INVO Fertility Reverse Stock Split Analysis: Compliance Effort and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Globe Newswire press release [1] published on July 17, 2025, announcing INVO Fertility’s 1-for-3 reverse stock split effective July 21, 2025.

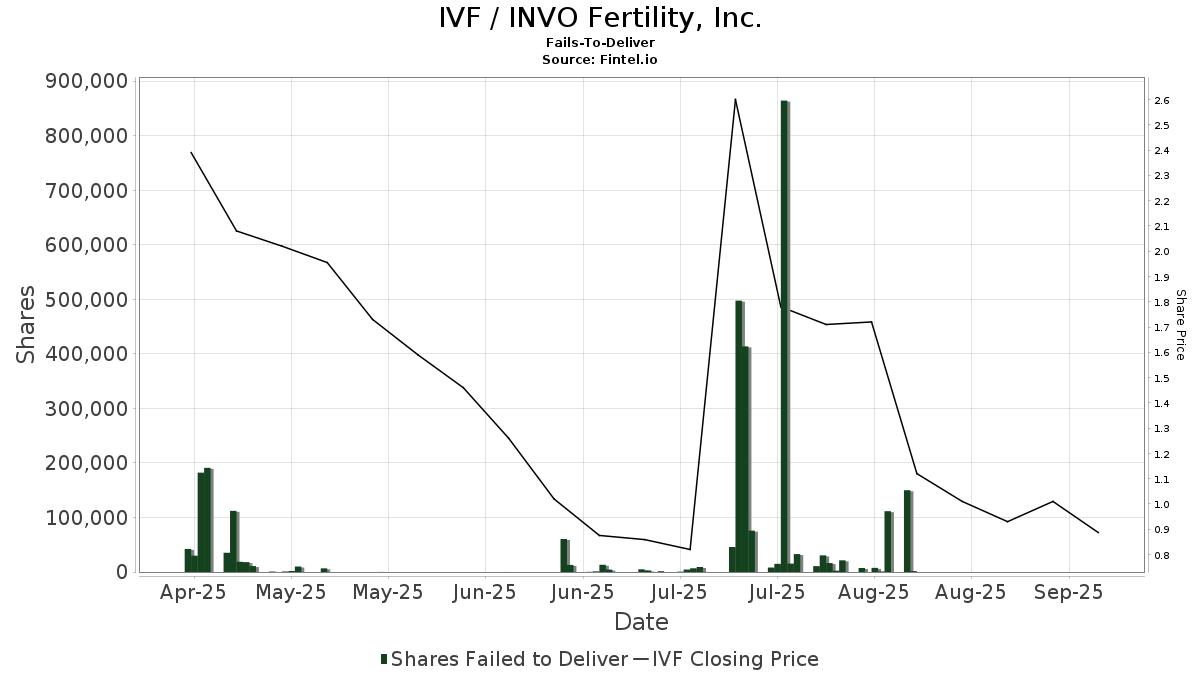

INVO Fertility executed the 1-for-3 reverse stock split as scheduled on July 21, 2025, at 12:01 AM Eastern Time, with trading commencing under the same IVF symbol on the Nasdaq Capital Market [1]. The company explicitly stated this action was “primarily intended to bring the Company into compliance with Nasdaq’s $1.00 per share minimum bid price requirement for continued listing” [1][2]. However, management provided a crucial caveat that “no assurance can be given that such reverse stock split will enable the Company to regain compliance with the Nasdaq minimum bid price requirement” [1].

The reverse split triggered immediate but unsustainable market activity. On July 22, 2025 (first full trading day post-split), the stock experienced extraordinary volume of 52.4 million shares, reaching a high of $4.24 before closing at $3.46 [0]. This represented a 35.7% increase from the pre-split adjusted price. However, the momentum proved temporary, with the stock declining throughout July 2025 from $2.61 to $0.96 (-63.22%) [0]. As of November 1, 2025, IVF trades at $0.54, well below the Nasdaq minimum bid requirement [0].

The company’s financial metrics reveal severe underlying challenges that the reverse split failed to address:

- Profitability Crisis: ROE of -597.99%, net profit margin of -422.10%, and EPS of -$92.72 (TTM) [0]

- Liquidity Concerns: Current ratio of 0.11 and quick ratio of 0.10 indicate potential cash flow issues [0]

- Revenue Scale: Recent quarterly revenues between $1.64M - $1.86M suggest limited business scale [0]

- Market Capitalization: Extremely low market cap of $501,824 reflects severe investor confidence erosion [0]

Notably, the company underwent significant structural changes, formerly operating as NAYA Biosciences, Inc. before rebranding to INVO Fertility, Inc. in April 2025 [2]. This transformation suggests a strategic pivot or reorganization coinciding with the compliance challenges.

The reverse split occurred within a significantly changed regulatory landscape. In January 2025, the SEC approved new rules limiting companies’ ability to use reverse stock splits to regain compliance with minimum price requirements [3]. Nasdaq’s amended rules specifically target companies that have “effectuated one or more reverse stock splits within a two-year period with a cumulative ratio of 250 shares or more to one” [4]. This regulatory tightening constrains the company’s options if the current reverse split proves insufficient.

The reverse split represents a technical compliance measure rather than addressing fundamental business challenges. The company’s year-to-date performance of -89.99% and 6-month performance of -90.41% [0] indicate deep-seated issues beyond share price mechanics. The 52-week range of $0.45 - $37.44 [0] demonstrates extreme volatility and a 96%+ decline from peak levels.

The brief post-split rally followed by continued decline suggests market skepticism about the company’s fundamental prospects. The trading pattern indicates that investors recognized the reverse split as a temporary technical fix rather than evidence of operational improvement.

The analysis reveals that the company faces significant delisting risk despite the reverse split implementation. The stock’s current trading level of $0.54 [0] indicates the primary compliance objective was not achieved. Users should be aware that Nasdaq may initiate delisting proceedings if the company cannot maintain the $1.00 minimum bid price for sustained periods.

The new SEC and exchange rules limiting reverse stock split usage [3][4] may constrain the company’s ability to execute additional technical compliance measures. This regulatory environment increases the urgency for fundamental business improvements.

The extremely low liquidity ratios (current ratio 0.11, quick ratio 0.10) [0] suggest potential cash flow constraints. The company’s negative profitability metrics and limited revenue scale raise questions about operational sustainability without additional financing.

Key factors requiring ongoing observation include:

- Nasdaq compliance notificationsand potential delisting determinations

- Financing activitiesand capital structure changes, given recent SEC filings showing ongoing private placements [5]

- Revenue trajectoryand business model validation in the fertility market

- Cash position and burn ratecritical for survival assessment

- Market sentimentgiven the extreme decline from 52-week highs [0]

The reverse stock split represents a technical compliance effort that has not resolved INVO Fertility’s fundamental challenges. The company’s severe financial distress metrics, poor liquidity, and continued sub-$1.00 trading price indicate ongoing operational difficulties. The new regulatory environment limiting reverse stock split usage [3][4] further constrains the company’s options for technical compliance solutions. The extremely low market capitalization of $501,824 [0] reflects significant investor confidence erosion and suggests substantial business model validation requirements remain. The company’s transformation from NAYA Biosciences to INVO Fertility [2] indicates strategic repositioning, but the financial metrics suggest this transformation has not yet achieved operational stability or market acceptance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.