Evaluation of Industrialization Progress and Valuation Risks of Chuanyi Technology's Sodium Battery Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Chuanyi Technology (002866.SZ) had a strong stock price performance today, closing at 19.76 yuan with a 10.02% daily limit, and a market capitalization of approximately 5.72 billion yuan [0]. The company is currently in a

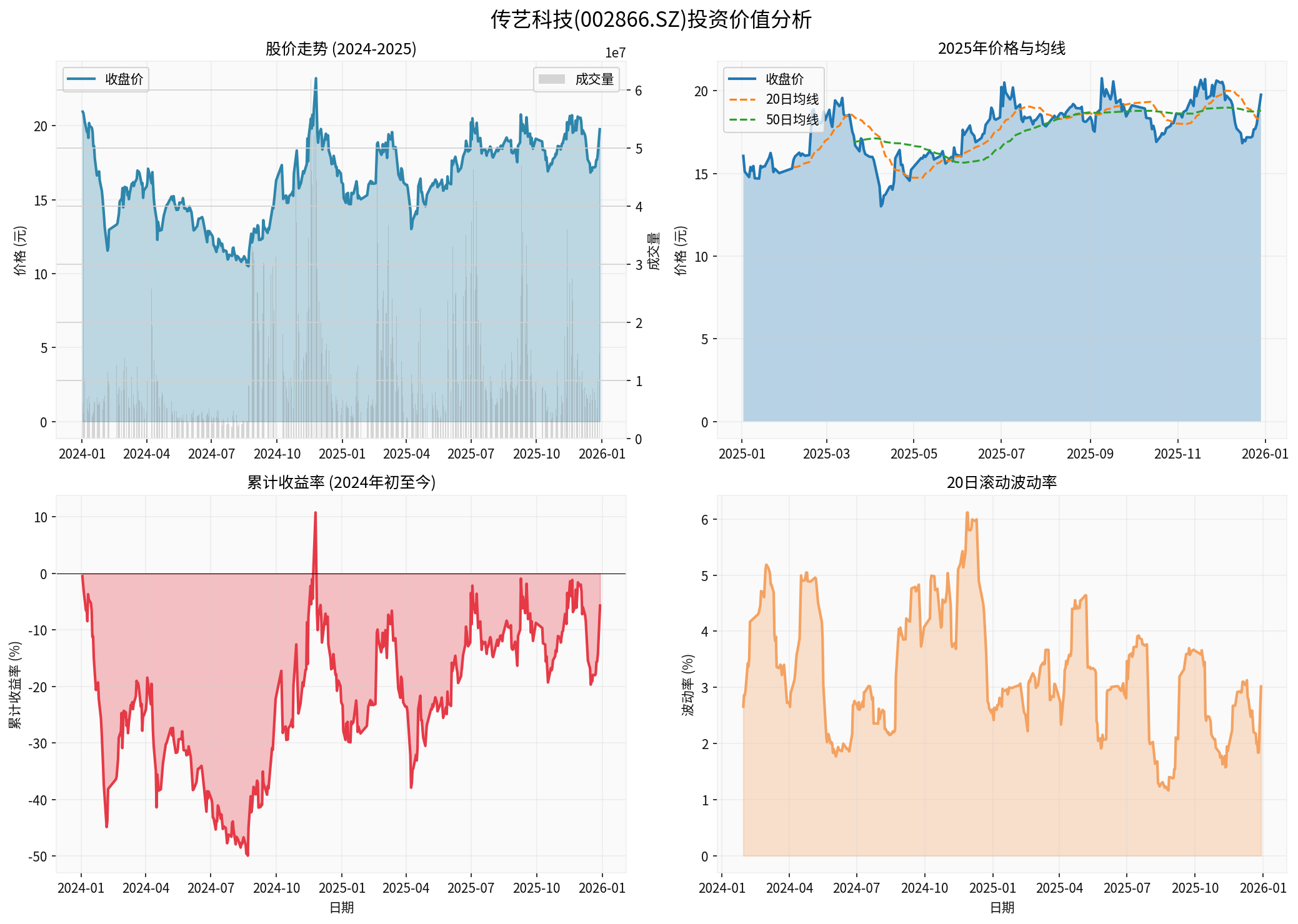

- Top Left Chart: Shows the stock price trend and trading volume of Chuanyi Technology from 2024 to 2025. The stock price fell from 21.18 yuan at the beginning of 2024 to a low of 10.30 yuan before rebounding, and is currently in a volatile period.

