In-depth Impact Analysis of Tianjian Technology (002977) 256 Million Yuan Military Product Price Reduction

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the company’s announcement, Tianjian Technology signed the Supplementary Agreement on Military Product Price Adjustment with customers due to the 2025 military product price review, resulting in:

- Revenue Reduction: Approximately 256 million yuan

- Net Profit Impact: Approximately -209 million yuan

- Delisting Risk: The 2025 non-recurring profit and loss adjusted net profit is expected to be negative, and the adjusted revenue is below 300 million yuan, which may lead to the implementation of delisting risk warning (*ST) [0]

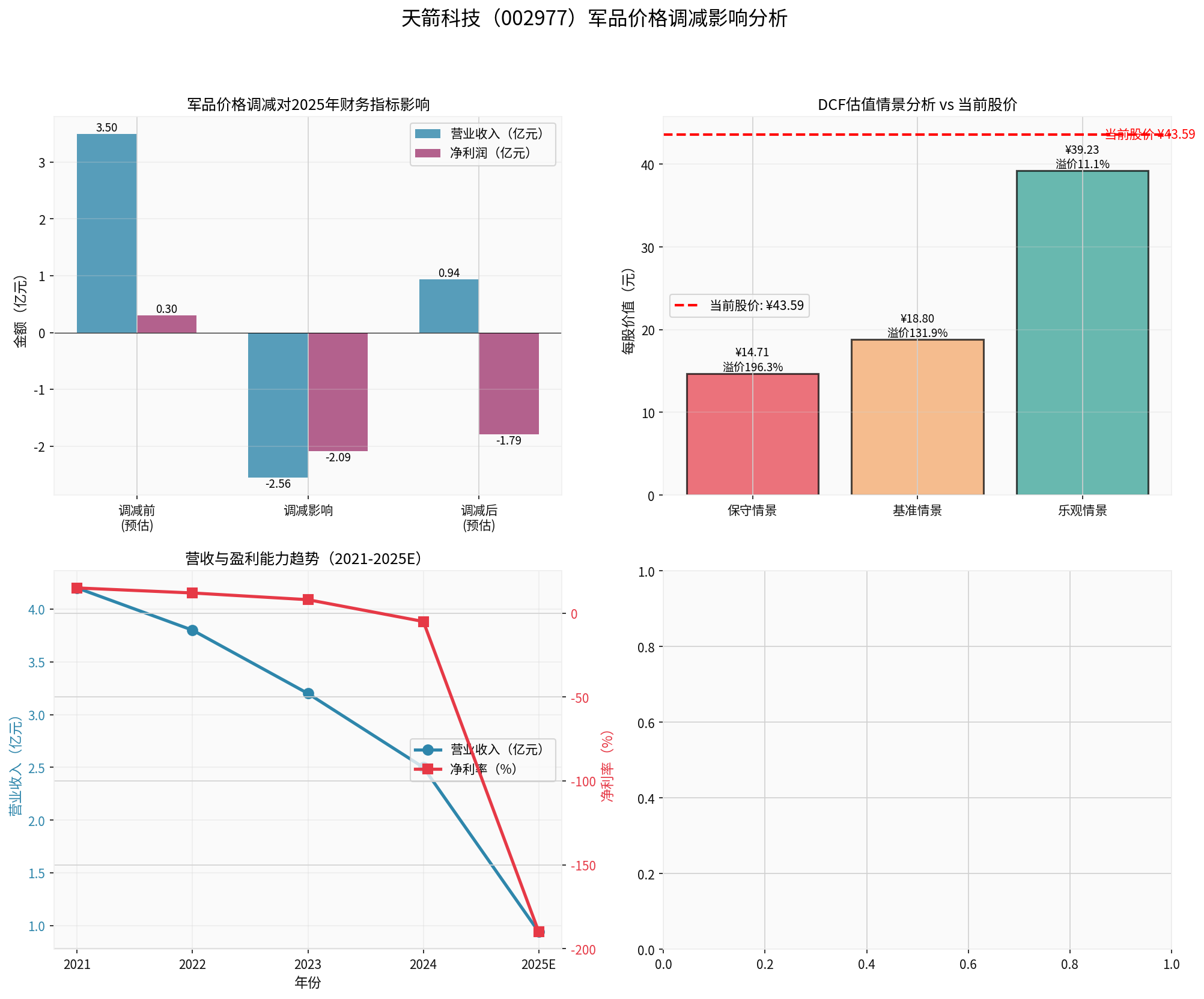

Based on data analysis, the military product price reduction will have a major impact on the company’s revenue:

