Investment Analysis Report on Yinlun Co., Ltd. (002126.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Yinlun Co., Ltd. (Zhejiang Yinlun Machinery Co., Ltd.) is an automotive parts enterprise specializing in thermal management systems. In recent years, it has actively expanded its presence in the digital energy and liquid cooling heat dissipation sectors, achieving diversified business growth [1].

- In 2024, digital energy business revenue reached 1.027 billion yuan, a year-on-year increase of 47.44%, accounting for 8.08% of total revenue [1]

- The company has successfully secured orders for liquid cooling heat dissipation systems from BTB computing power centers. It received 108 sets of orders in August 2024 and added 193 sets in December, covering three data center total solution providers [1]

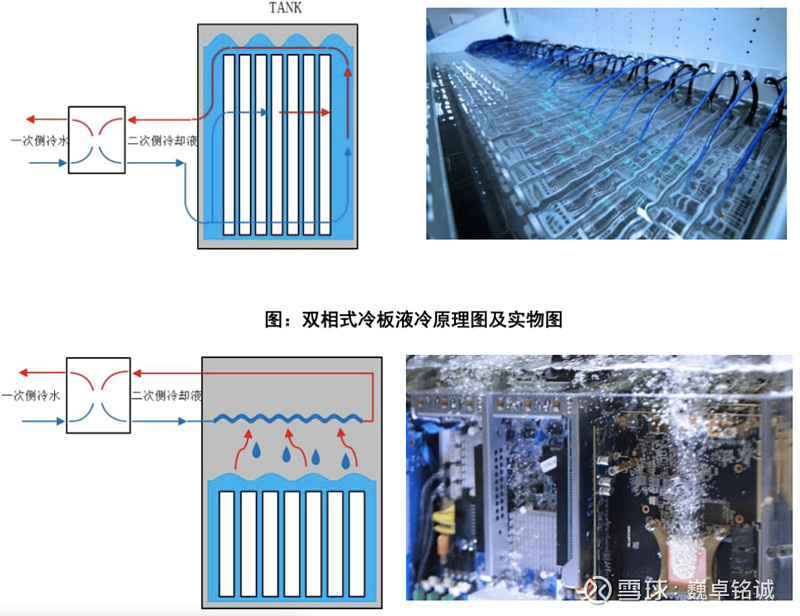

- Liquid cooling technology has achieved breakthrough applications in energy storage, ultra-fast charging, and data centers, among other fields [1]

- In the first three quarters of 2025, it achieved operating revenue of 11.057 billion yuan, a year-on-year increase of 20.12%

- Net profit attributable to owners of the parent company was 672 million yuan, a year-on-year increase of 11.18% [1]

- From August 2024 to August 2025, the company formed a layout of liquid cooling products covering the inside and outside of server cabinets in the data center field, and some categories have entered the gradual volume release stage [3]

Based on the latest technical analysis data (as of December 26, 2025) [0]:

| Technical Indicator | Value | Signal | Interpretation |

|---|---|---|---|

MACD |

No cross | bullish |

No golden cross or death cross formed, but overall bullish |

KDJ |

K:78.1, D:70.8, J:92.7 | bullish | In overbought area but still maintains upward momentum |

RSI(14) |

Normal range | - | No overbought or oversold signal |

Beta |

0.7 | - | Volatility lower than the market |

It should be noted that according to our technical analysis data,

The “MACD golden cross” mentioned by the user may be based on the following reasons:

- Different time frame analysis: A golden cross may not have formed at the daily level, but it may exist at smaller levels (e.g., 60 minutes, 30 minutes)

- Different data sources: There may be differences in data calculation between different brokers or platforms

- Lag: The golden cross signal may have formed before the data update

- High growth of liquid cooling business: The 58.94% revenue growth reflects the strong development momentum of the digital energy business [1]

- Institutions are generally optimistic: 18 institutions have commented on Yinlun Co., Ltd.'s third-quarter report, optimistic about the development prospects of the liquid cooling business [1]

- New product volume release: New products such as megawatt-level submerged integrated liquid cooling equipment have entered the gradual volume release stage [3]

- Reasonable valuation: Based on 25-27 times PE in 2025, the target price is 32.6-35.2 yuan, with a 14%-23% upside compared to the current stock price [2]

- Weak technical signals: MACD has not formed a golden cross, and the stock price is in a sideways consolidation phase [0]

- High valuation: The current P/E ratio is 36.69 times, higher than the industry average

- Short-term correction pressure: The stock price has fallen by 3.55% recently, and may face adjustments in the short term

Although the liquid cooling business has strong growth (a year-on-year increase of 47.44%), from the technical analysis perspective, the stock price has not yet sent a clear buy signal. Investors are advised to pay attention to the following indicators:

- Whether the MACD forms a golden cross (breaking through the $38.21 resistance level may trigger it)

- Whether the trading volume has effectively increased

- The implementation of liquid cooling business orders

If the stock price effectively breaks through $38.21 and is accompanied by a MACD golden cross, it may usher in a good buying opportunity. In the current sideways consolidation phase, investors are advised to remain on the sidelines or participate with a light position.

[1] DoNews - “NVIDIA GB300 Sparks New Liquid Cooling Battle: How Does Yinlun Co., Ltd. Seize the Opportunity?” (https://www.donews.com/article/detail/7331/92341.html)

[2] East Money - “Yinlun Co., Ltd. (002126.SZ)” (https://pdf.dfcfw.com/pdf/H3_AP202503241646791974_1.pdf)

[3] Zhejiang Yinlun Machinery Co., Ltd. - “2025 Semi-Annual Report Summary” (http://static.cninfo.com.cn/finalpage/2025-08-27/1224580481.PDF)

[0] Jinling AI Financial Database - Technical Analysis and Real-Time Market of Yinlun Co., Ltd.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.