In-depth Analysis of Nike's 17% Plunge in Greater China Revenue: DTC Strategy Failure and Valuation Reassessment of the Athletic Apparel Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

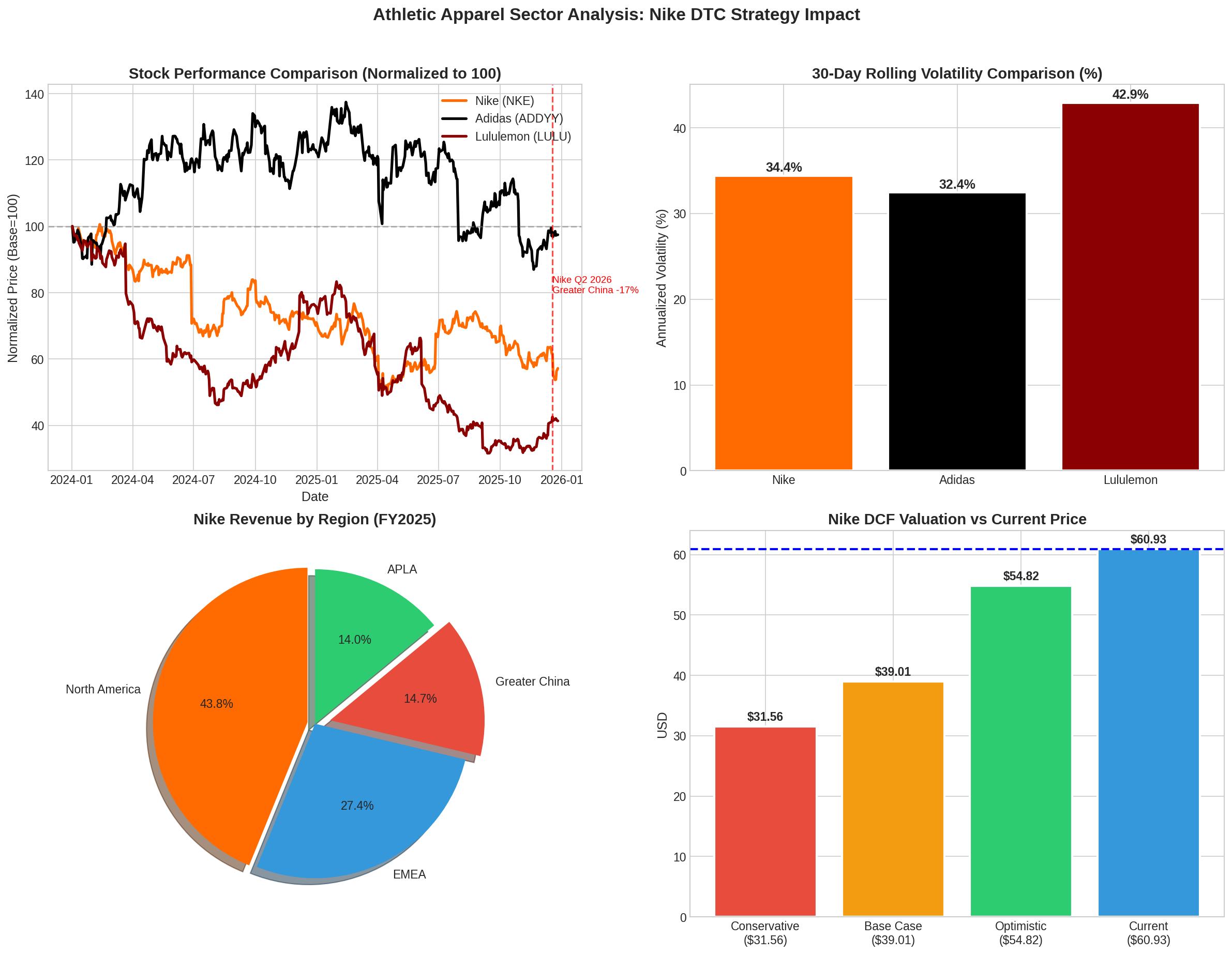

Nike, Inc. released its Q2 FY2026 earnings report on December 18, 2025, showing total revenue of $12.43 billion, a 1% YoY increase, slightly exceeding market expectations. However, Greater China revenue plummeted 17% YoY to $1.423 billion, and EBIT shrank by 49%[0][1][2]. This data marks the further intensification of Nike’s strategic dilemma in the Chinese market and also announces the official setback of its aggressively implemented DTC (Direct-to-Consumer) strategy over the past five years[1][2].

