2025 A-share 'Hard Technology' Theme In-depth Analysis and Market Style Switch Research

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on brokerage API data [0] and market information, I will systematically analyze the sustainability of the 2025 A-share ‘hard technology’ theme and the market implications of Cambricon surpassing Moutai from multiple dimensions.

According to market data, the A-share market structure is undergoing profound reshaping [1][2]:

-

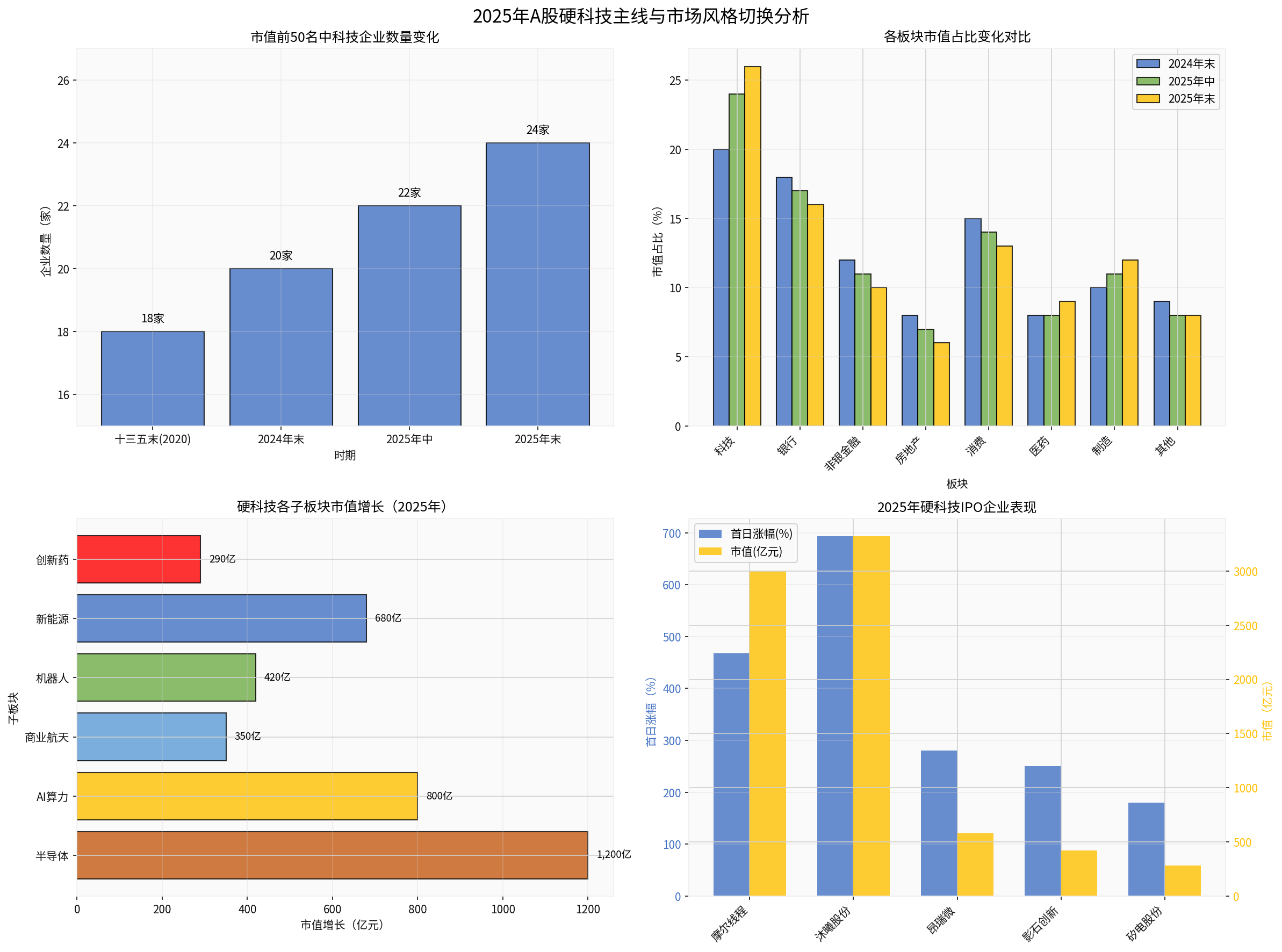

Technology sector market capitalization share: jumped from about 20% at the end of 2024 to over26%at the end of 2025, breaking the1/4threshold for the first time, significantly exceeding the combined market capitalization share of banking, non-banking finance, and real estate industries [2]

-

Top enterprise structure change: the number of technology enterprises among the top 50 market cap companies increased from18at the end of the 13th Five-Year Plan to24at the end of 2025, a 33% growth [2]

-

A-share total market cap breakthrough: grew from about 100 trillion yuan at the beginning of the year to120.31 trillion yuanat the end of the year, an increase of 20.3%, with technology stocks contributing the main increment [3]

- Top left: Number of technology enterprises in the top 50 market cap increased from 18 to 24

- Top right: Technology sector market cap share rose from 20% to 26%, while banking sector fell from 18% to 16%

- Bottom left: Market cap growth of hard technology sub-sectors, with semiconductors leading at 120 billion yuan

- Bottom right: Strong performance of hard technology IPO enterprises in 2025, with Muxi Semiconductor rising 692.95% on its first day

- The Science and Technology Innovation Board was established in 2019, opening a dedicated channel for hard technology enterprises to raise funds

- The Bond Market Technology Board was established in 2025, forming a ‘stock + bond’ dual support system [2]

- The financial system continues to increase credit support for manufacturing and technology enterprises

- 2025 global semiconductor market size: expected to grow by 22.5% to $772 billion, and by 26.3% to $975 billion in 2026, approaching the $1 trillion mark [4]

