Analysis of Sustainability and Risks of High Premium Arbitrage Strategy for SDIC Silver LOF (161226)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on real-time market data and in-depth analysis of SDIC Silver LOF (161226), I will comprehensively analyze the sustainability of the high premium arbitrage strategy and its risk-reward characteristics for you.

As the

- Over-the-counter (OTC) Market: Investors subscribe/redeem shares at the fund’s net value, which is determined by the value of the held silver futures contracts and reflects the fund’s true intrinsic value.

- Exchange Market: Investors trade at real-time matching prices like stocks, where prices are affected by supply-demand relationships and market sentiment, easily deviating from the net value.

This mechanism creates arbitrage space: when

T Day: OTC Subscription (at net value)

↓

T+1 Day: Share Confirmation

↓

T+2 Day: Exchange Sale (at market price) → Profit = Premium - Subscription Fee - Trading Commission

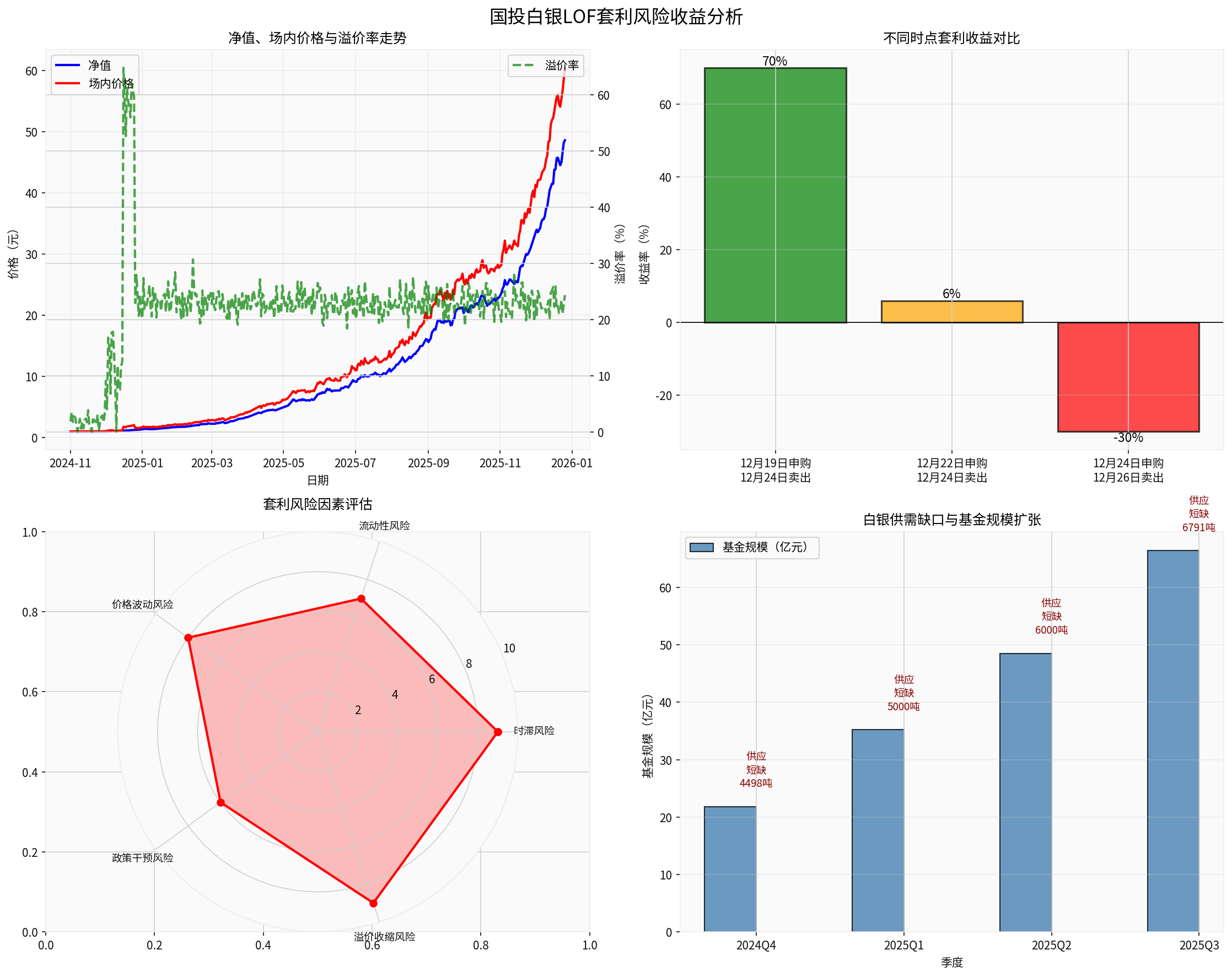

- Best Case: Subscribe on Dec 19 (net value 1.74 yuan) → Sell on Dec 24 (market price 3.116 yuan), with a return rate of about80%[0].

