In-depth Analysis of Valuation Bubble Risks and Performance Delivery Capability of Commercial Aerospace Concept Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

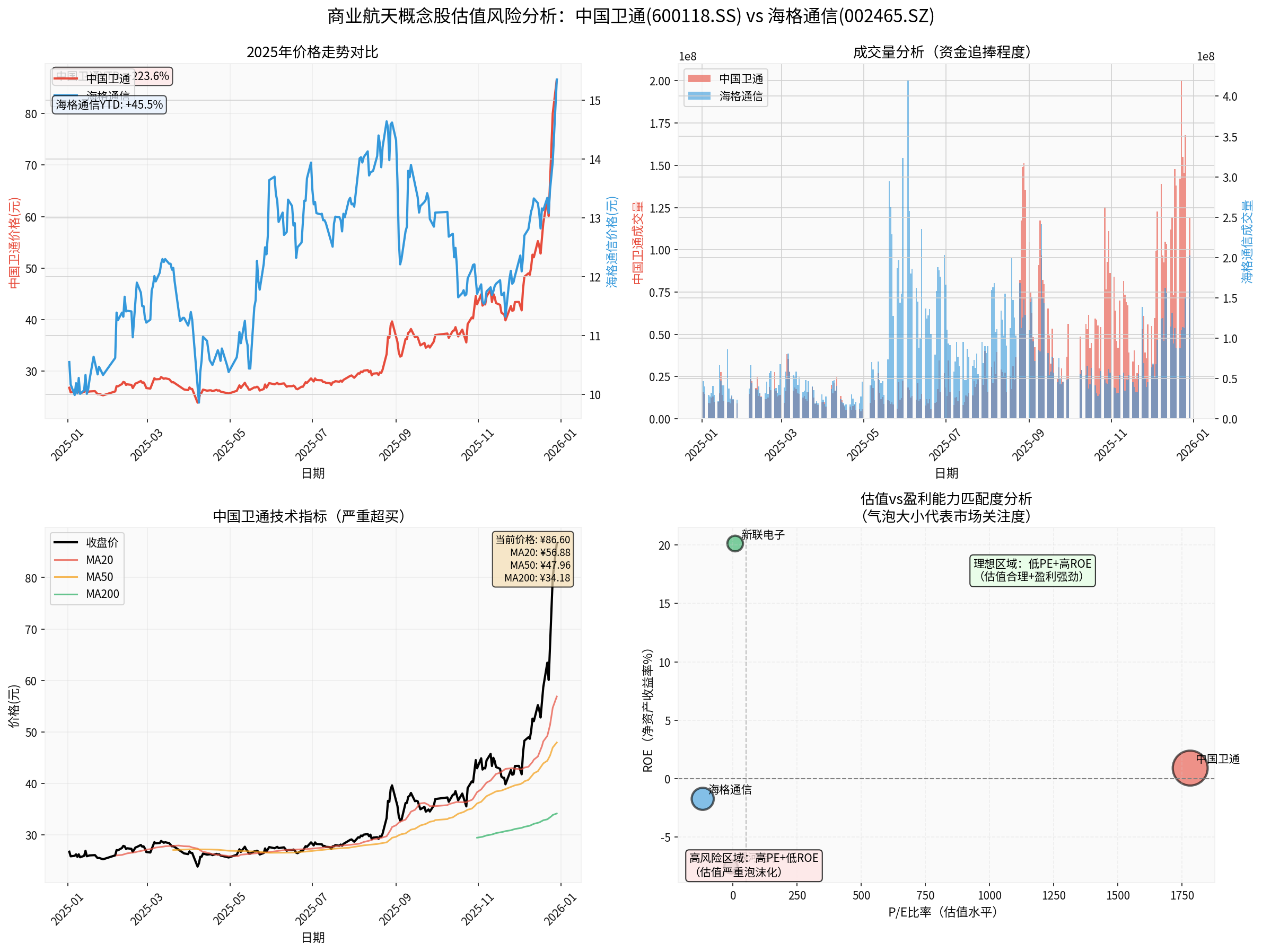

Based on a systematic analysis of the A-share commercial aerospace sector, the current sector has

