In-depth Analysis Report on the Tax Underpayment and Reimbursement Incident of Zhongchao Holding (002471.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

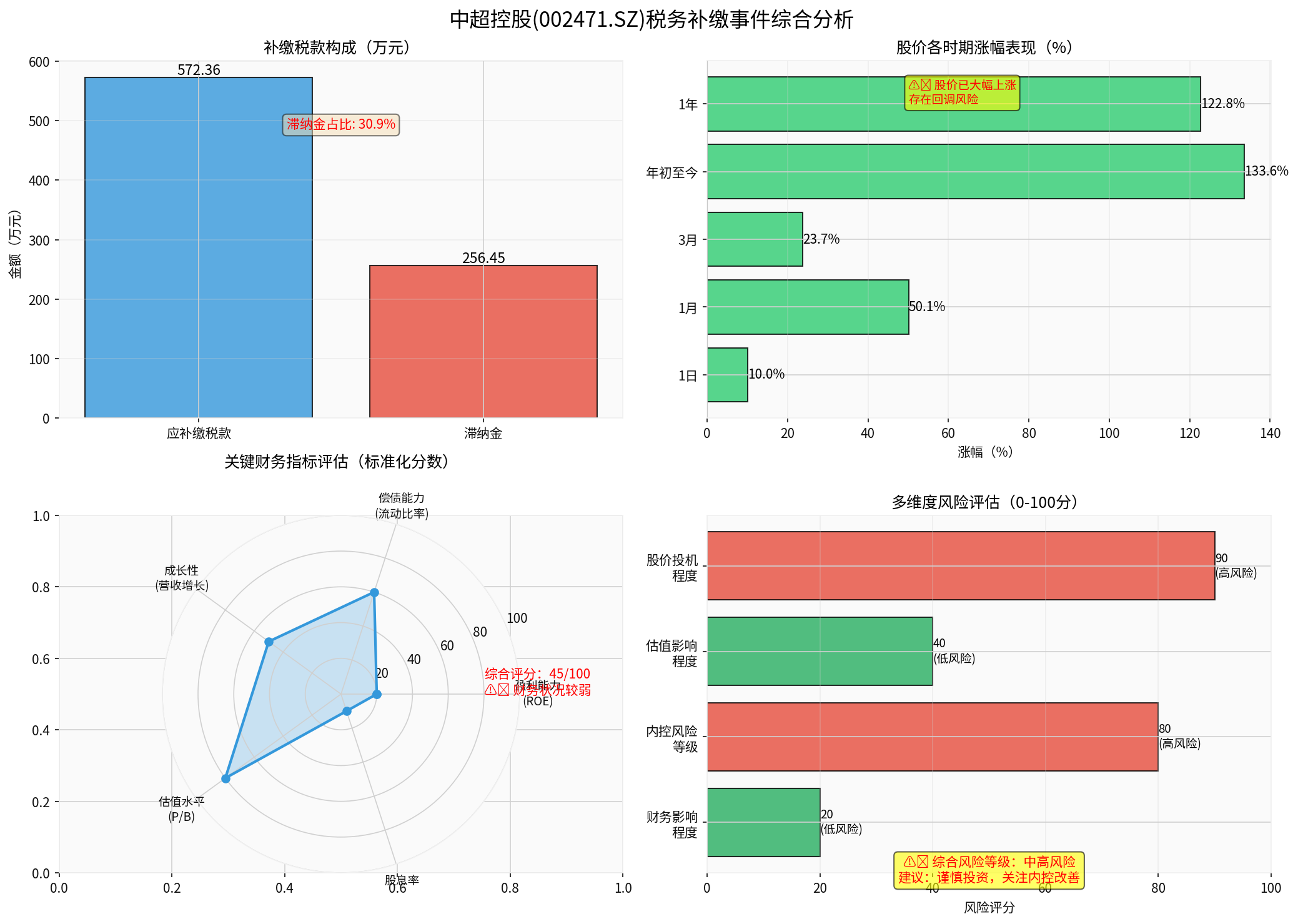

Jiangsu Zhongchao Holding Co., Ltd. (002471.SZ) recently conducted a tax self-inspection and found that it needs to pay back a total of

- Taxes to be reimbursed: 5.7236 million yuan

- Late payment fees: 2.5645 million yuan

- Late fee ratio: 30.94%[0]

The company has fully paid the amount and is not subject to administrative penalties; this expense will be recorded in the current profit and loss statement for 2025.