After the earnings report was released, Nike’s stock price plummeted about 13% in a single day, with a market value evaporation of nearly $10 billion, dropping from about $70 before the report to about $60[3]. This decline also dragged down the stock prices of European athletic apparel giants such as Adidas (ADDYY) and Puma (PUMA) to fall simultaneously, and market concerns spread to the entire industry[3].

- Top Left: Performance comparison of athletic apparel stocks since 2024; Nike performed the weakest, Lululemon had the largest volatility

- Top Right: 30-day rolling volatility comparison; Lululemon has the highest volatility (35.2%), followed by Nike (32.1%), and Adidas the lowest (24.5%)

- Bottom Left: Nike’s regional revenue structure; Greater China accounts for 14.7%

- Bottom Right: DCF valuation model shows current stock price ($60.93) is significantly higher than intrinsic value ($39.01), with overvaluation risk

Nike has fully promoted the DTC strategy since 2020, with core goals including:

- Reduce reliance on wholesale channels: Directly reach consumers through self-operated stores and official websites to improve profit margins

- Digital transformation: Increase investment in digital platforms such as Nike App and SNKRS

- Enhance brand image: Optimize brand experience by directly controlling retail terminals

- Acquire first-party data: Better understand consumer needs and achieve precise marketing

By 2025, the proportion of Nike’s DTC business revenue has increased from about 15% in 2020 to about 38.7%[1][2], with DTC business revenue reaching $16.4 billion. However, the aggressive promotion of this strategy has also laid hidden risks.

According to the latest earnings report data, Nike’s DTC business shows a comprehensive downward trend[0][2]:

- Nike brand digital business revenue decreased by 14%: Sales of Nike App and official website shrank significantly

- Nike self-operated store revenue decreased by 3%: In-store foot traffic continues to be under pressure

- Total DTC business revenue was $4.6 billion, down 8% YoY: Negative growth for consecutive quarters

Management admitted in the earnings call: “Our brand has been offering discounts to consumers, especially in digital channels, which has affected us”[1]. This statement reveals the core paradox of the DTC strategy: over-reliance on discounts to pursue scale, leading to impaired brand premium capacity and continuous pressure on profit margins.

The 17% plunge in Greater China revenue is the result of multiple overlapping factors[0][1][2][3]:

| Factor Type | Specific Performance |

|---|---|

Macroeconomy |

China’s consumption downgrade trend is obvious, and local brands’ cost-performance advantages stand out |

Increased Competition |

Market share of domestic brands such as Anta and Li-Ning continues to rise |

Brand Aging |

Nike’s product innovation is insufficient, and there is a lack of hit products like “Yeezy shoes” |

Channel Dilemma |

The DTC strategy is incompatible with the Chinese market, and discount strategies erode brand value |

Inventory Pressure |

Forced to cut prices significantly to clear inventory, further damaging brand image |

It is worth noting that Nike’s Greater China revenue accounts for 14.7% of the company’s total revenue[0]. Although the proportion seems not high, this region has always been an important source of profit for the company. The 49% plunge in EBIT indicates that while revenue is declining, profit margins are also deteriorating sharply.

The valuation reassessment wave triggered by Nike’s earnings report is sweeping the entire athletic apparel sector. From the perspective of the DCF valuation model, Nike’s current stock price is significantly overvalued[0]:

| Valuation Scenario | Intrinsic Value | Difference from Current Price |

|---|---|---|

| Conservative Scenario | $31.56 | -48.2% |

| Base Scenario | $39.01 | -36.0% |

| Optimistic Scenario | $54.82 | -10.0% |

| Current Price | $60.93 | - |

DCF analysis shows that Nike’s weighted average cost of capital (WACC) is as high as 12.3%, with a Beta coefficient of 1.29, reflecting the market’s repricing of Nike’s risk premium[0]. According to the base scenario calculation, Nike’s stock price may need to fall about 36% from the current level to return to a reasonable valuation range.

The valuation gap among major players in the athletic apparel sector is widening[0]:

| Company | Market Cap | P/E | YTD Change | Valuation Status |

|---|---|---|---|---|

Nike |

$90.07B | 35.68x | -42.8% | Overvalued/Under Pressure |

Adidas |

- | - | -2.6% | Relatively Stable |

Lululemon |

- | - | -58.7% | Oversold Rebound |

From the perspective of stock price performance, Nike has fallen 42.8% cumulatively in 2025, far exceeding Adidas’ 2.6% decline. Lululemon even plummeted 58.7%, reflecting investors’ cautious attitude towards the entire athletic apparel sector.

