Analysis of the Impact of Moutai Wholesale Price Increases on Performance, Valuation, and Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data, I will provide a comprehensive analysis of the impact of Moutai’s wholesale price increase.

According to the latest market data,

- 25-year Feitian Moutai original case: 1575 yuan/bottle(+15 yuan from the previous day)

- Loose bottle: 1560 yuan/bottle(+10 yuan from the previous day) [1]

- Feitian Moutai: The original case of the 25-year variant returned to around 1600 yuan from the 1550 yuan mark, and the original case of the 24-year variant reached 1630 yuan

- Non-standard products led the rise:

- Moutai 15 Years: Soared from 3520 yuan to 4070-4200 yuan(over 13% increase in more than 10 days, with a single-day surge of 600 yuan)

- Sanhua Feitian: Increased by 280 yuan to 2480 yuan

- Premium Moutai: Increased by 210 yuan to 2280 yuan

- Zodiac Snake original case: Increased by 390 yuan to 2000 yuan (230 yuan increase in a single day)

- Moutai 15 Years: Soared from 3520 yuan to

According to brokerage API data, Kweichow Moutai’s 2024 financial data are as follows:

| Indicator | 2024 | YoY Growth | Analysis |

|---|---|---|---|

| Operating Revenue | ~1,708.99 billion yuan | +6.36% | Hit an 11-year low [4] |

| Net Profit | ~862.28 billion yuan | +6.25% | Growth rate slowed significantly [4] |

| Net Profit Margin | 51.51% | - | Maintains extremely high profitability [0] |

| ROE | 36.48% | - | Industry-leading shareholder return [0] |

- Growth rate plummeted: From historical double-digit growth to around 6%, far below the previously set annual growth target of 9% [4]

- Lag effect of wholesale price increase: The wholesale price increase in December haslimited direct impacton 2024 performance, mainly reflected in:

- Improved dealer sentiment and increased inventory value

- But the actual revenue reflected in the 2024 financial statements is limited (shipments stopped in December)

- Stable ex-factory price: Moutai’s ex-factory price remains at the guidance price of 969 yuan; wholesale price increase does not directly boost revenue in the short term

- Improved channel profit: Wholesale price increase expands dealer profit margins and enhances channel push

- Enhanced brand value: Stable and rising wholesale prices help maintain Moutai’s high-end brand image

According to brokerage DCF analysis [0]:

| Scenario | Target Price | vs Current Price | Key Assumptions |

|---|---|---|---|

| Conservative Scenario | 1,088.67 yuan | -22.5% | Zero growth, WACC 11% |

| Baseline Scenario | 1,577.31 yuan | +12.3% | 20% growth, WACC 9.4% |

| Optimistic Scenario | 2,565.71 yuan | +82.6% | 23% growth, WACC 8% |

| Valuation Indicator | Value | Historical Position | Evaluation |

|---|---|---|---|

| P/E (TTM) | 19.55x | Recent low range [0] | Relatively reasonable |

| P/B | 6.85x | - | High but in line with high-quality consumer stock characteristics |

| P/S | 10.07x | - | Reflects market recognition of high profit margins |

| EV/OCF | 19.96x | - | Enterprise value/operating cash flow ratio is relatively healthy |

- The current stock price of 1405.10 yuan is 12.3% below the baseline valuation, with room for recovery

- Stable wholesale prices help support 2025 performance expectations, thereby raising the valuation center

- Volume control policy: Moutai stopped shipping to dealers in December until January 1, 2026

- Non-standard product quota reduction: Cut 30%-50% of quotas, directly suspended supply of colored glaze premium products

- Precise placement strategy: Reduce supply of high-end products to strengthen scarcity

- Spring Festival peak season stocking demand started

- Dealers have strong reluctance to sell (expecting prices to continue rising)

- Resonance between capital entry and channel hoarding

- Wholesale prices are expected to remain strong before the Spring Festival peak season

- May be further catalyzed after the dealer conference (December 28) policy is implemented

- Risk: After resuming supply, wholesale prices may pull back to fluctuate around 1700 yuan [1]

- Feitian Moutai: Wholesale price may fluctuate around 1700 yuan, and the probability of falling below the 1499 yuan guidance price is reduced [1][2]

- Non-standard products: Continue to strengthen, scarcity attributes support premium

- Mid-to-high-end Baijiu: Price inversion phenomenon will continue [1]

- Industry bottoming period: The deep adjustment cycle of the Baijiu industry is ongoing; expected to truly bottom out in Q2 2026 [1]

- Era of stock competition: The industry shifts from scale expansion to stock competition, re-dividing the market around real consumer demand [1]

- Moutai’s strategy shift: From performance-oriented to channel health, proactively relieving channel pressure

- Insufficient demand risk: Macroeconomic downturn suppresses consumer demand, and the Baijiu industry is under overall pressure

- Inventory risk: Channel inventory is high, and de-stocking pressure remains

- Policy risk: Improper implementation of volume control policies may affect market share

