Analysis of the Impact of State Grid's Digital Transformation on Investment in the Power Technology Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on current market data and industry trend analysis, I will provide you with a comprehensive analysis of the impact of State Grid’s digital transformation on investment in the power technology sector.

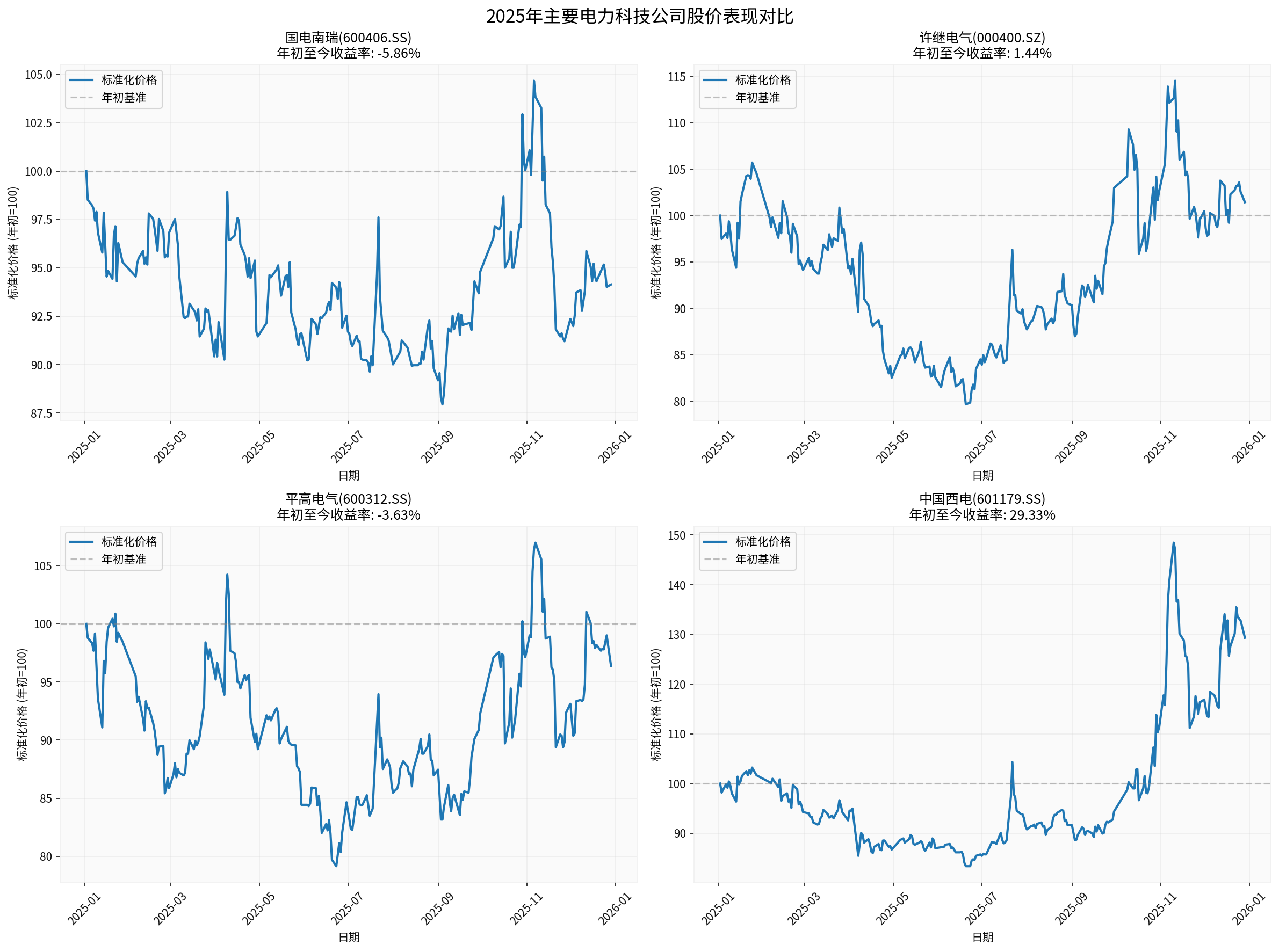

From the chart, we can see [0]:

- China XD Electric (601179.SS): The strongest performer with an annualized return of29.33%, current share price of 9.26 yuan, and market capitalization of 47.47 billion yuan

- Xuji Electric (000400.SZ): Steady rise with an annualized return of1.44%, current share price of 26.09 yuan, and market capitalization of 26.31 billion yuan

- Pinggao Electric (600312.SS): Slight decline with an annualized return of-3.63%, current share price of 17.52 yuan, and market capitalization of 23.77 billion yuan

- NARI Technology (600406.SS): Industry leader with an annualized return of-5.86%, current share price of 22.80 yuan, and market capitalization of 183.13 billion yuan

- NARI Technology: P/E 22.80, P/B 3.70, in a reasonable range [0]

- Xuji Electric: P/E 24.38, moderately valued [0]

- Pinggao Electric: P/E 20.61, relatively undervalued [0]

- China XD Electric: P/E 38.58, high valuation but reflects growth expectations [0]

The rapid development of AI technology is reshaping the power demand landscape. According to The Wall Street Journal, driven by AI power demand, almost all segments of the power industry—from solar to nuclear and coal—rose in 2025 [1].

