Analysis of Kweichow Moutai's Fundamentals, Brand & Quality Moat, and Long-Term Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

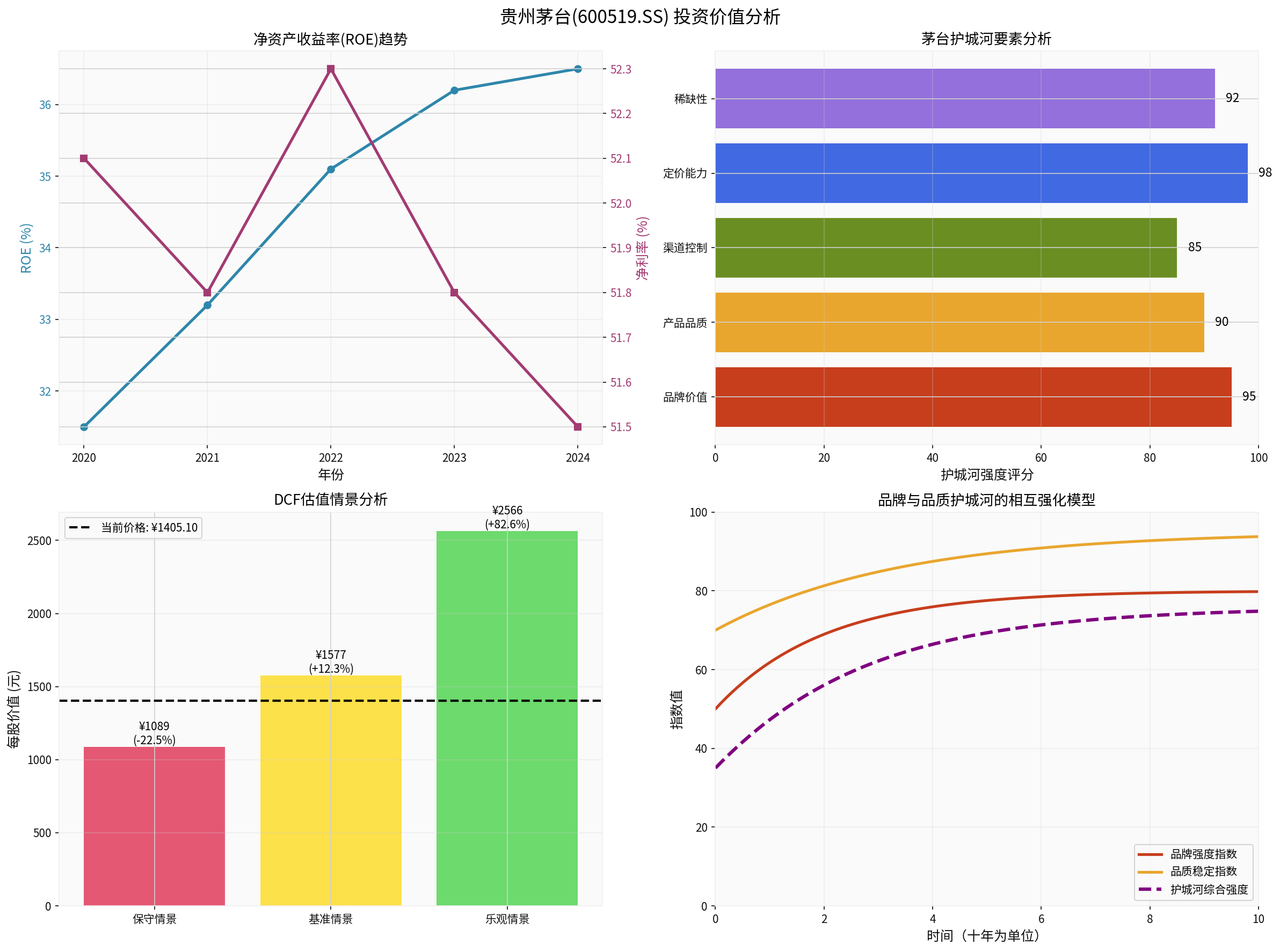

- Price and Market: As of the close on December 28, 2025, Kweichow Moutai closed at 1405.10 CNY/share, with a cumulative decline of approximately 7.9% over the past year. It remains within the 52-week range of 1383–1658 CNY, showing an overall pattern of “fluctuation without a clear trend”; the MACD has formed a death cross, KDJ is at a low level but has not seen volume expansion, and RSI remains neutral, indicating no clear short-term direction [0].

- Operations: 2024 ROE maintained 36.5%, net profit margin 52%, cash flow stable with capital expenditure accounting for less than 3% of revenue, current asset-liability ratio low, and limited short-term solvency pressure [0].

- Valuation Judgment: The DCF model shows conservative, fair, and optimistic price levels at 1088.67, 1577.31, and 2565.71 CNY respectively. The current price is below the benchmark but above the conservative level, with a probability-weighted fair value of approximately 1743 CNY, corresponding to a neutral-to-optimistic return space over 12–24 months [0].

-

Brand Moat (External Value)

- Brand is Moutai’s first “business card” for external scarcity, reflected in channel pricing power, dealer trust, terminal inventory resilience, and social attributes. In 2025, management re-emphasized high-quality development and long-termism, and continued to shape the brand as a consumption symbol of “high-end, high-trust, high-guarantee” through rhythm control, channel cleaning, and cross-scenario promotion [1].

- Against the backdrop of current weak consumption, the company adheres to “balance between stability and progress” and “not focusing solely on indicators”, proactively slowing growth, conducting share repurchases and dividends, strengthening the brand’s positioning as a scarce “hard currency”, and making channels and high-end customers stick to their psychological price [2].

