BioMarin Acquires Amicus Therapeutics: In-Depth Analysis and Implications for Biotech Small-Cap Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

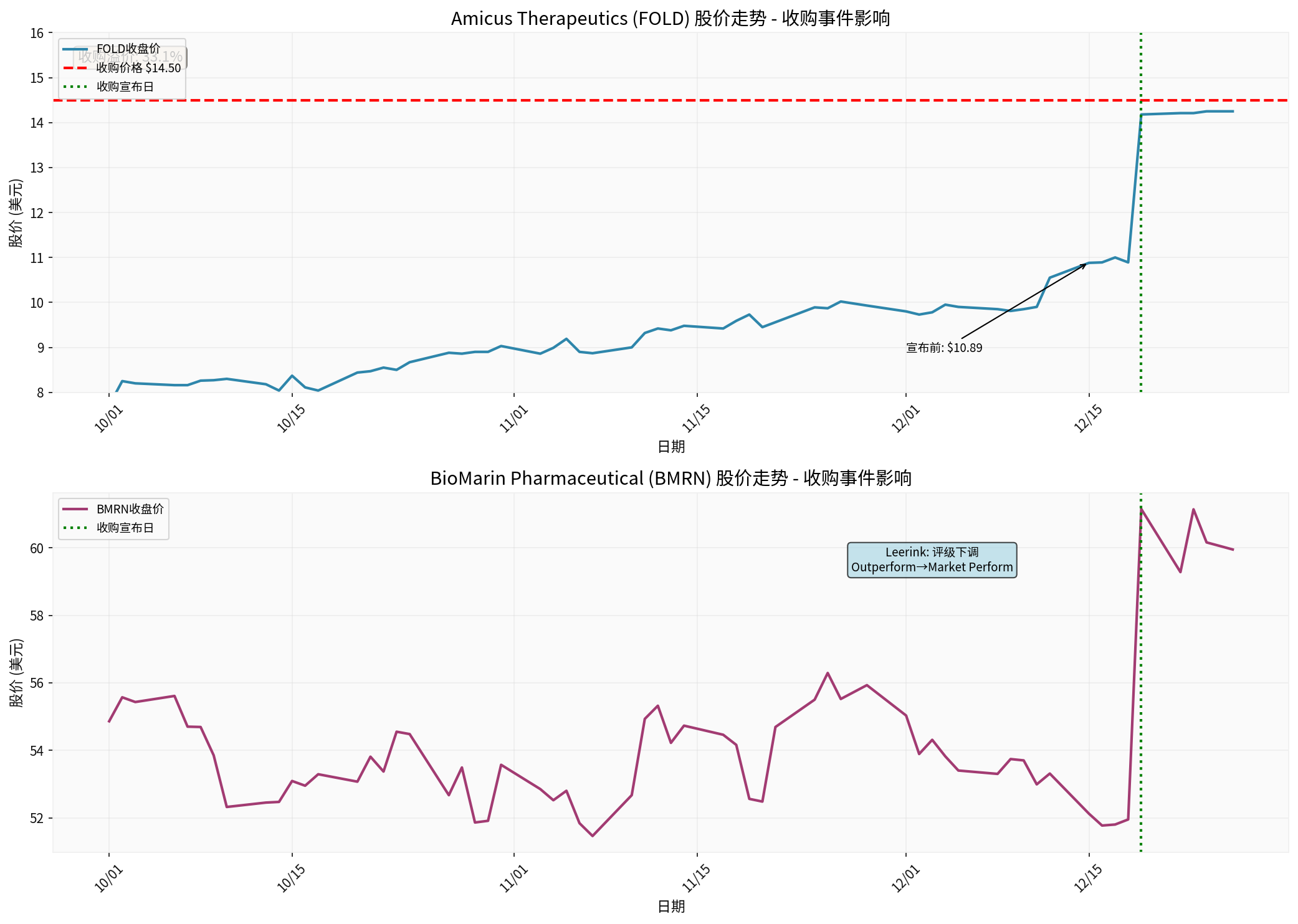

On December 19, 2025, BioMarin Pharmaceutical Inc. (BMRN) announced the acquisition of Amicus Therapeutics Inc. (FOLD) in an all-cash transaction at

- Acquisition Premium: 33% (relative to the closing price before the announcement)

- Payment Method: All-cash transaction

- Board Approval: Unanimously approved by both boards of directors

- Market Cap Impact: BioMarin’s market cap is approximately $11.52 billion, and the acquisition valuation is reasonable [3]

