Analysis of Seres' Potential for 'Turnaround from Adversity' Amid New Energy Sector Decline

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will systematically address your core question—whether Seres can achieve a ‘turnaround from adversity’ amid the overall decline of the new energy sector—from five aspects: stock price and valuation, financial fundamentals, business and competitiveness, sector and capital dynamics, and risks and strategies.

- Stock Price and Valuation: Recovery Space and Safety Margin

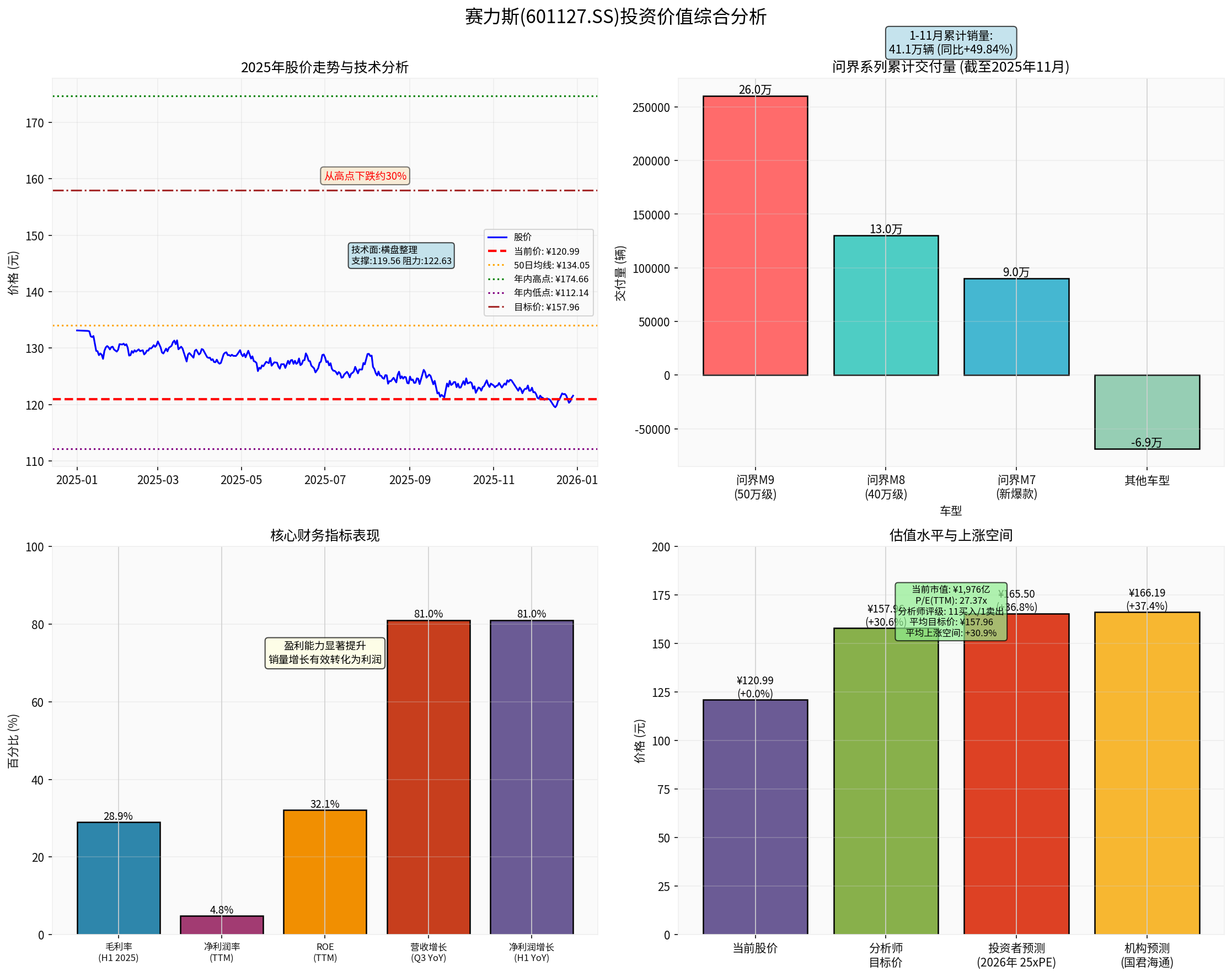

- Latest price: 120.99 yuan (+0.27%), market capitalization of approximately 197.6 billion yuan; year-to-date high of 174.66 yuan, with a notable pullback from the year’s peak.

- Valuation: PE(TTM) of about 27.37x, in the mid-to-low range of the industry; the historical annual line has declined by nearly 10 percentage points, reflecting weak capital sentiment [Brokerage API Data].

- Technical aspect: Medium-term stock price is below the 50-day (≈134 yuan) and 200-day (≈134 yuan) moving averages, with a sideways technical pattern. Support at around 119.56 yuan, resistance at around 122.63 yuan [Brokerage API Technical Analysis].

- Target price: Average institutional target price of approximately 157.96 yuan (from multiple brokerages), representing a potential upside of about +30.9% from the current price, reflecting medium-to-long-term recovery expectations [Web Search].

- Summary: Valuation safety margin and recovery space coexist, but capital and technical factors are needed to form a trend.

