Analysis of the Impact of Leading Securities Firms Competing for A500ETF Option Issuance Rights on the A-share Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

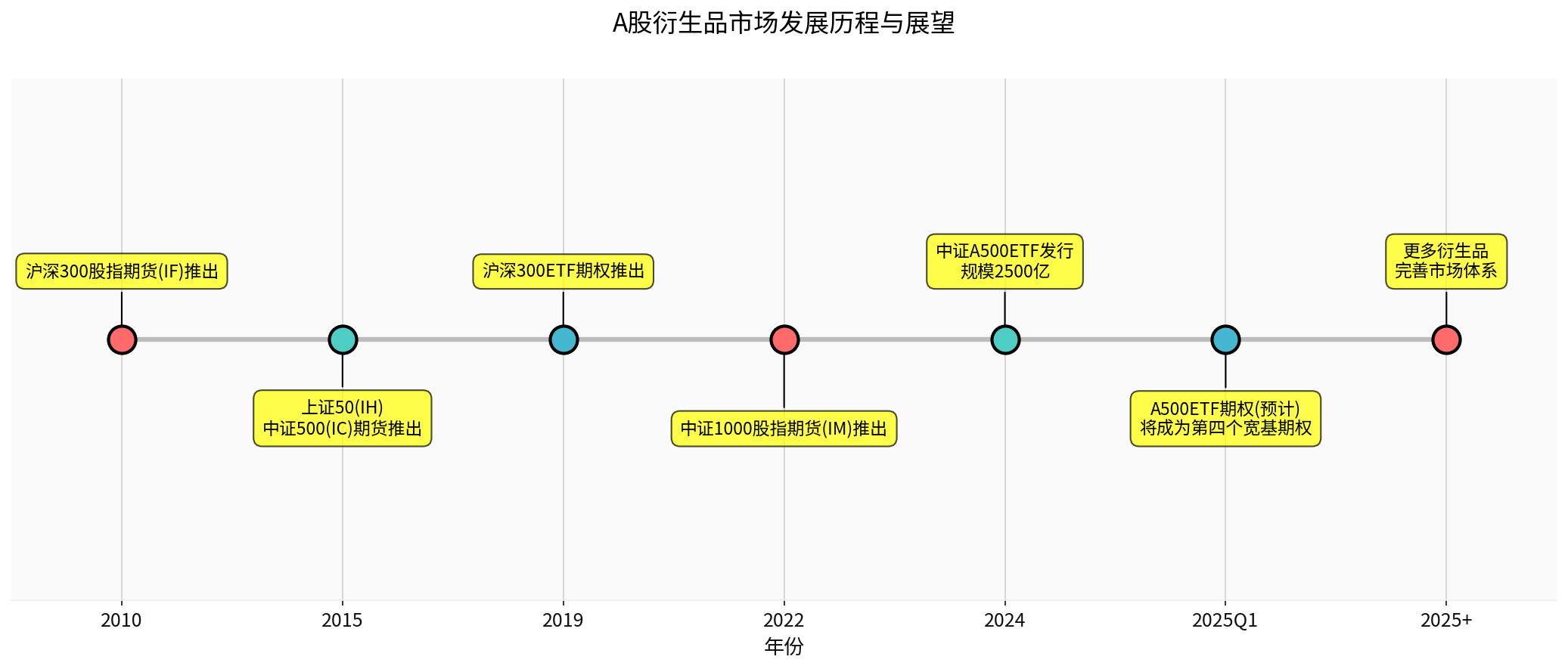

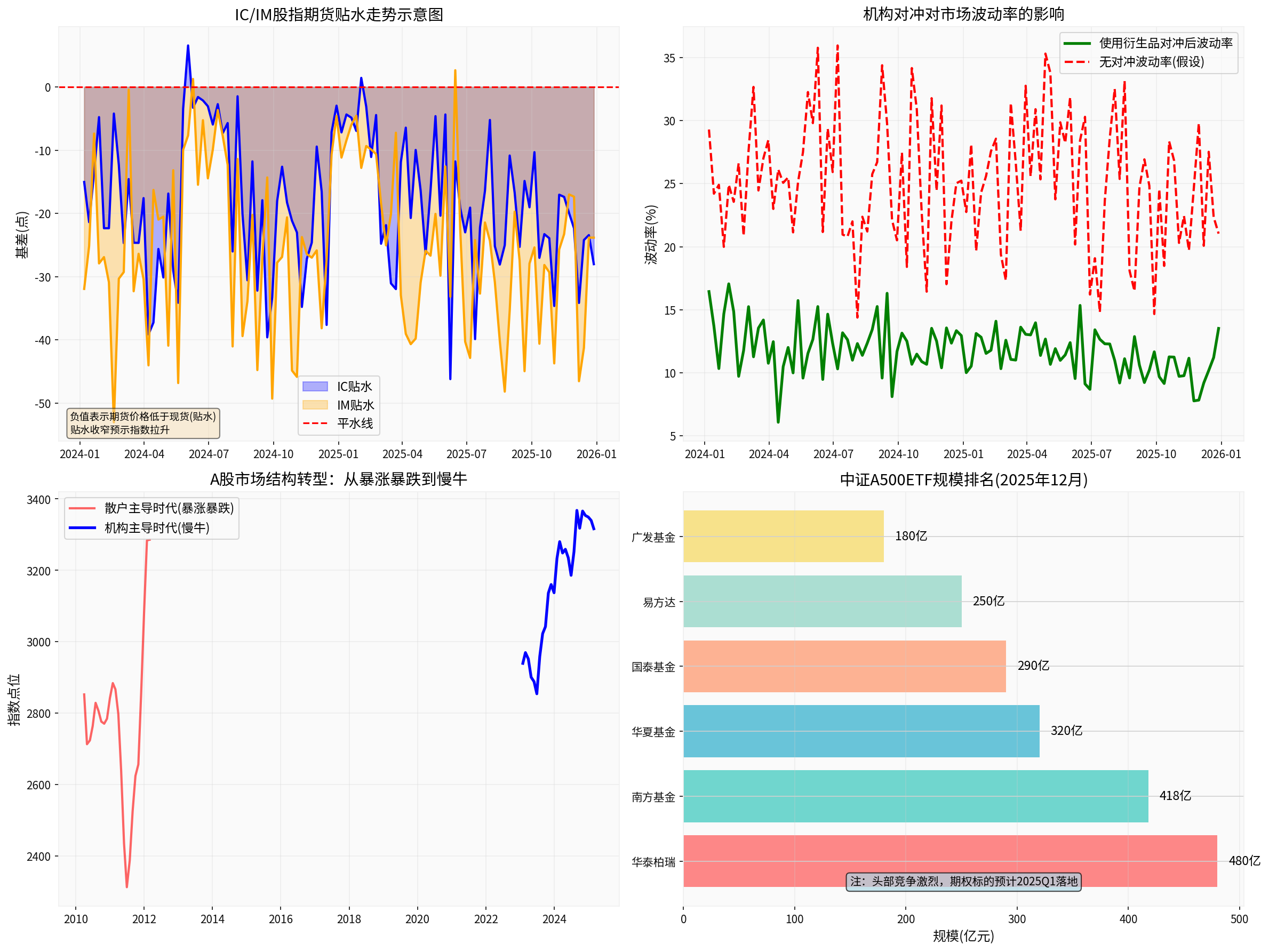

The CSI A500ETF was issued in September 2024 when the market was at its lowest point, with a special mission [1]. As of December 2024, the on-exchange scale of 22 A500ETF products has exceeded 250 billion yuan. After more than a year of fierce competition, the market structure has changed significantly:

- Huatai-PineBridge: Climbed to the top spot in the middle of the year, with scale remaining leading

- Southern Fund: Emerged suddenly in December, with a net inflow of 17.4 billion yuan, pushing its scale to 41.8 billion yuan

- China Asset Management: Net inflow of nearly 11 billion yuan in December, with scale approaching 32 billion yuan

- Cathay Fund: Once the “king”, its scale shrank by 10 billion yuan from 28 billion yuan before gradually recovering

