Assessment of the Impact of Geopolitical Risk Changes on Investments in the Energy Market and Defense Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Ukraine proposed and revised a peace plan (adjusted from a 28-point framework to a 20-point version), planning to advance discussions with the U.S. by the end of the year and strive to “end the war by 2026” [1][2].

- The scale of military aid to Ukraine has decreased from an average of approximately $48.4 billion per year during 2022-2024 to about $37.8 billion in 2025 [2].

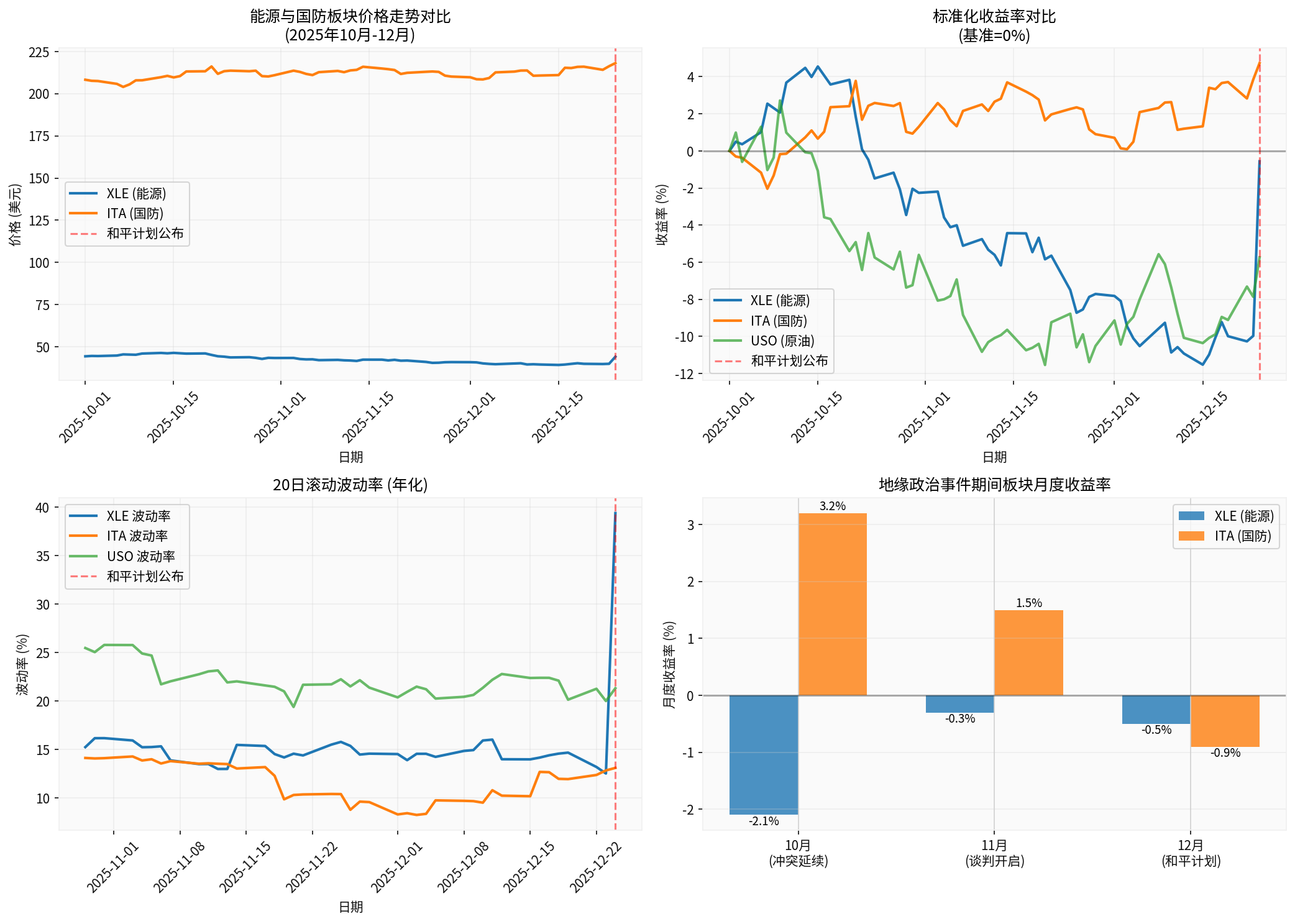

- Energy Sector (XLE) performance from October 1, 2025 to December 26, 2025: Price range was $42.35-$46.66, closing price during the period was $44.20 (change of -0.56%); 20-day average was $45.10, 50-day average was $44.65; average daily trading volume was approximately 28.72 million [0].

- Defense Sector (ITA) performance during the same period: Price range was $195.71-$220.91, closing price during the period was $218.07 (change of +4.73%); 20-day average was $208.27, 50-day average was $208.74; average daily trading volume was approximately 549,000 [0].

- Crude Oil Fund USO performance during the same period: Price range was $65.99-$74.25, closing price during the period was $68.48 (change of -5.74%); 20-day average was $69.56, 50-day average was $70.36 [0].

