Analysis of Abnormal Price Surge (6 Limit-Ups in 9 Days) for Zhejiang Shibao (002703.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

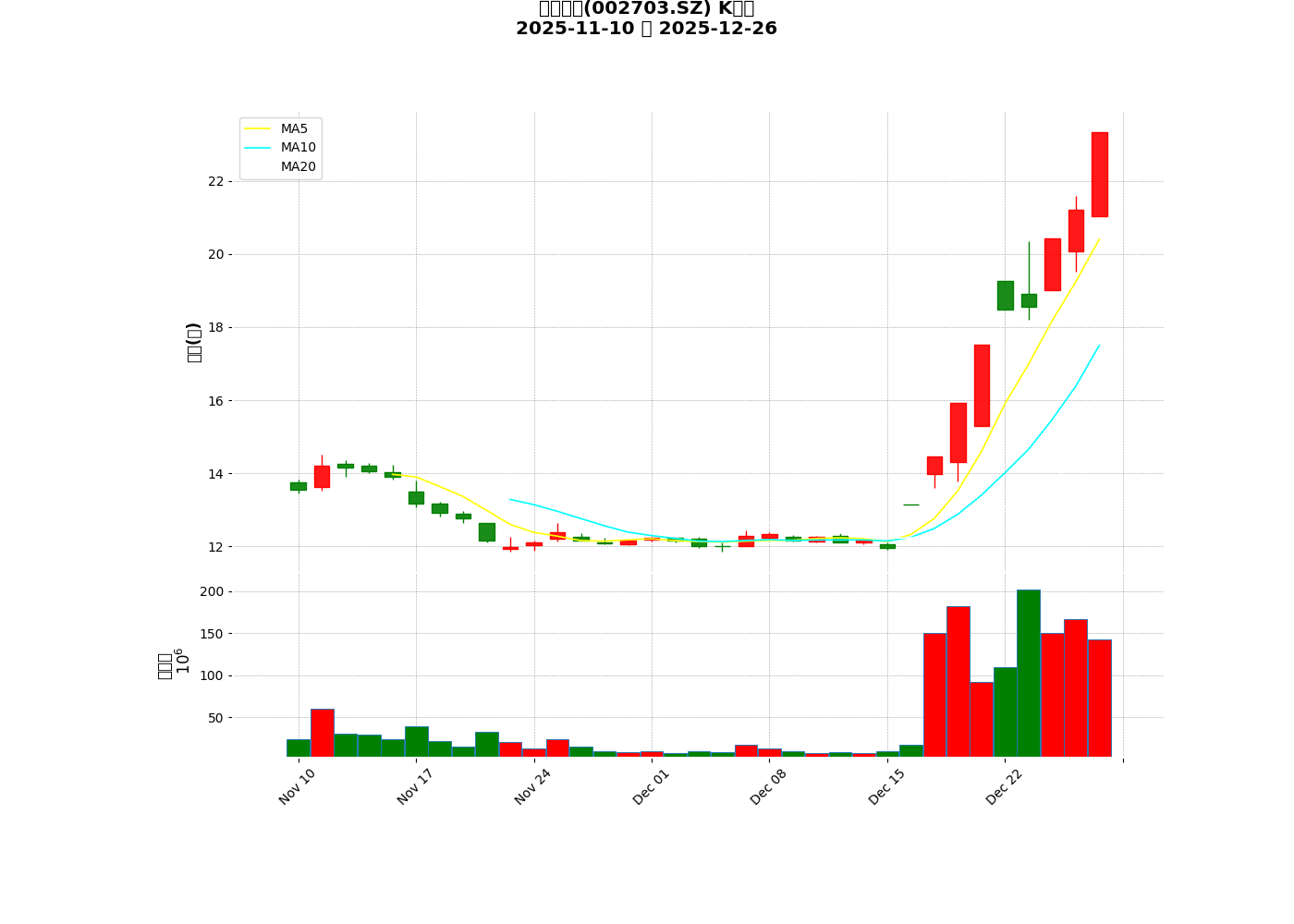

Based on daily line data obtained from brokerage APIs (range: 2025-11-10 to 2025-12-26), there were

