Zijin Mining (2899.HK) 2026 Production, Profit Growth and Investment Value Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my comprehensive analysis of Zijin Mining (2899.HK), I will now provide a detailed assessment of the sustainability of its 2026 production jump and profit growth, as well as the investment value of its multi-metal resource layout.

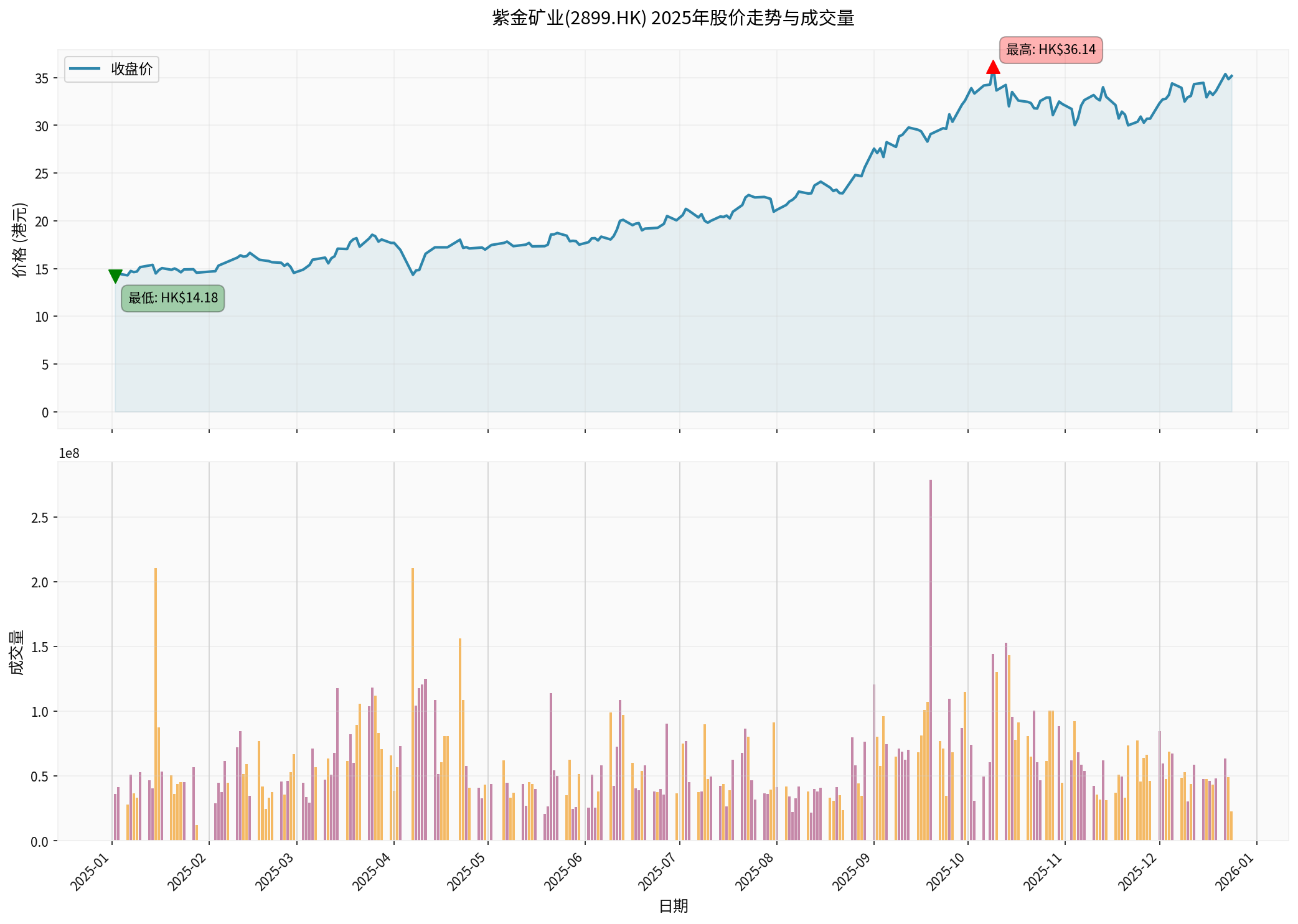

- Year-to-date return rate is as high as 148.10%, rising from HK$14.18 at the start of the year to the latest HK$35.18 [0]

- Annual highest price: HK$36.14 (October 9), lowest price: HK$14.18 (January 2)

- Market capitalization reaches HK$933.4 billion, P/E ratio:19.51x, P/B ratio:5.30x

- Annualized volatility:43.56%, indicating high stock price volatility

- Net profit margin:13.91%, operating profit margin:20.11%, ROE as high as30.60%

- Free cash flow:HK$24.063 billion, abundant cash flow

- Conservative accounting policies; high depreciation/capital expenditure ratio means profit still has room to improve as investment projects mature

