Analysis of Luzhou Laojiao's Strategic Transformation towards the 'Personal Baijiu Era'

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on current data (as of 2025-12-26) and peer industry observations, Luzhou Laojiao has a strong brand and channel foundation, but there are significant uncertainties regarding potential structural adjustment pressures in 2026:

- Valuation & Fundamentals: DCF scenarios based on 5-year historical averages and analysts’ consensus expectations show that the current stock price of 119.39 yuan has a significant valuation discount relative to the baseline scenario (the scenario range is +63.1%/+109.4%/+219.6% relative to the current price), indicating that the market has priced in relatively pessimistic expectations, but is highly sensitive to assumptions [0].

- Technical & Price-Volume Performance: The stock price fluctuated significantly in 2025, with technicals showing consolidation/ no clear trend; KDJ indicates a possible oversold recovery; annual returns were weaker than some peers, with high volatility [0].

- Industry & Peers: Baijiu leaders (Moutai, Wuliangye) showed divergent trends during the same period; in the volatile consumer cycle, the differentiation between mid-to-high-end and sub-high-end segments increased. Luzhou Laojiao performed moderately among peers, but still retained relative defensive attributes [0].

- Key Transformation Factors: The quality of digitalization and channel refinement implementation, as well as the cultivation cycle of the younger product matrix, are the main sources of uncertainty; the real pressure on industry inventory and price systems in Q1 2026 has not been verified by data and is a variable that needs close tracking (no verifiable specific meeting statements were retrieved currently) [0].

- Current market capitalization is approximately 175.5 billion yuan, corresponding to a TTM P/E ratio of about 13.9x [0].

- Net profit margin in the past 12 months is about 42.1%, with gross margin and operating profit margin at high industry levels [0].

- ROE (TTM) is about 26.1%, reflecting strong profit quality [0].

- Baseline scenario (5-year historical average): Implied fair value is approximately 249.95 yuan, with an upside potential of about 109% relative to the current price [0].

- Conservative scenario: Approximately 194.75 yuan (+63%) [0].

- Optimistic scenario: Approximately 381.59 yuan (+220%) [0].

- WACC is about 9.9%, Beta is about 0.81, and equity cost is about 10.1% [0].

- Free cash flow in the latest year is approximately 18 billion yuan, with robust cash flow quality [0].

- Current ratio is about 3.61, quick ratio is about 2.57, and debt risk rating is ‘Low Risk’ [0].

