Analysis of Investment Logic Behind Institutional Fund Position Adjustments and Subsequent Impacts

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data and fund flow trends, I will conduct an in-depth analysis of the investment logic behind this institutional fund position adjustment and its subsequent impacts for you.

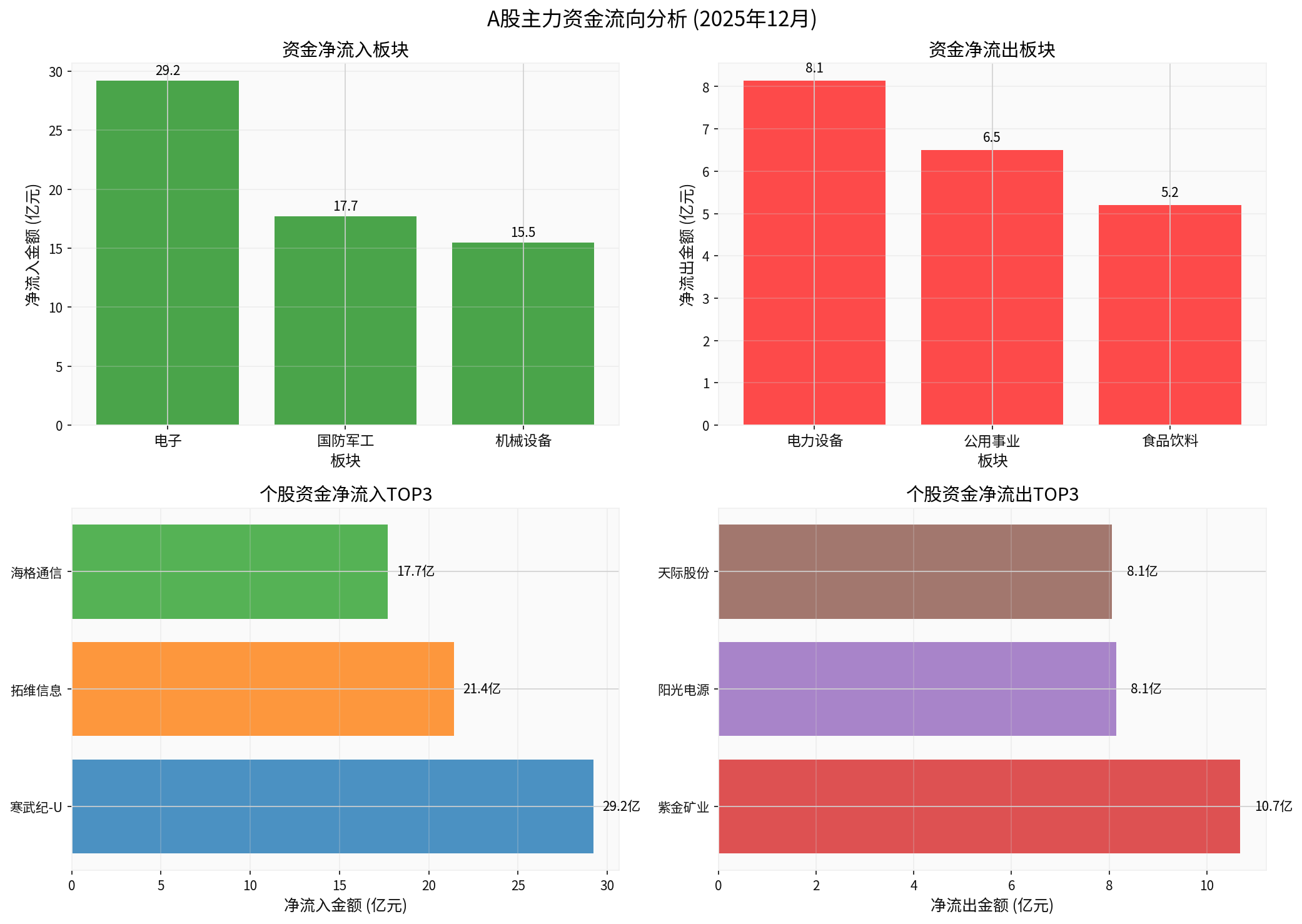

According to morning institutional fund flow data, the market shows obvious structural differentiation characteristics:

- Electronics sector: Net inflow of approximately 2.921 billion yuan (mainly driven by Cambricon-U)

- National Defense & Military Industry: Net inflow of approximately 1.770 billion yuan (Haige Communication leads the gains)

- Mechanical Equipment: Net inflow of approximately 1.55 billion yuan (driven by Talkweb Information etc.)