This acquisition adds two marketed rare disease drugs to BioMarin’s product portfolio [1][4]:

| Product | Indication | Market Position |

|---|---|---|

Galafold (migalastat) |

Fabry Disease | First oral small molecule treatment |

Pombiliti + Opfolda |

Pompe Disease | Innovative enzyme replacement therapy |

These two products generated combined revenue of

The acquisition announcement had a significant positive impact on Amicus’s stock price:

| Time Period | Change |

|---|---|

| 1 Month | +43.50% |

| 3 Months | +79.47% |

| 6 Months | +140.30% |

| Year-to-Date | +53.06% |

| 1 Year | +51.43% |

- 52-Week Range: $5.51 - $14.36

- Current Price: $14.25 (slightly below the acquisition price of $14.50)

- Acquisition Premium: The 33% premium fully recognizes Amicus’s long-term value

- Volume Surge: Trading volume increased significantly after the announcement

| Indicator | Amicus (FOLD) | BioMarin (BMRN) |

|---|---|---|

| Market Cap | $4.40B | $11.52B |

| P/E Ratio | 221.17x | 22.12x |

| P/B Ratio | 19.08x | 1.90x |

| Net Profit Margin | 3.32% | 16.82% |

| Current Ratio | 2.99 | 4.83 |

Despite Amicus’s high valuation multiples, the following factors justify it:

- High Growth Potential: The rare disease drug market is growing rapidly

- Pipeline Value: Clinical advantages of Pombiliti+Opfolda

- Acquisition Premium: The 33% premium reflects long-term value

This acquisition is an

BioMarin’s stock price rose

| Analyst Firm | Rating Change | Target Price Adjustment | Date |

|---|---|---|---|

Leerink Partners |

Outperform → Market Perform | $82 → $60 |

2025-12-03 |

Stifel |

Buy → Hold | Not Disclosed | 2025-11-06 |

Truist Securities |

Maintain Buy | $80 → $100 |

2025-12-23 |

H.C. Wainwright |

Maintain Neutral | $55 → $60 |

2025-12-22 |

Leerink Partners downgraded BioMarin from “Outperform” to “Market Perform” and cut the target price from $82 to

-

Integration Risks

- The large-scale $4.8 billion acquisition faces complex integration challenges

- Organizational restructuring may lead to short-term operational efficiency decline

- Cultural integration takes time and may affect team stability

-

Financial Pressure

- The all-cash transaction puts pressure on BioMarin’s financial position

- May need to increase debt burden, affecting financial flexibility

- Cash flow may be impacted in the short term

-

Increased Competition

- Voxzogo (achondroplasia treatment) faces competitive threats

- Pipeline restructuring may lead to insufficient resource allocation for other projects

- Changes in market competition may affect pricing power

-

Growth Sustainability Concerns

- Although the acquisition promises to accelerate revenue growth, analysts are cautious about long-term growth