| Financial Indicator | Before Reduction (Estimated) | Reduction Impact | After Reduction (Estimated) | Change Rate |

|---|---|---|---|---|

| Revenue | ~350 million yuan | -256 million yuan | ~94 million yuan | -73.1% |

| Net Profit | ~30 million yuan | -209 million yuan | ~-179 million yuan | -696.7% |

From a long-term perspective, this means:

- Severe Revenue Shrinkage: From the 300-400 million yuan revenue level in previous years to less than 100 million yuan

- Impaired Profitability: The company’s 2024 net profit margin was already -21.02% [0], and this reduction will cause the 2025 net profit margin to further deteriorate to approximately -190%

- Declining Industry Competitiveness: In the aerospace and defense industry, the significant shrinkage of revenue scale will weaken the company’s market position [0]

According to historical financial data [0]:

- Historical Net Profit Margin Trend: Continued decline from approximately 15% in 2021 to -21.02% in 2024

- Negative ROE: 2024 ROE was -1.55% [0], indicating a deterioration in shareholder return capacity

- Operating Profit Margin: 2024 was -28.70% [0], reflecting continuous losses in core business

The military product price reduction is a

- Adequate Liquidity: Current ratio 10.96, quick ratio 10.02 [0], indicating extremely strong short-term solvency

- Low Debt Risk: Financial analysis shows the debt risk level is “Low Risk” [0]

- Conservative Accounting Policy: Adopts a conservative financial attitude with a high depreciation/capital expenditure ratio [0]

- Continuous Losses Consume Cash: The expected 2025 loss of 209 million yuan will deplete cash reserves

- Investment Contraction: Declining profitability will limit R&D investment and capacity expansion

According to the Discounted Cash Flow (DCF) model analysis [0]:

| Scenario | Intrinsic Value | Premium Rate vs Current Stock Price | Rating |

|---|---|---|---|

| Conservative Scenario | ¥14.71 | -66.3% | Severely Overvalued |

| Base Scenario | ¥18.80 | -56.9% | Significantly Overvalued |

| Optimistic Scenario | ¥39.23 | -10.0% | Mildly Overvalued |

Current Stock Price |

¥43.59 |

- |

- |

- Even under the Optimistic Scenario, the current stock price (43.59 yuan) is still 10% premium over intrinsic value

- Under the Base Scenario, the overvaluation幅度 reaches 56.9%, meaning there is significant downside risk in valuation

- The probability-weighted intrinsic value is 24.25 yuan, with a 44.4% downside potential compared to the current stock price

Current valuation indicators [0]:

- P/E Ratio: -312.82x (Loss-making, meaningless)

- P/B Ratio:5.00x (Significantly higher than industry average)

- P/S Ratio:65.77x (Extremely high)

- A P/S ratio of 65.77x means the market values each 1 yuan of revenue at 65.77 yuan, which is extremely unreasonable given negative profits

- If 2025 revenue drops to 94 million yuan, based on the current P/S ratio valuation, the reasonable stock price should fall to approximately 12 yuan

- There is a serious valuation bubble, with huge pressure for price adjustment

According to the announcement, the company may touch the following delisting risk warning conditions:

- The lower of the net profit before and after deducting non-recurring gains and losses in the latest fiscal year is negative

- The adjusted revenue in the latest fiscal year is below 300 million yuan

Once *ST is implemented:

- Institutional Investors Exit: Public funds, social security funds and other institutions are usually prohibited from investing in *ST stocks

- Financing Capacity Restricted: Pledge financing, additional issuance and rights issue and other capital operation channels are restricted

- Liquidity Declines: Retail-dominated, stock price volatility intensifies

- Brand Value Damaged: Faces difficulties in business cooperation, talent recruitment, etc.

