Watson Biotech (300142.SZ) Market Analysis Report: Leading 13-Valent Pneumonia Vaccine Market Share but Under Demand Pressure

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Watson Biotech Co., Ltd. is a leading vaccine R&D and production enterprise in China. Its core product

- Product Name: 13-valent pneumococcal polysaccharide conjugate vaccine (Wuanxin)

- Target Population: Infants aged 6 weeks to 5 years

- R&D History: Watson Biotech spent over a decade and hundreds of millions of yuan on R&D

According to public data, China’s 13-valent pneumonia vaccine market presents a

| Manufacturer | Product Name | Market Share | Features |

|---|---|---|---|

Watson Biotech |

Wuanxin | ~50-60% |

First domestic, cost-performance advantage |

| Pfizer | Prevnar 13 | ~30-35% | Imported original, brand advantage |

| Kangtai Bio | Weiminfeibei | ~10-15% | Approved in 2021 |

| Lanzhou Institute | Xinwomei | Below ~5% | Approved in 2023 |

Watson Biotech maintains a leading position in the domestic market with

- Continuous decline in newborn population: China’s birth population dropped from 18.83 million in 2016 to approximately 9 million in 2024, a decrease of over 50%

- Shrinking target vaccination population: Directly affects the potential market size of vaccines

- After rapid growth from 2020 to 2022, the vaccination rate of infants has reached a high level

- Subsequent growth space narrows, and competition in the stock market intensifies

- Increased competitors: Products from Kangtai Bio, Lanzhou Institute, and other enterprises have been approved successively

- Price wars: Multiple enterprises adopt price strategies to争夺 market share

- Medical insurance cost control: Vaccine prices are under pressure in the overall medical cost control environment

- Slow economic growth affects household consumption expenditure

- Willingness to receive non-mandatory vaccines has decreased

According to the latest market data [0]:

