Analysis of Long-Term Investment Strategy for Overweighting Oil and Gas Stocks Against the Backdrop of Energy Transition

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on your investment portfolio and energy transition trends, I provide the following in-depth analysis and strategic recommendations.

According to the report ‘World and China Energy Outlook 2060 (2026 Edition)’ by Sinopec, the global energy transition shows the following characteristics:

- Oil consumption: Will enter a plateau in 2030, then gradually decline

- Natural gas consumption: Will peak around 2040 and play a strategic role in industrial low-carbon development and power system security

- Non-fossil energy: Will become the dominant power source around 2035 and the dominant energy source around 2045[1]

This means

Web searches show that national oil companies are playing an increasingly important role in global upstream capital expenditures:

- NOCs have political support, lower extraction costs, and clearer missions

- Most newly approved long-life projects are led by NOCs or rely on them as anchor partners

- Asian national companies maintain oil and gas as their core while increasing positions in metals, LNG, and trade[2]

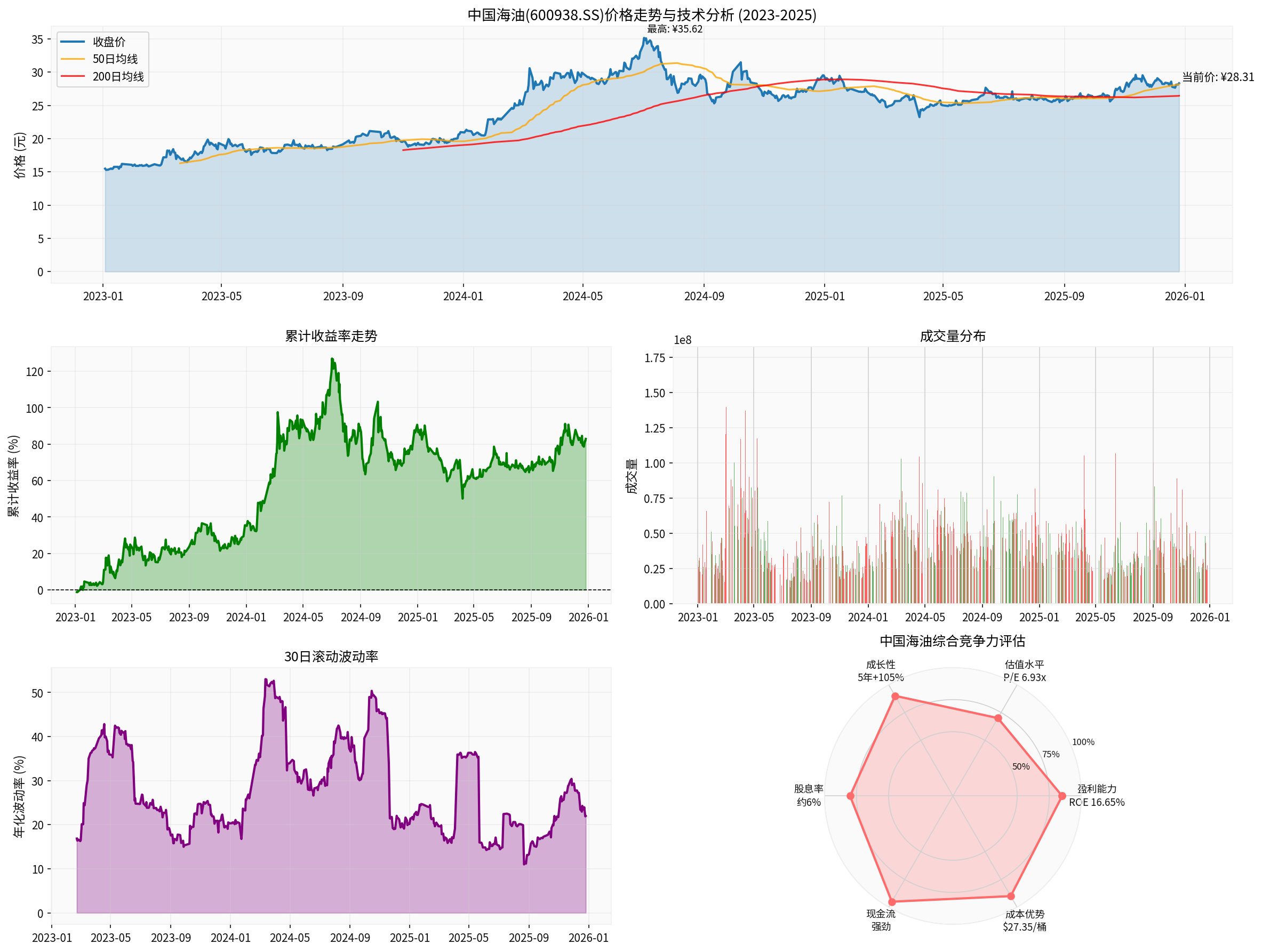

Chart shows: CNOOC’s 2023-2025 price trend, cumulative return, volume distribution, volatility, and comprehensive competitiveness assessment