- Top Right Chart: 2025 price and 20-day/50-day moving averages. The current stock price is above the moving averages, indicating strong short-term momentum.

- Bottom Left Chart: Cumulative return curve. It fell overall in 2024 and recovered somewhat in 2025, but with large fluctuations.

- Bottom Right Chart: 20-day rolling volatility. Shows high stock price volatility, with daily volatility between 3-5%.

Sodium-ion battery industrialization is

- Cost advantage emerging: Currently, the cost of sodium batteries has dropped to 90-125 USD per kWh, gradually approaching the level of lithium batteries (75-105 USD per kWh), and is expected to drop to a minimum of 40 USD/kWh in the future [1].

- Technological breakthrough: CATL has increased the energy density of mass-produced sodium batteries to 175 Wh/kg, comparable to lithium iron phosphate batteries, and will officially start mass production and shipment in December 2025 [2].

- Investment boom: In 2025, China added 42 planned sodium battery projects with a planned capacity of over 290 GWh and a total investment of over 100 billion yuan, both showing significant year-on-year growth [2].

- Market expectation: GGII predicts that sodium battery shipments will achieve 100% growth in 2026 and may reach 100 GWh by 2030, driving upstream and downstream materials to achieve 30-50 times growth [2].

- Business in early stage: The sodium battery business may not have generated significant revenue yet and is still in the R&D or trial production stage.

- Insufficient information disclosure: Compared to companies like CATL and Huayang Co., Ltd., Chuanyi Technology has less public information on sodium batteries.

- Industrialization level to be verified: Compared to Huayang Co., Ltd. (kiloton-level production line in normal operation, ten-thousand-ton-level project under commissioning) [1], Chuanyi Technology’s industrialization progress is relatively lagging.

The

- Lithium carbonate prices have fallen by more than 70% from historical highs, from 600,000 yuan/ton to about 100,000 yuan/ton, weakening the short-term cost competitiveness of sodium batteries [1].

- According to industry estimates, large-scale production of sodium batteries can still maintain a 15% cost advantage when lithium carbonate prices are 100,000 yuan/ton, but this advantage is narrowing [3].

- Sodium batteries still have certain gaps compared to mainstream lithium-ion batteries in comprehensive performance indicators such as energy density and cycle life, especially in the field of long-range electric vehicles that require high energy density, and it is difficult to achieve full replacement in the short term [1].

From the financial data, Chuanyi Technology is currently

- EPS in Q3 2025 was 0.09 yuan, but EPS in Q1 2025 was -0.40 yuan, with a large loss in the first half of the year [0].

- Operating profit margin was -7.02% and net profit margin was -2.37% [0].

- The company’s financial attitude was rated as “conservative”, showing a high depreciation/capital expenditure ratio, indicating that the company is investing in new businesses (such as sodium batteries) [0].

The profit prospects of the sodium battery business depend on the following factors:

- Broad market space: It is expected that China’s sodium battery market will reach the 100 GWh level by 2030 [2].

- Expansion of application scenarios: Penetration rate is continuously increasing in fields such as starting systems, energy storage, and two-wheeled electric vehicles [2].

- Cost reduction potential: With industrial chain maturity and large-scale production, costs are expected to further decrease.

- Intense competition: Leading companies such as CATL, BYD, and Huayang Co., Ltd. are accelerating their layout, with obvious technological and capital advantages.

- Lithium price fluctuations: If lithium carbonate prices remain low, the cost advantage of sodium batteries will be weakened.

- Long industrialization cycle: It takes 3-5 years from technology R&D to large-scale profitability, and it is difficult to contribute significant profits in the short term.

- Performance bottlenecks: There are still gaps in energy density and cycle life compared to lithium batteries, limiting high-end application scenarios.

