Analysis of the Drivers for the S&P 500 Breaking the 7,000 Point Mark and 2026 Market Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

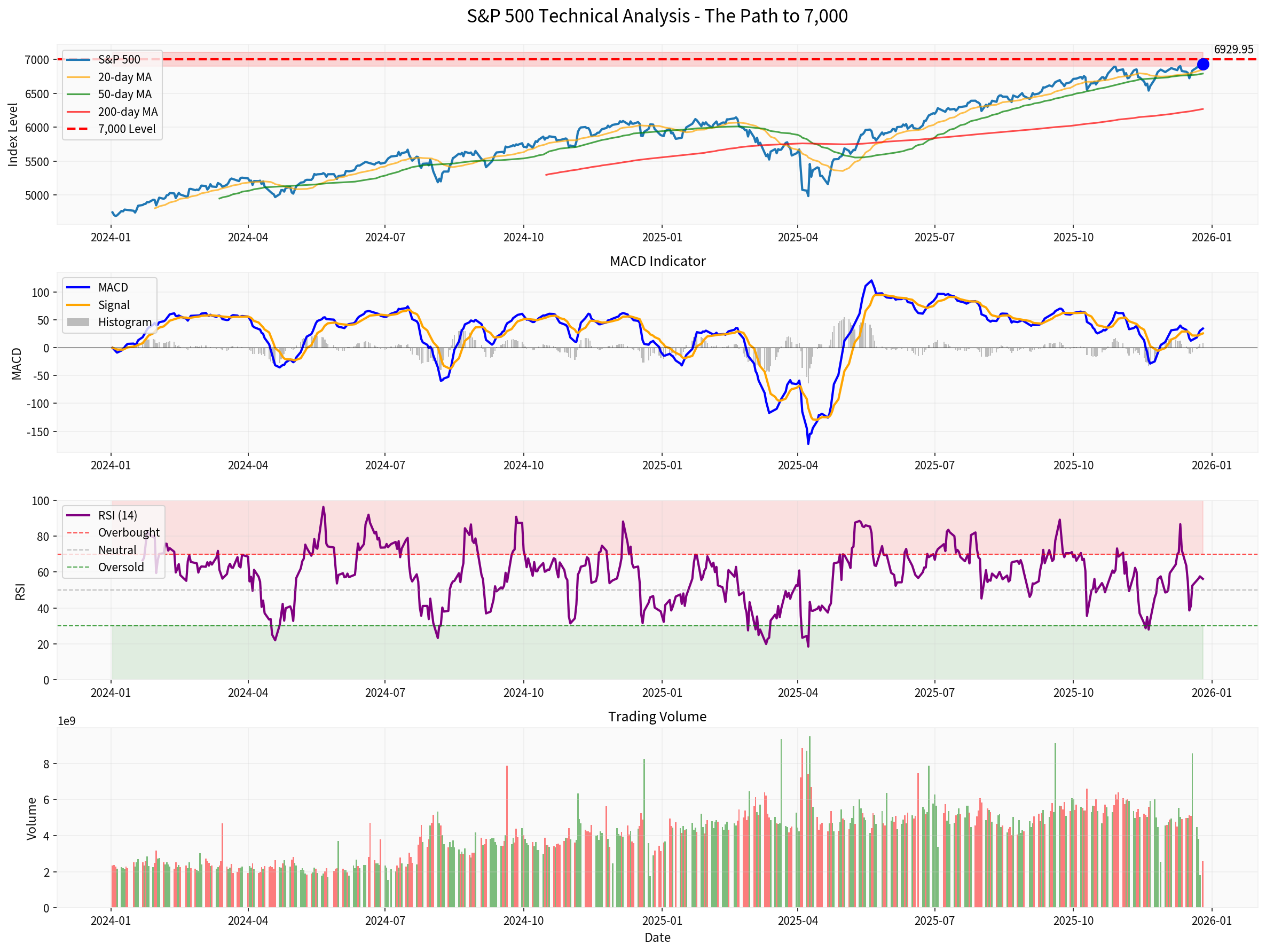

As of December 28, 2025, the S&P 500 index closed at 6,929.95 points, just

- Current Price: 6,929.95 points [0]

- Distance to 7,000 Points: 70.05 points (1.01%) [0]

- 2025 Range: High of 6,932 points, low of 4,983 points [0]

- 60-Day Annualized Volatility: 12.90% (relatively moderate) [0]

- Trading Volume: Approximately 5.15B daily on average recently [0]

The tech sector remains the

- Accelerated AI Commercialization: Large tech companies’ investments in AI infrastructure (chips, cloud computing) and AI applications are starting to translate into actual revenue

- Improved Profitability: AI tools help tech companies improve operational efficiency and expand profit margins

- Sustained Growth in Capital Expenditure: Despite market concerns about high capital expenditure, demand for AI infrastructure remains strong

Wall Street’s expected range for the S&P 500’s 2026 earnings per share (EPS) is

- Margin Expansion: Companies improve efficiency and reduce operating costs through AI technology