- 2025-12-16: Closing price 13.15 yuan, increase +10.04%, trading volume about 17 million shares

- 2025-12-17: Closing price 14.47 yuan, increase +10.04%, trading volume about 151 million shares

- 2025-12-18: Closing price 15.92 yuan, increase +10.02%, trading volume about 182 million shares

- 2025-12-19: Closing price 17.51 yuan, increase +9.99%, trading volume about 93 million shares

- 2025-12-24: Closing price 20.42 yuan, increase +10.02%, trading volume about 150 million shares

- 2025-12-26: Closing price 23.34 yuan, increase +9.99%, trading volume about 143 million shares

- Period (2025-11-10 to 2025-12-26, 35 trading days):

- Opening price about 13.76 yuan, closing price 23.34 yuan, range increase about 69.62% [0]

- Narrower window (2025-12-01 to 2025-12-26) increase about 91.63% [0]

- Trading volume significantly amplified: Daily volume from 12/16 to 12/26 was mostly over 100 million shares, far higher than the average level [0]

- X-axis: Date (2025-11-10 to 2025-12-26); Y-axis: Stock Price (yuan)

- Key Features:

- Formed a continuous limit-up trend from 12/16 to 12/26, with price rising from about 11.95 to 23.34 yuan [0]

- Moving averages show a long position arrangement (MA5, MA10, MA20), with strong short-term momentum [0]

- Trading volume明显放大 on limit-up days, indicating increased capital activity [0]

- Harman, a subsidiary of Samsung, plans to acquire ZF Friedrichshafen’s ADAS business (about 1.5 billion euros) to strengthen its layout in automotive smart driving and centralized computing platforms [1,2]

- Web searches and industry reports show that autonomous driving and smart cockpits are becoming important tracks for car companies and supply chains in 2025-2026, with rising sentiment on related themes [1,3]

- Important Note: The above are industry background and market sentiment factors, not company-specific events or orders disclosed in Zhejiang Shibao’s announcements or listed in brokerage APIs.

- Market capitalization about 14.14 billion yuan (at 23.34 yuan price) [0], a small-to-medium market capitalization target, easy to be driven by short-term capital

- Limit-ups appeared密集 in 6 trading days, accompanied by surging trading volume, showing typical “theme + capital” driving characteristics [0]

###3. Company Announcement Information (Constraints)

- The company announced: Normal operations, no major events that should be disclosed but not disclosed, no major changes in internal and external operating environment, controlling shareholders and actual controllers did not buy or sell company stocks during the abnormal fluctuation period (from user background information)

- This indicates that the current stock price fluctuation mainly comes from trading level and market sentiment, not from verifiable major changes in fundamentals

###1. Core Financial and Valuation Indicators (Source: Brokerage API and Python Analysis)

- Current stock price: 23.34 yuan (closing on 2025-12-26) [0]

- Price-to-Earnings Ratio (P/E, TTM): About 101.48 times [0]

- Price-to-Book Ratio (P/B): About 9.40 times [0]

- ROE (TTM): About 9.38% [0]

- Net Profit Margin (TTM): About 5.60% [0]

- Earnings Per Share (TTM): About 0.23 yuan [0]

- Market capitalization: About 14.14 billion yuan [0]

- Current ratio: About 1.62; Quick ratio: About 1.28 (healthy short-term liquidity) [0]

- Free cash flow: Negative in the latest year (about -100.1 million yuan), reflecting that profit quality needs attention [0]

###2. Valuation Pressure and Rationality Calculation

- PEG Perspective(calculated with P/E ≈101.48):

- PEG=1 (implied by reasonable valuation): Requires about 101% annual net profit growth rate (almost impossible to maintain long-term) [0]

