Tianfu Communication (300394.SZ) Valuation and AI Computing Power Risk Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

##1. Valuation and Profit Framework

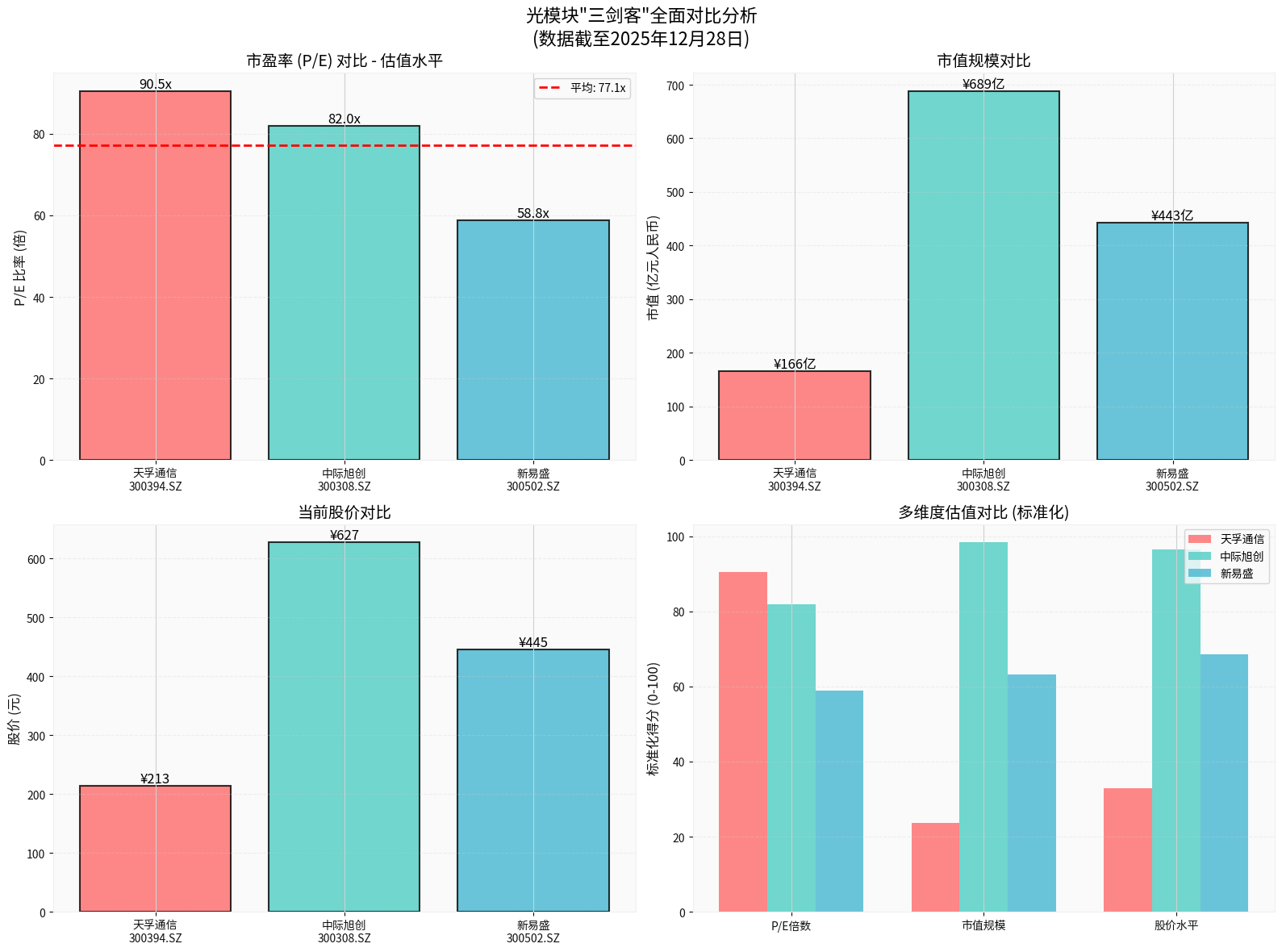

Tianfu Communication currently has an A-share market capitalization of approximately 160 billion yuan, with a TTM P/E ratio of over 90x and a TTM P/B ratio of 34x, far exceeding Zhongji Innolight and Eoptolink Technology, which are collectively known as the “Three Musketeers of Optical Modules” (their P/E ratios are approximately 82x and 59x respectively; their P/B ratios are both within 10x). This indicates that the market has a significant premium for its high growth expectations [0]. On the other hand, indicators such as the company’s ROE of nearly 41%, net profit margin of 38%, operating profit margin of 44%, sufficient cash flow, and stable asset-liability structure (current ratio of 4.5x) indicate strong profit quality, which still provides some support in the short term [0].

To more intuitively show the valuation differences, a chart comparing the three companies was generated (see chart). The chart also standardizes P/E, market capitalization, and current stock price, which can help interpret Tianfu’s current positioning in terms of “valuation height and scale” in the entire specific sub-sector.

##2. Price Rationality and DCF Guidance

Under favorable assumptions, the neutral scenario of the DCF model gives an implied reasonable stock price of approximately 223 yuan (a slight 5% premium over the current price), while in the conservative scenario, it falls to 160 yuan, a discount of approximately 25% from the current price [0]. If the weighted valuation is around 273 yuan (+28%), it indicates that the current market price has basically incorporated high growth expectations, and the neutral scenario is close to the upper limit of valuation; once growth is significantly revised downward, it will tend to approach the conservative value. Therefore, if the growth rate of AI computing power demand slows down or the industry fluctuates, there is significant room for valuation correction.

##3. Risk of AI Computing Power Boom Receding and External Industry Environment

