Impact Analysis of HUTCHMED's Liver Cancer Drug Receiving Priority Review Status

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Mechanism of action: Novel, highly selective, and potent oral inhibitor of FGFR 1/2/3

- Precise target: For ICC patients with FGFR2 gene fusion or rearrangement

- Excellent clinical data: Phase II study showed that the 300mg dose group achieved an objective response rate (ORR) of 50.0%, disease control rate (DCR) of90%, and treatment-related adverse events (TRAE) of grade 3 or above at 23.1%[2]

- Intrahepatic cholangiocarcinoma (ICC) is the second most common type of primary liver cancer (accounting for 8.2-15.0%)[3]

- China had 61,900 new ICC cases in 2015[2]

- From 2006 to 2015, the overall incidence rate of ICC in China increased by 9.2% annually[2]

- The 5-year overall survival rate of ICC patients is only about 9%, with a huge unmet clinical need[3]

- Approximately 10-15%of ICC patients worldwide have FGFR2 fusion or rearrangement[2,3]

- China has about 6,200-9,300 new FGFR2+ ICC patients annually (based on the 10-15% ratio)

- These patients have received prior systemic therapy and lack effective subsequent treatment options

- Pemigatinib: Approved for FGFR2+ cholangiocarcinoma with good clinical activity

- Infigratinib: Also targets FGFR2 fusion-positive cholangiocarcinoma patients

- Erdafitinib: Pan-FGFR inhibitor approved for urothelial carcinoma, with potential for indication expansion

- First domestically developed FGFR inhibitor for this indication in China

- Clinical data shows favorable efficacy and safety profiles

- Priority review status is expected to accelerate the launch process and seize market first-mover advantage

- Hutchison China MediTech holds the global rightsto this drug, enabling maximization of commercial value[3]