- E Fund: Steady performance, with scale rising steadily [1]

Market rumors suggest that the Shanghai Stock Exchange and Shenzhen Stock Exchange plan to select one CSI A500ETF each as an option underlying, which is very likely to be implemented in the first quarter of 2025 [1]. Once included as an option underlying:

- It will bring significant capital effects and head concentration trends

- Referring to the case of STAR 50 ETF, the gap in fund scale will widen rapidly after the option underlying is launched [2]

- Leading securities firms are competing to become option underlyings to gain derivatives pricing power and transaction commissions

In December 2024, leading A500ETFs suddenly experienced large capital inflows:

- Southern A500ETF had a single-week net inflow of over 10 billion yuan, with a net purchase of 19.949 billion yuan in December

- Similar situations occurred in leading products such as China Asset Management, GF Fund, and Huatai-PineBridge [2]

This

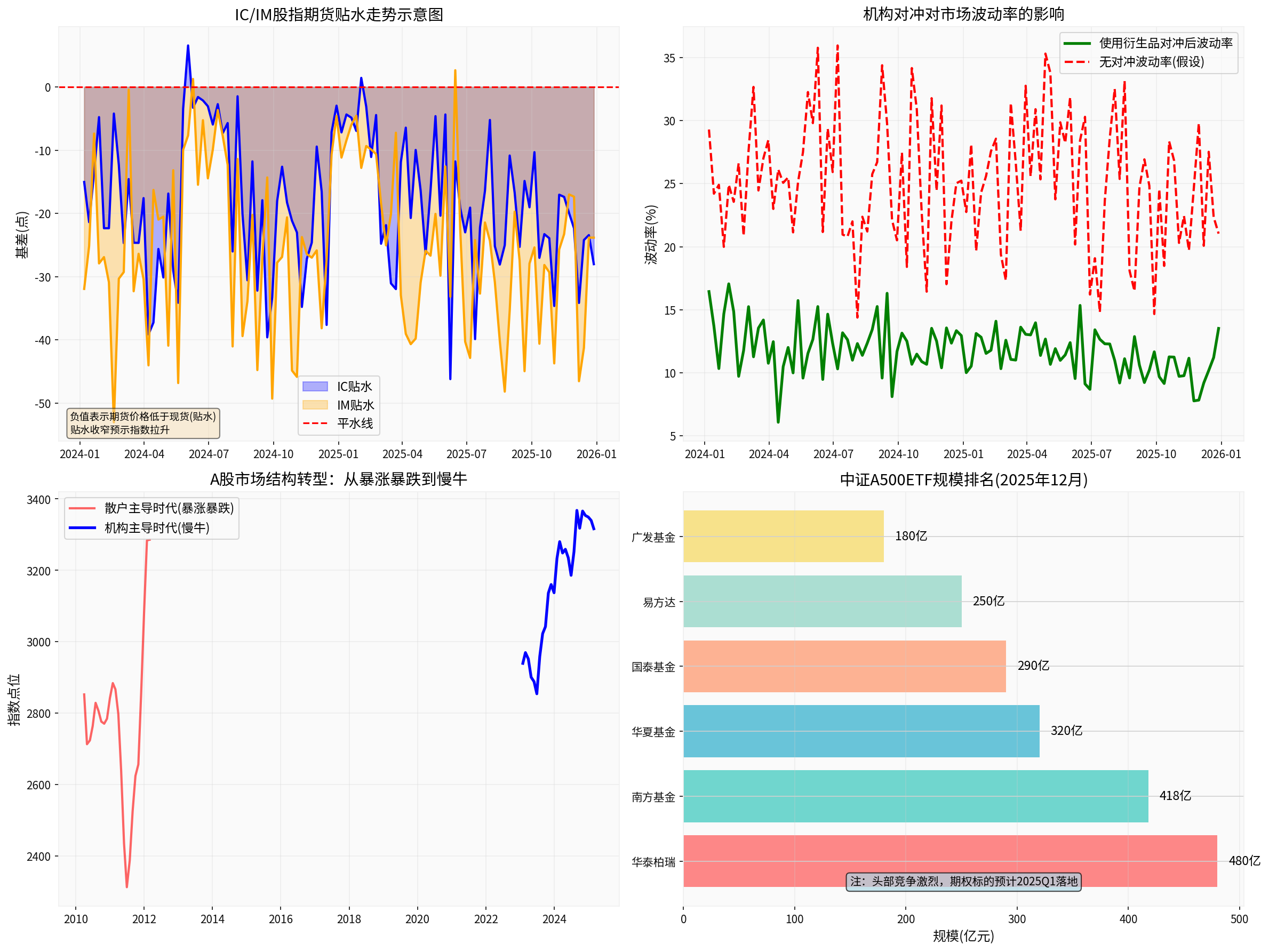

Due to the lack of short-selling mechanisms in the A-share market, CSI 500 (IC) and CSI 1000 (IM) futures have been in a state of deep contango (futures price lower than spot price) for a long time [3]. This reflects the demand of many institutions to hedge their long stock positions using stock index futures.

- Institutions buy spot while hedging with derivatives

- When the market rises sharply, institutions will quickly close their short positions

- The high leverage nature of derivatives leads to a large amount of incremental capital from liquidation

- The increase in naked long capital further pushes up the market

When the contango exceeds a certain threshold, hedging with stock index futures becomes uneconomical, and institutions will choose to liquidate positions. During the 924 rally in 2024, stock index futures briefly entered backwardation (futures price higher than spot price), which attracted more speculative long capital, leading to broad-based indices approaching the daily limit [3].