Chuanyi Technology’s current valuation has

| Valuation Indicator | Value | Evaluation |

|---|---|---|

| P/E Ratio | -112.88 | Loss-making state, traditional PE valuation not applicable |

| P/B Ratio | 2.75 | Reasonably high |

| P/S Ratio | 2.68 | Valuation is high relative to revenue |

| Market Capitalization | 5.72 billion yuan | Significant gap compared to leading company CATL (1.2 trillion yuan) [0] |

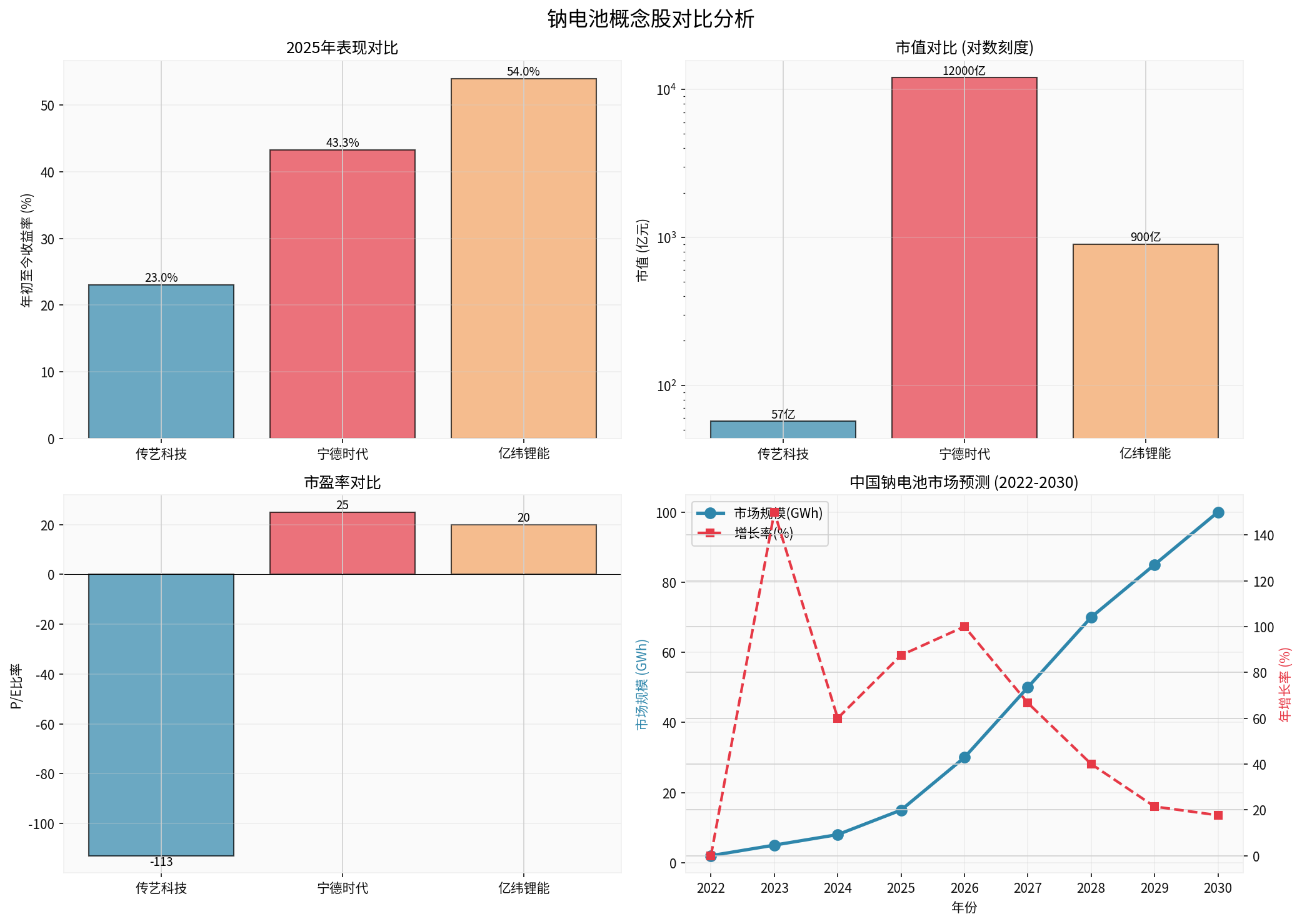

- Top Left Chart: Comparison of sodium battery concept stocks’ performance in 2025. Chuanyi Technology, as a small-cap stock, performed prominently but with greater volatility.