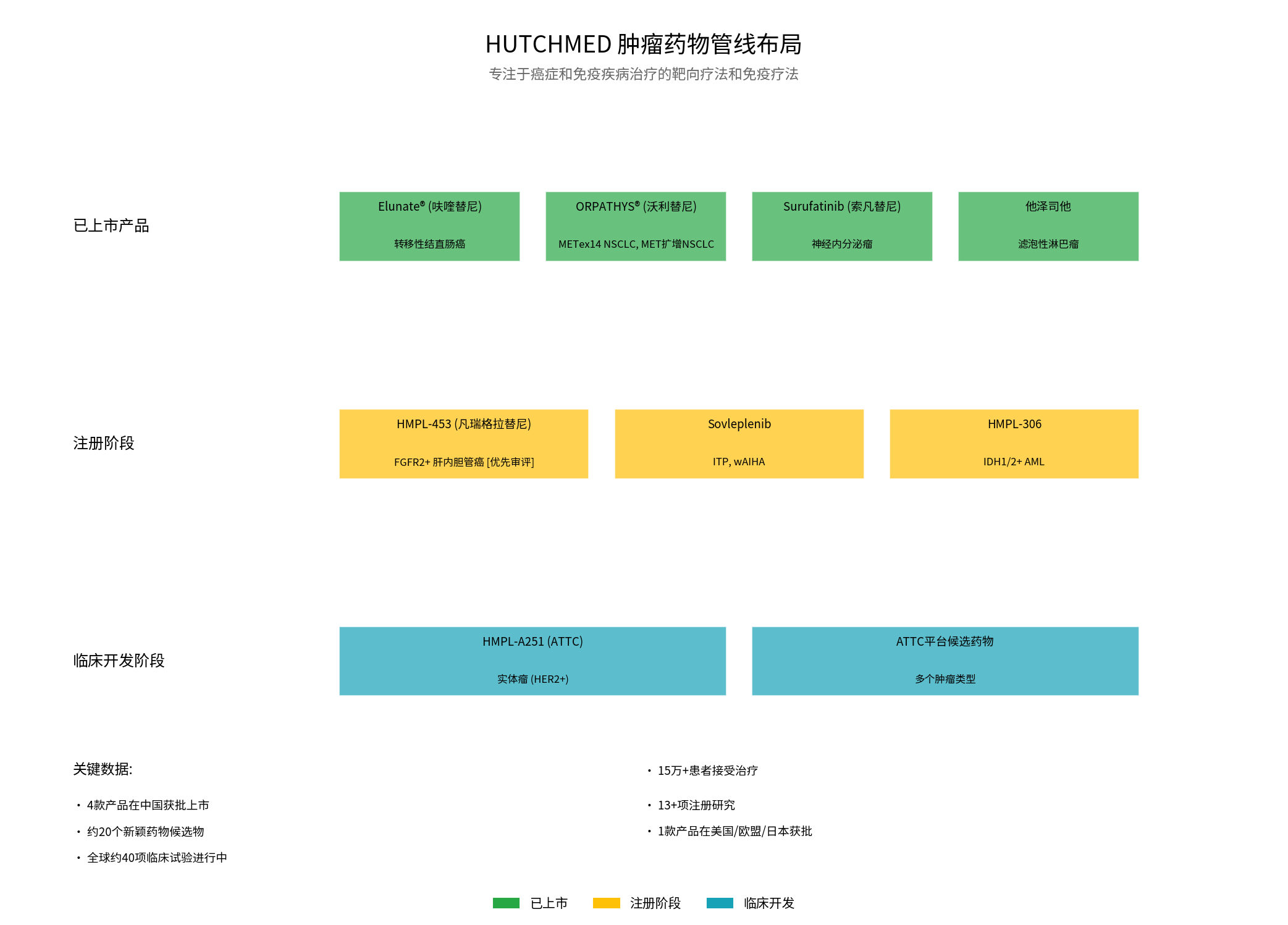

From the perspective of pipeline layout, HUTCHMED’s oncology drug strategy presents the following characteristics:

- Fruquintinib: Metastatic colorectal cancer (global market)

- Savolitinib: METex14 NSCLC and MET-amplified NSCLC

- Surufatinib: Neuroendocrine tumors

- Tazemetostat: Follicular lymphoma

- HMPL-453: FGFR2+ intrahepatic cholangiocarcinoma [Priority Review]

- Sovleplenib: ITP and wAIHA

- HMPL-306: IDH1/2+ AML

- ATTC Platform(Antibody-Targeted Conjugate Drug): HMPL-A251 has entered global clinical development phase[0]

- The priority review of HMPL-453 further consolidates the company’s advantages in the field of precision oncology

- Targeted therapy for FGFR pathway abnormalities represents an important direction in cancer treatment

- The success of this drug will enrich the company’s product line in the biliary tract cancerfield

- Localized R&D and production capabilities

- In-depth understanding of Chinese patient population

- Good cooperative relationship with regulatory authorities (multiple priority review statuses obtained)

- Existing commercialization experience and sales team

- China has about 6,200-9,300 new FGFR2+ ICC patients annually

- Assuming annual treatment cost is about RMB 200,000-300,000 (referencing similar targeted drugs)

- Theoretical annual market size could reach RMB 1.2-2.8 billion

- Considering penetration rate and medical insurance negotiation impacts, the actual peak sales are expected to be RMB 500 million-1 billion

- February 2025: Patient enrollment completed for China Phase II registration study[2]

- November 2025: Received priority review status

- First half of 2026: Expected to release Phase II clinical data[2]

- 2026: Potential approval and launch in China

- 2027-2028: Enter rapid volume growth phase

- Hutchison China MediTech holds global rights to HMPL-453[3]

- Can enter European and American markets through international cooperation or independent development

- Cholangiocarcinoma lacks effective targeted treatment options globally

- HMPL-453 can form combination therapies with other company drugs

- Lays the foundation for future expansion into other FGFR abnormality-driven tumor indications