- General Case: Subscribe on Dec 22 (premium rate 43%) → Sell on Dec24, with a return rate of only about6%, barely covering costs [0].

- Loss Case: Subscribe on Dec24 (premium rate61.64%) → Sell on Dec26 (premium rate23.22%), with a loss of about-30%[0].

The extreme premium of SDIC Silver LOF is mainly formed by the superposition of

- As the only domestic public fund mainly investing in silver futures, it became the only choicefor investors to lay out via this channel during the silver market boom.

- The fund scale surged from 2.178 billion yuan at the end of 2024 to 6.64 billion yuan at the end of Q3 2025, an increase of over 200%[0].

- In 2025, silver led the global precious metals rally, with London silver prices hitting a historical high of 72.7-79 USD/oz, up nearly150%year-to-date [1].

- Driven by both explosive industrial demand (photovoltaics, new energy vehicles, AI computing power) and enhanced safe-haven attributes.

- Strict purchase limits have been implemented since Oct 20, with the daily subscription limit for Class A shares adjusted from 100 yuan to 500 yuan.

- The OTC new supply channel is almost closed, forcing a large amount of funds to pour into the exchange secondary market for “hunting” [0].

According to market data, the premium rate of SDIC Silver LOF shows

| Time Node | Premium Rate | Exchange Price | Net Value | Price Movement Feature |

|---|---|---|---|---|

| End of Nov | 6.75% | - | - | Stable Period |

| Dec19 | - | - | 1.74 yuan | Subscription Benchmark Point |

| Dec24 | 61.64% |

3.116 yuan | 1.93 yuan | Peak,3 Consecutive Daily Limits |

| Dec25 | 45.44% | - | - | Daily Limit Down, Premium Contraction |

| Dec26 | 23.22% | - | - | Return to Rationality |

- Since its listing in August 2015, premium rates exceeding 10% have only occurred 15 times.

- Among them, 13 times were concentrated in December 2024, and 2 times in March 2020 [0].

- The cumulative increase in the past 20 trading days reached 116.84%, with a year-to-date return rate of over250%[0].

###3.1 Transmission of Futures Prices to Fund Net Value

The

- Position Structure: The fund mainly holds Shanghai Futures Exchange silver futures contracts, with the value of futures contracts accounting for 90%-100% of the fund’s net asset value.

- Net Value Calculation: The net value is calculated based on the settlement price of futures contracts after daily closing.

- Price Transmission: Silver futures price rises → Value of fund holdings increases → Fund net value grows.

- Supply Side: Global silver supply shortage continues for the fifth year, with the supply-demand gap expanding from 4,498 tons to 6,791 tons in 2025-2027.

- Demand Side: Explosive industrial demand (photovoltaics, new energy vehicles, AI computing power) and enhanced safe-haven attributes drive growth.

- Macro Environment: The U.S. enters an interest rate cut cycle, increasing the attractiveness of silver priced in dollars; tariff policies trigger hoarding demand.

###3.2 Amplification Mechanism of Premium Fluctuations

The price transmission between futures and the fund has a

Silver futures rise by 100%

↓

Fund net value rises by100% (theoretical tracking)

↓

Exchange price rises by250% (actual performance)

↓

Premium rate surges from 2% to61% (sentiment amplification)

- Liquidity Dilemma: OTC purchase limits lead to insufficient supply and scarce liquidity in the exchange market.

- Sentiment Resonance: Silver bull market + scarce品种 + capital inflow form a positive feedback.

- Arbitrage Failure: T+2 time lag + purchase limits prevent large funds from participating, temporarily invalidating the arbitrage mechanism.

###4.1 Quantitative Evaluation of Risk Factors

- T+2 settlement cycleleads to great uncertainty during the period.

- Silver prices can fluctuate by 5-10%daily, and the premium rate can drop from61% to23% within 2 days.

- Actual Case: Subscribe 500 yuan on Dec24, which may result in a loss of over30% by Dec26.

- Unable to sell when跌停: The closing order on Dec25 exceeded 1 billion yuan[0].

- Concentrated selling by arbitrage funds (nearly 300,000 participants) exacerbates selling pressure, possibly triggering a stampede effect.

- The fund company has released a total of 14 risk warning announcementssince December [0].

- Implemented 9 temporary suspensions(1 hour each) [0].

- Purchase limits are adjusted frequently (100 yuan→500 yuan→100 yuan), with great rule uncertainty.

- The fund company clearly emphasizes that “the high premium rate in the secondary market is not sustainable” [0].

- Regulatory authorities have also introduced risk prevention measures for silver futures [1].

- Once market sentiment cools down, the premium rate will quickly return to the normal level (2-10%).

###4.2 Uncertainty of Arbitrage Returns

Based on historical data and actual case analysis:

- Subscribe before the premium rate rises and sell near the peak.