According to brokerage API data [0]:

| Impact Dimension | Value | Analysis |

|---|---|---|

| Total Reimbursement | 8.2881 million yuan (≈1.15 million USD) | |

| Ratio to Market Cap | 0.014% | Negligible impact |

| Ratio to 2024 Revenue | 0.073% | Almost negligible |

| Impact on 2025 Net Profit | Increase loss by 1.15 million USD | The company is already in a loss state |

- The reimbursement amount accounts for an extremely low proportion of the company’s market cap (819 million USD), only 0.014% [0]

- It also accounts for only 0.073% of the 2024 revenue (157 million USD) [0]

- However, considering the company is currently in a loss state(net profit margin -0.73%, ROE -2.28%), this expense willfurther expand the 2025 loss[0]

Based on financial analysis data [0]:

| Indicator | Value | Evaluation |

|---|---|---|

Profitability |

||

| P/E Ratio | -208.84x | ⚠️ Severe loss |

| Net Profit Margin | -0.73% | ⚠️ Negative profit margin |

| ROE | -2.28% | ⚠️ Negative shareholder return |

Solvency |

||

| Current Ratio | 1.14 | ✓ Barely qualified |

| Quick Ratio | 0.88 | ⚠️ Below safety line of 1.0 |

| Free Cash Flow | -45.64 million USD | ⚠️ Negative cash flow |

Valuation Indicators |

||

| P/B Ratio | 4.74x | ⚠️ Overvalued |

| P/S Ratio | 1.51x | Neutral |

According to the latest trading data [0]:

| Time Period | Increase | Analysis |

|---|---|---|

| 1 Day | +10.02% | Limit up |

| 1 Month | +50.12% | 🔥 Extremely strong |

| Year-to-Date | +133.58% | 🔥 Doubled |

| 1 Year | +122.78% | 🔥 Long-term strong |

- Stock Price: $6.26 (Closing on December 26, 2025)

- 52-Week Range: $2.41 - $6.82

- Current price is close to the 52-week high, only 8.2% below the peak [0]

- Daily Trading Volume: 427.67M

- Average Trading Volume: 129.97M

- Turnover Rate: Approximately3.3xthe average level

This indicates a

According to technical analysis data [0]:

| Indicator | Value | Signal |

|---|---|---|

| Trend | Sideways Consolidation | No clear direction |

| MACD | No Cross | Bullish |

| KDJ | K=64, D=59.7, J=72.6 | Bullish |

| RSI(14) | Overbought Risk | ⚠️ Beware of correction |

| Beta | 0.63 | Lower than market volatility |

| Support Level | $5.07 | |

| Resistance Level | $6.45 |

-

Late fee ratio as high as 30.94%

- Normally, the late fee ratio in tax disputes is around 10-20%

- A ratio of 30.94% indicates the problem has existed for a long time, possibly spanning multiple tax years

- Implies the company failed to detect or address this tax issue for a long time

-

Problem found through self-inspection

- While reflecting the company’s initiative

- It also indicates previous internal control failed to effectively prevent such issues

- Exposes system loopholes in tax management

-

No administrative penalty involved

- This is a positive factor

- But does not rule out the possibility of further inspections by tax authorities

According to the financial analysis report [0]:

| Dimension | Evaluation | Explanation |

|---|---|---|

| Accounting Policy | Aggressive |

The company adopts relatively aggressive accounting treatments |

| Free Cash Flow | Negative |

Continuous negative cash flow, liquidity pressure |

| Profit Quality | Poor |

Continuous loss, weak fundamental support |

-

Tax Management Defects:

- There may be other unreported tax issues

- It is recommended to pay attention to whether the company has other self-inspection announcements in the future

-

Financial Report Quality:

- Aggressive accounting policies may affect the reliability of financial statements