- Power Equipment: Net outflow of approximately 814 million yuan (Sungrow Power etc. sold off)

- Utilities: Net outflow of approximately 650 million yuan

- Food & Beverage: Net outflow of approximately 520 million yuan

- Core Logic: Cambricon-U as AI chip leader, single-day fund inflow of 2.921 billion yuan, reflecting strong market expectations for AI computing power demand [0]

- Policy Catalyst: Continuous state support for semiconductor industry and accelerated domestic substitution process

- Tech Breakthrough: AI large model development drives computing power demand explosion, performance expectations of related industrial chain companies improve

- Risk Reminder: Current valuation level is high; need to pay attention to performance realization

- Core Logic: Under the background of complex geopolitical situation, military sector has long-term allocation value

- Data Verification: Haige Communication (002465.SZ) rose 10.04% today, with turnover reaching 20.257 billion yuan, far exceeding average level [0]

- Industry Characteristics: Strong order certainty, stable performance growth, relatively reasonable valuation

- Investment Themes: Informationization, missiles, aero-engines and other sub-fields

- Core Logic: Talkweb Information received 2.143 billion yuan of fund inflow, reflecting market expectations for manufacturing upgrade

- Macro Background: Domestic manufacturing PMI data shows recovery in prosperity

- Export Logic: Overseas inventory replenishment demand + improved competitiveness of Chinese manufacturing

- Core Logic: Sungrow Power (300274.SZ) had net outflow of 814 million yuan, stock price fell by 1.20% [0], reflecting market concerns about overcapacity in new energy industry

- Industry Predicament:

- PV and wind power industrial chains have experienced multiple rounds of price wars, corporate profits under pressure

- Overseas demand uncertainty increases, especially slowdown in European market demand

- Domestic power grid investment growth slows down, consumption issues to be solved

- Valuation Pressure: Some leading stocks’ valuations are still at high levels, need time to digest

- Core Logic: Costs like coal and natural gas rise, but electricity prices are regulated, profit margins compressed

- Fund Attribute: As traditional defensive sector, easy to be reduced when market risk appetite rises

- Core Logic: Consumption recovery less than expected, growth rate of total retail sales of social consumer goods slows down

- Inventory Pressure: Some sub-industries face de-stocking pressure

- Competition Intensifies: Fierce industry competition, high marketing expenses

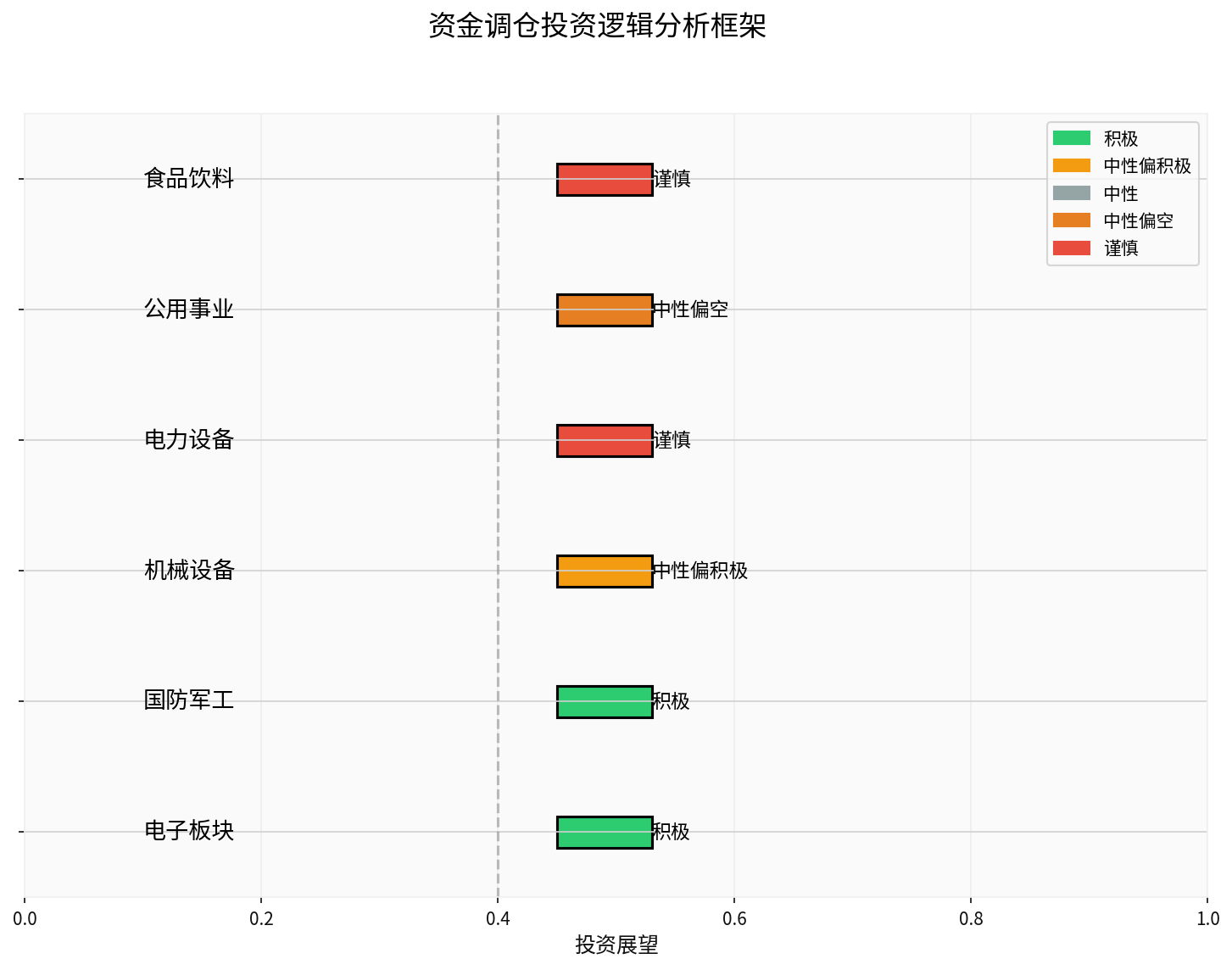

This fund adjustment reflects a major shift in institutional investors’ investment style:

- From stable defense(utilities, food & beverage) tooffensive growth(electronics, military)

- From overcapacity industries (power equipment) to tight supply-demand balance (AI chips, military)

- From domestic demand-driven to tech innovation-driven

- Upside Momentum: Large fund inflows will continue the upward trend, especially AI chip-related targets

- Volatility Risk: Popular stocks like Cambricon-U may face profit-taking pressure; pay attention to high-level fluctuations

- Performance Verification Period: Q1 2025 report will be a key verification point; focus on performance realization

- Structural Opportunities:

- AI computing power chips: Accelerated domestic substitution, high performance certainty

- Memory chips: Cycle bottoming and recovery, price stabilization and rebound

- Consumer electronics: Demand picks up but competition is fierce

- Valuation Risk: Some targets have valuations at historical high levels; need to be cautious

- Policy Certainty: Military expenditure maintains stable growth, national defense modernization continues to advance

- Geopolitics: Complex international situation enhances military sector allocation value

- Order Landing: Military orders usually have certainty and continuity

- Informationization, intelligent equipment

- Missile industrial chain

- Military-civilian integration fields

- Companies with core technical barriers

- Order delivery rhythm may affect performance

- Valuation digestion takes time

- Supply-demand Imbalance: Overcapacity leads to continuous price wars

- Profit Pressure: Gross profit margin continues to decline

- Valuation Repair: Needs time and performance to digest high valuations

- Accelerated capacity clearance, small and medium enterprises exit market

- New tech breakthroughs (e.g., perovskite batteries, new energy storage)

- Overseas markets reopen

- New policy catalysts emerge

- Short-term: Avoid or reduce positions

- Mid-term: Focus on allocation opportunities for industry leaders after valuation correction

- Long-term: Focus on structural opportunities brought by energy revolution

- Allocation Value: As defensive variety, has allocation value when market volatility increases

- Waiting for Timing: Layout after improvement signals like electricity price reform and cost decline appear

- Select Stocks Carefully: Focus on high-quality companies with stable cash flow and high dividend rate

- Long-term Logic: Consumption upgrade and brand value remain unchanged

- Short-term Pressure: Weak consumption and inventory issues need time to digest

- Allocation Strategy: Wait for consumption data improvement or valuation to fall to reasonable range

- Electronics (AI chips, semiconductors): 30-40% allocation

- National Defense & Military Industry: 20-30% allocation

- Mechanical Equipment (high-end manufacturing):15-20% allocation

- Power Equipment: Remain cautious before capacity clearance

- Utilities: Wait for clarity on electricity price reform

- Food & Beverage: Focus on consumption data improvement

- Valuation Risk: Overvalued popular sectors, avoid chasing highs

- Performance Verification: Q1 2025 report is key verification period; underperformance may trigger corrections

- Policy Risk: Watch domestic policy changes and overseas policy restrictions

- Market Style: Fund flows may change quickly; stay flexible

- Batch Position Building: Avoid chasing highs at once; use batch buying strategy

- Strict Stop-loss: Set stop-loss levels to control single stock loss range

- Diversified Allocation: Do not over-concentrate on single sector or stock

- Dynamic Adjustment: Adjust position allocation timely according to market changes

Despite short-term fund flow trends, investment decisions should combine:

- Corporate fundamentals (performance, valuation, growth)

- Industry prosperity (supply-demand, policy support)

- Macro environment (economic growth, interest rate level)

- Risk tolerance

This institutional fund adjustment reflects the market’s firm optimism towards tech innovation and industrial upgrade directions, while avoiding cyclical sectors with overcapacity and weak demand. In the short term, inflow sectors (electronics, national defense & military industry) are expected to maintain strength but need attention to valuation risks and performance verification; outflow sectors (power equipment, utilities, food & beverage) may continue to face pressure, but high-quality companies may present good allocation opportunities.

The core of investment is to grasp industrial trends and corporate value. It is recommended that investors follow fund flows to seize opportunities while maintaining rational judgment and avoiding blind chasing of highs and lows.

[0] Jinling API Data - A-share market real-time quotes, fund flow data and individual stock quotes

[1] Web Search Results - Industry fund flow and sector performance analysis (this week, this month)

[2] World Economic Forum - 2025 Top 10 Emerging Technologies and Frontier Technology Report

[3] Market Index Data (Nov 14 to Dec 26, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.