- Validates the company’s R&D capabilities in FGFR inhibitor platform

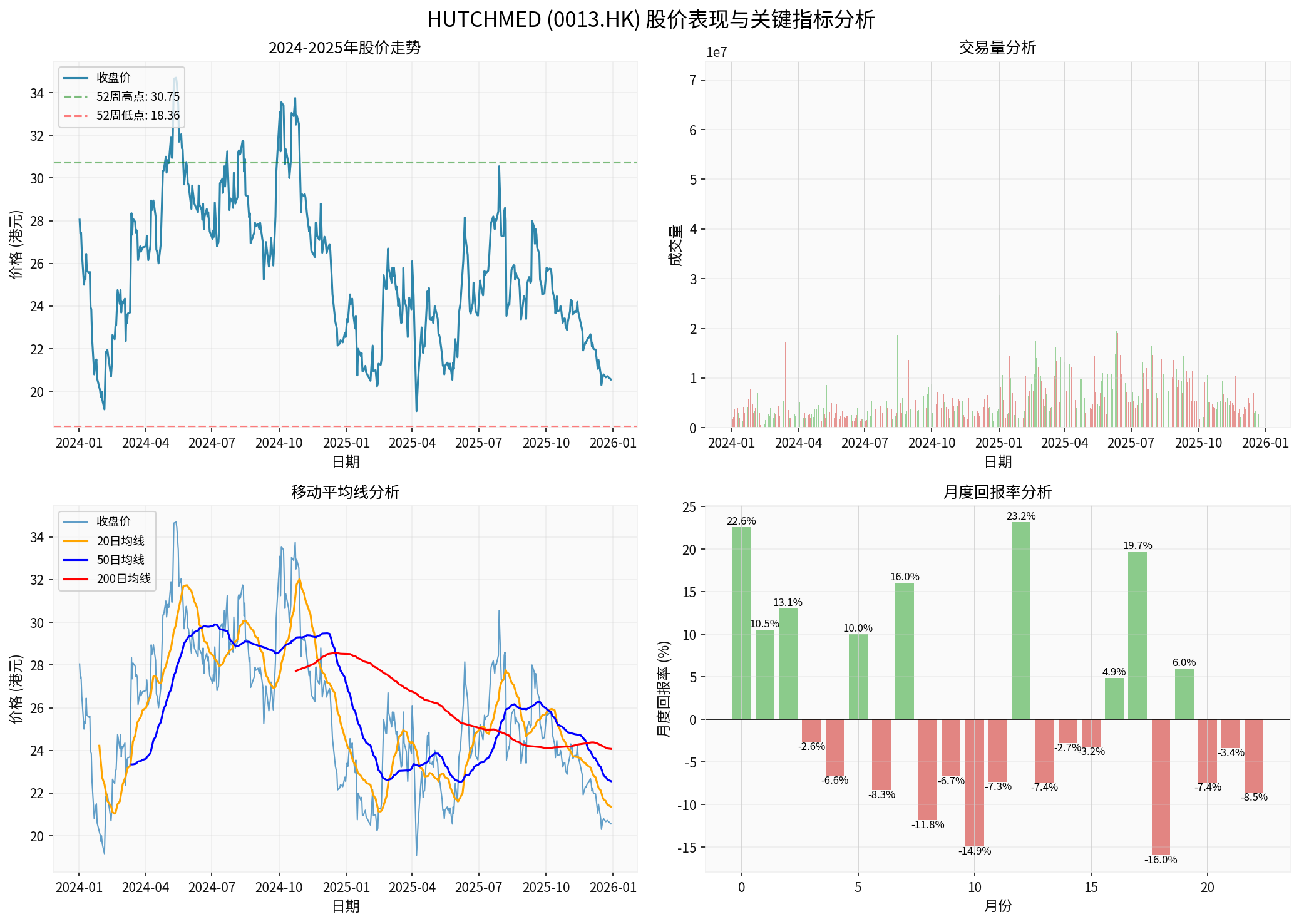

- Current stock price: HK$20.54 (as of December 29, 2025)

- 52-week range: HK$18.36-30.75

- Down 28.36%since 2024, at a relatively low historical level

- Market capitalization: HK$17.65 billion

- Price-to-earnings ratio (P/E): 4.95x (highly attractive)

- Net profit margin: 77.53%

- ROE: 46.95%

- Current ratio: 4.65 (financially stable)

- Current P/E is only 4.95x, significantly lower than the biopharmaceutical industry average

- Market capitalization does not fully reflect the potential value of multiple pipeline products

- Priority review of HMPL-453 brings short-term catalyst for the company

- First half of 2026: Release of HMPL-453 Phase II clinical data

- 2026: Potential approval of HMPL-453 in China

- End of 2025: Global clinical trial initiation of ATTC platform candidate drug

- Sustained milestone payments and collaboration revenue

- Clinical data below expectations: Phase II study results need to verify efficacy and safety

- Intensified competition: Other FGFR inhibitors may be approved or expand indications

- Medical insurance negotiation pressure: May affect the commercial value of the drug

- Increased R&D investment: Multiple clinical trials require substantial financial support

- The company has a stable financial position and sufficient cash reserves[0]

- Diversified product portfolio reduces the risk of a single product

- Rich experience in cooperation with international pharmaceutical companies such as AstraZeneca

- Consolidation of position in precision medicine: HMPL-453 is another important layout of the company in the field of precision oncology

- Leader in biliary tract cancer treatment: Becomes China’s first domestic innovative drug for FGFR2+ ICC

- Validation of R&D capabilities: Demonstrates the company’s professional strength in small molecule targeted drug development

- Optimization of regulatory relations: Priority review status shows good interaction between the company and regulatory authorities

- Expected to be approved and launched in 2026, becoming a new revenue source for the company

- Priority review shortens the launch time by approximately 6-12 months

- Enhances the company’s reputation and influence in China’s oncology drug market

- Peak sales can reach RMB 500 million-1 billion

- Provides sustained support for the company’s cash flow

- Lays the foundation for expanding into international markets

- FGFR inhibitor platform can expand to more indications

- Provides important support for the company’s precision medicine strategy

- Enhances the company’s overall valuation and investment value

- Strong valuation appeal: P/E is only 4.95x, at a historically low level

- Rich product line: 4 launched products + multiple pipeline drugs

- Value of innovation platform: ATTC platform brings long-term growth potential

- Clear short-term catalysts: Multiple drugs such as HMPL-453 are about to reach important milestones

- HMPL-453 Phase II clinical data in the first half of 2026

- Review progress of other drugs in registration phase

- Clinical development progress of ATTC platform

- Improvement of the company’s overall profitability

[0] Gilin API Data - Stock price, financial indicators, company information

[1] Zhihuiya New Drug Intelligence Database - “Hutchison China MediTech’s Class 1 Innovative Drug Expected to Be Included in Priority Review Procedure” (November 25, 2025)

[2] Hutchison China MediTech 2025 Interim Results Announcement - HMPL-453 clinical development progress

[3] GlobeNewswire - “HUTCHMED Announces NDA Acceptance in China with Priority Review Status for Fanregratinib” (December 29, 2025)

[4] Hutchison China MediTech 2024 Annual Report - Company pipeline and financial information

[5] BioWorld - “HUTCHMED unveils next-generation ATTC Platform and key R&D advances” (November 3, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.