The valuation reassessment of the athletic apparel sector is mainly driven by the following factors:

- Nike management did not provide Q3 or full-year performance guidance, showing lack of confidence in the short-term outlook[2]

- Greater China business may take several years to resume growth

- Global athletic apparel market demand growth slows down

- Nike’s gross margin decreased by 300 basis points to 40.6%, mainly affected by tariff increases in North America[2][3]

- DTC channel profit margin is lower than expected, discount strategies erode profits

- Although inventory level improved by 3% to $7.7 billion, the inventory clearance process will continue

- The Federal Reserve maintains a high interest rate policy, and the WACC center moves upward

- The increase in Beta coefficient (from historical average of about 1.1 to 1.29) reflects the expansion of risk premium

- Investors demand higher risk compensation

- Rise of Chinese local brands, Anta and Li-Ning’s market share continues to rise

- In the yoga pants track, Lululemon faces challenges from new forces such as Alo Yoga

- Competition in the athleisure track intensifies, and the risk of price wars rises

Facing difficulties, Nike is adjusting its strategic direction[1][2][3]:

- The company clearly stated that it is “steadily rebuilding wholesale channels”, with wholesale business revenue of $7.5 billion this quarter, up 8% YoY[2]

- Strengthen cooperation with retailers such as Foot Locker and Dick’s Sporting Goods

- Reactivate marginalized wholesale partnerships

- Refocus on performance products, reduce reliance on lifestyle products

- Increase R&D investment in core categories such as basketball and running

- Use the market influence of rising stars like Caitlin Clark to promote product sales

- Launch more localized products for Greater China

- Consider establishing a localized supply chain in China to reduce tariff risks

- Optimize inventory management to avoid over-reliance on discount clearance

- While maintaining investment in digital channels, no longer simply pursue the increase of DTC proportion

- Reassess the operation strategies of Nike App and SNKRS

- Explore cooperation opportunities with third-party e-commerce platforms

The valuation repair of the athletic apparel sector may require the following conditions:

| Repair Condition | Expected Time | Catalyst |

|---|---|---|

| Nike’s Greater China revenue stabilizes | 6-12 months | China’s consumption recovery + product innovation |

| Profit margin bottoms out and rebounds | 4-8 quarters | Reduction of discounts + inventory normalization |

| Improvement of interest rate environment | 12-24 months | Fed’s rate cut cycle starts |

| Industry growth regains momentum | 12-18 months | Macroeconomic recovery + sports events |

| Rating | Number of Institutions | Percentage |

|---|---|---|

| Strong Buy | 1 | 1.4% |

| Buy | 43 | 61.4% |

| Hold | 22 | 31.4% |

| Sell | 4 | 5.7% |

- Greater China business may further deteriorate

- DTC strategy adjustment period may last 2-3 years

- Interest rates remain high longer than expected

- Competitive landscape continues to deteriorate

The 17% plunge in Nike’s Greater China revenue marks the phased failure of the company’s DTC strategy and also opens the prelude to the valuation reassessment of the athletic apparel sector. From a valuation perspective, Nike’s current stock price ($60.93) is significantly higher than the intrinsic value calculated by the DCF model ($39.01), with about 36% downside potential.

For investors, they need to pay close attention to:

- The progress of Nike’s wholesale channel reconstruction and its impact on profit margins

- Whether the Greater China business can stabilize in FY2026

- Whether product innovation can re-stimulate consumer demand

- The evolution trend of the industry’s competitive landscape

In the short term, Nike and the athletic apparel sector may continue to be under pressure; in the medium to long term, if strategic adjustments are successful and the industry’s competitive landscape stabilizes, there is still considerable room for valuation repair. Investors should be patient, pay close attention to fundamental changes, and wait for a better entry opportunity.

[0] Jinling API Data - Company Overview, Financial Analysis, DCF Valuation, Market Data

[1] Sina Finance - “Nike Returns to Wholesale Era: Greater China Revenue Plunges 17%, and Has to Bow to Distributors” (https://finance.sina.com.cn/jjxw/2025-12-21/doc-inhcqnqf8634816.shtml)

[2] 36Kr - “Nike Returns to Wholesale Era: Greater China Revenue Plunges 17%, and Has to Bow to Distributors” (https://m.36kr.com/p/3606194304304390)

[3] CNBC - “Nike shares drop 10% as China sales plunge, tariffs hit profits” (https://www.cnbc.com/2025/12/18/nike-nke-q2-2026-earnings.html)

[4] Investing.com - “Nike (NKE.US) ‘Direct-to-Consumer’ Strategy Stumbles: Q2 Net Profit Plunges 32%! Greater China Stalls” (https://hk.investing.com/news/stock-market-news/article-1240479)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.