Impact Assessment of the Investigation into ST Huluwa (605199) on Its Pharmaceutical Business and Investors' Rights and Interests

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- On December 26, 2025, ST Huluwa (605199.SH) and its chairman Liu Jingping received the “Investigation Notification Letter” from the China Securities Regulatory Commission (CSRC) on suspicion of illegal and non-compliant information disclosure. The company disclosed this information to the public on the evening of December 28 [1].

- Official response from the company: “Currently, all production and operation activities are proceeding normally and in an orderly manner.” It will cooperate with the investigation and fulfill its information disclosure obligations in accordance with the law [1].

- ST Background: The company was given a negative opinion on its 2024 annual internal control, and has been subject to “Other Risk Warnings” (ST) since April 30, 2025 [1]. This investigation, combined with the previous risk warning, further amplifies market concerns about the company’s governance and information disclosure quality.

- The company emphasizes that its “production and operations are normal”, and there is no public disclosure of production suspension, R&D suspension, or supply chain disruption [1].

- Business Composition: Covers respiratory, digestive, anti-infective, and nutritional supplement categories. Its production bases and R&D centers are located in Haikou and Nanning, with an emphasis on “intelligent production lines” and an “online + offline” marketing system [1].

- Although the investigation targets the field of information disclosure, the continuous operation of the pharmaceutical business still requires attention to regulatory progress and the spillover effects of supporting rectifications.

- Financial data shows sustained performance pressure: Net profit attributable to shareholders in 2024 was a loss of approximately 274 million yuan; the loss in the first three quarters of 2025 was approximately 11.2139 million yuan [1].

- Management noted in the 2025 semi-annual report that intensified industry competition and phased adjustments in demand have put pressure on revenue and profits [1].

- Illegal and non-compliant information disclosure does not necessarily equate to “product quality issues”. It may involve areas such as financial/disclosure standards, related-party transactions, or failure to disclose major matters in a timely manner.

- If the investigation results point to major deficiencies closely related to business substance, such as revenue recognition, expense accrual, or related-party transactions, it may trigger:

- Reassessment of commercial terms for mergers and acquisitions or channel cooperation;

- Potential tightening of bank credit and supplier payment terms;

- Increased risk control prudence from partners (hospitals, chain pharmacies, e-commerce platforms).

- Conversely, if the violations mainly focus on procedural or timeliness disclosure issues, the direct impact on the pharmaceutical main business operations is relatively controllable.

- The pharmaceutical industry is highly sensitive to compliance and information disclosure. During the investigation period, it may affect bidding, as well as the confidence of customers and channel partners.

- If the final penalty confirms major false statements, the restoration of goodwill and brand will take longer, and compliance costs and communication costs will increase.

- Current Price: 8.85 yuan/share, with a significant decline this year. The 52-week range is 8.18-21.00 yuan, market capitalization is approximately 3.54 billion yuan, and P/E is negative (around -21x) [0].

- On December 26 (the day of the investigation announcement): Closing price was 8.85 yuan, a slight increase of 0.11%, with a turnover of approximately 3.6206 million lots; recent average daily turnover is approximately 5.3826 million lots, and the volume on that day was low [0].

