Addsino Technology (000547) In-depth Analysis of Commercial Low-Orbit Satellite Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

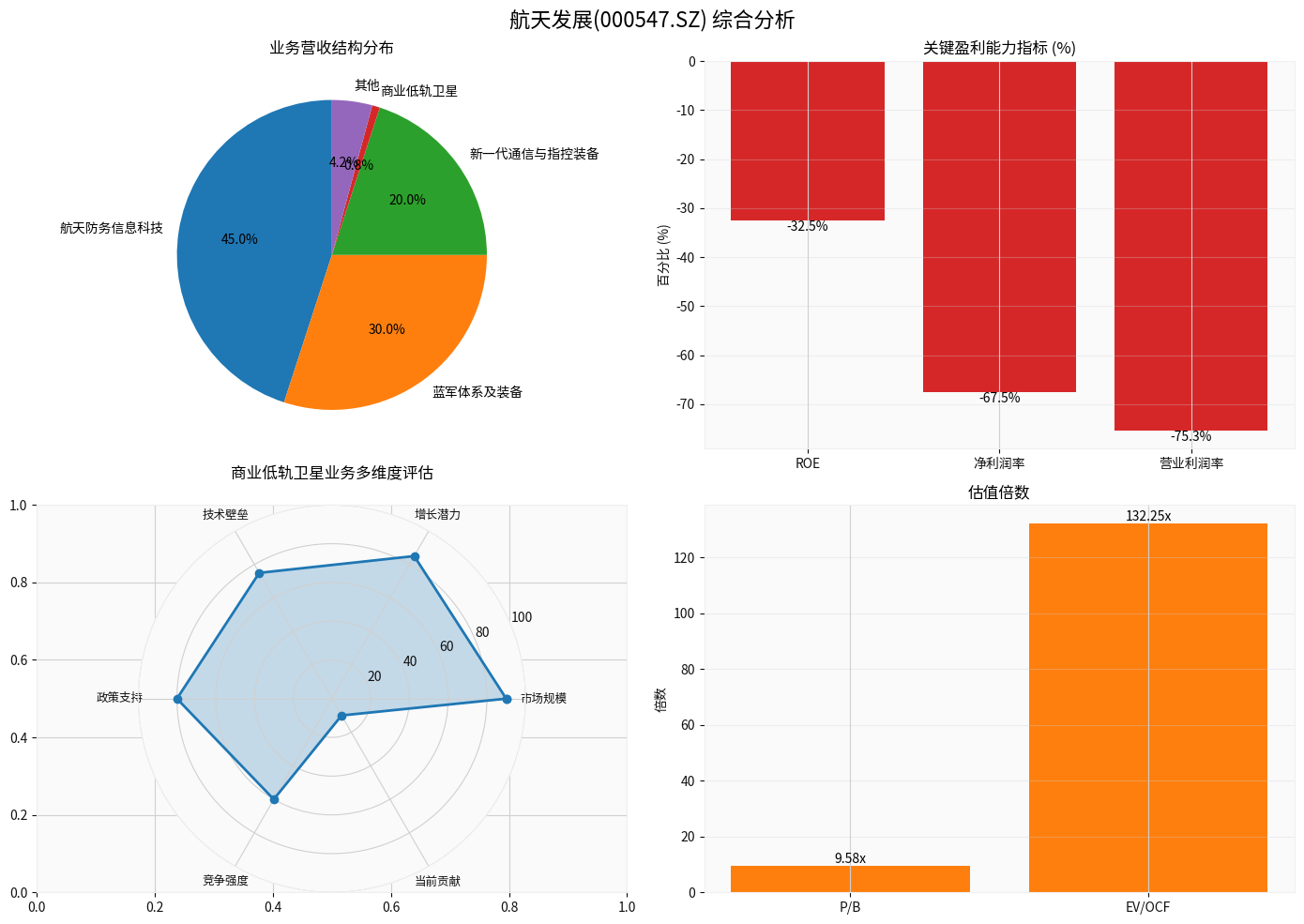

According to the latest data [0], Addsino Technology’s current market capitalization is

- P/B Ratio: 9.58x (far higher than traditional military enterprises)

- P/E Ratio: -28.07x (negative due to losses)

- EV/OCF: 132.25x (extremely high enterprise value/operating cash flow multiple)