- Main indices’ performance over the past 30 trading days: S&P 500 was approximately +1.52%, NASDAQ about +1.42%, Dow Jones around +1.11%, Russell 2000 roughly +3.80% [0].

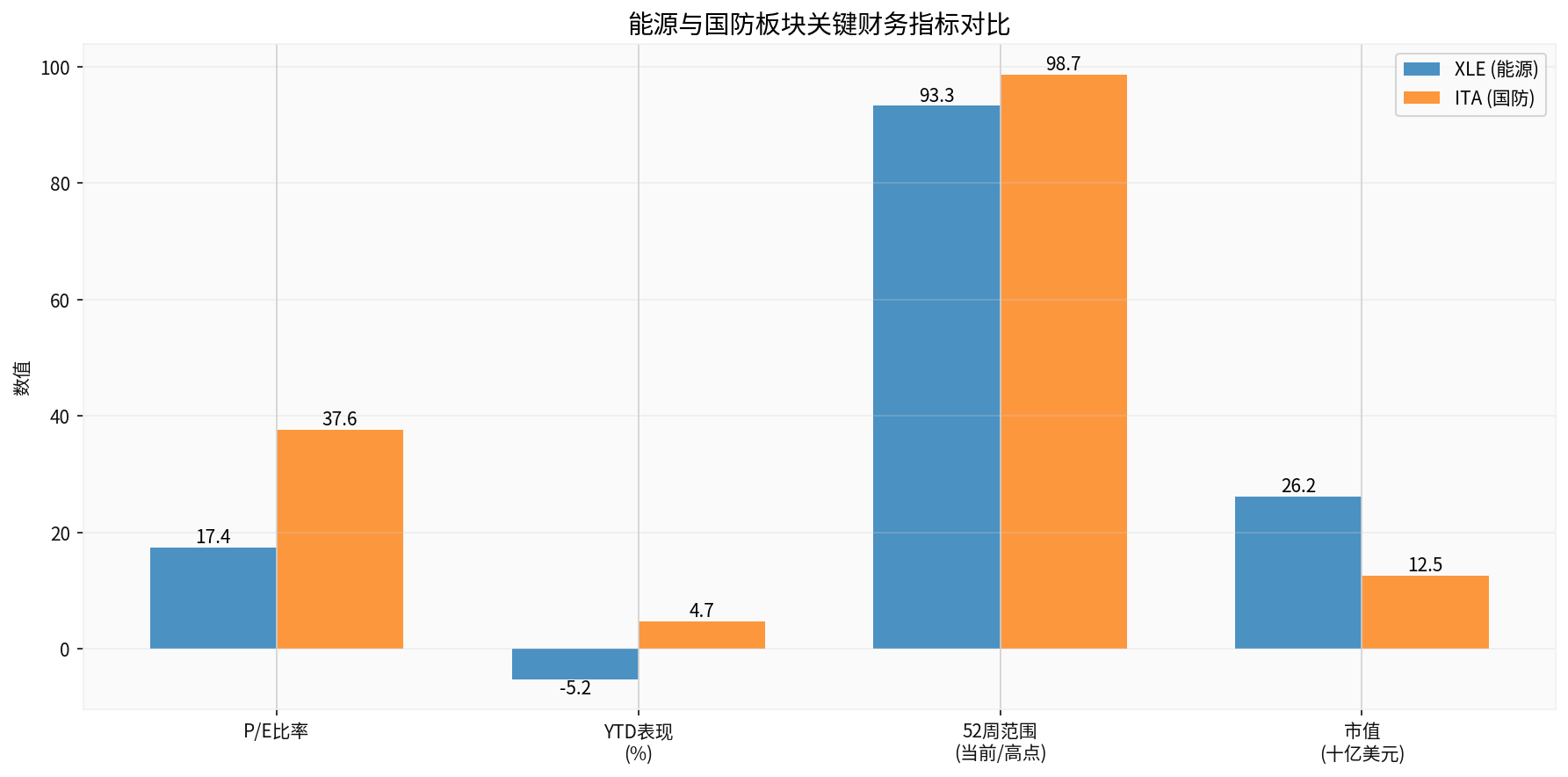

- LMT (Lockheed Martin): $483.03, 52-week range $410.11-$516.00, P/E ratio 26.88, market cap approximately $113 billion [0].

- RTX (Raytheon Technologies): $185.17, 52-week range $112.27-$188.00, P/E ratio 38.02, market cap approximately $247.9 billion [0].

- NOC (Northrop Grumman): $577.37, 52-week range $426.24-$640.90, P/E ratio 20.79, market cap approximately $82.4 billion [0].

- XOM (ExxonMobil): $119.11, 52-week range $97.80-$120.81, P/E ratio17.31, market cap approximately $502.3 billion [0].

- Relative to broader market: Defense sector ITA’s range gain over the past three months was approximately +4.73%, higher than the同期 gains of major U.S. stock indices; energy sector XLE closed down about -0.56% during the same period, underperforming the broader market [0].