- Financial Fundamentals: Profitability and Performance Resilience

- Performance: Latest quarterly revenue and EPS significantly exceeded expectations (revenue 48.13B vs expected 27.57B; EPS 1.45 vs expected 0.0155), verifying scale effects and high-end profit contributions [Brokerage API Data].

- Profit quality: H1 gross margin rose to 28.93%, H1 net profit attributable to parent company increased by 81% YoY, ROE of about 32%, net margin of about 4.8%, indicating improved efficiency in converting sales volume to profits [Brokerage API Financial Data].

- Cash flow and leverage: Free cash flow turned positive, liquidity indicators marginally improved; overall financial health ranks above average in the industry [Brokerage API Financial Analysis].

- Summary: Profitability and financial quality form the performance foundation for a ‘turnaround from adversity’, with stable profit expectations for Q4 and 2025.

- Business and Competitiveness: High-endization, Intelligence, and Internationalization

- Sales structure: Cumulative sales from January to November reached 411,000 units (+49.8% YoY). Aito M9 cumulative deliveries exceeded 260,000 units, M8 exceeded 130,000 units, and the new Aito M7 received over 90,000 pre-orders within 41 days of launch. The high-end model matrix drives average price and profit margins [Web Search and Sales Data].

- Technology and intelligent driving: Leading layout in intelligence (ADS3.0, HarmonyOS Cockpit) and L3 technology under the collaborative ecosystem, benefiting from the advancement of first-batch L3 vehicle access policies [Web Search].

- Capacity and overseas expansion: Completed A+H dual listing, HKEX IPO net proceeds of approximately HK$14 billion, with 70% planned for R&D; overseas expansion focuses on the Middle East and Europe, supported by channel and localization布局 [Web Search and Company Materials].

- New business: Layout in embodied intelligence directions such as robotics with ecosystem synergy, expected to form a second growth curve in the long term [Web Search].

- Summary: High-endization and intelligence form competitive barriers; overseas expansion and new businesses provide medium-term growth momentum.

- Sector and Capital Dynamics: Opportunities and Pressures Amid Rotation

- Sector performance: The new energy vehicle sector has recently corrected, with capital flowing to commercial aerospace and PCB sectors阶段性 [Web Search Sector].

- Industry trends: Industry competition pattern is accelerating differentiation; price wars and subsidy retreat put pressure on small and medium-sized automakers to exit; profitability becomes the key to success [Web Search Industry].

- Macro and policies: Expectations for the continuation of the 2026 ‘New National Subsidy’ are stable, but the intensity and implementation effect need to be observed; tariffs and carbon border adjustment mechanisms pose both challenges and opportunities for overseas expansion [Web Search Policies and Overseas Expansion].

- Summary: Weak sector sentiment suppresses valuation, but industry exit and concentration improvement benefit leading players.

- Risks and Strategies: Time Dimension and Recommendations

- Main risks: Intensified industry price wars, high-end demand falling short of expectations, geopolitical and compliance risks for overseas expansion, and valuation pressure from sustained sector capital rotation.

- Strategy Recommendations:

- Long-term fundamental investors: Phased layout at relatively reasonable valuation ranges (support around 120 yuan), focusing on profit realization and overseas capacity release in the medium term;

- Short-term traders: Monitor trading volume and technical breakthrough signals, wait for sector capital inflow and policy catalysts;

- Risk control: Set reasonable stop-loss and position management to cope with industry volatility and macro uncertainty.

Conclusion and Judgment:

- Seres has medium-term potential for a ‘turnaround from adversity’: Stable performance and fundamentals, high-end products and technology forming barriers, overseas expansion and R&D supporting growth, and considerable valuation recovery space.

- Short-term (several months) is still constrained by sector capital rotation and technical volatility; may need to wait for sustained performance verification and sector sentiment recovery;

- Medium-term (6-12 months) is expected to stage a recovery driven by profit realization, order and capacity landing, overseas expansion, and new product cycles, with the target price referencing the institutional average of around 158 yuan.

- Key Observations: Q4 and 2025 order and delivery status, high-end model market share, overseas channel and factory progress, policy implementation pace.

(Note: The above analysis is based on available market, financial, and industry data and does not constitute investment advice. Please make independent decisions based on your own risk preference.)

[0] Jinling API Data

[1] Economic Reference Network - Seres’ Sales and Capital Double Success: High-end Strategy Initially Shows Profit Effect

[2] NetEase - Aito M9 Deliveries Exceed 260,000 to Lead High-end Market; Seres Starts New Journey with Capital Benefits

[3] Xinpai Network - Seres New Energy Vehicle Monthly Sales Exceed 50,000 Again, Up 50% YoY; Aito Continues to Lead High-end Market

[4] Eastmoney.com - [ETF Strategy Weekly] New Energy Sector Tracking: Energy Storage Demand Remains Strong, ‘Anti-involution’ Continues to Advance

[5] Caifuhao - 2026 ‘New National Subsidy’ Invests 500 Billion! Will New Energy Vehicle Replacement Change?

[6] Gasgoo - The Frenzy, Shuffle, and Breakthrough of Intelligent Driving | Seeing 2025

[7] Industry views from Deutsche Bank and JPMorgan cited from self-media collated reports - Subsidy Exit, Demand Freeze: 50 Chinese EV Makers May Exit Collectively in 2026

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.