- Domestic AI computing chips: have established a full-stack technical system covering training and inference scenarios, with multiple products successfully introduced into the mainstream server supply chain [4]

- China’s innovation index ranking: entered the global top 10 for the first time in 2025, rising 25 places cumulatively from 2013 [2]

The most representative is the performance explosion of

- First three quarters of 2025: revenue of 4.607 billion yuan, a year-on-year increase of2386.38%; net profit of 1.605 billion yuan, turning from loss to profit (loss of 725 million yuan in the same period last year) [5]

- Third quarter alone: revenue of 1.727 billion yuan, a year-on-year increase of 1332.52%; net profit of 567 million yuan [5]

- Stock price performance: surpassed Kweichow Moutai for the first time in August to become the new ‘Stock King’, with the maximum lead over Moutai exceeding 3% on October 27 [5]

- In 2025, 104 stockswere listed on the A-share market, continuing the ‘zero IPO break’ trend [6]

- 60 stocksrose more than 200% on their first day, and 5 new stocks rose more than 500% [6]

- Among the top five ‘big profit tickets’ of the year, 4 are semiconductor chip manufacturers, with hard technology accounting for 70% [6]

In August 2025, Cambricon (688256.SH) surpassed Kweichow Moutai (600519.SH) in stock price for the first time, becoming the new ‘Stock King’ of the A-share market [2]. This event has symbolic significance:

| Comparison Dimension | Kweichow Moutai (Traditional Consumer Leader) | Cambricon (Hard Technology Newcomer) |

|---|---|---|

Industry Attribute |

Consumer Goods (Liquor) | Semiconductor (AI Chip) |

Market Cap Scale |

About 1.77 trillion yuan (current) [0] | Once exceeded Moutai at its peak [2] |

Growth Model |

Steady growth, brand premium | Technology-driven, exponential growth |

2025 Performance |

YTD -4.96% [0] | First three quarters revenue +2386% [5] |

Representative Significance |

Symbol of traditional economic value | Representative of New-Quality Productivity |

- Old Paradigm: Stable investment logic centered on consumption, pharmaceuticals, and finance