- Top Right Chart: Market capitalization comparison (logarithmic scale). CATL’s market capitalization is more than 200 times that of Chuanyi Technology, with significant scale effects.

- Bottom Left Chart: P/E ratio comparison. Chuanyi Technology has a negative value (loss-making), while leading companies have relatively reasonable valuations.

- Bottom Right Chart: China’s sodium battery market forecast. It is expected that the market size will reach 100 GWh by 2030, with peak annual growth rates from 2026 to 2028.

- Obvious concept speculation: The daily limit of the stock price is more based on the speculation of the sodium battery concept rather than actual performance support.

- Mismatch between market capitalization and business: The 5.72 billion yuan market capitalization corresponds to the sodium battery business that has not yet generated substantial revenue.

- Technical analysis warning: Technical analysis shows overbought risks, with large short-term correction pressure [0].

- High volatility: Beta coefficient is 1.7, significantly higher than the market average, with strong speculative attributes [0].

- Risk of industrialization falling short of expectations: Sodium batteries need to overcome multiple challenges such as yield rate, cost control, and supply chain from laboratory to large-scale production. Chuanyi Technology’s technical accumulation and industrialization capabilities in this field have not yet been verified by the market.

- Risk of intensified market competition: Leading companies such as CATL, BYD, and Huayang Co., Ltd. have strong capital strength and deep technical accumulation, and Chuanyi Technology is at a disadvantage in terms of cost, technology, and channels.

- Risk of continued decline in lithium prices: If lithium carbonate prices remain low, the cost advantage of sodium batteries will be further weakened, and the commercialization rhythm may slow down.

- Risk of expanded performance losses: The company is currently in a loss-making state. If the sodium battery business continues to invest but cannot generate income in the short term, it may lead to expanded losses and increased capital pressure.

- Risk of valuation correction: The current stock price has reflected the market’s optimistic expectations for sodium batteries. Once the industrialization progress falls short of expectations or the industry heat cools down, the stock price will face greater correction pressure.

- Extremely high risk: The current stock price is in the stage of concept speculation, with剧烈 short-term fluctuations.

- Advice to be cautious: Technical analysis shows overbought risks, so it is not advisable to chase highs.

- Strict stop-loss: If participating in short-term operations, strict stop-loss positions must be set.

- Wait and see: Wait until the sodium battery business realizes large-scale production and generates actual revenue before evaluating.

- Focus on indicators: Focus on key indicators such as sodium battery capacity utilization rate, order status, and gross profit margin turning positive.

- Comparative selection: Compared to Chuanyi Technology, leading companies such as CATL and Huayang Co., Ltd. have more certainty and scale advantages.

- Optimistic about the track: As a supplementary technology to lithium batteries, sodium batteries have application prospects in specific scenarios such as energy storage and low-speed electric vehicles.

- Differentiation trend: The industry will show obvious differentiation, and leading companies with technical and capital advantages will occupy a dominant position.

- Time window: 2026-2030 is the key period for sodium battery commercialization, and continuous tracking of industrial progress is required.

There are

- Industrialization progress: Relatively lagging, not yet entering the large-scale production stage.

- Profit prospects: Optimism is not justified in the short term; continuous investment is still needed, and profitability may not be achieved within 3-5 years.

- Valuation risks: There are obvious concept speculation and overheating risks in current valuation, with large short-term correction pressure.

[0] Gilin API Data - Including stock price, financial data, technical analysis and company overview of Chuanyi Technology (002866.SZ)

[1] People’s Daily - “Sodium-ion Battery Industrialization Prospects Promising” (December 15, 2025)

https://paper.people.com.cn/zgnyb/pc/content/202512/15/content_30125316.html

[2] China Economic Net - “‘Lithium-Sodium Complementation’ is Expected to Promote Global Energy Transition” (December 1, 2025)

http://www.ce.cn/cysc/newmain/yc/jsxw/202512/t20251201_2611202.shtml

[3] Wall Street CN - “Wall Street CN Breakfast FM-Radio | December 18, 2025”

https://wallstreetcn.com/articles/3761594

[4] Securities Times - Huayang Co., Ltd. Investor Interaction Platform (December 22, 2025)

https://www.stcn.com/quotes/index/sh600348.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.