- Pricing Power: Companies maintain pricing power in a stable demand environment

- Operating Leverage: Margin improvement driven by revenue growth

- Interest Rate Cut Cycle: The Federal Reserve has started an interest rate cut cycle, reducing corporate financing costs

- Valuation Support: Lower interest rates increase the present value of stocks, supporting higher P/E multiples

- Economic Soft Landing: The economy maintains growth while inflation cools, creating a “Goldilocks” environment

Although growth may be relatively moderate, the U.S. economic fundamentals remain healthy:

- GDP Growth: Although GDP growth may be slow in 2026, it remains positive

- Consumer Resilience: A stable job market supports consumer spending

- Corporate Investment: AI-related capital expenditure drives business investment

From a technical analysis perspective, the current market has the conditions for a breakthrough:

- Bullish Arrangement: The price is above the 20-day, 50-day, and 200-day moving averages [0]

- Neutral RSI: The RSI is at 56.17, not entering the overbought zone (>70), leaving room for further upside [0]

- Volume Confirmation: A breakthrough requires increased trading volume

- Psychological Level: As an integer level, breaking 7,000 points may trigger technical buying

Major investment banks are relatively optimistic about the S&P 500’s 2026 target levels:

| Institution | Target Level | 2026 EPS Forecast | Core Logic |

|---|---|---|---|

Bank of America (BofA) |

7,100 points | $310 | Driven by both valuation expansion and earnings growth |

Barclays |

7,400 points | $305 | Continued AI narrative, interest rate cut benefits, loose financial conditions [1] |

- Upside Potential: Calculated from the current 6,930 points, BofA’s target implies an increase of about 2.5%, while Barclays’ target implies about 6.8%

- Implied P/E Ratio: Based on EPS of $305-$310, 7,000-7,400 points correspond to a P/E ratio of about 23-24x

- Sustained Growth: These forecasts assume the market continues to rise after its strong performance in 2025

- AI commercialization exceeds expectations, tech giants’ earnings significantly beat forecasts

- Federal Reserve successfully achieves a soft landing, inflation stabilizes around 2%

- Geopolitical tensions ease

- Corporate earnings growth reaches over15%

- AI growth meets expectations, but valuation concerns limit gains

- Federal Reserve’s interest rate cut pace meets market expectations

- Economic growth is moderate but stable

- Earnings growth of10-12%

- AI investment returns fall short of expectations, tech stock valuations correct

- Inflation is stubborn, Federal Reserve maintains high interest rates

- Geopolitical conflicts escalate

- Economy enters a recession

###5. Risk Factors and Uncertainties

Although the conditions for breaking the7,000-point mark are becoming increasingly mature, investors need to be alert to the following risks:

####1.

- The current P/E ratio of the S&P500 is already at a historical high

- Tech stock concentration risk (top10 companies account for too high a weight in the index)

- Limited room for upward revisions to earnings expectations

####2.

- Whether large-scale capital expenditure can translate into actual profits remains uncertain

- The commercialization speed of AI applications may be slower than expected

- Regulatory risks may limit AI development

####3.

- Inflation may rise again

- Uncertainty in the Federal Reserve’s policy path

- Fiscal deficit and national debt issues may bring pressure

####4.

- Global trade tensions

- Regional conflicts may affect market sentiment

- Intensified competition between major powers

###6. 2026 Investment Strategy Recommendations

- Quality First: Focus on companies with strong cash flow, high ROE, and low debt

- AI Industry Chain:

- Infrastructure: Chips, cloud computing, data centers

- AI Applications: Software, services, platforms

- Sectors Benefiting from Interest Rate Cuts:

- Finance

- Real Estate

- Small-cap Value Stocks

- Defensive Assets:

- Healthcare

- Consumer Staples

- Utilities

- Diversification: Avoid over-concentration on tech giants

- Dynamic Adjustment: Adjust positions timely based on changes in earnings expectations

- Long-term Perspective: Despite possible short-term fluctuations, the long-term trend remains upward

- Maintain Liquidity: Reserve cash for market corrections

###7. Conclusion: Breaking the7,000 Point Mark is Only a Matter of Time

Comprehensive analysis shows that the S&P500 has a

- Late December2025-Early January2026: Year-end “Christmas Rally” combined with New Year capital inflows

- Q12026 Earnings Season: If corporate earnings beat expectations, it may trigger a breakthrough

Breaking the7,000-point mark is not only a psychological level but may also mark the start of a new upward cycle for U.S. stocks. However, investors need to remain清醒:

The probability of the S&P500 breaking the7,000-point mark in the first half of2026 is about

[0] Gilin API Data - S&P500 Real-time Quotes, Historical Price Data, Technical Indicator Analysis

[1] Yahoo Finance - “Wall Street’s2026 outlook for stocks” (https://finance.yahoo.com/news/wall-streets-2026-outlook-for-stocks-150650909.html)

[2] Yahoo Finance - “Wall Street strategists are divided over valuations” (https://finance.yahoo.com/news/wall-street-strategists-are-divided-over-valuations-165910618.html)

[3] Yahoo Finance - “Q4 Earnings: Tech Expected to Remain Growth Driver” (https://finance.yahoo.com/news/q4-earnings-tech-expected-remain-005600980.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.