Analysis of Seres' Valuation Repair and Growth Prospects

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive analysis, Seres has the

- Strong new product cycle (M9, M8, M7 matrix)

- Technical premium from L3 autonomous driving policy breakthroughs

- Significant improvement in profitability (turning from loss to profit) in 2024-2025

- Successful Hong Kong Stock Exchange IPO provides sufficient capital support

- ‘Revenue growth without profit growth’ in Q3 raises market concerns about expense ratio

- The stock price has fallen about 31% from its high, facing technical pressure

- High sales expense ratio issue

- Uncertainty in overseas expansion implementation and certification cycles

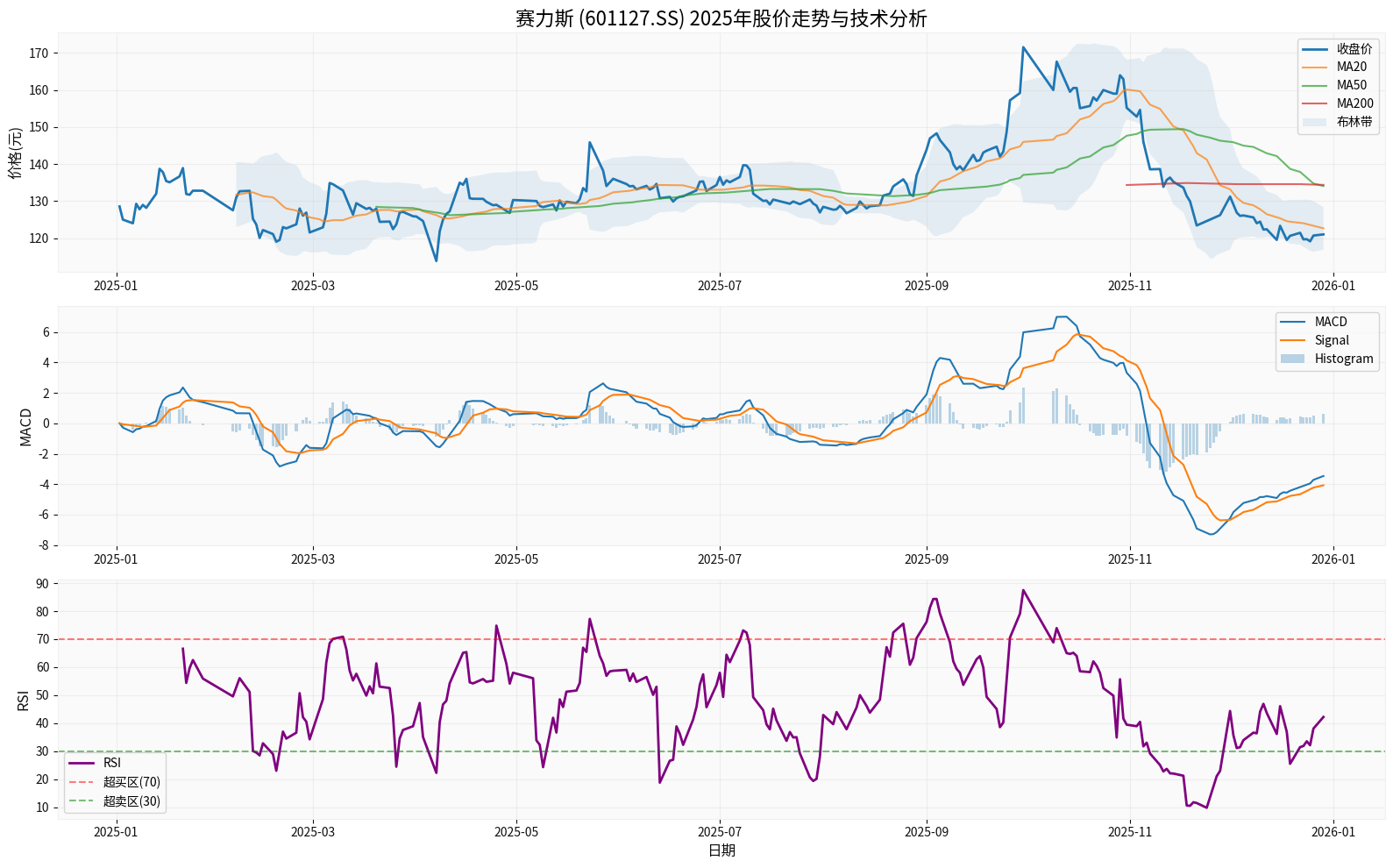

- Opening price at the start of the year: 131.66 yuan

- Current price (December 29): 120.99 yuan

- Annual change: -8.10%

- Annual highest price: 174.66 yuan (September 30)