- Investors need to focus on audit opinions

-

Governance Structure Issues:

- The long-term undetected tax issue reflects the failure of supervision mechanisms

- Internal audit and risk control systems may have flaws

-

Management Capability:

- Doubts about financial management capabilities

- Need to pay attention to whether the management has specific measures to improve internal control

| Impact Factor | Evaluation |

|---|---|

| Financial Impact | ★☆☆☆☆ (Minor) - The amount accounts for only 0.014% of market cap |

| Valuation Multiple | Affected by continuous loss, PE is negative; valuation mainly refers to P/B and P/S |

-

Governance Discount:

- Internal control issues may lead to valuation discount

- Investors may require a higher risk premium

- Internal control issues may lead to

-

Downward Adjustment of Profit Expectation:

- Need to bear an additional expense of 8.2881 million yuan in 2025

- On the basis of existing losses, the loss will further expand

-

Damaged Market Confidence:

- May affect the confidence of institutional investors

- Long-term funds may remain on the sidelines

| Indicator | Current Value | Industry Average | Evaluation |

|---|---|---|---|

| P/B Ratio | 4.74x | ~2-3x | ⚠️ Overvalued |

| P/S Ratio | 1.51x | ~1-2x | Neutral High |

| P/E Ratio | Negative | - | Not comparable |

| Risk Dimension | Score (0-100) | Level | Explanation |

|---|---|---|---|

| Financial Impact Degree | 20 | Low Risk | Small amount, limited direct impact |

Internal Control Risk Level |

80 |

High Risk |

⚠️ Systemic internal control flaws |

| Valuation Impact Degree | 40 | Medium Risk | Governance discount may emerge |

Stock Speculation Degree |

90 |

High Risk |

🔥 Abnormally high turnover |

Comprehensive Risk Level |

65 |

Medium-High Risk |

⚠️ Need to treat cautiously |

- Do not chase high: The stock price has risen by 133%, is at a high level, and has high correction risk

- Wait for better entry point: It is recommended to wait for the stock price to correct to below $5.0 before considering

- Monitor internal control improvements: Wait for the company to announce specific rectification measures

- Set strict stop-loss: It is recommended to set a stop-loss at $5.80

- Control position: Do not exceed 5% of the total position

- Fast in and out: Not recommended for long-term holding

Need to focus on the following indicators in the next 1-3 months:

| Monitoring Indicator | Warning Line | Explanation |

|---|---|---|

Follow-up self-inspection announcements |

- | Whether there are other reimbursement matters |

2025 Q1 Financial Report |

- | Whether the loss further expands |

Internal control rectification measures |

- | Whether the management has substantive improvements |

Stock trading volume |

- | Whether it continues to be high-volume at high prices |

Audit Opinion |

- | Type of annual report audit opinion |

Regulatory Inquiry |

- | Whether it receives regulatory letters |

##7. Core Conclusions

- The absolute amountof reimbursement is small, with limited impact on the company’s finances

- The company actively conducted self-inspection, reflecting compliance awareness

- No administrative penalty involved, avoiding more serious consequences

-

Serious internal control issues:

- Late fee ratio of 30.94% indicates long-standing problems

- May expose deeper management flaws

- Investors need to remain highly alert

-

Weak financial fundamentals:

- Continuous loss, negative free cash flow

- Poor profitability, negative ROE

- Overvalued (P/B ratio of 4.74x)

-

High stock risk:

- Short-term surge of 133%, strong speculation

- Abnormally high turnover, possibly driven by funds

- Technical indicators show overbought status, high correction risk

| Evaluation Dimension | Score | Explanation |

|---|---|---|

| Event Impact | ★☆☆☆☆ | Minor financial impact |

| Internal Control Risk | ★★★★☆ | ⚠️ Highly alert |

| Valuation Risk | ★★★☆☆ | Overvalued, correction pressure |

Comprehensive Rating |

★★★☆☆ |

Medium-High Risk, Recommend Cautious |

[0] Jinling API Data (Company Profile, Real-Time Quotes, Historical Prices, Financial Analysis, Technical Analysis)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.