- Options provide more flexible hedging tools

- Institutions can manage risk exposure more accurately

- The “stampede effect” during liquidation may amplify short-term volatility

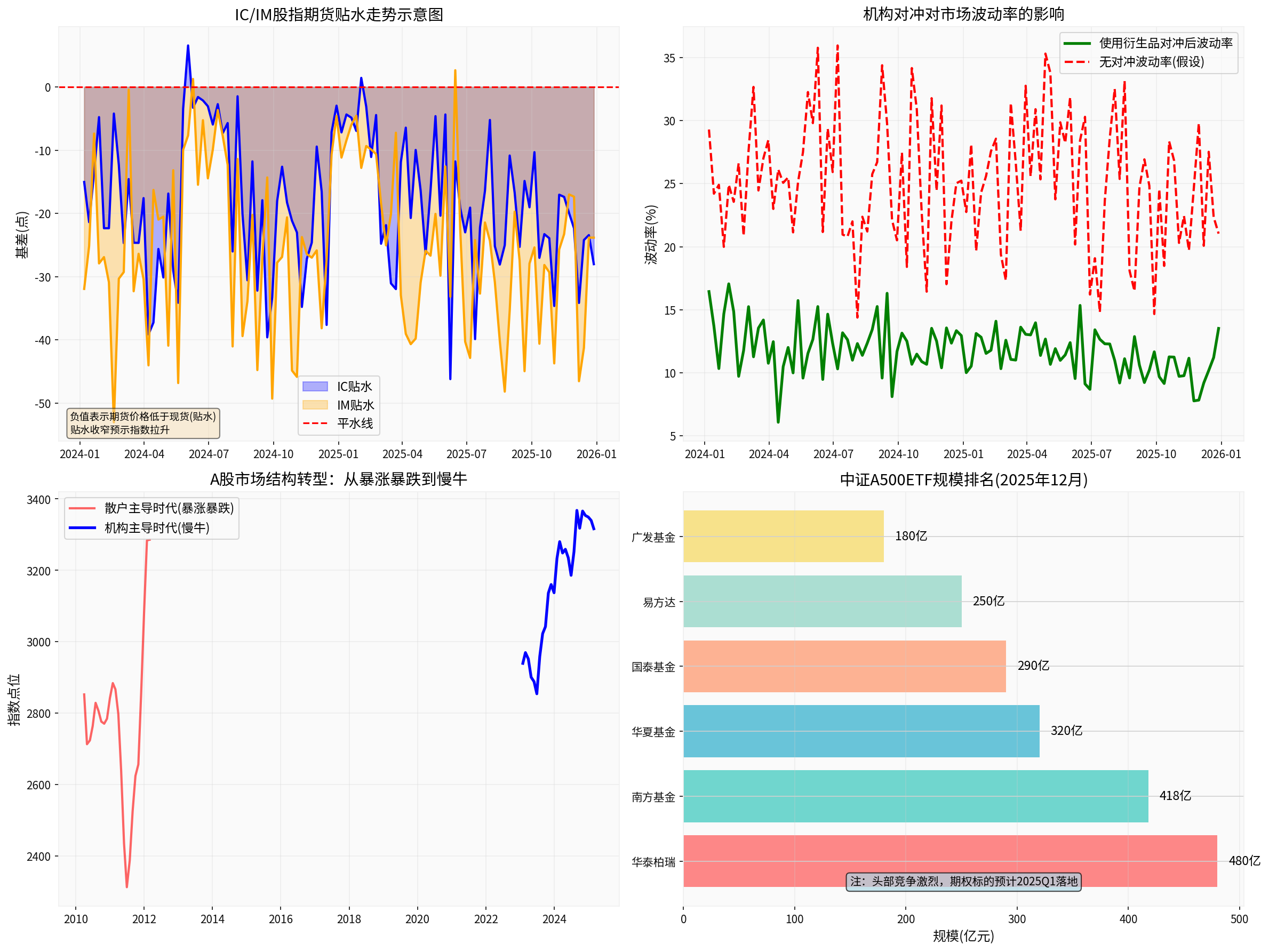

The improvement of the derivatives market is not just an increase in financial tools, but an important symbol of the maturity of the A-share market:

The A-share market is undergoing profound structural changes:

- Retail-dominated era: Institutional funds are not flexible enough; once the market fluctuates, they can only ensure safety by quickly pulling up to get out of the cost zone

- Institution-dominated era: With the increase in institutional investors and the enrichment of financial derivatives, institutions can control stock price volatility through derivative hedging [4]

In 2025, the Shanghai Composite Index rose by 16%, and the median individual stock gain reached 20%, but less than 5% of investors could outperform this level [4]. This indicates that the market profit model has shifted from “price increase” to “volume growth”, forming the so-called “slow bull” market.

A mature short-selling mechanism and derivatives market can:

-

Reduce risk exposure of large funds: Large funds are not flexible enough; once the market has unexpected fluctuations, they often cannot withdraw quickly. Short-selling through derivatives can effectively hedge against abnormal market fluctuations and avoid amplifying market volatility by following sell-offs during declines [3]

-

Improve market efficiency: The existence of short-selling mechanisms will correct mispricing, suppress malicious speculation, and make the market more rational and efficient [3]

-

Attract long-term capital such as insurance funds: Long-term institutional investors such as insurance funds and pension funds need sound risk management tools, and the derivatives market provides them with necessary hedging means

The CSI A500ETF option will become the fourth broad-based index in the A-share market with ETF options (following CSI 300, SSE 50, and CSI 500/1000). Its strategic significance lies in:

- Covering new economic fields: The A500 index covers more emerging industries and growth enterprises, filling the gap in existing derivatives for hedging innovative economies

- Improving the product chain: Options complement futures, providing institutions with more abundant risk management tools

- Enhancing market depth: More participants can participate in the market through different strategies, improving liquidity and pricing efficiency

According to online search analysis, a sound derivatives market can:

- Diversify risks: Distribute concentrated risks to investors with different risk preferences through the derivatives market

- Smooth volatility: Institutions avoid concentrated selling during market declines through hedging operations

- Enhance resilience: The market’s ability to absorb shocks is enhanced, avoiding crashes caused by the “herd effect”

The improvement of derivatives has changed the investment behavior model of institutions:

- From “fast in and fast out” to “long-term holding + hedging”

- From “chasing rises and killing falls” to “value investment + risk management”

- From “gaming opponents” to “risk sharing”