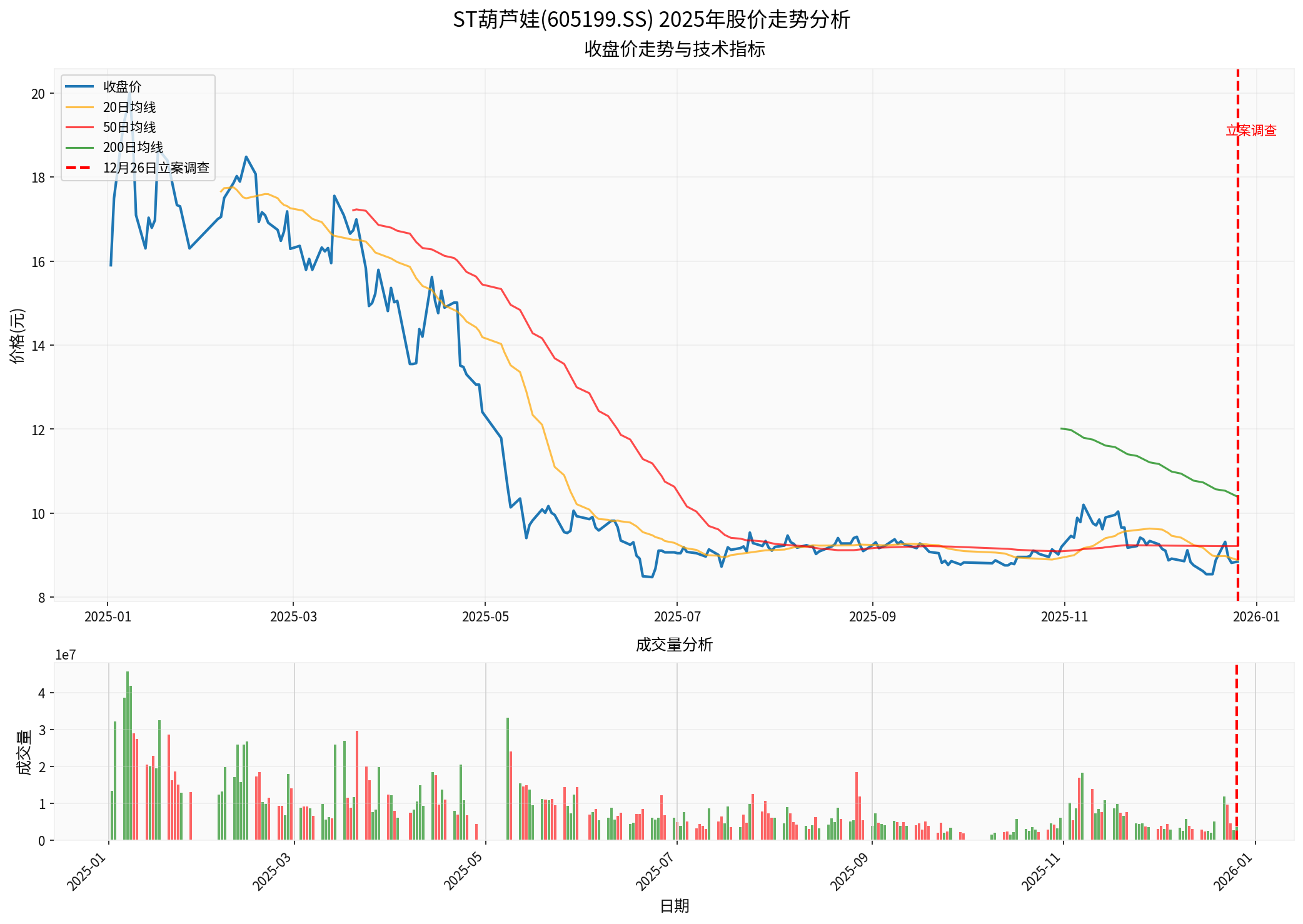

- Technical Form (Based on Python Data Analysis):

- Recent daily volatility is approximately 2.10%, with a maximum single-day drop of about -4.97% in late October [0].

- The 5-day/10-day/20-day moving averages are 8.96/8.79/8.89 yuan respectively. The moving averages are intertwined, the trend is unclear, and it has entered a short-term consolidation phase [0].

- The market reaction after the investigation announcement was mild, but combined with the ST status and the cumulative annual decline (-44.34%) [0], it indicates that the market has partially priced in negative expectations.

(Note: The chart shows the full-year 2025 price trend and trading volume; the red dashed line marks the investigation date of December 26)

- If the investigation confirms illegal information disclosure with serious circumstances, the company and relevant responsible entities may face administrative penalties such as warnings, fines, and market entry bans; in severe cases, further criminal liability cannot be ruled out (refer to other similar cases) [2].

- With the investigation coinciding with the ST status, regulatory attention has increased significantly, and subsequent continuous inquiries, special inspections, and rectification requirements may follow [2].

- For false statement cases, investors can file civil compensation lawsuits based on relevant judicial interpretations after administrative penalties or criminal judgments take effect (claim conditions are subject to court confirmation) [3].

- Key Points for Investor Claims:

- Scope of Claims: Investment difference losses, commissions, stamp duties, interest, etc.;

- Evidence Materials: Identity proof, account information, transaction statements, etc.;

- Agency Channels: Lawyer teams, professional claim platforms, etc. [3].

- Compensation Limitation: Pay attention to the statute of limitations and initiate the rights protection process in a timely manner.

- The controlling shareholder, Hainan Huluwa Investment Development Co., Ltd., holds approximately 41.76% of the shares, of which about 23.9 million shares are under judicial freeze (accounting for 14.3% of its holdings and 5.97% of the total share capital), with the freeze period until December 2028 [1].

- The combination of judicial freeze and investigation may exacerbate market concerns about potential control stability and refinancing capabilities.

- Business Side: No public announcement of production/R&D suspension; short-term operations may remain stable, but compliance rectifications may increase management costs and affect commercial terms and cooperation confidence. Medium- and long-term impacts depend on the investigation conclusions and rectification effectiveness.

- Investor Side:

- Short-term liquidity may be constrained, and market sentiment is cautious;

- Medium- and long-term attention should be paid to the potential financial impact of penalty results, rectification progress, and claim scale.

- Core Observation Indicators:

- CSRC investigation progress and penalty decisions (nature, amount, rectification requirements);

- Systematic rectification and verification of the company’s internal control and information disclosure;

- Changes in controlling shareholder’s pledges/freezes and refinancing environment;

- 2025 annual report and audit opinion type, auditor communication, and regulatory letter status;

- Progress of investor claims and judgment/settlement status.

- The investigation conclusion has not been announced, and there are uncertainties regarding the specific violations and legal liabilities, which may have a significant impact on business and finance;

- Against the ST background, delisting risk and progress in removing the ST label still depend on subsequent financial and compliance performance;

- Investors should closely monitor company announcements, regulatory disclosures, and judicial progress, and evaluate their personal holdings and rights protection timing.

[0] Jinling API Data (Real-time quotes, company overview, financial analysis, technical indicators, Python quantification and charts)

[1] Sina Finance - 605199, Under Investigation by CSRC! (https://finance.sina.com.cn/stock/s/2025-12-28/doc-inheixvi8888963.shtml)

[2] Securities Times - 605199, Under Investigation by CSRC! (https://www.stcn.com/article/detail/3561335.html)

[3] 21st Century Business Herald - Latest Regulatory Updates: Two Companies Under Investigation, Two Companies Receive Pre-penalty Notices (https://www.21jingji.com/article/20251226/herald/315b3588f2215d16043fec823d3b370a.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.