In-depth Analysis of the Impact of Xiaomi Group's Diversification Expansion on Investment Logic and Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest market data and web search information, the following provides a systematic analysis of whether diversification from smartphones to automobiles and then to home appliances changes investment logic, and the impact of blurred business boundaries on valuation.

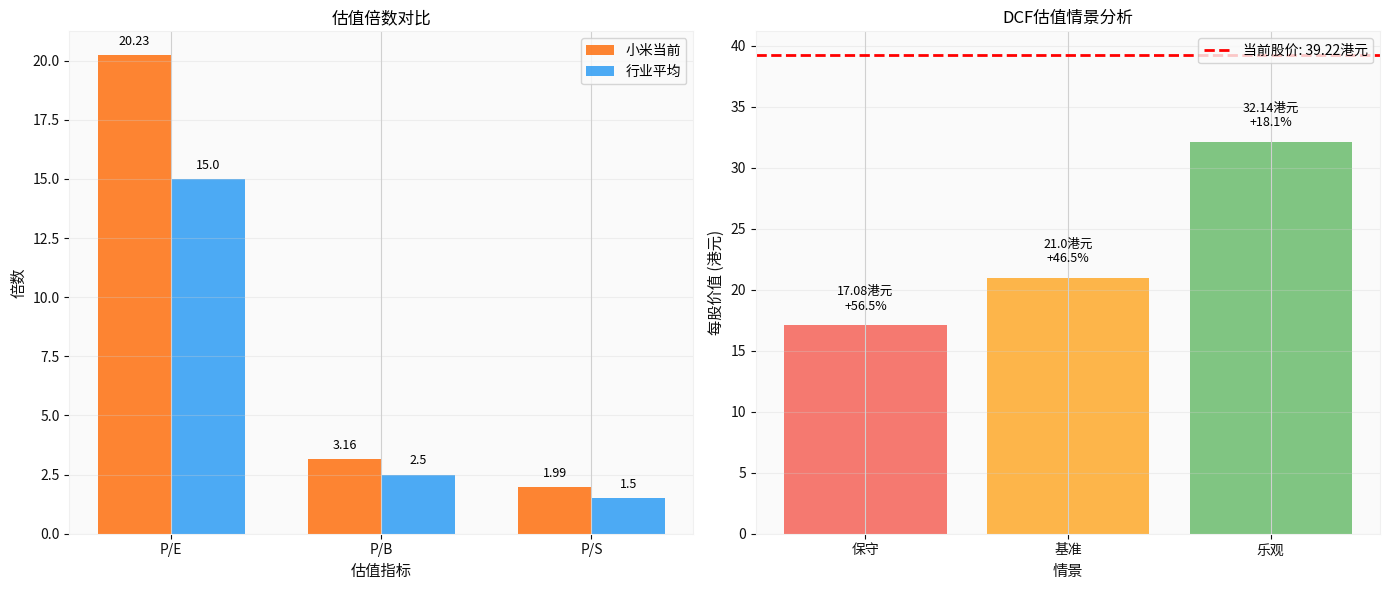

- Stock Price: HKD 39.22 (2025-12-24), Market Capitalization: ~HKD 1.02 Trillion [0]

- Valuation: P/E ~20.23x, P/B ~3.16x, P/S ~1.99x [0]

- Recent Performance: -28.23% in past 3 months, -33.47% in past 6 months, YTD +15.35%; ~+249.55% over 3 years [0]

- Technical Analysis: No clear trend currently, trading range ~HKD38.59–41.09; KDJ indicates oversold opportunity [0]

- DCF Scenarios (Tool Data): Conservative/Baseline/Optimistic intrinsic values ~HKD17.08/21.00/32.14; current stock price has premium over baseline scenario [0]

- The company unifies cross-terminal via HyperOS, building an intelligent ecosystem closed loop of ‘Human × Car × Home’; expanding from consumer electronics to smart cars and large home appliances, emphasizing scenario interconnection and experience synergy [1].

- Web search information shows: Xiaomi’s AI investment returns in 2025 ‘far exceed expectations’, and it is advancing from general AI to ‘embodied AI’ direction, emphasizing deep integration of AI with the physical world to support ecosystem expansion [1].

