line (https://www.21jingji.com/article/20251219/herald/b898956981b879cd41cbaa83f625ddef.html)

[3] Futu Information - Intel’s Recovery Road Still Long and Arduous, Success Depends on 14A Process (https://news.futunn.com/post/66676857/intel-s-path-to-recovery-remains-long-and-arduous-with)

[4] Futu Information - Daily Summary of Investment Bank/Institutional Views (2025-12-23) (https://news.futunn.com/post/66541516/daily-summary-of-investment-bank-institutional-views-2025-12-23)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.