INVO Fertility Q2 2025: Revenue Growth Amid Severe Financial Distress

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

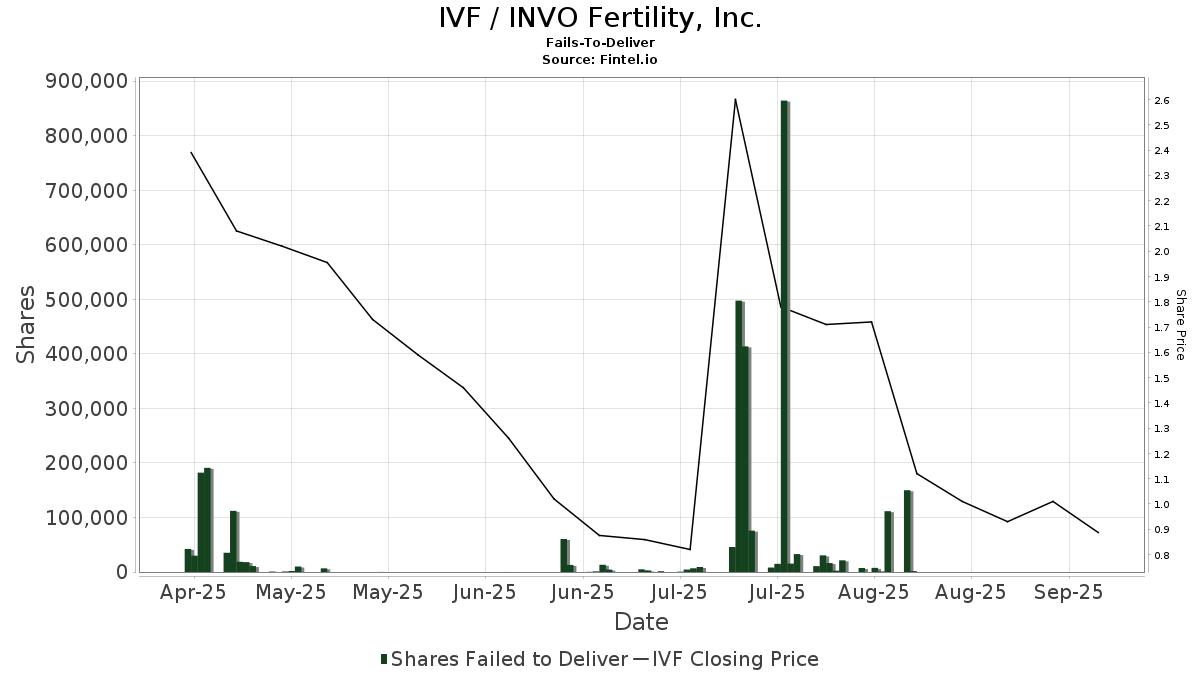

This analysis is based on the INVO Fertility Q2 2025 earnings announcement [1] published on August 14, 2025, which reported record quarterly revenue but revealed severe underlying financial deterioration. The announcement triggered a significant negative market reaction, with the stock declining dramatically in the days following the release [0].

- Going Concern Risk:Current ratio of 0.11 indicates immediate liquidity challenges that could threaten operational continuity [0]

- Profitability Deterioration:Widening losses despite revenue growth suggest fundamental business model unsustainability [1]

- Market Capitalization Collapse:Market cap of $501,824 reflects extreme market pessimism and limits financing options [0]

- Competitive Disadvantage:Minimal revenue scale versus established fertility providers with stronger financial positions

- Operational Restructuring:The completed NAYA divestiture provides a focused platform for potential operational improvements [1]

- Service Expansion:Telehealth capabilities and PRP therapy introduction at Wisconsin clinic represent revenue diversification efforts [1]

- Brand Recognition:Wisconsin Fertility Institute’s recognition on Newsweek’s America’s Best Fertility Clinics 2025 provides marketing leverage [1]

INVO Fertility’s Q2 2025 results present a complex picture of nominal revenue achievement against severe financial deterioration. The record quarterly revenue of $1.86 million (+1% YoY) [1] represents minimal growth that fails to offset expanding operational losses and critical liquidity constraints. The company’s current ratio of 0.11 and 98.6% stock price decline from 52-week highs [0] indicate substantial market concern about operational sustainability.

Strategic initiatives including telehealth expansion, PRP therapy introduction, and patent protection extension through 2040 [1] have not yet demonstrated meaningful financial impact. The completed NAYA Therapeutics divestiture in June 2025 [1] represents a necessary strategic refocusing but has not yet resolved the fundamental scale and profitability challenges.

Investors should be aware that the company’s financial metrics suggest immediate working capital challenges, with operating margins at -383.29% and net profit margins at -422.10% [0]. These indicators, combined with the market’s severe valuation compression, reflect substantial perceived risk regarding the company’s ability to achieve sustainable operations without significant additional capital or operational restructuring.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.