According to the latest data, CNOOC has

- Main cost per barrel of oil: $27.35/barrel in the first three quarters of 2025, significantly lower than international peers (about $40)

- Break-even point: Can still be profitable even if oil prices fall to $45/barrel

- Risk resistance capacity: Low-cost advantage allows it to maintain profit resilience amid oil price fluctuations[1]

- Abundant reserves: Net proven reserves of 7.27 billion barrels of oil equivalent in 2024, with a reserve replacement ratio of 167%

- Production target: Net production target of 760-780 million barrels of oil equivalent in 2025 (growth of 5.4% to 8.3%)

- National share: Production accounts for 79% of national crude oil increment[1]

According to brokerage API data[0]:

| Indicator | Value | Industry Comparison |

|---|---|---|

| ROE (Return on Equity) | 16.65% | Far exceeding industry average |

| Net Profit Margin | 31.83% | Highly competitive |

| P/E Ratio | 6.93x | Significantly undervalued |

| P/B Ratio | 1.12x | Close to book value |

| Current Ratio | 2.36 | Financially stable |

| 5-Year Return | +105.29% | Excellent long-term performance |

- Dividend ratio: 45% high dividend policy provides stable cash flow

- Dividend yield: Approximately 6% (estimated based on current stock price)

- Repurchase potential: Strong cash flow supports future stock repurchases

For your overweight position, we recommend adopting a

- Strategy positioning: Continue to use CNOOC as thecash flow engineof the portfolio

- Operation recommendations:

- Maintain current core position (30-40%仓位)

- Use 45% high dividends as a stable income source

- Reinvest quarterly dividends into internet or consumer stocks to achieve industry diversification

- Expected return: 6-8% dividend yield +5-10% stock price appreciation =11-18% annualized return

- Strategy positioning: Gradually transition to acomprehensive energy company

- Operation recommendations:

- Reduce position to 25-30%

- Focus on CNOOC’s layout in natural gas (target 50% share by 2035) and new energy sectors

- Increase allocation to clean energy infrastructure such as natural gas pipelines and LNG transportation

- Transformation focus: Focus on CNOOC’s progress inoffshore wind power, hydrogen energy, CCUS(Carbon Capture, Utilization and Storage)[3]

- Strategy positioning: Shift from pure oil and gas stocks toenergy infrastructure operators

- Operation recommendations:

- Determine final position (20-25%) based on transformation success

- If successfully transformed into a comprehensive energy company, continue to overweight

- If transformation is slow, gradually reduce position to below 15%

Oil Price Level Recommended Position Reason

─────────────────────────────────────────

$80+ 35-40% Profit explosion period, expand gains

$60-80 30-35% Normal holding range

$45-60 25-30% Profit under pressure, moderately reduce position

$45 below 20-25% Cost advantage emerges, add positions on dips

For your concern about the balance between dividends and growth, I propose the following framework:

- Dividend strategy: Hold 40-45% position, rely on 6% dividend yield for stable cash flow

- Growth allocation: 30% allocation to growth stocks like Tencent and Midea

- Bond alternative: 30% allocation to high-grade bonds or money market funds

- Expected portfolio return: 8-12% annualized, low volatility

- Dividend strategy: Hold 35% position in CNOOC as the portfolio ‘stabilizer’

- Growth allocation: 40% allocation to Tencent (25%) + other tech stocks (15%)

- Satellite position: 25% allocation to high-dividend low-volatility targets like Qingdao Port

- Expected portfolio return:12-18% annualized, moderate volatility

- Dividend strategy: Hold 25-30% position in CNOOC, reduce weight

- Growth allocation:50% allocation to Tencent (30%) + high-growth stocks like AI/semiconductors (20%)

