US Stock Market Volatility Patterns During Holidays and Strategies to Mitigate Low Liquidity Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

- Observation over the past 90 days (2025-08-20 to 2025-12-26): The daily standard deviation of S&P 500 volatility is approximately 0.72%, and the CBOE Volatility Index (VIX) decreased from 15.95 to 13.60 during this period, with a 20-day moving average of around 15.75, indicating overall mild volatility [0].

- Holiday season period from November 2024 to January 2025: The average daily volatility (standard deviation) was approximately 0.88%, and the S&P 500 rose by about 3.96% cumulatively during this period, showing mild volatility despite fluctuations [0].

- Longer historical sample (Thanksgiving/Christmas periods from 2020 to 2024): The average volatility during holiday periods was approximately 0.69%, usually lower than or close to the average of regular trading days, reflecting the long-term pattern of narrowed volatility [0].

- Real-time market data (updated 2025-12-28): VIX is around 13.60, which is in the historical low range (52-week range: 13.38–60.13), confirming the current low-volatility environment [0].

- Recent sample (around Thanksgiving/Christmas 2025): The average trading volume during Christmas was approximately 64% of the regular level (0.67x), and around Thanksgiving it was about 91% (0.91x), consistent with reduced institutional and individual participants and shorter trading hours during holidays [0].

- Statistics for the holiday season period (2024-11-01 to 2025-01-15): The average daily trading volume was approximately 4.18 billion shares, with a total volume of around 209.22 billion shares [0].

- Media reports also confirm the slowdown in market activity and light trading during Thanksgiving and Christmas [1][2][4].

- Historical sample from 2020 to 2024: The average daily return during Christmas was approximately 0.404%, with an average period return of about 1.0%; the average daily return during Thanksgiving was approximately 0.183%, with an average period return of about 0.55%, showing an overall positive bias and low volatility [0].

- Post-holiday effect: The overall trend during the holiday season period often moves upward; the S&P 500 rose cumulatively by about 3.96% from November 2024 to January 2025, indicating the “amplification” effect of improved post-holiday sentiment on prices [0][5].

- Widening bid-ask spreads and increased slippage are typical characteristics during holidays. Low trading volume and large orders are more likely to impact prices; history and media have warned of “potential volatility in post-holiday short sessions” and short-term liquidity shortages [2][4].

- Intraday volatility may be amplified by external news or technical adjustments, even if overall daily volatility is low.

- Data coverage: Both the recent 90 days (2025-08-20 to 2025-12-26) and the 2024 holiday season period (November 2024 to January 2025) show mild volatility, low trading volume, and an overall upward trend [0].

- Daily samples around Thanksgiving (November 27) and Christmas (December 25) in 2025:

- S&P 500: The average daily return around Thanksgiving was approximately 0.57%, with volatility of about 0.693%; the average daily return around Christmas was approximately 0.35%, with volatility of about 0.284% [0].

- VIX: The average during normal trading days was approximately 18.22; during Thanksgiving it was about 17.74; during Christmas it was about 13.79, indicating significantly narrowed volatility expectations during holidays [0].

- Trading volume: The average trading volume during Christmas was approximately 64% of the regular level (53.86 million vs. 84.43 million), and around Thanksgiving it was about 80% (67.79 million vs. 84.43 million) [0].

- Media and market observations also point to the market entering a “low volatility mode” at the end of the year; although there was discussion of “unusual volatility” in December 2025, the overall pattern was still light trading and narrowed volatility [2][3].

