Geopolitical Fallout: Impact on European Energy Security and Defense Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Kremlin’s statement that

- Kremlin statement:Vladimir Putin and Donald Trump both oppose the European-Ukrainian push for a temporary ceasefire; both leaders agreed that Ukraine “needs to make a decision about Donbas without delay” and that a temporary ceasefire for a referendum “will only prolong the conflict” [1][2].

- Market signal:The absence of U.S. and Russian backing for a temporary pause underscores that the conflict remains structurally unresolved, preserving the risk premium in energy and the urgency behind European defense rearmament.

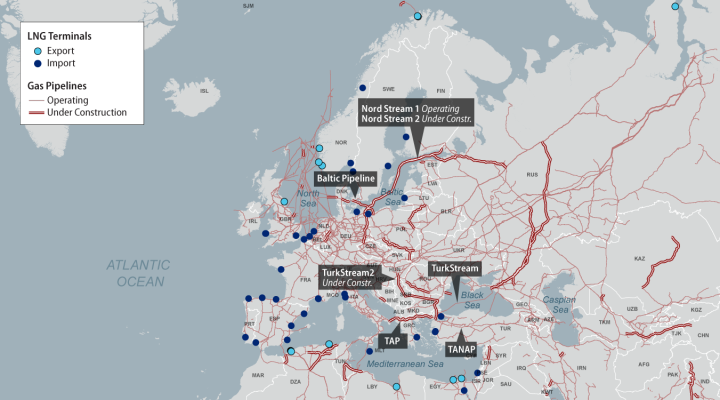

- EU plan to phase out Russian gas:The EU has agreed tofully ban Russian natural gas imports by late 2027(pipeline and LNG), moving from 45% pre-2022 to roughly 12% as of October 2025 [4][5].

- Strategic outcome:European supply security is increasingly anchored in LNG terminals, renewable buildout, and diversified non-Russian supplies—reducing direct leverage from Russian supply cuts over time, even as short-term price volatility persists.

- Oil:WTI at $56.74 (−2.76% on the day) reflects softness more tied to global demand and inventory, with limited immediate spike tied to this weekend’s headlines. A weaker energy sector (−0.41% today) shows markets are not pricing a major immediate supply shock [0].

- Natural gas:TTF (the European benchmark) is trading off 2022 highs but can tighten during winter peaks. The EU’s 2027 ban means that any Russian disruption is increasingly “priced into policy,” reducing surprise-factor risk.

- Implication:Without a ceasefire path,energy risk premia stay elevatedbut policy diversification caps extreme upside. European energy equities remain more a cash-flow and capital discipline story than a pure geopolitical lever.

- TotalEnergies (TTE):YTD +18.97%; TTM P/E ~11.66x; sideways tone [0].

- Shell (SHEL):YTD +15.39%; TTM P/E ~14.57x; sideways tone [0].

- Equinor (EQNR):YTD −6.23%; TTM P/E ~7.40x; subdued tone [0].

- Interpretation:Attractive valuations and solid free cash flows support defensive value; however, macro/commodity swings and policy constraints (transition pathways, fiscal regimes) cap upside. In a “no-quick-ceasefire” world, they areincome compounding stories with moderate exposure to geopolitical upside, not high-beta war plays.

| Company | YTD Return | 1-Year Return | TTM P/E | Technical Tone |

|---|---|---|---|---|

| Rheinmetall (RNMBY) | +195.03% | +187.35% | ~84.55x | Sideways, high-valuation risk [0] |

| Saab (SAABY) | +178.90% | +174.67% | ~54.76x | Sideways, rich valuation [0] |

| Leonardo (FINMY) | +119.52% | +117.07% | ~54.92x | Bullish on order story, expensive on earnings [0] |

| Thales (THLEF) | +86.99% | +82.61% | ~68.99x | Elevated multiples, range-bound [0] |

| BAE Systems (BAESY) | +65.67% | +64.43% | ~26.21x | Relative value play vs. peers, sideways [0] |

- Sector message:Massive YTD run has priced in multiyear rearmament and export prospects; current P/E levels offerlittle room for disappointment on orders or execution.

- Recent stress:Mid-December, European defense names (Rheinmetall, Saab, Leonardo) dropped 4%+ on “peace hopes,” illustrating howquickly sentiment can reverse on headlines[5][6].

- Structural demand:NATO 2% targets and national capability gaps sustain a multiyear order backlog (ammunition, air defense, land systems). Continued conflict keeps this pipeline robust.

- Execution and capacity:Can the industry scale fast enough without margin pressure? Supply chain, labor, and capital allocation are key variables.

- Export exposure:Companies with strong non-European order books may better weather regional demand cycles.

- BAE Systems:Sideways with support/resistance in a tight band; low beta (−0.07) suggests defensive profile but limited near-term catalyst unless orders surprise [0].

- Rheinmetall:Sideways, rich valuation; KDJ shifting between neutral/bullish zones; high volatility around news flow [0].

- Thales:Sideways with overbought warnings on KDJ; valuation cap limits upside unless earnings catch up [0].