- China currently has the world’s largest power grid system. From 2010 to 2024, China’s power generation growth exceeded the sum of all other regions in the world

- China’s power generation in 2024 was more than twicethat of the United States

- Goldman Sachs predicts that by 2030, China will have approximately 400 gigawattsof surplus power generation capacity, about three times the expected global data center power demand at that time [3]

This advantage gives China an

The establishment of the Jibei New Power System Research Institute, whose business scope covers

- Technology Innovation Driven: Deeply integrate cutting-edge technologies such as AI and big data into grid operations to enhance grid intelligence

- Industrial Chain Collaboration: Integrate upstream and downstream resources of the industrial chain through the research institute platform to promote the construction of a power technology ecosystem

- Talent and Knowledge Accumulation: Cultivate interdisciplinary talents and accumulate core technologies for power digitization

- Business Model Innovation: Explore new models such as power data assetization and digitalization of power services

From the perspective of the capital market, this initiative will:

- Boost Market Confidence: A clear digital transformation direction strengthens investors’ long-term optimism about the power technology sector

- Drive Order Growth: Accelerated construction of smart grid and digital substation projects brings order growth for related companies

- Elevate Valuation Levels: Expectations of digital transformation will drive power technology companies to transform from traditional equipment manufacturers to technology service enterprises, raising the valuation center

-

Shift from Equipment Competition to Technology Competition

- Traditional power equipment market competition mainly revolves around price and quality

- After digital transformation, the focus of competition shifts to AI algorithms, data analysis, cloud service capabilities

- Enterprises with strong technological R&D capabilities will gain advantages

-

Shift from Single-Point Competition to Ecosystem Competition

- Digital transformation requires enterprises to have system integration capabilities

- Enterprises that can provide end-to-end solutionswill be more competitive

- Industrial chain collaboration and ecosystem building capabilities become key

- Digital transformation requires enterprises to have

-

Expansion from Domestic Market to Global Market

- China’s technological accumulation in UHV and smart grid fields lays the foundation for global output

- Countries along the Belt and Road have strong demand for smart grids

- Enterprises with core technologies will face overseas expansion opportunities

- Continuous UHV Construction: State Grid has a huge UHV investment scale during the 14th Five-Year Plan period, benefiting related equipment suppliers

- Smart Distribution Network: Urban distribution network transformation and rural grid upgrading bring sustained demand

- New Energy Integration: Large-scale integration of new energy such as wind power and photovoltaics requires support from intelligent dispatching systems

- Digital Transformation Services: Emerging service markets such as power big data analysis and AI operation and maintenance have broad space

- Technology Iteration Risk: AI and big data technologies evolve rapidly, requiring enterprises to continuously invest in R&D

- Policy Risk: The pace of grid investment is greatly affected by policies

- Intensified Market Competition: New entrants (such as tech companies like Huawei and Alibaba) may increase competition intensity

- Valuation Risk: Valuations of some companies already reflect high growth expectations

- Leading Enterprises with Strong Performance Certainty: NARI Technology, as an industry leader, has stable performance and strong technical strength

- Valuation Repair Opportunities: Pinggao Electric and Xuji Electric have relatively low valuations and room for repair

- Order Elastic Targets: Pay attention to the bidding situation of State Grid’s centralized procurement and companies with rapid order growth

- Technology Leading Enterprises: Companies with core technology accumulation in AI, big data, etc.

- Platform-Type Companies: Enterprises that can provide system integration and overall solutions

- International Layout: Companies with breakthroughs in the Belt and Road markets

- Investment plans and bidding situations of State Grid and China Southern Power Grid

- R&D investment ratio and number of technical patents of each company

- Proportion and growth of digital business revenue

- Overseas orders and revenue growth

The accelerated digital transformation of State Grid has a long-term and far-reaching impact on the power technology sector. The explosive growth of AI power demand combined with grid intelligent upgrading brings historic development opportunities for power technology enterprises.

Energy central SOEs’ layout of new technologies such as AI and big data is reshaping the competitive landscape of the power industry:

- Transformation from traditional equipment manufacturing to intelligent technology services

- Shift from single product competition to ecosystem competition

- Expansion from domestic market to global market

- Leading enterprises with strong technical strength and high R&D investment

- Companies with breakthroughs in digital business

- High-quality targets with reasonable valuations and growth potential

Although some individual stocks have adjusted within the year, in the long run, digital transformation and AI power demand will drive the power technology sector to enter a new growth cycle. Investors are advised to carry out medium-to-long-term positioning based on company fundamentals, valuation levels, and technical strength.

[0] Gilin API Data - Market Data, Financial Analysis, Technical Analysis, Python Visualization of Power Technology Companies

[1] WSJ - “Why the ‘Everyone’s a Winner’ Energy Trade Can’t Last Forever” (https://cn.wsj.com/articles/why-the-everyones-a-winner-energy-trade-cant-last-forever-c3679d4c)

[2] Bloomberg - “AI Energy Demand Has Helped Send Grid Tech Stocks Soaring…” (https://www.bloomberg.com/news/articles/2025-12-08/ai-energy-demand-has-helped-send-grid-tech-stocks-soaring)

[3] WSJ - “Witnessing China’s Another Ace in the Global AI Race in Inner Mongolia: The World’s Largest Power Grid” (https://cn.wsj.com/articles/在内蒙古目睹中国竞逐ai赛道的另一张王牌-全球最大电网-3ca6eb72)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.