- Return Rate:50-80% (e.g., subscribe on Dec19→sell on Dec24).

- Subscribe during the high premium platform period, with small fluctuations in the premium rate.

- Return Rate:5-15%, barely covering handling fees and time costs.

- Subscribe at the peak or during the decline of the premium rate.

- Loss Rate:-20% to-40% (e.g., subscribe on Dec24→sell on Dec26).

###5.1 Current Environment Analysis

-

Premium Rate Has Fallen Sharply

- Dropped from the peak of61.64% to23.22%, compressing the arbitrage space by over60%.

- As the market returns to rationality, the premium rate will further return to the historical normal level (2-10%).

- Dropped from the peak of61.64% to23.22%, compressing the arbitrage space by

-

Increased Arbitrage Competition

- “Arbitrage tutorials” are刷屏 on social platforms, with nearly300,000 participants [0].

- Subscription volume surged from 10.97 million shares to162.43 million shares within a week, competition intensifies to suppress returns.

-

Intensive Regulatory Adjustments

- The fund company’s attitude is clear: continuous purchase limits, suspensions, and risk warnings.

- Emphasizes that “the high premium rate is not sustainable”, and may take more strict measures.

-

Market Structure Limitations

- T+2 time lagamplifies risks in extreme market conditions instead of providing arbitrage opportunities.

- Purchase limits prevent large funds (institutions) from participating, partially invalidating the arbitrage mechanism [0].

###5.2 Sustainability Rating

- The premium rate is in a rapid return channel, and the arbitrage window is closing.

- The fund company actively regulates to compress the arbitrage space.

- Regulatory risks increase, with high policy uncertainty.

- Market participants are highly crowded, and return uncertainty surges.

- T+2 time lag constitutes a substantial risk in extreme fluctuations.

- The premium rate soars to over30%again and is in an upward trend.

- The fund company relaxes purchase limit policies.

- Silver futures enter a relatively stable upward channel.

- Market sentiment shifts from over-excitement to rational optimism.

###6.1 Recommendations for Different Investors

- Not Recommendedto participate in high premium LOF arbitrage currently.

- If you must participate, you need to meet the following conditions:

- Premium rate>30% and in an upward channel.

- Able to bear fluctuations of over20% during the T+2 period.

- Use idle funds and strictly control positions (single time <5% of funds).

- Prioritize taking profits and exitingto avoid losses from premium regression.

- If you are optimistic about the long-term trend of silver, you can wait for the premium rate to return to within5% before re-entering.

- Consider direct investment in silver futuresorgold and silver ETFs(premium rate usually <3%).

- Or participate indirectly through silver stocks(e.g., Industrial Bank Tin, Shengda Resources) to avoid LOF premium risks.

###6.2 Key Risk Warnings

⚠️

- High Premium Is Not Sustainable: The fund company clearly warns that the current premium rate will return to the normal level.

- T+2 Time Lag Risk: Extreme reversals from +80% returns to -30% losses may occur within 2 days.

- Liquidity Drying Risk: Unable to sell when跌停, possibly facing deep traps.

- Policy Adjustment Risk: The fund company may adjust purchase limit policies at any time, affecting the arbitrage logic.

- Market Sentiment Reversal Risk: Once silver prices correct, the LOF premium rate will contract by a larger margin.

[0] Gilin API Data (Silver LOF Fund Net Value, Price, Premium Rate and Other Market Data)

[1] East Money Network - “SDIC Silver LOF Premium Rate Exceeds61%! Someone Earned350 Yuan by Arbitraging500 Yuan in Two Days” (https://wap.eastmoney.com/a/202512243601040821.html)

[2] Time Finance - “SDIC Silver LOF Premium Rate Exceeds61%! Someone Earned350 Yuan by Arbitraging500 Yuan in Two Days” (Reprinted by Sina Finance, https://finance.sina.com.cn/roll/2025-12-24/doc-inhcxqhx5530853.shtml)

[3] The Paper - “Three Consecutive Daily Limits, Premium Rate Near70%! SDIC Silver LOF Announces Temporary Suspension Again” (https://www.thepaper.cn/newsDetail_forward_32247349)

[4] Securities Times - “From Hunt Brothers to ‘Invisible Hand’: Similarities and Differences Between Two ‘Silver Manias’” (https://www.stcn.com/article/detail/3560783.html)

[5] Investing.com - “Silver LOF Wins Three Consecutive Daily Limits! Premium Rate Jumps to68%, Exchange Funds Surge to Daily Limits” (https://cn.investing.com/news/stock-market-news/article-3141007)

[6] Fortune Account - “Full Sorting of A-share Beneficiary Listed Companies Silver Prices Soared Over120% This Year” (https://caifuhao.eastmoney.com/news/20251223121709183894560)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.