- Europe indices (30-day):DAX −0.11%; CAC 40 −2.02%—modest weakness versus U.S. indices (S&P 500 +1.52%; Nasdaq +1.42%; Dow +1.11%; Russell 2000 +3.80%) [0].

- Sector leadership:U.S. sector snapshot shows Communication Services (+0.70%) outperforming; Energy (−0.41%) lagging—consistent with the idea that energy is not repricing dramatically on this weekend’s headlines alone [0].

- Interpretation:The market is not in “risk-off” mode; instead, it is discriminating among sectors—penalizing cyclicals and energy, while favoring select growth and defensive areas.

| Dimension | Impact | Time Horizon | Key Risks & Opportunities |

|---|---|---|---|

Energy Security |

Supply diversification and 2027 ban on Russian gas reduce structural shock risk; price volatility from geopolitical noise remains but is capped by policy. | Medium to Long | Risk: Winter demand spikes and LNG delays; Opportunity: Companies with strong LNG/renewable exposure benefit from transition spending. |

Oil & Gas Equities |

Attractive valuations and cash flows offer defensive value; limited lever to pure geopolitical upside due to policy offset. | Near to Medium | Risk: Commodity swings and fiscal regime changes; Opportunity: Dividends and buybacks at modest multiples (TTE, SHEL, EQNR). |

Defense Contractors |

High valuations price in multiyear rearmament and export prospects; current P/E levels offer little room for disappointment on orders or execution . |

Near to Long | Risk: Peace-narrative headlines trigger sharp rotations; high P/Es increase downside on misses. Opportunity: Firms with visible orders and capacity expansion can still compound earnings if they deliver. |

Broader Markets |

European indices underperform U.S. modestly; sector leadership tilts away from cyclicals and energy. | Near | Risk: Escalation or sanctions steps can shock risk assets; Opportunity: Selective defensives and quality exporters may outperform. |

- Focus on cash-flow resilience and capital disciplineover pure geopolitical leverage.

- Watch:LNG import capacity progress, storage levels, and winter weather patterns; EU policy updates on 2027 ban implementation; company capex/dividend frameworks.

- Prioritize balance sheet strength, order visibility, and valuation cushion.

- BAE Systemsoffers relatively more attractive valuation versus peers [0].

- RheinmetallandSaabhave strong growth profiles but require earnings delivery to justify rich multiples [0].

- Event risk:Any progress toward a framework peace deal could trigger sector-wide de-risking; conversely, escalation or sanctions tighten reinforce the rearmament trade but may strain supply chains.

- Diversification:A barbell combining income-generating energy equities with select defense names (weighting towards valuation-supported picks) can balance income and growth.

- Risk management:Use of stop-loss levels and position sizing is critical given headline-driven volatility in both sectors.

- Geopolitical:Frequency and tone of U.S.-Russia communications; EU-Ukraine-Russia statements; any movement toward a peace framework.

- Energy:TTF gas price curves; EU storage inventories; LNG shipping rates and terminal utilization; weather patterns.

- Defense:National budget allocations and NATO spending updates; new contract announcements and guidance; earnings execution vs. expectations.

The lack of U.S. and Russian support for a European-Ukrainian ceasefire

- Energy:Limited direct upside from this weekend’s headlines alone; value lies in companies with strong cash generation and disciplined capital allocation. Structural policy moves (2027 Russian gas ban) reduce—but do not eliminate—energy security risk, anchoring a moredefensive positioningin the energy complex.

- Defense:A continued tailwind for orders, butpremium valuations leave the sector vulnerable to sharp correctionson any peace-narrative progress. Stock selection now favors firms with clear earnings power and reasonable valuations (e.g., BAE Systems) over the most expensive momentum names.

[0] 金灵API数据

[1] Reuters - “Putin and Trump do not support European-Ukrainian temporary ceasefire idea, the Kremlin says” (https://www.reuters.com/world/china/putin-trump-do-not-support-european-ukrainian-temporary-ceasefire-idea-kremlin-2025-12-28/)

[2] Axios - “Trump: Russia and Ukraine peace talks in ‘final stages’” (https://www.axios.com/2025/12/28/trump-putin-zelensky-ukraine-russia-peace)

[4] CNN - “Europe strikes a deal to phase out Russian natural gas imports by late 2027” (https://www.cnn.com/2025/12/03/business/eu-deal-phase-out-russian-natural-gas-intl)

[5] CNBC - “What a Russia-Ukraine peace deal could mean for Europe’s gas supplies” (https://www.cnbc.com/2025/12/23/what-a-russia-ukraine-peace-deal-could-mean-for-europes-gas-supplies.html)

[6] Bloomberg - “Europe Defense Stocks Fall as Ukraine Peace Talks Cool Investor Sentiment” (https://www.bloomberg.com/news/articles/2025-12-19/peace-hopes-add-to-valuation-question-for-europe-s-defense-rally)

[7] WSJ - “Oil Prices, Defense Stocks Fall on Ukraine Talks” (https://www.wsj.com/livecoverage/jobs-report-stock-market-today-12-16-2025/card/9guu4omsW

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.