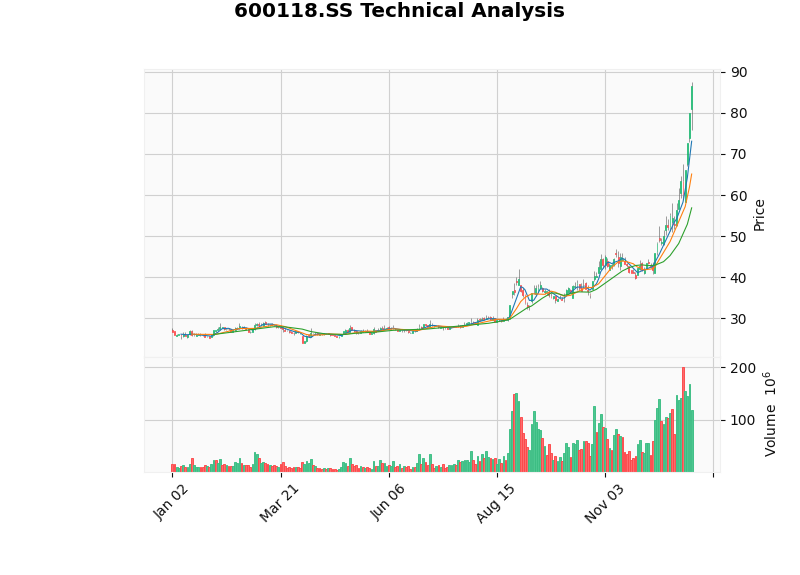

As the sector leader, China Satellite Communications (600118.SS) has shown typical “sentiment-driven” characteristics in its 2025 price trend:

- Year-to-date: Soared from 27.25 yuan to 86.60 yuan, up +217.80%

- 3-month gain: +150.58%

- 1-month gain: +99.54%

- Single-day performance: On December 29, it rose +8.25% in a single day with a trading volume of 119 million shares, far higher than the average of 77.34 million shares [0]

- Haige Communications (002465.SZ): Year-to-date gain +39.80%, single-day limit-up +10.04%, trading volume reached 203 million shares, 3x the average [0]

- Sunlink Electronics (002546.SZ): Relatively rational, year-to-date gain +66.12% but PE ratio only 8.42x, ROE 20.13% [0]

- Galaxy Electronics (002519.SZ): In loss state with EPS of -0.77 yuan [0]

| Stock Code | Stock Name | P/E Ratio | P/B Ratio | Market Cap (100M CNY) | Valuation Judgment |

|---|---|---|---|---|---|

| 600118.SS | China Satellite Communications | 1781.99x |

16.12x | 1,024 | Extremely Bubbled |

| 002465.SZ | Haige Communications | -118.08x | N/A | 381 | Loss Overvaluation |

| 002546.SZ | Sunlink Electronics | 8.42x | 1.57x | 59 | Relatively Reasonable |

| 002519.SZ | Galaxy Electronics | -8.23x | N/A | 71 | Loss Undervaluation |

- China Satellite Communications’ PE ratio is as high as 1781.99x, meaning it would take 1781 yearsto recover investment costs (assuming unchanged profits)

- In sharp contrast, its ROE is only 0.91% and net profit margin is only 0.87%, extremely weak profitability[0]

- The reasonable industry PE ratio is usually between 20-50x, China Satellite Communications’ valuation is 35-89xthe industry average

###3.2 Severe Overbought Technical Condition

Technical analysis shows China Satellite Communications has entered

- KDJ Indicator: K value reaches 93.2, issuing overbought warning

- RSI Indicator: Shows overbought risk

- Trend State: Although in uptrend, marked as “pending” (to be confirmed)

- Support Level: 65.12 yuan (still 25% downside from current position)

- Resistance Level:87.51 yuan (already hit historical high)

###3.3 Quantitative Judgment of Valuation Bubble

According to the “Valuation vs Profitability Matching Degree” analysis (top right quadrant of scatter plot), the commercial aerospace sector shows typical characteristics:

- High Valuation: PE >100x or negative

- Low Profitability: ROE <5% or negative

- High Gain: YTD gain >50%

This combination historically often indicates

###4.1 Financial Data Comparative Analysis

| Financial Indicator | China Satellite Communications | Haige Communications | Sunlink Electronics | Industry Standard |

|---|---|---|---|---|

ROE(%) |

0.91 | -1.72 | 20.13 | >10% Excellent |

Net Profit Margin(%) |

0.87 | N/A | 91.68* | >10% Healthy |

Operating Profit Margin(%) |

-0.91 |

N/A | 58.89 | >5% Normal |

EPS(TTM) |

0.04 | -0.13 |

0.84 | >1 Good |

Free Cash Flow |

-523 million CNY |

N/A | N/A | Positive Preferred |

*Note: Sunlink Electronics’ abnormally high net profit margin may include one-time gains [0]

- China Satellite Communicationshas negative operating profit margin (-0.91%), meaning core business is actually loss-making

- Haige Communicationshas negative EPS (-0.13 yuan), in continuous loss state

- China Satellite Communicationshas free cash flow of-523 million CNY, cash flow situation deteriorating [0]

###4.2 Revenue Growth and Profit Quality

China Satellite Communications’ latest financial data shows [0]:

- 2025 Q2 Revenue:879 million CNY

- 2025 Q2 EPS: -0.01 yuan (turned loss YoY)

- 2024 Full-year Revenue:3.48 billion CNY

- Serious mismatch between revenue scale and market cap: Market cap is 102.4 billion CNY while annual revenue is only 3.5 billion CNY, PS (Price-to-Sales Ratio) is still as high as15.55x

###4.3 Business Model Sustainability Doubts

According to industry analysis [1]:

- China Commercial Aerospace Market Size: Grew from 380 billion CNY in 2015 to 2.3 trillion CNY in2024

- But actual deployment progress lags: China applied for 51,300 satellite spectrum resources, but only less than400 were actually deployed as of November2025

- Significant gap with international peers: SpaceX has launched over10,000 satellites, China’s is less than4% of that

- Technology Generation Gap: SpaceX rocket recovery success rate exceeds91%, Chinese private aerospace companies’ recovery tests have failed repeatedly

###5.1 China Satellite Communications(600118.SS): Typical Bubble Case

- Extreme Valuation: PE1781.99x, P/B16.12x [0]

- Extremely Weak Profitability: ROE0.91%, Operating Profit Margin-0.91% [0]

- Price Deviated from Fundamentals: YTD +223.62% but EPS only0.04 yuan [0]

- Overbought Technical Condition: KDJ 93.2, RSI overbought [0]

- Deteriorating Cash Flow: Free Cash Flow-523 million CNY [0]

###5.2 Haige Communications(002465.SZ): Loss Speculation

- EPS negative (-0.13 yuan), PE negative

- Year-to-date gain +39.80%, mainly driven by sentiment

- Actual performance is in loss state, valuation completely deviates from profit basis

###5.3 Sunlink Electronics(002546.SZ): Relatively Rational Target

- PE8.42x, ROE20.13%, relatively healthy fundamentals

- Year-to-date gain +66.12%, but valuation still in reasonable range

- Can be used as relatively safe option in the sector

###6.1 Policy Support

According to latest industry report [1]:

- Science and Technology Innovation Board opens door for hard tech enterprises

- “15th Five-Year Plan” includes commercial aerospace in national strategy for the first time

- China National Space Administration set up special Commercial Aerospace Department to coordinate resources

- 2025 is considered the first year of China’s commercial aerospace capitalization

###6.2 Market Expectations vs Reality

- New technologies like satellite internet, space computing, direct satellite connection to mobile phones will bring explosive growth

- It is estimated that if 2% of global computing power is moved to space by2029, it will drive 6,800 rocket launches in China [1]

- Technology Gap: SpaceX Starship’s payload is150 tons, China’s Long March 5 is only 25 tons

- Cost Gap: SpaceX’s launch cost is 20,000 USD/kg, China’s is still several times higher

- Progress Lag: China’s actual deployed satellite number is only0.8% of target

###7.1 Valuation Bubble Burst Risk Rating

| Stock | Bubble Degree | Correction Risk | Investment Recommendation |

|---|---|---|---|

| China Satellite Communications | Extremely Severe |

Extremely High (>50%) |

Avoid/Reduce Position |

| Haige Communications | High |

High (30-50%) |

Avoid |

| Sunlink Electronics | Low |

Medium (10-20%) |

Cautious Watch |

| Galaxy Electronics | Medium |

High (30-40%) |

Avoid |

###7.2 Investment Strategy Recommendations

- Avoid Chasing High: Currently at sentiment peak with severe overbought technical condition

- Take Profits: Existing holders can consider reducing positions in batches

- Wait for Correction: Focus on technical support level (China Satellite Communications around65 yuan)

- Focus on Performance Delivery: Wait for substantial improvement in enterprise profitability

- Technical Breakthrough Verification: Focus on private aerospace rocket recovery and satellite deployment progress

- Policy Catalyst Timing: Wait for “15th Five-Year Plan” detailed rules to land

- Select Truly Benefited Targets: Focus on companies with core technical breakthroughs and fast commercialization

- Diversified Allocation: Avoid excessive concentration on single stock

- Valuation Discipline: Adhere to the principle of “performance matching valuation”

###7.3 Core Risk Warnings

- Valuation Regression Risk: Current PE is as high as1781x, even if profit grows50%, it still takes over30 years to recover cost

- Technical Breakthrough Below Expectations: China still has generation gap with international leading level

- Commercialization Progress Lag: Satellite deployment number is far below expectation

- Policy Promotion Strength: Actual support strength may be lower than market expectation

- Market Sentiment Reversal: Once热度消退, it may trigger stampede-like decline

Commercial aerospace concept stocks currently show typical

- China Satellite Communications: PE1781x vs ROE0.91%, mismatch index 1957(PE/ROE)

- Gain Driver:223% gain vs 0.91% ROE, gain is 245x of profitability

- Reasonable Valuation:8-16 yuan vs current 86.60 yuan, bubble degree 440%-980%

[0] Gilin API Data - Real-time stock quotes, financial data, technical analysis, historical price data (December29,2025)

[1] Yahoo Finance - “1.5 Trillion USD Market! China-US Commercial Aerospace Race: SpaceX Ignites the Largest IPO in History” (https://hk.finance.yahoo.com/news/1-5兆美元市場-中美商業航太競速-spacex引爆史上最大ipo-陸航太民企集體衝剺科創板-075003307.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.