- Annual lowest price: 112.14 yuan (April 7)

- Current retracement from the highest point: 30.73%[0]

- MACD: The histogram is 0.61, indicating that short-term momentum has started to turn positive (signs of bottom divergence)

- RSI: 42.23, in the neutral to weak area (not entering the oversold zone below 30), with room for short-term repair remaining

- Moving Average System:

- The stock price is running near the 20-day moving average (122.63), with short-term support/resistance in a stalemate

- The 50-day moving average (134.05) and 200-day moving average (134.36) form medium-to-short-term resistance to the stock price

- The current moving average pattern shows a medium-term weak pattern; if the convergent triangle and MACD bottom divergence are accompanied by a volume breakthrough, it is expected to trigger a technical rebound

- Annualized Volatility: 35.45%, with a high level of volatility, reflecting large market divergence

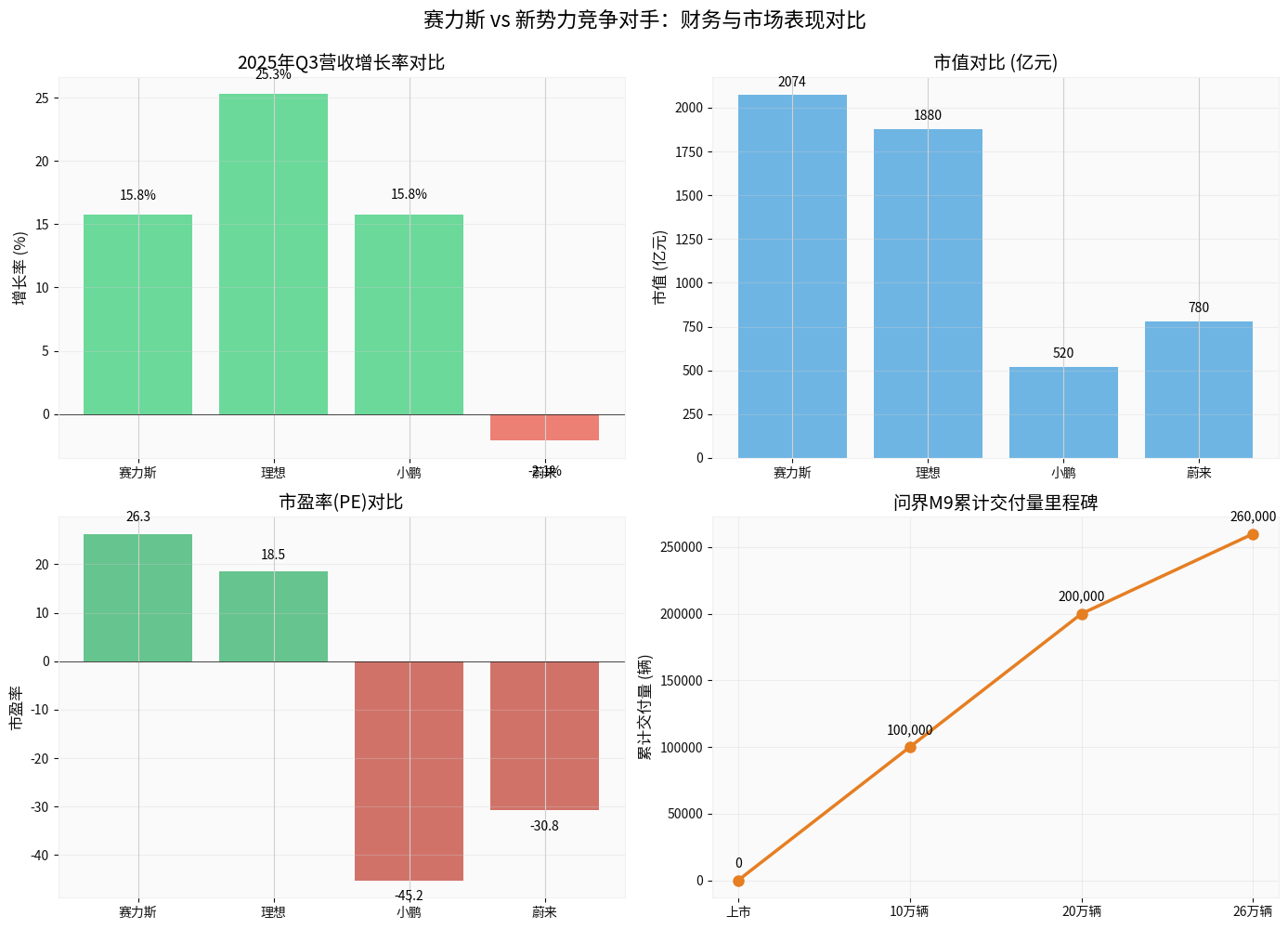

- Market capitalization: approximately 207.3 billion yuan

- P/E ratio (TTM): approximately 26.3 times (2024 EPS is about 4.60 yuan)

