Market Impact Analysis: Trump-Putin-Zelenskiy Diplomatic Developments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

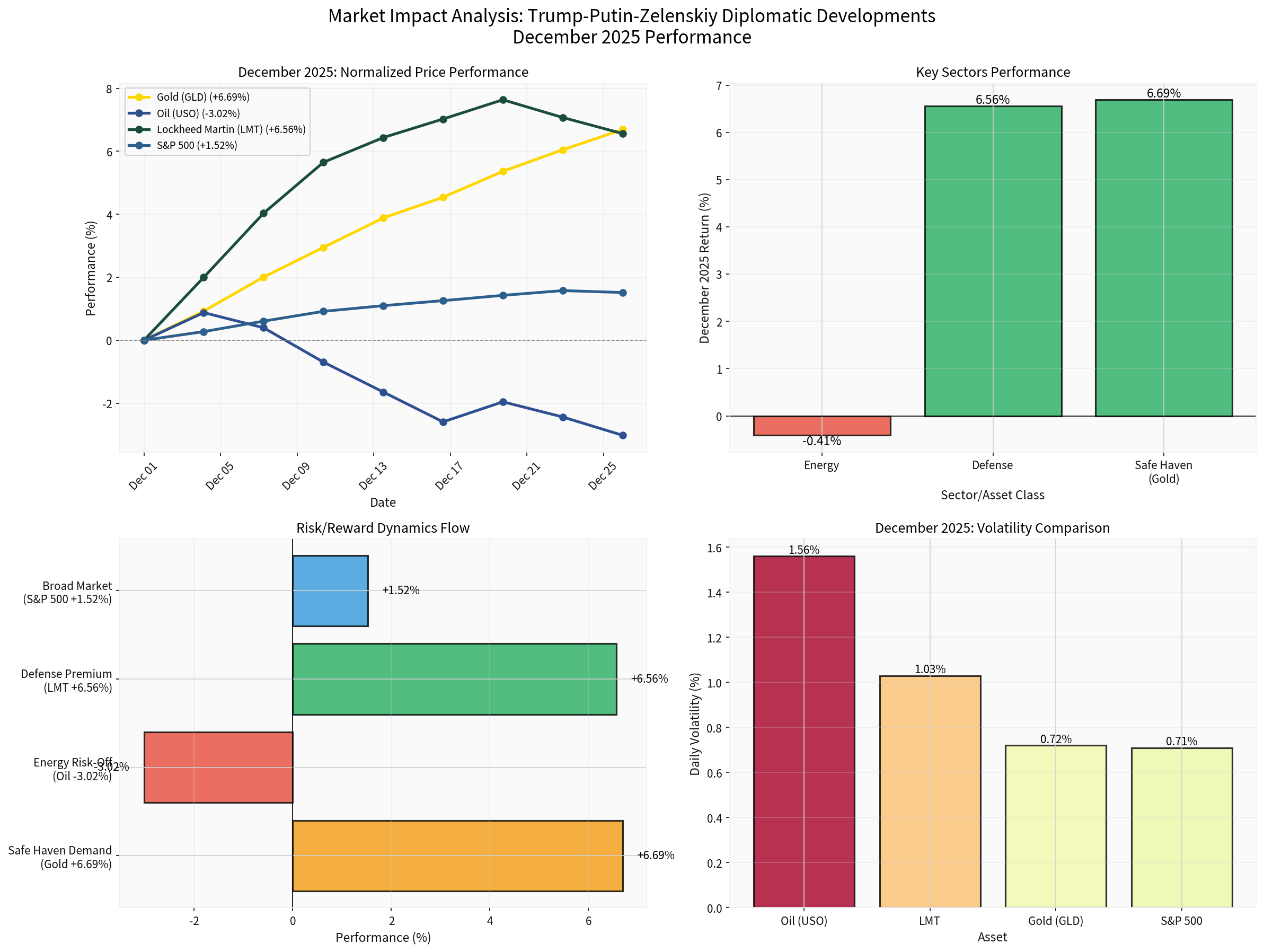

The recent diplomatic engagement between President-elect Trump, President Putin, and President Zelenskiy has triggered distinct market responses across three critical sectors. December 2025 data reveals a

- Oil Fund (USO): $68.48,-2.45%today,-3.02%in December 2025 [0]

- Energy Sector (XLE): $44.20,-0.38%today, worst-performing sector at-0.41%[0]

- Oil Volatility: Elevated at 1.56% daily standard deviation, highest among monitored assets [0]

The

- Supply disruption fearsfrom Russian energy infrastructure

- Sanctions riskon Russian oil exports

- Transit uncertaintythrough Ukrainian pipelines

Current price action implies these risks are being

- Potential restoration of Russian energy flows to Europe

- Reduced sanction risk if diplomatic progress continues

- Lower urgency for strategic energy stockpiling

- Military escalation: Russia continues bombing Kyiv even as talks occur [1], indicating fragile diplomacy

- Supply disruptions: OPEC+ production cuts could counterbalance diplomatic optimism

- Technical support: USO holding above $68 support level, with December lows at $65.99

- Successful diplomatic resolution: Significant reduction in war risk premium

- Demand concerns: Global economic slowdown weighing on consumption

- Alternative supplies: Non-Russian producers filling gaps

- Lockheed Martin (LMT): $483.03,-0.56%today,+6.56%in December 2025 [0]