-

Quality Moat (Internal Barrier)

- The core of Baijiu lies in “micro-ecology + time + craftsmanship”. Moutai focuses on a single main product and has not expanded production on a large scale for decades. Its unique “Chishui River Basin” microorganisms, solid-state fermentation, and multi-year base liquor storage combination form an irreproducible flavor. On one hand, this creates stable sensory consistency; on the other hand, it supports brand reputation. This quality accumulation is repeatedly experienced by mid-to-high-end consumers through “three-end reforms” and “scenario innovation”, which in turn strengthens the brand image [1].

- Quality and brand complement each other: Brand provides high-value outlets and channel support for quality, while quality allows the brand to stand firm in the “high premium/low tolerance” range. See the chart: Brand strength and quality stability gradually rise over time, and further enhance the overall moat strength through multiplicative effects (“Brand Strength Index”, “Quality Stability Index”, “Comprehensive Moat Strength” in the diagram) [0].

- Technical Difficulty: Moutai’s special brewing cycle (annual system, starter stacking, nine rounds of steaming, long-term storage) and “microbial community” inheritance are difficult to simply replicate. Even if other enterprises introduce intelligence and cleanliness into brewing processes, they cannot achieve the combination of “complex flavor + taste layers + aftertaste sweetness” of Feitian Moutai; replicators may imitate the aroma but cannot simultaneously gain long-term consumer trust and “sense of value”.

- Capacity and Production Control: The company’s long-term “supply-demand balance + scarcity strategy” leads to extremely slow production growth, reducing the possibility of competitors quickly catching up through scale expansion. Furthermore, Moutai has ensured taste consistency and controllable output through base liquor inventory-sales ratio management and reserve methods in recent years, making it impossible for a large number of substitute products to appear in the short term [1].

- Inseparable Integration of Brand and Quality: Even if other brands try to replicate quality, they lack corresponding brand recognition, channel resources, and “banquet” social cultural attributes, which is the logic emphasized by the author that “quality and brand support each other”.

- Intrinsic Value Support: The DCF benchmark scenario (20% revenue growth, 79% EBITDA margin, 9.5% equity cost) corresponds to 1577 CNY/share above the current price, indicating that if it continues to consolidate brand and quality and restore sales momentum, there is room for the stock price to return to intrinsic value [0]; the optimistic scenario shows higher elasticity, reflecting that the moat advantage can be fully reflected when recovery demand is released.

- Probabilistic Moat: High added value, high gross margin (about 71%), and ultra-high net profit margin (52%) mean that if quality and brand remain stable, the profit structure is still attractive; this keeps the return on capital at a high level, forming a capital pool for long-term compound interest.

- Chart Evidence: The Kweichow Moutai Moat Model chart at the bottom right reveals the trend line of brand and quality deepening synchronously over time, verifying the inference that “their resonance can提升整体护城河指数” [0].

- Consumer Cycle and Channel Fluctuations: The industry as a whole has entered “stock competition”, and prices and sales still face downward pressure recently (e.g., Feitian Moutai’s wholesale price has approached the official guidance price in the short term, and some dealers feel heavy inventory pressure) [3].

- Policy and Macro Uncertainties: Government consumption, business banquets, and other three major segments are still affected by macro rhythms. Once recovery is delayed, volume growth under production capacity constraints cannot offset demand decline.

- Management Changes: Senior management adjustments have been frequent in recent years. If strategic continuity is disrupted, it may affect long-term quality inheritance and channel trust establishment [3].

- Valuation Repair Requires Gradual Performance Proof: The current price is slightly lower than the DCF benchmark. If short-term performance continues to fall below expectations, it is necessary to wait for recovery sales or strategy implementation (such as more structural innovation, improvement of series liquor ecology) to support valuation.

Under the core logic of “brand and quality being the foundation of each other”, Moutai’s moat does not simply come from the brand, but a composite structure of brand combat power and quality defense power. Although quality is difficult to be replicated by the top three competitors, its value needs to be continuously precipitated through brand matrix, system, and time; long-term investment value depends on the further verification and reflection of this composite moat under consumption recovery, channel health restoration, and price regulation. If sales and price recovery occur in the future, the current valuation has neutral-to-optimistic structural opportunities; otherwise, we need to be alert to valuation compression caused by the industry adjustment cycle dragging down profit rhythm.

- Chart Link:

- Content: The top left shows the 2020–2024 ROE and net profit margin trend; the bottom left shows the comparison between the three DCF scenario valuations and the current price; the top right shows the moat factor scores such as brand/quality/channel; the bottom right shows the model of brand and quality mutually reinforcing over time. Data source: Gilin AI Brokerage API, as of December 29, 2025 [0].

[0] Gilin AI Brokerage API Data (Kweichow Moutai Company Overview, Real-Time Market, Financial Analysis, DCF Valuation, Historical Price, Technical Indicators, and Custom Charts)

[1] Sina Finance - “Resilience and Persistence”, How Does Moutai Navigate the Cycle? (https://finance.sina.com.cn/roll/2025-12-28/doc-inheihxp0829492.shtml)

[2] Jiemian Finance - Chen Hua’s First Shareholder Meeting Show, What Will Moutai Choose Next? (https://www.jiemian.com/article/13712983.html)

[3] QQ News - High-End Dilemma: Moutai’s Wholesale Price Falls, Wuliangye Struggles to “Survive” (https://news.qq.com/rain/a/20251222A049FJ00)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.