- Analysts’ 12-month average target price: approximately 157.96 yuan (11 analysts, target range 129.10-199.00 yuan)

- Implying an upside potential of about 30.5% from the current price

- After the Hong Kong Stock Exchange listing, the A+H dual-platform financing channel has been further expanded, enhancing financing and globalization capabilities

- Cumulative deliveries have exceeded 260,000 units (December 2025 data), becoming the sales champion of luxury SUVs priced above 500,000 yuan

- The average transaction price per vehicle is about 550,000 yuan, with cumulative sales exceeding 140 billion yuan

- In 2024, AITO M9 contributed approximately 75 billion yuan in revenue, accounting for 51.7% of the company’s total revenue

- In October 2025, monthly NEV sales reached 51,000 units, a historical high; cumulative sales in the first 10 months were 356,000 units

- AITO M8: Positioned as a mid-to-high-end SUV, with an annual sales target of about 300,000 units combined with M9

- AITO M7: Extended-range SUV, main volume model, with a sales target of over 200,000 units

- M9L Extended Version/M9 Custom: Higher premium models, expected to further increase the average price and gross profit margin

- The market expects annual sales of about 650,000 units, corresponding to revenue of approximately 250 billion yuan (institutional calculation)

- Management guidance and channel research show that monthly average deliveries in Q4 are expected to reach 50,000-60,000 units (brokerage report)

- New product volume release helps increase revenue and profit scale

- Increased high-end share drives gross profit margin improvement (Q3 gross profit margin has reached about 29.9%, industry average about 22%)

- M9/M8/M7 form a ‘pyramid’ matrix, with a clear gradient from flagship to volume products, which is conducive to the continuous improvement of market share and brand momentum

- In December 2025, the Ministry of Industry and Information Technology approved L3-level mass production access for two models, Changan Deepal SL03 and ArcFox Alpha S6, for pilot operation on specific roads in Beijing and Chongqing

- For the first time at the national level, the responsibility division for L3-level autonomous driving was clarified (car companies may bear main responsibility when the system is activated)

- In October 2025, the penetration rate of L2.5 and above intelligent driving reached 32.19%, with a cumulative penetration rate of 25.89%, and high-level intelligent driving is accelerating penetration

- Deeply bound with Huawei, equipped with the ADS intelligent driving system (ADS 3.0 has been applied to M9)

- Through a 11.5 billion yuan strategic investment in Huawei’s Auto BU subsidiary ‘Yinwang Intelligence’, obtained 10% equity to become the second largest shareholder

- Yinwang Intelligence’s 2024 revenue exceeded 20 billion yuan and plans to go public independently in 2026; based on the 2025 forecast net profit of about 5 billion yuan, potential investment income is expected to boost the company’s net profit

- 2025 is called the ‘first year of commercialization’ for L3 conditional autonomous driving

- Many car companies have set the L3 mass production schedule for 2025-2026

- The number of high-level autonomous driving (120 km/h) models in China is still in the early stage, and HarmonyOS Intelligent Mobility models are expected to achieve rapid market share growth with technical advantages

- L3 technology is expected to support higher brand premium and profit margin (the ‘high growth rate, high premium’ characteristics of the intelligent luxury car track)

- Companies leading in intelligent driving are expected to enjoy double premiums of technology and brand, leading to an upward shift in the valuation center

- Yinwang’s equity income is expected to contribute additional investment income and boost net profit (brokerage calculation: 2026 penetration rate about 7%)

- On November 5, 2025, Seres listed on the Hong Kong Stock Exchange under ‘09927.HK’, with a net fundraising of approximately 14.016 billion Hong Kong dollars (over 100 times oversubscription)

- Fund use: 70% for R&D, 20% for new model development, and 10% for supporting overseas market expansion

- This provides financial security for intelligent driving iteration and globalization

- Middle East and Europe: Promote globalization layout as a breakthrough, and AITO M9 has carried out brand and product awareness building locally