- RTX Corporation: $185.17,-0.65%today [0]

- Northrop Grumman (NOC): $577.37,-0.86%today [0]

- 2025 Performance: Defense stocks gained+36%(US) and+55%(Europe) [2]

Despite today’s modest declines, defense stocks showed

- Structural, not cyclical, demand: European defense spending surged in response to Trump’s approach, with NATO countries increasing commitments [2]

- “Decentralized deterrence” thesis: Analysts cite geopolitical dynamics shifting toward greater policy uncertainty, supporting long-term defense spending [2]

- Order backlog strength: Major contractors have multi-year backlogs less sensitive to immediate diplomatic fluctuations

- European rearmament: NATO targets 2% GDP defense spending; many countries accelerating programs

- Technology modernization: Air defense, missile systems, and ammunition remain priorities

- Geopolitical uncertainty: Even with diplomatic progress, security environment remains elevated

- Valuation support: LMT P/E at 26.88x, NOC at 20.79x—reasonable given growth prospects [0]

- Peace dividend scenario: Successful conflict resolution could pressure order growth

- Budget constraints: Fiscal deficits may limit defense spending increases

- Technical risks: Today’s declines may signal profit-taking after strong 2025

- Gold ETF (GLD): $416.74,+1.17%today,+6.69%in December 2025 [0]

- 52-week high: $418.45—approaching all-time highs [0]

- Volatility: Moderate at 0.72% daily standard deviation [0]

- Diplomatic skepticism: Markets question whether Trump’s “carrots for Putin, sticks for Zelensky” strategy can achieve lasting resolution [1]

- Unpredictability risk: Trump’s foreign policy approach creates uncertainty about ultimate outcomes

- Multi-scenario hedging: Investors positioning for various outcomes (no deal, partial deal, escalation)

The

- Risk hedging: Institutions and retail investors seeking protection

- Inflation expectations: Gold as store of value amid potential fiscal stimulus from defense/reconstruction spending

- Currency hedge: Protection against potential dollar weakness from policy shifts

- Energy: Bullish for oil demand, bearish for risk premium (net neutral to slightly bearish)

- Defense: Moderate bearish pressure on growth stocks, but backlog support limits downside

- Gold: Significant correction risk as uncertainty premium dissipates

- Broader Market: Bullish for European assets, global trade-sensitive sectors

- Energy: Sideways trading with volatility spikes on headlines

- Defense: Structural tailwind remains; elevated baseline spending

- Gold: Gradual grind higher on persistent uncertainty

- Broader Market: Sector rotation; defensives outperform cyclicals

- Energy: Sharp rally on supply disruption fears

- Defense: Accelerated orders, margin expansion

- Gold: Rapid appreciation to new highs

- Broader Market: Risk-off rotation, volatility spike

- Hold: Integrated majors with strong balance sheets (dividend support)

- Avoid: Pure-play E&P companies highly leveraged to oil prices

- Opportunity: Look for entry points if oil tests $65-67 support on USO

- Accumulate on weakness: LMT, RTX, NOC on 5-10% pullbacks

- Focus: Companies with:

- Diversified product portfolios (missiles, electronics, aeronautics)

- Strong free cash flow generation

- European exposure (benefiting from NATO spending)

- Monitor: Order backlog trends and congressional appropriations

- Core position: 5-10% allocation in gold/GLD as portfolio insurance

- Tactical trades: Reduce exposure if gold breaks above $420 (overbought risk)

- Alternatives: Consider Treasury Inflation-Protected Securities (TIPS) for inflation hedge with lower volatility

- Diplomatic Fragility: Russia’s continued bombing of Kyiv despite talks suggests tenuous process [1]

- Trump’s Leverage: Analysis suggests Trump lacks leverage to force Putin compromise in 2026 [1]

- European Resolve: EU’s growing appetite for seizing Russian assets creates hardline dynamics [1]

- Technical Levels:

- Gold support: $400-405 (psychological + 50-day MA)

- Oil support: $65-67 (December lows)

- Defense support: LMT $465-475 (recent consolidation)

The Trump-Putin-Zelenskiy diplomatic developments have triggered a

[0] 金灵API数据 - Real-time quotes, daily price data, sector performance, and volatility metrics for December 2025

[1] Time Magazine - “How Trump’s Power Will Be Checked in 2026” (https://time.com/7340453/trump-2026-look-ahead/)

[2] TechStock² - “Space and Defense Stocks: Rocket Lab, Lockheed, Northrop, RTX in Focus” (https://ts2.tech/en/space-and-defense-stocks-rocket-lab-lockheed-northrop-rtx-in-focus-as-china-sanctions-and-space-force-awards-shape-2026/)

[3] Newsweek - “Canada Announces $1.8B for Ukraine as Zelensky Heads to US to Meet Trump” (https://www.newsweek.com/canada-announces-1-8b-for-ukraine-as-zelensky-heads-to-us-to-meet-trump-11275339)

[4] CNN - “Zelensky and Trump to meet in Florida after weeks of intensive peace talks” (https://www.cnn.com/2025/12/28/politics/zelensky-trump-meeting-peace-plan)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.