The company is currently in a

| Financial Indicator | Value | Analysis |

|---|---|---|

| ROE (Return on Equity) | -32.55% |

Severe loss, in investment phase |

| Net Profit Margin | -67.50% |

Weak profitability |

| Operating Profit Margin | -75.32% |

Core business loss |

| Current Ratio | 1.34 | Short-term solvency is acceptable |

| Quick Ratio | 0.92 | Cash flow situation needs attention |

Figure1: Addsino Technology Comprehensive Analysis

Based on the information provided and the company’s public data, Addsino Technology’s business structure is as follows:

| Business Segment | Revenue Share | Strategic Position |

|---|---|---|

| Aerospace Defense Information Technology | ~45% | Core business, stable cash flow source |

| Blue Army System and Equipment | ~30% | Core military informatization business |

| Next-generation Communication and Command Equipment | ~20% | Military-civil fusion field |

Commercial Low-Orbit Satellite |

<1% |

Strategic incubation, future growth engine |

| Others | ~4% | Auxiliary business |

Although the commercial low-orbit satellite business currently accounts for less than 1% of revenue, its impact on long-term valuation is reflected in the following dimensions:

- Current contribution to revenue and profit is almost negligible

- But already reflected in the stock price as a “call option”pricing

- Explains why the company has severe losses but a high P/B Ratio of 9.58x

- If the business expands successfully, revenue share is expected to rise to 10-15%

- May become a key catalyst for valuation re-rating

- High-growth business can support higher valuation multiples

- Satellite internet and data application services are national strategic directions

- Addsino Technology relies on the background of China Aerospace Science and Industry Corporation and has unique advantages

- Expected to transform from a pure military enterprise to a “military + commercial aerospace” dual-drive model

Based on option pricing thinking, we can construct a simplified valuation framework:

Enterprise Value = Main Business DCF Value + Commercial Satellite Business Option Value - Risk Discount

- Main Business (Military Informatization): Using DCF valuation, growth rate of 8-12%

- Commercial Satellite Business: Using real option method, success probability of30-50%

- Risk Adjustment: Technical risk, market risk, policy risk

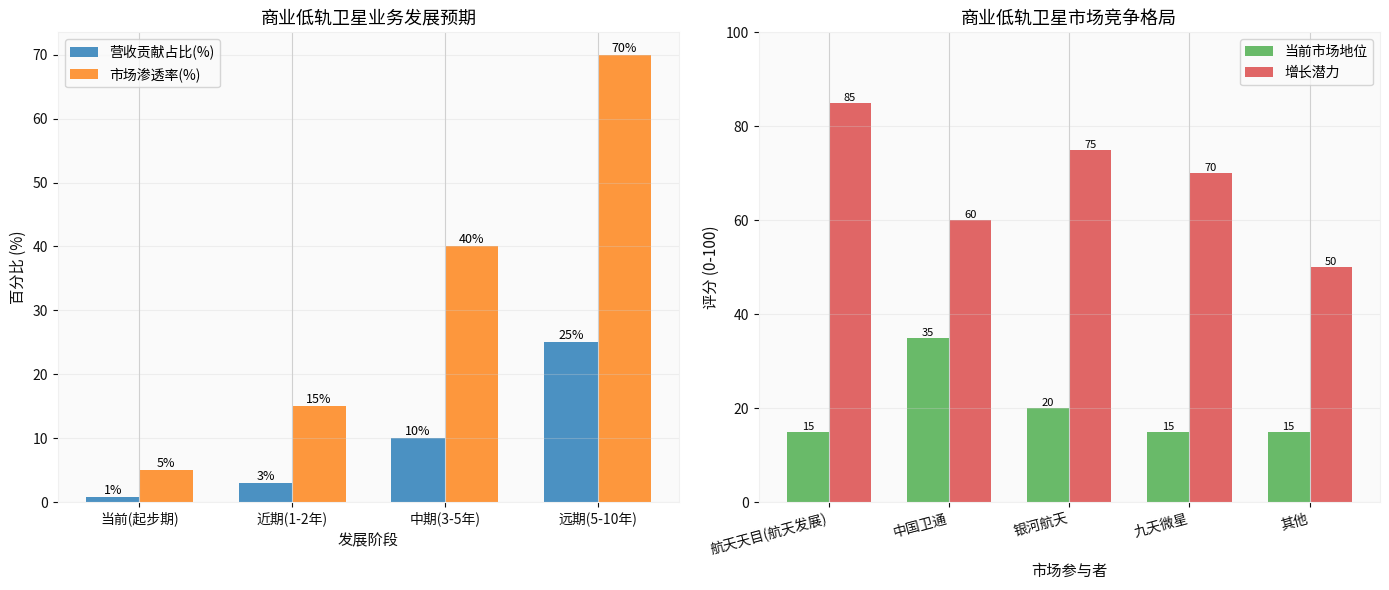

The commercial low-orbit satellite and data application market presents a pattern of