- Products and channels: M9, M8 and other products are overseas flagship models, and are expected to be quickly deployed relying on Huawei’s overseas channels (over 1,000 stores)

- Sales target: 2026 export target of about 50,000 units (brokerage calculation)

- Revenue elasticity: If overseas sales account for 10%, it can bring about 15 billion yuan in additional revenue (industry calculation)

- The European NEV market size is about 5 million units/year, but the share of L3 intelligent luxury cars is still less than 1%, and the overall market share of Chinese brands is about 8% (2024), with considerable room for improvement

- Compliance cycles such as EU WVTA certification may restrict the implementation pace, and relevant progress needs to be monitored

- If the overseas market breaks through smoothly, it will open up medium-to-long-term growth space and provide a second curve for revenue and profit

- Global layout is conducive to smoothing single market fluctuations and improving brand premium and profit stability

- Hong Kong listing provides a global financing platform, which is conducive to capital expenditure and merger and acquisition integration

- Operating revenue: 145.176 billion yuan

- Net profit: 5.946 billion yuan (2023 was a loss of 2.45 billion yuan, achieving a significant turnaround from loss to profit)

- Operating revenue: 110.534 billion yuan (YoY +15.75%)

- Net profit attributable to parent company: 5.312 billion yuan (YoY +31.56%)

- Q3 single-quarter revenue: 48.133 billion yuan (YoY +15.75%)

- Q3 single-quarter net profit: 2.371 billion yuan (YoY -1.74%), “revenue growth without profit growth” triggered discussions on expenses and profit margins

- Q3 gross profit margin: about 29.9% (significantly higher than the NEV industry average of about 22%)

- Gross profit margin leads the industry (M9 gross profit margin exceeds 35%)

- Profitability improved rapidly (from a loss of 2.45 billion yuan in 2023 to a profit of 5.946 billion yuan in 2024)

- Operating cash flow improved, product structure optimization and scale effect gradually reflected

- High sales expense ratio: The market questions the high sales expense level in Q3, which drags down the net profit margin; there are differences in the market, and subsequent expense control and efficiency improvement need to be monitored

- R&D investment intensity: As a technology-driven company, it needs continuous high-intensity R&D investment, which may suppress profit elasticity in the short term

- Accounts receivable turnover: Changes in accounts receivable and inventory turnover should be monitored for their impact on operational efficiency

- Free cash flow (2024): approximately 15.37 billion yuan (financial analysis tool data)

- Debt risk classification: medium risk (financial analysis tool)

- Capital expenditure and depreciation and amortization form certain pressure on cash flow, but with the improvement of scale effect and operational efficiency, the quality of cash flow is expected to improve

- Q3 revenue increased by 15.75% YoY, but net profit decreased by 1.74% YoY, leading to market concerns about expense ratio and profit margin

- Some views believe that sales expense investment is too large, triggering discussions on expense efficiency

- The overall valuation system of the NEV track is being restructured, and the market’s requirements for profit quality and sustainability have increased

- Q3 data disturbance triggered a re-examination of the long-term profit path

- After the stock price peaked near 174.66 yuan, technical correction pressure was released

- Institutional funds had phased net outflows (December single-day data shows a single-day net outflow of about 400 million yuan)

- The 50-day/200-day moving average forms resistance, and the weakening technical pattern leads to trend fund outflows

- NEV price wars continue, with particularly fierce competition in the 200,000-300,000 yuan range

- Competitors like Li Auto, NIO, and Xpeng are accelerating iterations, and market concerns about the ‘impossible triangle’ of share and profit margin are rising

- Under the A+H dual-platform pricing mechanism, the valuation system needs rebalancing

- After the Hong Kong listing, some funds are adjusting their allocation between A/H shares

- Some market views believe that there is a high overlap between shareholders and potential customers, and stock price fluctuations may backfire on the brand and orders (but this logic is controversial and needs to be treated with caution)

- Q4 sales data (if monthly average deliveries of 50,000-60,000 units are realized)

- Launch and order data of new products like M9L and M9 Custom

- Progress of L3-related policy details and pilot expansion

- Clearer fund use and overseas expansion routes after Hong Kong listing

- Short-term target price: 130-140 yuan

- Trigger condition: Technical breakthrough of the 50-day moving average (about 134 yuan), which needs to be verified with volume and Q4 delivery data

- Continuous ramp-up of models like M8 and M7 and achievement of sales targets

- Implementation pace of L3 functions in more cities/roads

- Specific progress in overseas markets (e.g., certification, channels, and first deliveries)

- 2025 full-year performance guidance and 2026 targets

- Medium-term target price: 150-160 yuan (close to the lower limit of institutional target price range)