| Indicator | Value |

|---|---|

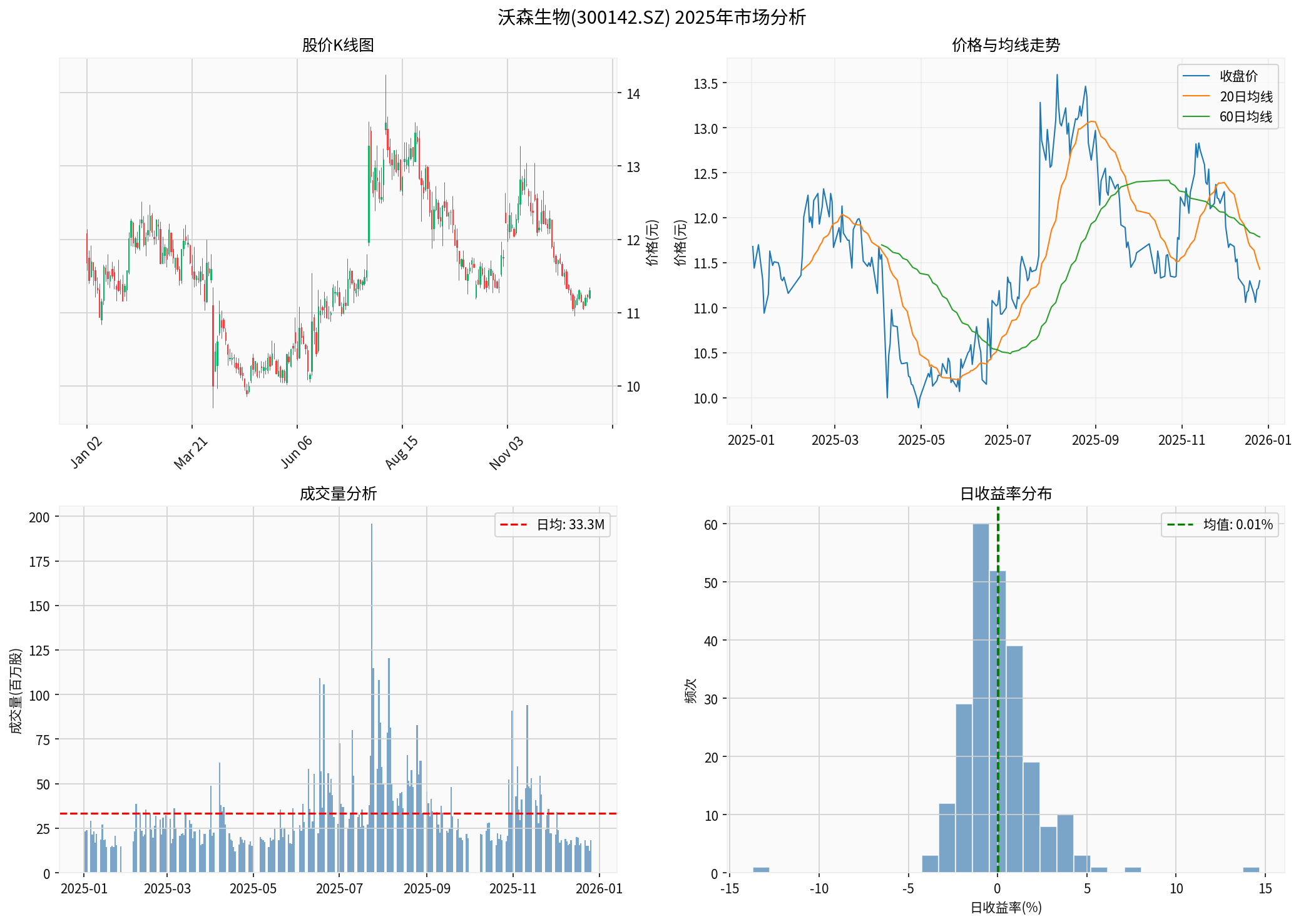

| Current Stock Price | 11.30 CNY |

| YTD Change | -3.25% |

| 52-Week High | 14.25 CNY |

| 52-Week Low | 9.70 CNY |

| Market Cap | 18.07 Billion CNY |

| P/E Ratio | 376.67x |

- Q1 2025: -4.45%

- Q2 2025: -5.82%

- Q3 2025: +2.38%

- Q4 2025(to date): -3.50%

| Indicator | Value | Evaluation |

|---|---|---|

| Net Profit Margin | 2.05% | Low |

| Operating Profit Margin | -6.49% | Loss-making |

| ROE | 0.52% | Weak profitability |

| Current Ratio | 3.52 | Strong short-term solvency |

- Revenue: 565 Million CNY (26.5% YoY decrease, below market expectations)

- EPS: 0.08 CNY (7.44% above expectations)

- Core product 13-valent pneumonia vaccine faces significant sales pressure

- R&D of 20-valent pneumonia vaccine: Iterate to higher valency to maintain technological leadership

- Develop combination vaccines: Such as pneumonia + meningitis combination vaccines to increase product added value

- Expand adult indications: Develop pneumonia vaccine products for the elderly population

- International layout: Actively explore overseas markets such as Southeast Asia, the Middle East, and Africa

- Lower-tier market penetration: Strengthen coverage in third- and fourth-tier cities and primary medical institutions

- Adult immunization market: Develop the pneumococcal polysaccharide vaccine (PPV23) market

###3. Cost Control Measures

- Improve production efficiency: Optimize production processes to reduce unit costs

- Supply chain optimization: Strengthen localization of raw materials to reduce procurement costs

- Expense control: Reasonably control marketing expense expenditure

###4. R&D Pipeline Layout

- mRNA vaccine technology platform: Build next-generation vaccine technology capabilities

- Other varieties such as influenza vaccines: Enrich product portfolio

- Strategic cooperation and mergers: Expand product lines through外延式 development

- Continuous decline in newborn populationleading to long-term demand shrinkage

- Intensified market competitionbringing downward price pressure

- R&D progress falling short of expectationsmay affect the launch time of new products

- Policy risks: Changes in policies such as medical insurance cost control and vaccine price regulation

The current P/E ratio is as high as 376x, reflecting the market’s high expectations for the company’s future growth. However, considering the demand pressure faced by the main products, investors need to pay attention to the progress of the company’s new product R&D and the effectiveness of international layout.

As a leading enterprise in domestic 13-valent pneumonia vaccines, Watson Biotech holds approximately 50-60% market share with first-mover advantage and cost-performance advantage [0]. However, facing multiple challenges such as declining newborn numbers, vaccination rate entering a plateau, and intensified competition, the company is under pressure of decreasing demand.

The company needs to应对 challenges through

- R&D progress of new products such as the 20-valent pneumonia vaccine

- Effectiveness of adult immunization market expansion

- Progress of international layout

It is recommended that investors closely follow the company’s R&D pipeline and product approval progress, and carefully evaluate investment value.

[0] Gilin API Financial Database - Watson Biotech (300142.SZ) Real-time Quotes and Company Overview (https://www.gilin-ai.com)

[1] Watson Biotech Company Announcements and Public Information

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.