Analysis of Yinlun Co., Ltd.'s Acquisition of Shenlan Co., Ltd. to Strengthen Thermal Management Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The acquisition of Shenlan Co., Ltd. by Yinlun Co., Ltd. (002126.SZ) is currently

- Focuses on industrial/commercial air conditioner controllers and drives

- Gross profit margin up to ~48%, net profit margin ~25%

- H1 2024 revenue ~71.52 million yuan

- Holds a key position in data center liquid cooling controllers (core CDU components) [2]

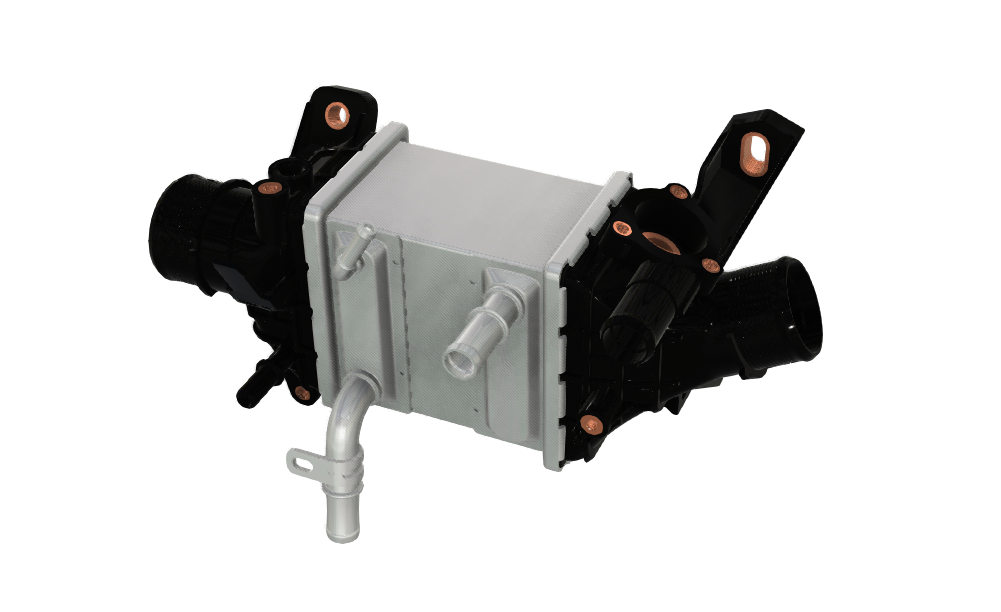

Yinlun excels in “heat exchange” hardware manufacturing, while Shenlan leads in “controller/drive” software and control. Post-acquisition, Yinlun will upgrade from component sales to system sales, offering integrated “hardware + control” CDU solutions to significantly boost average customer price and competitiveness [2].

Yinlun’s “digital energy business” (including liquid cooling) shows strong growth [2]:

| Indicator | 2024 | H1 2025 |

|---|---|---|

| Revenue | 1.027 billion yuan | Nearly 700 million yuan |

| YoY Growth | 47.44% | 58.94% |

| % of Total Revenue | ~8%-10% | - |

- From late 2024 to early 2025, the company won large orders for 301 and 193 liquid cooling systems for computing centers

- Cumulatively addressed over 500MW of computing power heat dissipation needs

- Key customers include ByteDance, Baidu, and other leading enterprises [2]

- Liquid cooling plate: No.2 in China

- Heat exchanger: No.1 in China [2]

The thermal management of Tesla’s humanoid robot faces major technical challenges [3]:

- Battery Life Bottleneck:Optimus uses a 2.3kWh battery with a battery life of only ~1.5-2 hours

- Heat Dissipation Difficulty:Humanoid robots have strict requirements for power sources (high energy density, safety, durability, low cost)

- Technology Iteration:Zhongqing Robot’s T800 features the industry’s first high-performance solid-state battery for humanoid robots, extending battery life to 4-5 hours with an active heat dissipation system for all leg joints [4]

According to industry analysis, the humanoid robot industry is at a critical turning point from lab R&D to commercialization [3]:

- 2026: Optimus V3 is expected to launch, entering rhythmic production verification

- 2027: Start production of V4.0

- Tesla plans to build a 1 million-unit/year humanoid robot production line at its Fremont factory

With the AI computing power boom (e.g., NVIDIA GB300 high-power chips), liquid cooling penetration will rise sharply. Institutions predict Yinlun’s digital energy revenue share may exceed 30% by 2028 [2].

Based on DCF model, Yinlun’s valuation range is as follows [5]:

| Scenario | Valuation | Increase from Current Price |

|---|---|---|

| Conservative | $56.12 | +49.8% |

| Base | $75.94 | +102.7% |

| Optimistic | $125.33 | +234.6% |

| Probability Weighted | $85.80 | +129.0% |

| Indicator | Value |

|---|---|

| Market Cap | $30.94B |

| Current Price | $37.46 |

| P/E (TTM) | 36.69x |

| P/B (TTM) | 4.58x |

| ROE | 13.05% |

| Net Profit Margin | 5.85% |

| Beta | 0.70[5] |

As of December 26, 2025 [5]:

- Trend:Sideways consolidation, no clear direction

- Trading Range:[$34.84, $38.22]

- MACD:No crossover (bullish bias)

- KDJ:Bullish signal

- Technical Synergy:

- Yinlun (hardware: heat exchanger) + Shenlan (software: controller) → integrated “hardware + software” solution

- Full-chain services from components to systems

- First-Mover Advantage:

- No.2 in liquid cooling plate, No.1 in heat exchanger in China

- Existing leading customers (ByteDance, Baidu)

- High-Growth Track:

- AI computing power drives liquid cooling demand

- Humanoid robot industry enters commercialization phase

- Transaction Uncertainty:

- Acquisition still under regulatory review → uncertainty

- Gross Margin Gap:

- Shenlan’s 48% gross margin vs Yinlun’s lower traditional business margin

- Profitability improvement post-integration needs verification

- Market Competition:

- Competitors like Envicool, Shenling Environment also in liquid cooling

- Continuous R&D needed to maintain leadership

- Early-Stage Market:

- Tesla Optimus mass production still takes time

- Thermal management specs/tech routes not fully determined

- Acquire Shenlan to fill controller gaps → integrated liquid cooling system capability

- AI computing power boom drives rapid liquid cooling demand

- Humanoid robot industry brings long-term incremental market

- DCF valuation shows large current price discount

- Acquisition approval

- Continuous liquid cooling order wins

- Breakthrough in humanoid robot thermal management

- Acquisition approval risk

- Integration underperformance

- Intensified competition

- Slow humanoid robot commercialization

[1] Caihua She - Yinlun’s Acquisition of Shenlan Under Regulatory Review (https://www.finet.com.cn/news/694ccd205a7712fdbfdf17de.html)

[2] Caifuhao - Entering AI Liquid Cooling Track (https://caifuhao.eastmoney.com/news/20251226230748999992140)

[3] Wall Street CN - Tesla Optimus Development & Thermal Management Challenges (https://wallstreetcn.com/articles/3761537)

[4] NE Times - Solid-State Battery & Heat Dissipation for Humanoid Robots (https://ne-time.cn/web/article/37372)

[5] Jinling AI - Yinlun Financial Analysis & DCF Valuation Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.