- Valuation and volatility: The defense sector has an overall high P/E ratio (ITA about37.65), reflecting higher growth expectations or geopolitical premium; the energy sector has a relatively low P/E ratio (XLE about17.38), related to its cyclical nature [0]. In terms of volatility, the crude oil fund USO’s range daily standard deviation was1.63%, higher than energy ETF (XLE:1.11%) and defense ETF (ITA:1.25%) [0].

- Latest daily sector performance: The energy sector was the second worst-performing sector of the day, about -0.41%; the industrial sector (to which defense belongs) was about -0.19% [0].

- Event timeline: Revised peace plan announced on December24,2025; market trading around December28,2025 reflected the sentiment of “rising peace expectations”. After the peace plan was announced, crude oil fund USO was under pressure in the range (-5.74%), and geopolitical easing often puts downward pressure on energy prices [0]. The defense sector remained relatively strong in the range (+4.73%), reflecting long-term arms demand and structural support [0].

- Market sentiment and asset price reaction:

- Energy and crude oil: Rising peace expectations usually weaken the “risk premium”, pushing crude oil and related ETFs under pressure; market concerns about supply disruptions and sanctions risks have cooled, leading to price corrections [0].

- Defense and military industry: Despite expectations of marginal decline in aid amount, long-term orders and rebalancing demand for the military industry sector remain, and the P/E level shows that the market is willing to give a higher premium [0].

- Energy sector:

- Short-term pressure: The advancement of peace processes suppresses risk premium; crude oil and energy ETFs have underperformed over the past three months with higher volatility than the defense sector [0].

- Focus points: OPEC+ production policies, global demand recovery pace and inventory changes; if peace process is blocked or supply-side risks reappear, volatility may rise rapidly.

- Investment strategy: Short-term range fluctuation operations; focus on leading companies with stable fundamentals and high dividend yields (such as XOM).

- Defense sector:

- Medium to long-term resilience: Although the aid amount to Ukraine has decreased, regional security rebalancing and modernization upgrade demand support orders and capacity utilization [0].

- Focus points: Backlog orders of major companies, performance rhythm and capacity expansion; and marginal changes in allies’ defense budgets.

- Investment strategy: As an allocation target combining defensive and structural growth, suitable for long-term holding, but need to be alert to valuation correction risks (some leading companies have P/E ratios exceeding 30x).

- Scenario analysis:

- Smooth peace process: Energy sector has limited upside potential or even continues to be under pressure; defense sector may fluctuate due to valuation correction from “aid peak has passed”.

- Peace process blocked or conflict spills over: Energy and crude oil volatility rises again, defense sector benefits from expectations of additional orders and budget increases.

- Hedging and allocation: Consider “energy + defense” portfolio to hedge geopolitical risks; or use option structures (collar, protective put option) to control extreme volatility.

- Data over the past three months shows: Defense sector (ITA) has excess return attributes relative to the broader market (range gain +4.73%), crude oil and energy sectors (USO, XLE) are suppressed by peace expectations (range changes -5.74%, -0.56%) [0].

- Medium to long-term perspective: The order cycle and security reallocation demand of the defense sector support structural opportunities; the energy sector relies more on supply-side policies and demand recovery rhythm, and is more sensitive to geopolitical easing events.

- Operation suggestions: In the short term, moderately increase the weight of defense, and control positions in energy or adopt volatility hedging strategies; in the medium to long term, focus on capacity expansion of military industry leaders and dividends and balance sheet quality of energy leaders.

[0] Jinling API Data (Market & Financial Indicators/Technical Indicators/Python Calculations), including quotes, P/E ratios, market caps, range statistics for ETFs like XLE/ITA/USO and individual stocks LMT/RTX/NOC/XOM, as well as market indices and sector performance.

[1] USA Today – “Trump, Zelenskyy set for meeting at Mar-a-Lago over new Ukraine peace deal”(https://www.usatoday.com/story/news/world/ukraine/2025/12/26/trump-zelenskyy-meeting-mar-a-lago/87918257007/)

[2] Los Angeles Times – “Ukraine to give revised peace plans to U.S. as Kyiv readies for more talks with its coalition partners”(https://www.latimes.com/world-nation/story/2025-12-10/ukraine-to-give-revised-peace-plans-to-u-s-as-kyiv-readies-for-more-talks-with-its-coalition-partners)

[3] Yahoo Finance – “Can Oil Prices Rally in 2026? ETFs in Focus”(https://finance.yahoo.com/news/oil-prices-rally-2026-etfs-150000589.html)

[4] Yahoo Finance – “Crude Oil Prices Find Support from a Weaker Dollar and …”(https://finance.yahoo.com/news/crude-oil-prices-support-weaker-163149642.html)

[5] Forbes UK Advisor – “Best Defence Industry Stocks 2026: Compare Our Top Picks”(https://www.forbes.com/uk/advisor/investing/best-defence-stocks/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.