- New Paradigm: Hard technology investment logic represented by AI chips, semiconductors, and commercial aerospace

- Root Cause: China’s economy has shifted from high-speed growth to high-quality development, with growth momentum shifting from factor-driven to innovation-driven

- Traditional Valuation Framework: PE and PB as the main indicators, focusing on current profits and cash flow

- Hard Technology Valuation Framework: Increased weight on PS (Price-to-Sales Ratio), R&D investment, technical barriers, and market share

- Market Performance: Although Cambricon only turned profitable in 2025, the market has given it a high valuation, reflecting the pricing offuture growth expectations

According to market cap data, the 2025 A-share market cap landscape has undergone profound changes [3]:

- Beijing: Total market cap of 32.88 trillion yuan leads by a large margin, with Cambricon and Hygon Information contributing about 400 billion yuan in market cap growth

- Shanghai: Total market cap exceeded 11 trillion yuan, with SMIC, Hua Hong Semiconductor, and Montage Technology contributing significantly

- Jiangsu Province: Market cap increased by more than 30%, with outstanding performance in semiconductors, digital economy, and intelligent manufacturing

- Sichuan Province: Eoptolink (optical module leader) replaced Wuliangye as the province’s top market cap company, an epitome of industrial upgrading from ‘a glass of liquor’ to ‘a beam of light’ [3]

| Track | 2025 Market Cap Growth (Estimated) | Core Drivers | Sustainability Rating |

|---|---|---|---|

Semiconductor |

About 120 billion yuan | AI computing demand + domestic substitution + global cycle upturn | ★★★★★ |

AI Computing |

About 80 billion yuan | Explosion of large models like DeepSeek + cloud training demand | ★★★★★ |

Commercial Aerospace |

About 35 billion yuan | Rocket launches entering ‘fast lane’ + low-orbit satellite constellation construction | ★★★★☆ |

Robotics |

About 42 billion yuan | Embodied intelligence + acceleration of humanoid robot commercialization | ★★★★☆ |

New Energy |

About 68 billion yuan | Increase in electrification penetration + explosion of energy storage demand | ★★★★☆ |

Innovative Drugs |

About 29 billion yuan | Biotech breakthroughs + medical insurance payment reform | ★★★☆☆ |

- WSTS predicts that the global semiconductor market will grow by 22.5% in 2025 and 26.3% in 2026 [4]

- Rapid growth of the AI industry drives the rapid development of upstream industries such as computing chips, optical modules, PCBs, and high-end storage [4]

- Domestic cloud vendors continue to increase investment in computing infrastructure, bringing incremental demand for domestic AI computing chips [4]

- In 2025, 8 semiconductor enterpriseswere listed on the A-share market, raising a total of over23 billion yuan(only 6 enterprises raised 5.973 billion yuan in 2024) [4]

- Domestic GPU enterprises like Moore Threads and Muxi Semiconductor took only 88 days from acceptance to approval, with IPO review efficiency greatly improved [4]

- Hong Kong’s ‘Specialist Technology Company Listing Regime (Chapter 18C)’ has become an important financing position for domestic high-end chip enterprises like GPU [4]

- DeepSeekemerged during the 2025 Spring Festival, achieving strong reasoning capabilities with lower training costs, driving the全面沸腾 of China’s technology sector [7][8]

- Domestic large models are achieving or approaching the comprehensive capabilities of advanced overseas closed-source models at lower costs, indicating that China has made breakthrough progress in the AI field [8]

- Huatai Securities pointed out that the low cost and high efficiency on the hardware side are expected to accelerate terminal penetration, and the application of large models is also speeding up, so industrial chain companies will enter the real ‘performance output’ stage from theme speculation [7]

The 2025 A-share market showed the characteristics of alternating rises between the ‘

- When dividend stocks take a break, technology stocks take over the rise

- When technology stocks reach a new level, dividend stocks rise

- This rotation provides more lasting operating space for the hard technology theme