| Market Participant | Market Position | Core Advantage | Growth Potential |

|---|---|---|---|

China Satcom |

Leader (35%) | Satellite communication license, resource advantage | ★★★☆☆ |

GalaxySpace |

Challenger (20%) | Leading low-orbit satellite technology | ★★★★☆ |

Addsino Tianmu (Addsino Technology) |

New Entrant (15%) | Military background, data application capability | ★★★★★ |

| 9SkySat | Niche Area (15%) | IoT application | ★★★★☆ |

| Others | 15% | Differentiated competition | - |

Figure2: Commercial Low-Orbit Satellite Market Competitive Landscape and Development Stage Analysis

Although its market position is not yet prominent, Addsino Tianmu has unique competitive advantages:

- Data Application Capability: Relying on the main business of aerospace defense information technology, it has deep accumulation in data processing and analysis fields

- Military Security Qualification: Compared with private enterprises, it is easier to obtain classified and military-grade projects

- Group Synergy Effect: Satellite manufacturing and launch capabilities within the China Aerospace Science and Industry Corporation can form synergy

- “Space-Ground-Person” Integration: Full industrial chain layout of satellite operation + ground equipment + data service

China’s commercial low-orbit satellite market is on the

- Satellite Internet: Expected to reach 100 billion-level market size by2030

- Remote Sensing Data Service: Rapid growth in demand for land and resources monitoring, agriculture, environmental protection, etc.

- Emergency Communication: Rigid demand scenarios such as natural disaster rescue and maritime communication

Based on industry rules, the commercial low-orbit satellite business can be divided into the following stages:

| Stage | Time Span | Expected Revenue Share | Key Milestone |

|---|---|---|---|

Start-up Phase |

2024-2025 | <1% | Technical verification, small-scale pilot |

Growth Phase |

2026-2028 | 3-5% | Commercial model validated, scaled |

Acceleration Phase |

2029-2032 | 10-15% | Become an important growth engine |

Maturity Phase |

2033+ | 20%+ | Stable profit and cash flow contribution |

Based on the above analysis, the investment value of Addsino Technology is reflected as:

- Defensive: Military informatization main business provides stable business foundation and policy support

- Offensive: Commercial low-orbit satellite business provides long-term growth imagination space

- Valuation Support: The high valuation of P/B9.58x has partially reflected the market’s expectations for the future

| Risk Type | Specific Description | Impact Level |

|---|---|---|

Technical Risk |

Long satellite constellation construction cycle, fast technology iteration | High |

Market Competition |

Strong competitors such as China Satcom and GalaxySpace | Medium-High |

Policy Risk |

Commercial aerospace regulatory policies may change | Medium |

Financial Risk |

Sustained loss of main business, cash flow pressure | High |

Valuation Risk |

Current stock price has fully reflected optimistic expectations | Medium-High |

- ✅ Investors who are optimistic about the long-term development of China’s commercial aerospace

- ✅ Long-term investors who can bear 3-5 years of incubation

- ✅ Investors who understand the characteristics of military enterprises and pay attention to national strategies

- ❌ Value investors seeking short-term stable dividends

- ❌ Investors who cannot bear performance fluctuations and sharp stock price swings

- ❌ Speculators who are overly optimistic about commercial satellite business expectations

- Limited Short-term Impact: Commercial low-orbit satellite business accounts for less than1% of revenue, with negligible contribution to current finance

- Significant Long-term Strategic Value: As a potential second growth curve, it provides importantoption valuefor the company

- Valuation Partially Reflected: The high valuation of P/B9.58x and 300% annual increase indicate that the market has given premium pricing to the commercial satellite business

- Key Observation Indicators:

- Satellite constellation construction progress

- Commercialization of data application services

- Degree of synergy with military main business

- Progress of main business turning from loss to profit

It is recommended that investors continue to track from the following dimensions:

- Quarterly Performance: Focus on when the main business turns profitable and the growth rate of satellite business

- Major Contracts: Large orders in satellite operation and data service fields

- Technical Breakthrough: Key nodes of low-orbit satellite constellation construction

- Policy Trends: National policy support for commercial aerospace and satellite internet

- Competitor Dynamics: Business progress of China Satcom and GalaxySpace

[0] Gilin API Data (including company profile, stock price data, financial indicators, market performance, etc.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.