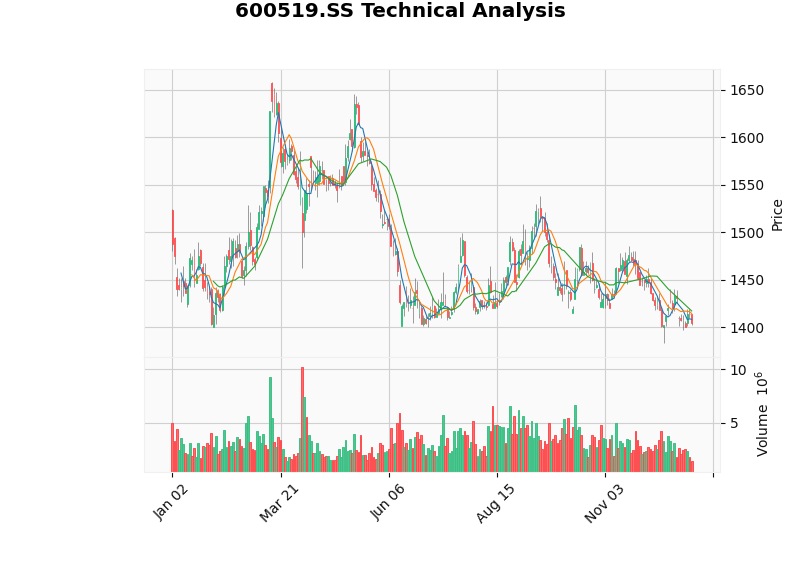

According to technical analysis [0]:

- Trend: Sideways consolidation, no clear direction

- Key Levels:

- Support level: 1397.42 yuan

- Resistance level: 1417.32 yuan

- Technical Indicators: MACD death cross (bearish), KDJ biased bearish, RSI in normal range

- Cautiously optimistic: Stable wholesale prices help repair sentiment, but technicals show that a breakthrough still needs to be observed

- Focus on catalysts: Dealer conference policy implementation, Spring Festival sales data

- Operation suggestion: Can lay out at lows around 1400 yuan, target price 1500-1600 yuan

- Strategic allocation: The valuation of the Baijiu sector is at a recent low, fundamentals are close to the bottom, and has layout value [1]

- Core logic:

- Moutai has a deep brand moat

- Stable wholesale prices indicate that the industry’s most pessimistic phase may have passed

- Performance growth is expected to回升 to 8-10% in 2025-2026

- Target price: Based on DCF baseline scenario of 1577.31 yuan (+12.3% upside potential)

| Indicator | Focus Points |

|---|---|

| Wholesale price trend | Can it stand above 1600 yuan and break through to 1700 yuan? |

| Sales data | Actual sales during the Spring Festival peak season |

| Inventory de-stocking | Changes in channel inventory levels |

| Policy implementation | Sustainability and intensity of volume control policies |

| Industry data | Overall price trend of high-end Baijiu |

- On 2024 performance: The wholesale price increase has limited direct impact; 2024 operating revenue and net profit growth rates are only 6.25%-6.36%, hitting an 11-year low

- On valuation impact: The current stock price of 1405.10 yuan is12.3% below the baseline valuation; stable wholesale prices help valuation recovery, target price is 1577 yuan

- Price sustainability:

- Short-term: Fluctuating upward, expected to hit 1700 yuan before the Spring Festival

- Mid-term: Fluctuating around 1700 yuan, non-standard products continue to strengthen

- Long-term: The industry will truly bottom out in Q2 2026, and Moutai will recover first with its brand advantage

- Investment value:The time for strategic allocation has arrived; it is recommended to lay out in batches around 1400 yuan and hold for the long term

[0] Jinling API Data (real-time quotes, financial analysis, DCF valuation, technical analysis, historical price data)

[1] The Paper - “Dealers say they can’t understand the current market! Moutai prices rise across the board, non-standard products see significant gains” (https://m.thepaper.cn/newsDetail_forward_32245717)

[2] National Business Daily - “Moutai’s wholesale price returns to upward trend! The next six months are still the period for absolute return funds to lay out the Baijiu cycle” (https://www.nbd.com.cn/articles/2025-12-24/4193432.html)

[3] East Money - “Moutai’s wholesale price breaks 4000! 15-year variant surges 600 yuan, three major risks hidden behind capital rush” (https://caifuhao.eastmoney.com/news/20251224150440021640130)

[4] CBNData - “Feitian Moutai falling below 1499 yuan, and the Baijiu era that can’t go back” (https://www.cbndata.com/information/294819)

[5] Sohu Securities - “Kweichow Moutai (600519) Key Financial Indicators” (https://q.stock.sohu.com/cn/600519/cwzb.shtml)

[6] Sina Finance - “Kweichow Moutai (600519) Income Statement” (https://vip.stock.finance.sina.com.cn/corp/go.php/vFD_ProfitStatement/stockid/600519/ctrl/part/displaytype/4.phtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.