- Julong Copper Mine Phase II: Flagship project in Tibet, China; expected to reach full production in2026 and become one of the world’s largest copper mines

- Kamoa Copper Mine: World-class copper mine in the DRC, under continuous expansion

- Juno Copper Mine: JORC-standard resource project in Serbia

- Positive copper price outlook: Goldman Sachs predicts average copper price will hit US$10,710/tonne in H12026

- Global copper supply “structural imbalance”: IEA warns of strategic gap from 2025; new mine development takes15-20 years

- Strong demand: Emerging industries like AI data centers, grid upgrades, EV penetration drive long-term demand

- Haiyu Gold Mine: World-class gold project in Shandong

- Expansion of existing gold mines and overseas acquisitions

- Gold prices soared ~70% in2025, best annual performance since1979

- Goldman Sachs predicts gold price will reach US$4,900 by end-2026

- Global central bank gold buying spree continues: Expected to maintain >750 tonnes in2026

- 43% of central banks say they will increase gold holdings in next12 months

###3. Lithium Production Growth (Target:130,000 Tonnes)

- Overseas lithium projects like Argentina’s 3Q project

- Lithium prices rose ~30% cumulatively in2025

- Lithium carbonate prices fell from 2021-2022 highs but show recent stabilization signs

- Long-term EV demand is certain, but short-term oversupply risk exists

- Mineral diversification: Copper, gold, lithium, silver, zinc etc. hedge single commodity price risk

- Regional diversification: Presence in China (Tibet), DRC, Serbia, Colombia, Peru etc. reduce geopolitical risk

- Julong Copper Mine:9% tax rate (Tibet special policy)

- Serbia projects:15% tax rate

- vs. domestic 25% rate, significantly boosts net profit margin

- Boldly acquired quality assets during industry downturns (2015,2020)

- Kamoa Copper, Timok Copper-Gold prove management’s excellent vision

- Floating profits from listed stocks as extra profit source

- Investment income + core business form “dual-engine drive”

- Current ratio:1.20, quick ratio:0.92

- Debt risk classified as “moderate”

- Free cash flow HK$24.063B, abundant liquidity

- Current P/E:19.51x (reasonable range)

- P/B:5.30x (reflects market recognition of growth)

- EV/OCF:15.22x (attractive cash flow valuation)

Based on technical data:

- Trend: Sideways consolidation, no clear direction

- Support: HK$33.34

- Resistance: HK$35.84

- MACD: Bullish signal

- KDJ: K(73.2), D(68.3), J(83.1) (bullish)

- Beta:1.25 (higher than market volatility)

##2026 Performance Outlook

- Copper:1.26M tonnes (+>20% expected)

- Gold:110 tonnes (+>15% expected)

- Silver:610 tonnes

- Lithium:130k tonnes

- Copper: High level, expected average US$10,700+/tonne

- Gold: Challenge US$4,900-5,000

- Lithium: Stabilize and recover

- 2025 net profit attributable to shareholders: RMB55-56B

- 2026 expected growth:25%-35%

- Key drivers: Production increase, high metal prices, low tax, non-recurring income

- Certain growth:2026 production jump has strong certainty

- Favorable prices: Copper/gold outlook positive, lithium stabilizing

- Cost advantages: Low tax + scale + counter-cyclical M&A

- Multi-metal hedge: Diversify price risk

- Sound finances: Abundant cash flow, controllable debt

- Price volatility: Affected by macro, monetary policy, geopolitics

- Geopolitical risk: High overseas assets exposure

- Project execution: Delays/cost overruns for large mines

- Valuation risk:148% price surge leads to short-term correction pressure

- Cyclicality: Mining industry cyclicality, peak risk

- Rating: Buy

- Reason: Certain production growth, multi-metal layout, reasonable valuation

- Strategy: Batch position building, long-term hold

- Rating: Watch/Follow dip

- Reason: Sideways consolidation; wait for breakout

- Strategy: Buy near HK$33.34 support; add after breaking HK$35.84 resistance

- Rating: Neutral to Bullish

- Reason: Focus on metal price breakthroughs, project outperformance

- Strategy: Option strategies like call options or bull spreads

Enable

- Peer comparison: BHP, FCX, Jiangxi Copper

- Project analysis: ROI and capacity ramp-up for major mines

- ESG assessment: Environmental/social/governance risks

- Macroeconomic sensitivity: Performance under different scenarios

- Valuation: Multi-stage DCF model

This analysis is based on public data and does not constitute investment advice. Investment involves risks.

[0] Gilin API Data (Real-time quotes, financial analysis)

[1] Yahoo Finance - Metal Surge, Energy Turmoil:2026 Investment Layout

[2] Yahoo Finance - Gold Surge 60%:2026 Bubble or New Start?

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.