- Need to prove that Amicus products can achieve expected revenue targets

- High strategic synergy, aligned with BioMarin’s rare disease focus strategy

- Amicus products are highly compatible with BioMarin’s global infrastructure

- Long-term cash flow prospects are improved

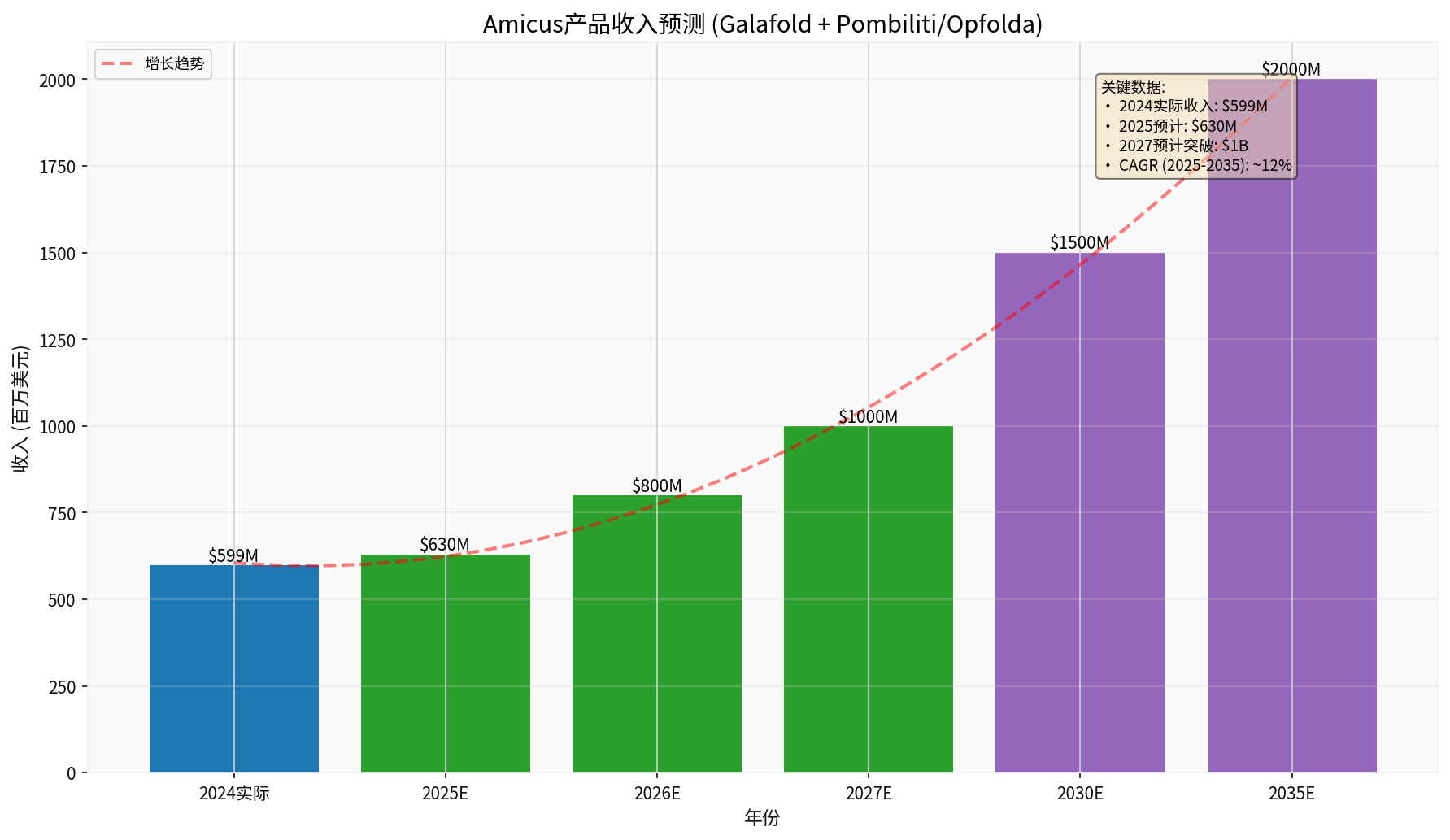

According to forecasts by Leerink Partners analyst Joseph Schwartz [4][9]:

| Year | Projected Revenue (Million USD) | Growth Rate |

|---|---|---|

| 2024 (Actual) | $599 | - |

| 2025E | $630 | +5.3% |

| 2027E | $1,000+ |

Exceed $1 billion |

| 2035E | $2,000 |

Long-term steady growth |

- Galafold: Increased global market penetration, especially in the U.S. and European markets

- Pombiliti+Opfolda: Rapid expansion in the Pompe disease treatment field

- R&D Synergy: Use BioMarin’s global network to accelerate commercialization

This acquisition reflects important trends in the biotech industry:

- Large pharmaceutical companies strengthen their rare disease product portfolios through acquisitions

- Rare disease drugs have attractive pricing advantages and market exclusivity

- BioMarin previously acquired Inozyme, reflecting strategic consistency [10]

- Small biotech companies with marketed products become high-quality M&A targets

- The market begins to re-evaluate the long-term value of R&D pipelines

- Investors pay more attention to commercialization capabilities and clinical data quality

- All-cash transactions reduce transaction execution risks

- Provide certainty and liquidity for seller shareholders

- Reflect the buyer’s confidence in the acquired assets

Leerink Partners’ downgrade of BioMarin reveals the complex considerations in biotech stock investment ratings:

- Short-Term: Integration risks, financial pressure, execution uncertainty

- Long-Term: Strategic synergy, revenue growth, market position enhancement

- The market’s immediate reaction (+19%) reflects optimistic sentiment

- Analyst downgrades reflect cautious assessment of fundamentals

- The divergence creates investment opportunities or risks

- Industry consolidation intensifies competition, which may affect pricing power of all participants

- Large players gain scale advantages through acquisitions, putting more pressure on small companies

- Valuation methods need to consider M&A premiums and strategic value

Based on this acquisition case, implications for biotech small-cap investors:

- Companies with marketed products or late-stage clinical pipelines

- Have differentiated advantages in scarce treatment areas (e.g., rare diseases)

- Strong commercialization capabilities or clear partners

- Focus on premium levels of peer M&A transactions (usually 20-40%)

- Consider the company’s strategic value and synergy effects

- Analyze large pharmaceutical companies’ acquisition strategies and financial status