Although AI computing power demand is regarded as the core growth driver, relevant research institutions still point out that the risk of “AI chip fluctuations” in 2026 is accumulating. An industry analysis this winter mentioned that as cost and capital pressures expand, the volatility of AI semiconductors may rise in the next year, putting pressure on the performance and valuation of upstream and downstream suppliers such as memory and packaging. The article also emphasized that although this round of AI-driven growth has not ended, it is still necessary to pay attention to changes in capital costs, inventory, and demand elasticity in the short term [1]. If the progress of new computing power center construction is less than expected, or cloud vendors other than OpenAI/Anthropic delay their investment pace, the orders, shipment pace, and prices of optical module suppliers will be affected, and valuations will face correction pressure.

##4. Conclusions and Recommendations

- Valuation Height: Tianfu Communication’s current valuation is far higher than that of its peers, and has fully reflected high growth expectations; if future gross profit or order rhythm deviates from expectations, the downside risk of profit multiples is greater than the upside potential.

- Profit Support: High ROE, net profit margin, and free cash flow support some rationality of the current valuation, but it is necessary to continuously track the under-construction scale of AI computing power centers and customer concentration.

- Risk Points: The sustainability of the AI computing power boom, external demand/policies (such as the financing rhythm brought by H-share issuance), and endogenous technology iterations (such as the popularization of CPO and LPO, and chip localization) may all become valuation triggers. At the same time, when the industry fluctuates, the magnitude of P/E decline is often larger than the decline in revenue, so it may be necessary to pay attention to quarterly performance guidance and order changes in the short term.

For further in-depth analysis (such as building a more detailed order progress model, comparing the customer structure of Eoptolink Technology/Zhongji Innolight, or constructing an AI computing power life cycle simulation), you can consider enabling the deep research mode to obtain more detailed business and supply chain data.

[0] Jinling AI Brokerage API Data (300394.SZ real-time market, company概览, technical analysis, financing analysis and DCF model).

[1] Semiconductor Stocks Today (Dec 25, 2025) – “Nvidia–Groq Deal, Micron’s HBM Boom, Intel Foundry Questions, and 2026 Forecasts”, ts2.tech. https://ts2.tech/en/semiconductor-stocks-today-dec-25-2025-nvidia-groq-deal-microns-hbm-boom-intel-foundry-questions-and-2026-forecasts/

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.