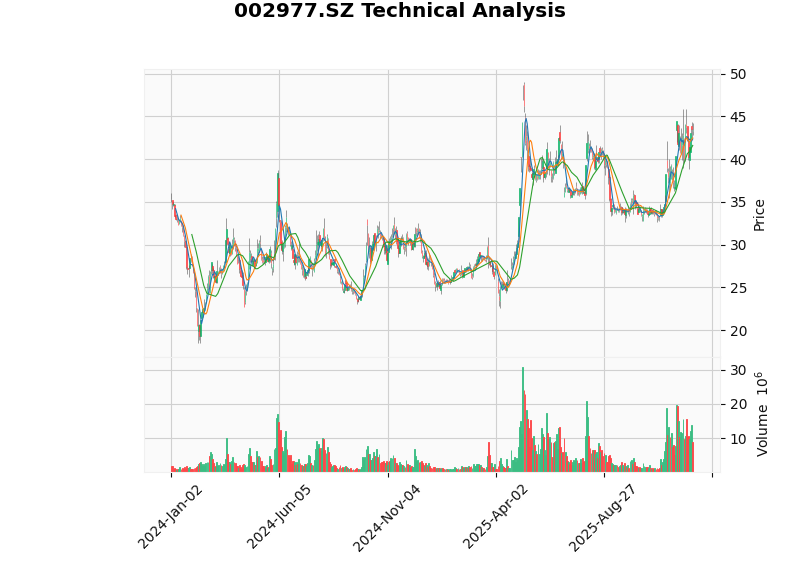

According to technical analysis [0]:

- Current Trend: Sideways consolidation, no clear direction

- Support Level:41.60 yuan

- Resistance Level:44.70 yuan

- Beta Coefficient:0.18 (Low volatility)

- The stock price fluctuates between 41.60 and 44.70 yuan

- Once it breaks below the 41.60 yuan support level, it may accelerate downward to the 32-35 yuan range

- Recent cumulative gains are large (3 months +28.70%), there is callback pressure

- One-time Adjustment: The price review reduction is a one-time event and does not represent continuous deterioration of profitability

- Low Debt Risk: Debt risk level is low [0]

- Industry Barriers: Aerospace and defense industry has high entry barriers

- Adequate Liquidity: High liquidity ratio provides a buffer to deal with crises

- Permanent Revenue Shrinkage: Price reduction is a structural adjustment, not a temporary fluctuation

- Severe Overvaluation: Current stock price is overvalued by 56.9%-66.3% compared to intrinsic value [0]

- Delisting Risk: *ST will trigger chain negative reactions

- Industry Cycle Downturn: Military industry enters price adjustment cycle, profit margins are under pressure

| Time Dimension | Impact Assessment | Key Variables |

|---|---|---|

Within 1 Year |

Highly Negative |

*ST Risk, Valuation Regression, Stock Price Decline |

2-3 Years |

Neutral to Negative |

Revenue Recovery, New Order Acquisition, Cost Control |

Over 3 Years |

Depends on Transformation |

Product Structure Optimization, Military Product Pricing Reform, Civil Product Expansion |

- Delisting risk warning (*ST) will trigger institutional selling

- Severe valuation bubble, with more than 56% downside potential

- Technical support level at 41.60 yuan, once broken will accelerate the decline

- Pay attention to the company’s revenue recovery

- Pay attention to new military product pricing policies

- Pay attention to the progress of civil product business expansion

| Risk Category | Risk Level | Explanation |

|---|---|---|

| Delisting Risk | ⭐⭐⭐⭐⭐ | Extremely High, may be implemented *ST in 2025 |

| Profit Risk | ⭐⭐⭐⭐ | High, expected 2025 loss of 209 million yuan |

| Valuation Risk | ⭐⭐⭐⭐⭐ | Extremely High, overvalued by56.9%-66.3% vs intrinsic value [0] |

| Liquidity Risk | ⭐⭐ | Low, company has adequate liquidity |

| Industry Risk | ⭐⭐⭐ | Medium, military product price reform continues |

- Shareholders: It is recommended to reduce positions when rebounding to the 44-45 yuan range to avoid *ST risk

- Potential Investors: It is recommended to wait for the stock price to fall to the 20-25 yuan range (close to intrinsic value) before considering entry

- Long-term Value Investors: Wait for the 2025 annual report disclosure and clear delisting risk before making decisions

[0] Gilin API Data - Includes Tianjian Technology (002977.SZ) real-time quotes, company overview, financial analysis, DCF valuation, technical analysis and historical price data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.