Although the improvement of the derivatives market is a

-

High proportion of retail investors: Although the scale of institutional funds has grown, retail investors still account for a considerable proportion, and emotional trading still exists

-

Uneven quality of listed companies: Some companies have imperfect corporate governance structures and low dividend returns, making it difficult to support a long-term slow bull

-

Macroeconomic environment impact: Economic cycles, policy adjustments, and other macro factors will still trigger market volatility

The current use of the derivatives market has structural imbalances:

- Long-term deep contango in IC and IM indicates that hedging demand far exceeds speculative supply

- Quantitative hedging products such as neutral strategies account for too high a proportion, which may amplify risks in specific directions

- Retail investors lack the ability and awareness to use derivatives and cannot fully participate in hedging

Based on domestic and foreign experience, to realize the true slow bull pattern in the A-share market, continuous efforts are needed in the following aspects:

| Level | Tools | Goals |

|---|---|---|

| Basic | Stock index futures (IF/IH/IC/IM) | Systemic risk hedging |

| Advanced | ETF options | Refined risk management |

| High-level | Individual stock options, OTC derivatives | Personalized risk hedging |

- Encourage insurance, pension funds, and other long-term capital to enter the market

- Cultivate the derivative application capabilities of institutional investors

- Promote product innovation for public and private funds, and develop more hedging products

- Popularize derivative knowledge and break the misunderstanding that “short-selling = malicious”

- Guide investors to use derivative tools rationally

- Establish a sound risk disclosure and investor suitability management system

- Short-term impact: It will indeed trigger market volatility, mainly manifested in abnormal capital flows and intensified gaming

- Long-term value: Promote the improvement of the derivatives market and lay the foundation for the A-share slow bull pattern

- Necessary condition for slow bull: Provide risk management tools, reduce market volatility, and attract long-term capital

- Not sufficient condition for slow bull: Needs to be supported by systematic projects such as market structure optimization, improvement of listed company quality, and investor education

For different types of investors, the following strategies should be adopted in the current market environment:

-

Recognize market ecology changes: Understand the characteristics of the institution-dominated era and abandon the “fast in and fast out” gaming mindset

-

Embrace index investment: Choose broad-based indices or industry ETFs and let professional institutions manage them

-

Focus on dividend income: The total cash dividends of A-shares in 2025 reached 2.61 trillion yuan, a record high [2], so dividend investment is worth paying attention to

-

Enhance derivative application capabilities: Treat hedging as a regular risk control method rather than a temporary tool

-

Focus on basis fluctuation opportunities: Narrowing of IC/IM contango is often a signal of market rally

-

Diversified strategy layout: Develop more income sources beyond quantitative hedging

With the launch of more derivatives such as A500ETF options, the A-share market will gradually mature:

- Short-term (1-2 years): The market will still fluctuate, but volatility is expected to gradually decrease

- Medium-term (3-5 years): The proportion of institutions will further increase, and the slow bull pattern will take initial shape

- Long-term (more than 5 years): If supporting reforms are in place, the A-share market is expected to usher in a true “long and slow bull”

[0] Jinling API Data - Financial market data and analysis tools provided by securities firm APIs

[1] NetEase - “A500ETF Soars at Year-end, Hundreds of Billions of Capital Inflows, Leading Public Funds Compete in Groups” (https://www.163.com/dy/article/KHG63916055695KW.html)

[2] Sina Finance - “Too Crazy, the Rise is Breath-taking” (https://finance.sina.com.cn/cj/2025-12-27/doc-inhefuwf1571304.shtml)

[3] East Money - “Yesterday, the A-share market suddenly plummeted near midday. It was a shock!” (https://caifuhao.eastmoney.com/news/20251227071121313675170)

[4] NetEase - “The Biggest Investment Trap in 2025: The Slow Bull You Think is an Illusion!” (https://www.163.com/dy/article/KHD7D4Q70556G82U.html)

[5] Qiushi Net - “How to Understand the Steady Development of Futures, Derivatives and Asset Securitization” (https://www.qstheory.cn/20251222/54a256d1cc3b4a269bea6130a68c149f/c.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.