- PEG=2 (high growth premium): Requires about 50% annual growth rate (extremely challenging) [0]

- P/B-ROE Perspective:

- Reasonable P/B ≈ ROE ×1.5 ≈14.07%; corresponding valuation center is significantly lower than current 9.4 times P/E [0]

- Reasonable P/B derived from ROE of 9.38% is far lower than current level [0]

- Scenario Sensitivity (Based on EPS≈0.23):

- If given 15 times P/E (conservative): Corresponding stock price about 3.45 yuan [0]

- If given 25 times P/E (neutral growth premium): Corresponding stock price about5.75 yuan [0]

- If given40 times P/E (optimistic growth premium): Corresponding stock price about9.20 yuan [0]

- Current 23.34 yuan is significantly higher than the upper limit of the above scenarios [0]

###3. Conclusion on Fundamental Support

- Profitability: ROE about9.38%, net profit margin about5.60%, medium profitability, difficult to support P/E above 100 times [0]

- Cash Flow Quality: Negative free cash flow, need to pay attention to profit quality and capital expenditure pressure [0]

- Announcement Constraints: The company提示 no major changes in operating environment, further strengthening the judgment that “speculation > fundamentals” [user background]

###1. Summary of Driving Factors

- Main Drivers: Smart driving/autonomous driving theme sentiment (industry level) + capital promotion + small-to-medium market capitalization characteristics;not from verifiable major positive fundamentals of the company[0,1,2,3]

- Secondary Factors: Continuous limit-ups on the technical side attract follow-up, amplifying short-term fluctuations [0]

###2. Can Fundamentals Support Current Valuation?

- Cannot Support: Current P/E≈101.48 and P/B≈9.40 are seriously deviated from the reasonable range, requiring extremely high and unsustainable performance growth to digest valuation [0]

- Consistent with the company’s announcement that “operating environment has not changed significantly”, indicating that the stock price is running away from fundamentals [user background]

###3. Risk Tips

- Valuation Regression Risk: Current stock price has overdrawn growth expectations for many years in the future; if performance growth is lower than expected, there is huge pressure for valuation correction [0]

- Liquidity Risk: Theme stocks have violent fluctuations; after continuous limit-ups are opened, rapid declines and heavy volume swaps are easy to occur [0]

- Profit Quality Risk: Negative free cash flow, need to be alert to the erosion of cash flow by profit content and capital expenditure [0]

###4. Investment Recommendations (Risk Level: Extremely High)

- Only Suitable for Short-Term Speculators: Value investors and prudent investors should avoid

- Holders: It is recommended to reduce positions at high prices under strict stop-loss discipline to lock in part of the floating profit

- Watchers: Wait for valuation to return to a reasonable range before evaluating entry timing (take 20-40 times P/E as reference anchor) [0]

- [0] Gilin API Data (Real-time Quotes, Company Overview, Financial and Technical Analysis, Python Quantification and Visualization) [Chart: https://gilin-data.oss-cn-beijing.aliyuncs.com/financial_charts/e53ba40c_002703_analysis.png]

- [1] WSJ - “Samsung to Acquire ZF Friedrichshafens ADAS Unit for Nearly $1.8 Billion” (https://www.wsj.com/business/autos/samsung-to-acquire-zf-friedrichshafens-adas-unit-for-nearly-1-8-billion-4ba79f6f)

- [2] Samsung Newsroom - “HARMAN To Acquire ZF’s ADAS Business” (https://news.samsung.com/global/harman-to-acquire-zfs-adas-business)

- [3] The Globe and Mail - “3 Self-Driving Tech Stocks to Ride into 2026 as AV Race Heats Up” (https://www.theglobeandmail.com/investing/markets/stocks/BIDU/pressreleases/36765033/3-self-driving-tech-stocks-to-ride-into-2026-as-av-race-heats-up/)

(Data and conclusions are based solely on the above public and verifiable information and do not constitute investment advice. The stock market is risky, and investment needs to be cautious.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.