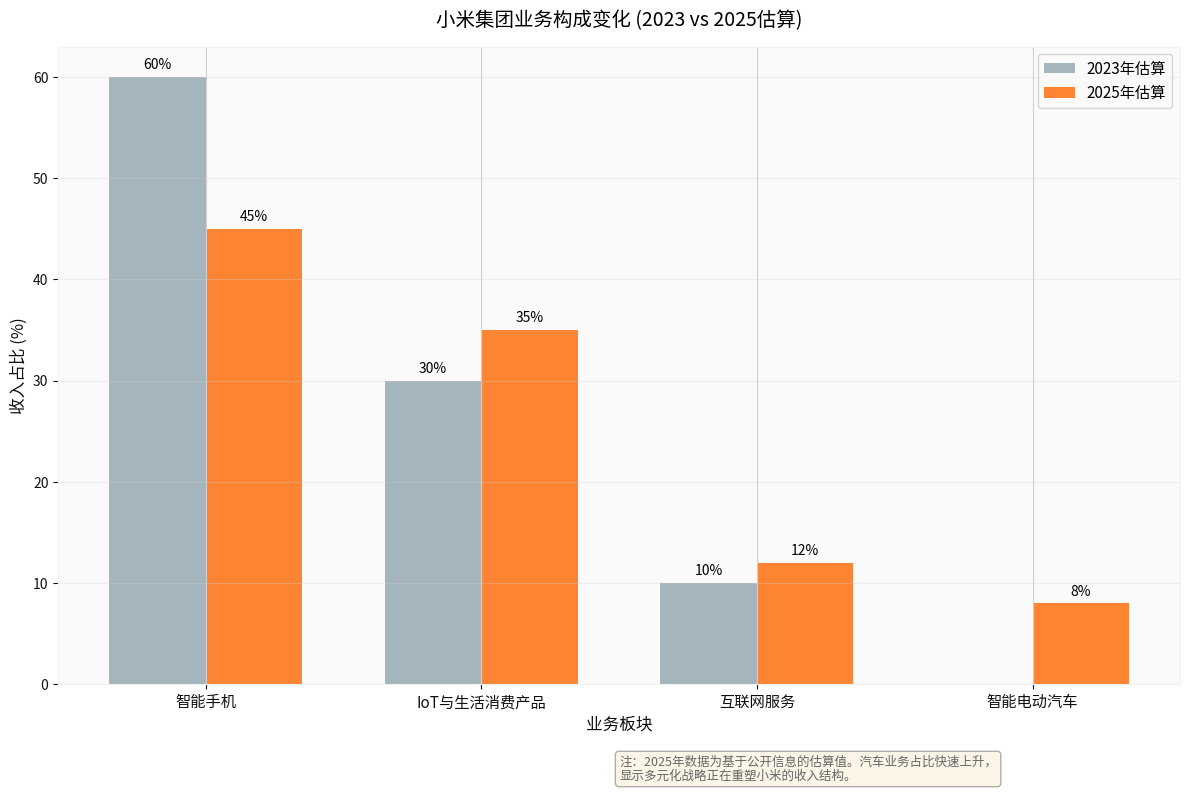

The following chart shows the possible evolution of business proportions (for illustrative purposes; refer to company disclosures for exact figures):

- Trend: Smartphone proportion gradually decreases, IoT/lifestyle consumption proportion increases, smart electric vehicle business scales rapidly, driving more diversified revenue sources (illustrative in above chart; based on public data estimates).

- Tool data shows: The company’s latest quarterly (as of 2025-11-17) EPS is ~HKD0.51, revenue ~HKD135.08 Billion [0]. New businesses like automobiles achieved ‘first profit’ in Q3 2025 (web search), but no specific amount provided by tools [1].

- Impact: Heavy capital investment businesses like automobiles bring both short-term profit growth and volatility, posing higher requirements for valuation methods.

- AIoT and automobile businesses enhance ‘stickiness’ and ARPU potential, driving long-term value through scenario cross-pull; ecosystem companies have more imaginative space in user lifetime value and scale effects.

- Risk: Diversification increases R&D and capital expenditure, putting short-term financial statements under pressure, but if network effects form in the long run, it helps improve profit sustainability and anti-cyclical capabilities.

- The combination of AI+OS+chips strengthens cross-scenario capabilities; if autonomous driving/cockpit and consumer electronics AI capabilities are connected, it will build long-term barriers for software-hardware synergy [1].

- Comparison with industry average: Current P/E (20.23x) is higher than comparable industry average (~15x), P/B (3.16x) is also higher than average (~2.5x) [0].