Based on institutional views, the hard technology theme will still have strong sustainability in 2026:

- AI Computing Infrastructure: Domestic AI chips, servers, optical communications, data centers

- Semiconductor Equipment and Materials: Wafer fab expansion drives equipment demand, with large room for improvement in localization rate

- AI Application Landing: Accelerated commercialization in vertical scenarios such as education, medical care, finance, and office

- Commercial Aerospace and Low-Altitude Economy: Industrial chain such as rocket launches, satellite communications, and drones

- Humanoid Robots: The first year of embodied intelligence, with accelerated mass production and application landing

- Technology Iteration Risk: The AI technology develops rapidly, and there is a risk of technical routes being subverted

- Valuation Bubble Risk: Some hard technology stocks have high valuations, with callback pressure

- Geopolitical Risk: External factors such as technological friction and export controls

- Performance Verification Risk: Some companies have not yet achieved stable profits, so attention should be paid to their performance fulfillment capabilities

- Structural transformation: The market cap share of the technology sector exceeded 1/4, becoming the dominant force in the market

- Policy and industry resonance: National strategic support + global semiconductor cycle upturn

- Performance verification: Leading enterprises like Cambricon moved from concept to profit, and the model was verified

- Technical breakthrough: Domestic large models like DeepSeek became popular, boosting market confidence

- Marks the style switch of the A-share market from ‘traditional economy’ to ‘New-Quality Productivity’

- Reflects the transformation of the valuation system from PE-oriented to PS + technical barrier-oriented

- Indicates that hard technology will become the core investment theme of the A-share market in the next 3-5 years

Looking forward to 2026, driven by both the ‘technology narrative’ and the ‘low-interest rate narrative’, the A-share hard technology theme is expected to continue, but attention should be paid to valuation bubbles and performance verification risks. It is recommended to focus on leading enterprises in segmented tracks such as

[0] Gilin API Data - Kweichow Moutai Stock Quotes and Financial Data

[1] China News Service - ‘Towards New and Better! 5 Firsts Outline the New Picture of High-Quality Development’ (https://www.chinanews.com.cn/cj/2025/12-24/10539319.shtml)

[2] Jiemian News - ‘Macro Narrative Switch, 2025 China Asset Reassessment’ (https://www.jiemian.com/article/13785750.html)

[3] Sina News - ‘AI Wave ‘Overturns the Table’, A-share Market Cap Landscape Reshaped, Yangtze River Delta Market Cap Exceeds 30 Trillion for the First Time’ (https://news.sina.cn/2025-12-22/detail-inhcruit6512694.d.html)

[4] Sina Finance - ‘Semiconductor Enterprises Set Off IPO Wave: ‘Reserve Army’ Continues to Expand, Multiple Companies Sprint ‘A+H’’ (https://finance.sina.com.cn/roll/2025-12-26/doc-inhecmrf8008383.shtml)

[5] East Money - ‘Cambricon Plans to Use Nearly 2.8 Billion Capital Reserve to Make Up for Losses, Net Profit Turned from Loss to Profit in the First Three Quarters’ (https://wap.eastmoney.com/a/202512163592760829.html)

[6] Time Finance - ‘2025 New Stock Inventory: Over 100 Listed with ‘Zero IPO Break’, 60 Rose Over 200% on First Day’ (https://www.tfcaijing.com/touch/article/page/6851655959456133776455624d7735576344676e4b773d3d)

[7] Nanfang+ - ‘DeepSeek Is Popular in the Capital Market, Will the Value of China’s Technology Stocks Be Re-evaluated?’ (https://www.nfnews.com/content/z6LvZn2wye.html)

[8] Wall Street News - ‘The A-share Narrative of DeepSeek’ (https://wallstreetcn.com/articles/3740361)

[9] East Money - ‘2025 Semiconductor Industry Core Trends and Market Dynamics Report: AI-driven, Advanced Packaging’ (https://caifuhao.eastmoney.com/news/20251224225052254132840)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.