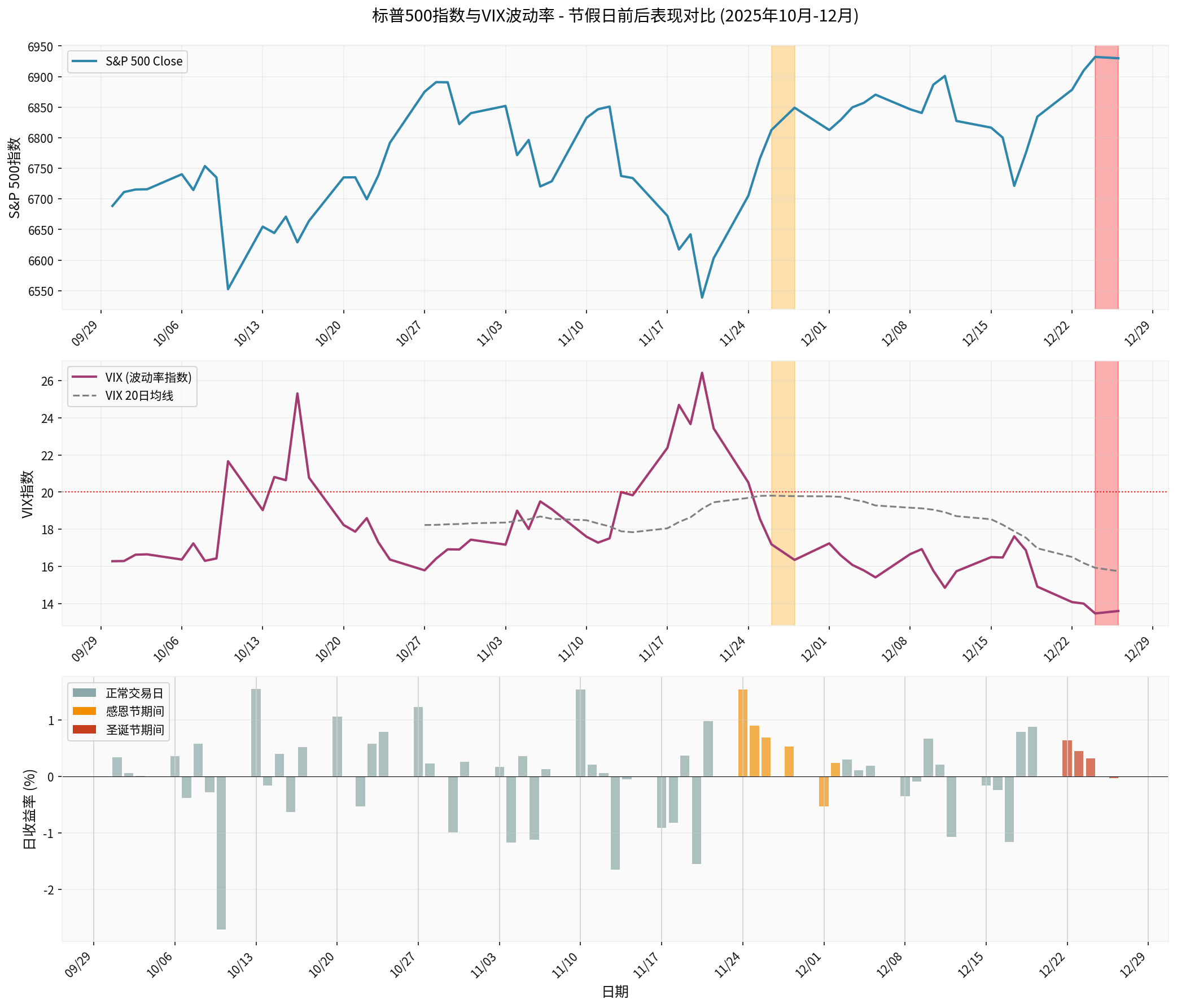

- The chart above shows the S&P 500, VIX, and daily return distribution from October to December 2025. The orange shaded area is around Thanksgiving (before and after 11/27), and the red shaded area is around Christmas (before and after 12/25). It can be直观地 seen that:

- VIX was below the 20-day moving average around holidays and generally low.

- The magnitude of daily returns around holidays was generally narrow, with occasional small amplifications on individual days due to news or adjustments.

- Reduce leverage and position size: Large trades are more prone to slippage in low-liquidity environments; moderately reduce positions to lower execution costs.

- Use limit orders instead of market orders: Avoid excessive slippage caused by market orders in light trading.

- Diversify execution time: Split large orders and spread them over time to reduce instantaneous impact on the order book.

- Pay attention to pre-market/after-hours and short session risks: Markets may close early or be closed during holidays; note trading hours and liquidity windows.

- Set reasonable stop-loss/take-profit levels: In low-liquidity environments, prices may “gap”, and regular stop-losses may not be triggered in time.

- Avoid increasing positions during key data/event windows: If macro data or unexpected events occur near holidays, both price and liquidity volatility may be amplified.

- Use hedging tools: Appropriate options or volatility-related exposures (e.g., VIX futures/options) can hedge tail risks, but note costs and contract liquidity.

- Moderately increase the weight of cash and defensive assets: Cash in profits appropriately before holidays and increase cash proportion.

- Evaluate Gamma risk: Option sellers need to be alert to rapid losses caused by amplified Gamma.

- Long-term perspective: If there is no urgent trading need, reduce high-frequency operations and maintain long-term allocation rhythm.

- “Santa Claus rally” and post-holiday effect: Historical statistics show that the period from the end of the year to the beginning of the next year is often upward (e.g., the 2024–2025 holiday season period saw a cumulative increase of about +3.96%) [0]. If short-term volatility leads to mispricing, moderately seize opportunities to buy quality assets on dips, but control positions and build positions in batches.

- Volatility strategies: When VIX is relatively low, selling volatility moderately requires more caution; if volatility rises rapidly, pay attention to applicable scenarios for option strategies (e.g., straddles or spreads).

- Thanksgiving in 2025 is November 27 and Christmas is December 25; the current date is December 29, 2025; the above recent and historical samples have been aligned with the actual calendar to avoid year confusion.

- Data and information update frequency decreases during holidays; decisions need to be more cautious: Prioritize official calendars and exchange announcements, and avoid overtrading when information is lagging.

[0] Jinling API Data (includes: S&P 500 and VIX daily line/index, Python statistical analysis)

[1] Yahoo Finance - Christmas Bell Not Ringing? US Stocks May See Unusual Volatility in December (https://hk.finance.yahoo.com/news/聖誕鐘敲不響?美股12月或反常添波動-060849422.html)

[2] WSJ Chinese Edition - US Stocks Consolidate Sideways; Wall Street Awaits Holiday Rally (https://cn.wsj.com/articles/美股横盘整理-华尔街期待节日行情-37d2c78f)

[3] Yahoo Finance - US Stock Index Futures Resume Trading After Technical Issues; Post-Thanksgiving Short Session May See Volatility (https://hk.finance.yahoo.com/news/美股-期指於技術問題後恢復交易-感恩節後短市或現波動-140358825.html)

[4] Bloomberg - Retail Stocks Need Unlikely Holiday Miracle to Save Rough 2025 (https://www.bloomberg.com/news/articles/2025-11-22/retail-stocks-need-unlikely-holiday-miracle-to-save-rough-2025)

[5] Investopedia - What to Expect in Markets This Week: Christmas Holiday, GDP… (https://www.investopedia.com/what-to-expect-in-markets-this-week-christmas-holiday-q3-gdp-consumer-confidence-jobless-claims-11871934)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.