- Corresponding upside potential: about 24%-32%

- Overseas market breakthrough and increased sales share (e.g., realization of 2026 export target of 50,000 units)

- L3 penetration rate increases to about 7% (brokerage expectation), driving brand premium and software monetization

- Investment income from Yinwang Technology gradually reflected in the financial statements

- Annualized net profit achieves a CAGR of over 40% (brokerage calculation)

- Long-term target price: 166-199 yuan (brokerage target price range)

- Corresponding upside potential: about 37%-65%

- The current stock price has fallen about 31% from the September high, and valuation pressure has been partially released

- Strong new product cycle (M9/M8/M7 matrix), expected to continue high prosperity in Q4 and 2026

- L3 policy implementation opens up intelligent driving commercial space, and deep binding with Huawei builds technical and ecological barriers

- Hong Kong IPO and global layout provide a second curve of medium-to-long-term growth

- Clear valuation repair path: short-term focus on technical aspects and sales realization, medium-term focus on new products and intelligent driving implementation, long-term focus on overseas expansion and profit quality

- Conservative target: 130 yuan (about 7% upside potential)

- Benchmark target: 150 yuan (about 24% upside potential)

- Optimistic target: 166 yuan (about 37% upside potential, referring to some brokerage target price ranges)

- Current position (120-121 yuan): Can consider bottom-up layout, focusing on Q4 delivery data and expense ratio changes

- Pullback to 115-120 yuan: If a technical second bottom appears, it is a better left-side buying point

- Breakthrough of 135 yuan: Can consider increasing positions, indicating that the medium-term trend has turned strong

- Price wars continue or escalate, eroding gross profit margin and profit margin

- Competitors like Li Auto, NIO, Xpeng continue to put pressure in the 200,000-500,000 yuan range

- L3 intelligent driving policy implementation pace is slower than expected

- Intelligent driving safety accidents may trigger regulatory tightening

- EU WVTA and other certification cycles are extended

- Uncertainty in geopolitics and trade barriers (e.g., tariffs)

- Brand building locally takes time, and sales realization pace may be lower than expected

- Sales expense ratio remains high, suppressing net profit margin

- New product iteration pace or sales are lower than expected

- Dual-platform pricing and capital allocation efficiency after Hong Kong listing

- The overall valuation of the A-share NEV sector is under pressure

- Market risk preference for growth stocks fluctuates

- Weekly/monthly delivery and order data

- Institutional fund flow and northbound fund position changes

- Technical indicators (MACD, RSI, moving average system)

- Gross profit margin, net profit margin, expense ratio

- Operating cash flow and free cash flow

- Overseas sales and channel construction progress

- L3 function implementation cities and user feedback

Seres is in a

- Strong new product cycle: AITO M9’s phenomenal hit (260,000+ units) drives the product matrix (M8/M7) to form a pyramid growth engine

- Technical breakthrough dividends: First year of L3 commercialization and deep binding with Huawei’s intelligent driving, expected to continue to enjoy technical and brand premiums

- Improved profitability: From a loss of 2.45 billion yuan in 2023 to a profit of 5.946 billion yuan in 2024, and then to a 31.56% YoY profit growth in the first three quarters of 2025

- Global layout: Hong Kong IPO and overseas market expansion open up the second growth curve

If the company can meet sales targets in Q4 and 2026, control expense ratios, and advance overseas and intelligent driving implementation in an orderly manner, Seres has a strong possibility of achieving valuation repair to the range of 150-166 yuan. Investors are advised to focus on Q4 delivery data, 2025 full-year performance guidance, L3 policy implementation pace, and overseas market certification and channel progress to seize medium-to-long-term layout opportunities.

[0] Gilin API data (stock price, financial data, technical analysis, valuation data, Python calculation)

[1] Economic Observer - “AITO M9 deliveries exceed 260,000 units leading the high-end market, Seres opens a new journey with capital benefits” (https://www.163.com/dy/article/KFMLVGPC05199DKK.html)

[2] Xueqiu - “Under the high growth expectation of the L3 intelligent luxury car track, the underlying support for Seres’ high revenue and profit growth” (https://caifuhao.eastmoney.com/news/20251219124745165221510)

[3] Sina Finance - “L3-level autonomous driving officially ‘licensed to hit the road’, opening a new era of human-machine co-driving in the commercialization元年” (https://finance.sina.com.cn/roll/2025-12-20/doc-inhcmhcp6857261.shtml)

[4] CICC - "Mid-to-high-end NEV

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.