- Do not blindly chase M&A rumors

- Focus on fundamentals and valuation rationality

- Diversify investments to reduce single-event risks

- Focus on the company’s core competitiveness and pipeline value

- M&A exit is just one way to realize value

- Long-term holding of high-quality companies may yield greater returns

This acquisition is a continuation and strengthening of the biotech industry’s consolidation trend:

- Active biotech M&A transactions from 2024 to 2025

- Rare disease segment becomes M&A hotspot

- Large pharmaceutical companies seek to supplement pipelines through acquisitions

- Increased industry concentration

- Mid-sized companies face strategic choices of “being acquired or acquiring”

- Small innovative companies have more exit opportunities

- DCF valuation cannot fully reflect the long-term value of rare disease drugs

- The market needs to consider M&A premiums and strategic value

- Phased valuation methods (risk-adjusted NPV) may be more applicable

- M&A premium potential

- Strategic synergy value

- Diversity of exit channels

- Execution risks during acquisition integration

- Regulatory approval uncertainty

- Continued market attention to integration success

- Amicus product revenue exceeds $1 billion

- BioMarin’s position in the rare disease segment is strengthened

- More similar M&A transactions may occur

- Long-term strategic value of the acquisition will be verified

- Biotech industry pattern will be further concentrated

- Competition in rare disease treatment market will intensify

BioMarin’s acquisition of Amicus Therapeutics is an important milestone in the biotech industry, with significant implications for investors and market participants:

- The 33% premium provides an attractive exit opportunity

- Reflects market recognition of the long-term value of Amicus’s product portfolio

- Significant stock price increase (6 months +140.30%) reflects M&A expectations

- High strategic synergy, aligned with long-term development direction

- Faces challenges in integration execution and financial management

- Analyst divergence reflects trade-off between short-term risks and long-term value

- M&A integration provides a way to realize value for high-quality companies

- Investment ratings need to comprehensively consider M&A potential and fundamental risks

- Continued opportunities exist in rare disease and specialty treatment areas

- Industry consolidation accelerates, concentration increases

- Changes in competitive landscape affect strategic choices of all participants

- Valuation methods need to be more diversified

Leerink Partners’ downgrade reminds investors that

[1] Investing.com - “BioMarin to acquire Amicus Therapeutics for $4.8 billion” (https://www.investing.com/news/company-news/biomarin-to-acquire-amicus-therapeutics-for-48-billion-93CH-4417185)

[2] BioMarin Official News Release - “BioMarin to Acquire Amicus Therapeutics for $4.8 Billion” (https://investors.biomarin.com/news/news-details/2025/BioMarin-to-Acquire-Amicus-Therapeutics-for-4-8-Billion-Expanding-Position-as-a-Leader-in-Rare-Diseases-Accelerating-Revenue-Growth-and-Strengthening-Financial-Outlook/default.aspx)

[3] Gilin API Data - Real-time quotes and company profiles for FOLD and BMRN

[4] MedCity News - “BioMarin’s Presence in Rare Enzyme Disorders Grows With $4.8B Amicus Therapeutics Acquisition” (https://medcitynews.com/2025/12/biomarin-amicus-therapeutics-acquisition-rare-disease-enzyme-deficiency-bmrn-fold/)

[5] Yahoo Finance - “Analysts Grow More Bullish on BioMarin Pharmaceuticals Inc. After Amicus Acquisition” (https://finance.yahoo.com/news/analysts-grow-more-bullish-biomarin-031846064.html)

[6] Gurufocus - “Truist Securities Raises BioMarin Pharmaceutical (BMRN) Price Target to $100” (https://www.gurufocus.com/news/4085546-truist-securities-raises-biomarin-pharmaceutical-bmrn-price-target-to-100)

[7] Investing.com - “BioMarin stock price target raised to $60 from $55 at H.C. Wainwright” (https://www.investing.com/news/analyst-ratings/biomarin-stock-price-target-raised-to-60-from-55-at-hc-wainwright-93CH-4419237)

[8] Investing.com - “BioMarin ends development of BMN 349 for AATD liver disease” (https://www.investing.com/news/sec-filings/biomarin-ends-development-of-bmn-349-for-aatd-liver-disease-93CH-4419537)

[9] StockStory - “Why BioMarin Pharmaceutical (BMRN) Stock Is Trading Up Today” (https://stockstory.org/us/stocks/nasdaq/bmrn/news/why-up-down/why-biomarin-pharmaceutical-bmrn-stock-is-trading-up-today-2)

[10] Porter’s Five Forces Analysis - “BioMarin’s acquisition of Inozyme in early 2025” (https://portersfiveforce.com/products/biomarin-five-forces-analysis)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.