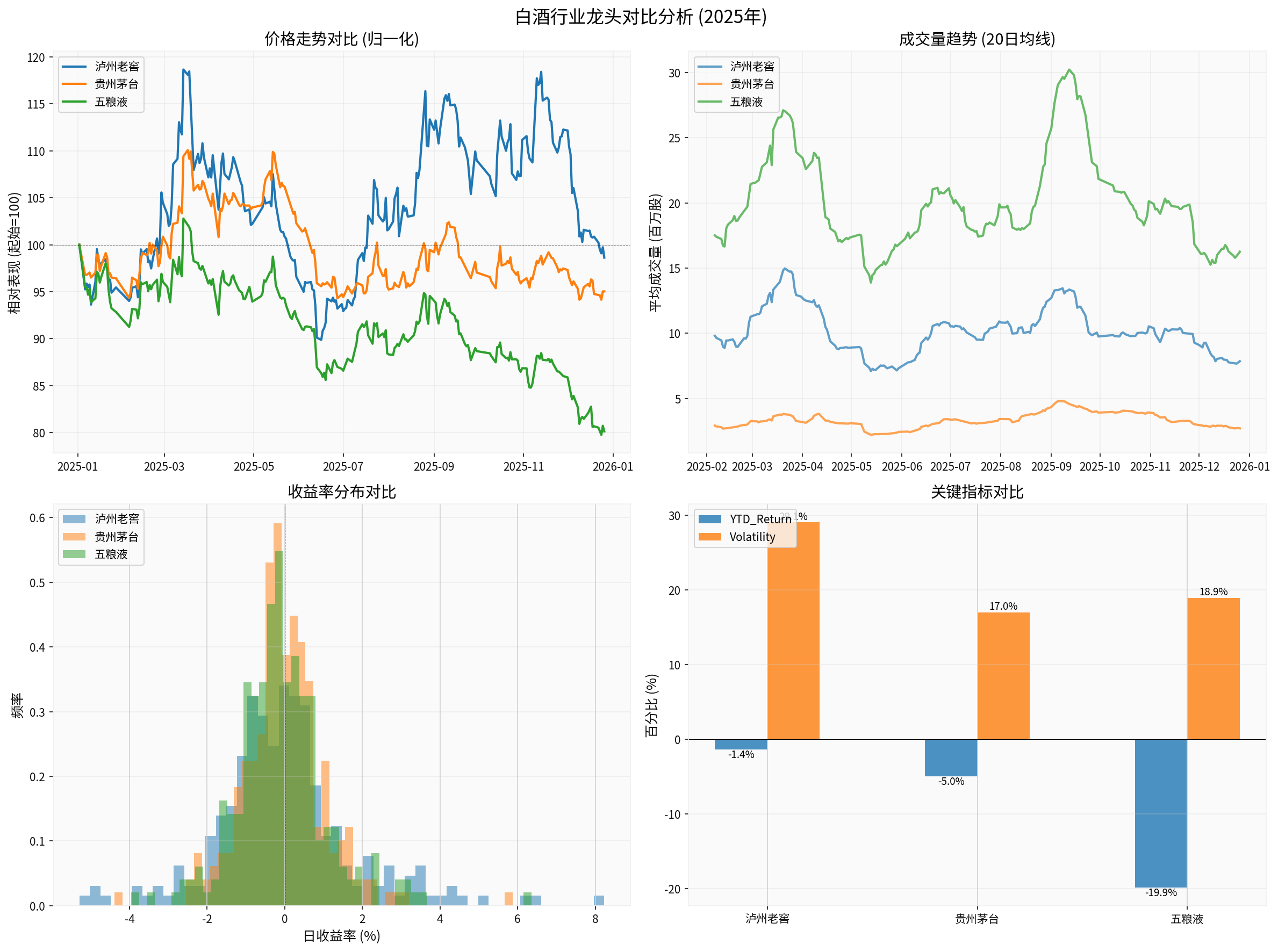

- Divergent trends among peer leaders (Moutai, Wuliangye, Luzhou Laojiao) in 2025:

- Luzhou Laojiao YTD: ~-1.37%, volatility ~29.1% [0].

- Kweichow Moutai YTD: ~-4.96%, volatility ~17.0% [0].

- Wuliangye YTD: ~-19.86%, volatility ~18.9% [0].

- Luzhou Laojiao’s annual volatility is significantly higher than peers, reflecting large market分歧 on expectations and fundamental recovery paths [0].

- Recently, the daily consumer sector has performed relatively stably, but consumer confidence and the recovery pace of business banquets are uneven; channel inventory and price systems are still in the rebalancing stage (based on peer and sector performance observations) [0].

Chart: 2025 Analysis of Luzhou Laojiao’s Price, Trading Volume, Return Rate, and Volatility [0]

- Price Range: Annual high of about 146.72 yuan, low of about 106.75 yuan, current price of about 119.39 yuan [0].

- Technical Status: MACD has no clear crossover signal (indicating no clear trend), KDJ is in the oversold range (possible recovery), overall judgment is ‘volatile/no clear trend’ [0].

- Trading Volume: After phased expansion, it tends to decline; need to observe sustainability in combination with Spring Festival stock preparation and post-festival sales rhythm [0].

Chart: 2025 Performance Comparison of Major Baijiu Leaders [0]

- In the comparable period, Luzhou Laojiao’s annual decline was smaller than Wuliangye’s, significantly outperforming some sub-high-end targets, but still under pressure overall [0].

- Compared to Moutai’s defensiveness, Luzhou Laojiao has both ‘recovery elasticity’ and ‘volatility risk’, making it more suitable for balanced risk-return allocation.

- ‘Personal Baijiu Era’: Products and channels evolve towards personal consumption, quality, and scenario diversification. Youthfulness and digitalization are regarded by the market as long-term directions (specific statements and implementation effects need channel verification).

- Digitalization & New Productivity: Supply chain and channel refinement management, intelligent brewing, green low-carbon, etc., help reduce costs, increase efficiency, and stabilize quality.

- Insufficient Demand Verification: If the recovery of social/business and banquet scenarios is weaker than expected, there is uncertainty whether ‘personalization’ can quickly compensate for demand.

- Channel De-Stocking Rhythm: The real inventory and price plate pressure in Q1 2026 still needs to be observed through terminal sales data; currently, no authoritative source’s specific ‘critical point’ statement has been retrieved for verification.

- Youth Cultivation Cycle: Brand awareness and taste education require continuous investment, with limited contribution to revenue in the short term.

- Assumption Sensitivity: DCF valuation is sensitive to revenue growth and WACC; if growth slows or costs rise, the valuation space may converge [0].

- Technically volatile; focus on Spring Festival and post-festival sales verification. If channel de-stocking accelerates and prices stabilize, there is room for valuation recovery [0].

- Key Focus Areas: Quarterly revenue growth, gross margin changes, expense ratio, and cash flow quality.

- Strong brand strength and cash flow resilience; digitalization and product structure optimization are expected to build long-term barriers, but the pace of realization depends on execution and market cooperation.

- Whether the ‘Personal Baijiu Era’ can effectively hedge against government/business scenario adjustments needs to be verified through continuous tracking.

- It is recommended to evaluate allocation timing in phases based on quarterly verification and channel tracking, combined with volatility and valuation scenarios.

- If more in-depth structural analysis of channel inventory, regional price plates, and product matrix is needed, activate the ‘Deep Research Mode’ to further obtain dealer data, cost structures, expense efficiency, and other detailed information.

[0] Jinling API Data (Company Overview, Real-Time Quotes, Technical Analysis, Financial Analysis, DCF Valuation, Stock Daily Line & Sector Data, Python Analysis & Charts)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.