- Option enhancement: Use option strategies to enhance returns

- Expected portfolio return:18-25% annualized, high volatility

Recommend adopting a

- First 2 years: Reinvest all dividends into CNOOC to maximize compound interest effect

- Years3-5: Reinvest 50% of dividends into CNOOC, 50% into other industries

- After year5: Reinvest30% into CNOOC,70% into emerging industries (AI, new energy, biotechnology)

This strategy can utilize the compound interest effect while gradually achieving industry diversification.

| Risk Type | Impact Degree | Monitoring Indicator | Response Measure |

|---|---|---|---|

Oil price collapse |

High | Brent oil price <$45 | Use cost advantage to add positions |

Accelerated energy transition |

Medium | New energy penetration rate >40% | Gradually reduce position |

Policy risk |

Medium | Carbon tax, resource tax policies | Follow policy changes, adjust flexibly |

Geopolitics |

Medium | China-US relations, South China Sea situation | Maintain moderate diversification |

Production below expectations |

Low | Quarterly production report | Analyze reasons, decide to stay or leave |

- Stop-loss line: Reduce position by20% when stock price breaks below 200-day moving average with increased volume

- Take-profit line: Reduce position by30% when stock price hits all-time high and P/E>12x

- Rebalancing: Check position quarterly, adjust when it exceeds target ±5%

- CNOOC: Provides6% dividend yield + low valuation + stable cash flow

- Tencent: Provides15-20% growth + digital economy dividends

- Synergy effect: CNOOC’s high cash flow can hedge against high volatility in the internet industry

- Qingdao Port: Also a high-dividend, low-volatility target

- Industry diversification: Oil and gas vs port, reduce industry concentration risk

- Dividend enhancement: Double dividend portfolio provides more stable cash flow

- Midea/Haier: Global home appliance leaders, export-oriented

- Hedge effect: Rising oil prices benefit CNOOC but may suppress consumption, forming a hedge

- Global layout: All three companies have strong overseas businesses, diversifying single market risk

Based on CNOOC’s current stock price of 28.31 yuan and P/E ratio of6.93x:

-

Short-term (next3 months):

- Maintain current position unchanged

- If stock price retracts to below 25 yuan (-12%), add 5% position

- Focus on 2025 annual report (March2026) production targets and cost control

-

Medium-term (full year2026):

- Target position:30-35%

- If stock price breaks through35 yuan (+24%), reduce position by30% to lock in gains

- Use dividends to reinvest in other industries

-

Long-term (2027 and beyond):

- Start to gradually evaluate CNOOC’s progress in new energy sectors

- If transformation is successful, continue to overweight; otherwise, gradually reduce weight

- Focus on the approaching of oil demand plateau in2030

2025 Portfolio:

- CNOOC:40% (main position)

- Tencent:30%

- Others:30%

→2026 Target:

- CNOOC:35%

- Tencent:30%

- Other high dividends (e.g., Qingdao Port):15%

- Emerging industries (AI/new energy):20%

→2027 Target:

- CNOOC:25-30%

- Tencent:25%

- Other high dividends:20%

- Emerging industries:25-30%

Although energy transition is an irresistible trend, I believe

- Irreplaceable cost advantage: $27.35/barrel cost can maintain profitability even amid oil price fluctuations in2025-2030

- National energy security support: As the owner of95% of oil and gas exploration rights in domestic waters, its strategic value is prominent

- Underestimated transformation capability: Offshore wind power technology and deepwater development experience lay the foundation for new energy transformation

For an excellent investor like you (22% return in2025, 11.55x cumulative return over10 years), my recommendations are:

- Do not overtrade: Continue to believe in the power of compound interest

- Moderate diversification: Shift from single reliance on oil and gas to diversified energy portfolio

- Dynamic adjustment: Review investment logic quarterly, adjust flexibly according to changes

- Patience to hold: Energy transition is a decades-long process, no need to rush for short-term adjustments

This not only retains the value creation capability of high-quality assets but also reduces systemic risks of energy transition, laying a solid foundation for sustained growth in the next10 years.

[0] Gilin API Data - CNOOC(600938.SS) Real-time Market, Company Profile and Financial Data

[1] East Money Wealth Channel - ‘Core Competitiveness of CNOOC’ (December23,2025)

[2] Yahoo Finance - ‘National Oil Companies Quietly Set The Pace For The Next…’

[3] Huawei Tianjin - '[Energy Observer] New Energy Chess Game of Oil and Gas Giants: Analysis of Transformation of

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.