- Reason: The market gives ecosystem premium, but is also waiting for new businesses like automobiles to deliver stronger profit growth.

- Scenario analysis shows that only under optimistic assumptions does intrinsic value approach current stock price; under conservative/baseline scenarios, stock price has certain premium over intrinsic value [0].

- Key Variables: Revenue growth and profitability of new energy vehicle business, IoT gross margin, AI-related monetization pace, etc.

- Traditional P/E easily underestimates long-term value of ecosystem enterprises, requiring combination of SOTP: Smartphone business applies comparable hardware company multiples, automobile business references new势力 EV sales/delivery rhythm and profit path, internet services focus on DAU/ARPU.

- Web search emphasizes the strategic narrative and scenario value of ‘Human × Car × Home Full Ecosystem’, increasing attention to synergy effects and long-term growth potential [1].

- Execution and Synergy Risk: Cross-category cross-scenario organizational complexity increases, synergy effects take time to land.

- Capital Return Volatility: High investment intensity in businesses like automobiles; if production capacity ramp-up is less than expected or demand fluctuates, it will drag down overall ROIC.

- Intensified Competition: Faces strong opponents in mobile phones, EV, home appliances lines; product iteration and experience within ecosystem need to stay ahead continuously.

- AI Embodiment and Scenario Landing: AI investment returns exceed expectations, providing intelligent base for ‘Human × Car × Home’ [1].

- Ecosystem Stickiness and Cross-selling: Automobile and home appliance entrances enhance touch points, increasing user lifetime value.

- Brand and Cost Advantages: Brand awareness and supply chain scale effects support medium-to-long term profit margin improvement.

- Partially Changed: Valuation logic shifts from pure hardware to ‘ecosystem + scenario’ repricing, profit model becomes more diversified. However, core business essence (hardware monetization + service value-added) remains unchanged; the key lies in whether new businesses can deliver stronger profit growth and ecosystem synergy.

- Yes. The market needs to replace single P/E with ‘ecosystem + SOTP’ and combine scenario analysis to manage uncertainty. Current valuation already reflects part of ecosystem premium; follow-up needs to track automobile business gross margin, IoT penetration rate and AI monetization progress.

- Short-term Focus: Quarterly delivery and gross margin improvement, inventory and cash flow health status.

- Mid-term Anchor: DAU, cross-scenario MAU and ARPU growth, proving ecosystem value.

- Long-term Verification: Depth of integration between autonomous driving/cockpit and AI capabilities, formation of moat.

[0] Gilin API Data (Stock Price, Finance, Valuation, Technical Indicators, DCF Scenarios, etc.)

[1] Yahoo Finance — China’s Xiaomi says returns from AI investments ‘far exceed expectations’ (2025-12-28)

Link: https://finance.yahoo.com/news/chinas-xiaomi-says-returns-ai-093000691.html

[2] Yahoo Finance — Xiaomi Plans to Place Shares via Old-for-New Way to Raise Up to HKD38.5 Billion (Discussing Cash Flow and Investment Expansion)

Link: https://www.zhihu.com/question/15686034665

[3] Yahoo Finance — Discussion on Xiaomi SU7 Ultra Pricing at HKD529,900

Link: https://www.zhihu.com/question/13619041106

[4] Yahoo Finance — Xiaomi SU7 Delivery Milestone Related Reports

Link: https://media.zenfs.com/en/market_digest_986/09791cb1dcfb45a75b4d4b347c1c156a

[5] Yahoo Finance — Xiaomi IoT/Home Appliances and HyperOS Ecosystem Reports

Link: https://media.zenfs.com/en/prnewswire_hk_285/1de810e97c9195008adf824268656f65

[6] Yahoo Finance — Xiaomi 15T Series and IoT Home Appliances Ecosystem

Link: https://media.zenfs.com/en/prnewswire_hk_285/3e72f118be3e07dc9ea4468e7e4d43cf

[7] Yahoo Finance — Automobile Business Related News (Bloomberg/WSJ etc., EV Market and Strategy)

Link: https://www.bloomberg.com/news/newsletters/2025-12-08/five-things-to-watch-in-china-s-ev-market-next-year

[8] Yahoo Finance — Foreign Automakers’ Strategies in China (Background)

Link: https://www.bloomberg.com/opinion/articles/2025-12-02/how-foreign-carmakers-can-stay-the-course-in-china

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.