Analysis of Chinese Power Stocks: Valuation, Strategies, and Price Trends

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

I. 4% Dividend Rule Valuation System and Applicability to Power Stocks

- Method: Anchor on the 10-year government bond yield, compare the expected dividend yield of stocks with the risk-free rate to evaluate risk premium and valuation attractiveness. If the 10-year government bond yield is around 1.892%-3%, a dividend yield of about 4% can provide a risk premium of 1-2 percentage points [3].

- Applicable Premises: Need to consider dividend stability, earnings volatility, capital expenditures, and cash flow quality. Currently, both power companies have negative free cash flow and high debt risk; dividend stability is constrained by capital expenditure and debt pressure. The 4% rule as a valuation reference needs to be dynamically adjusted in combination with fundamental factors [0].

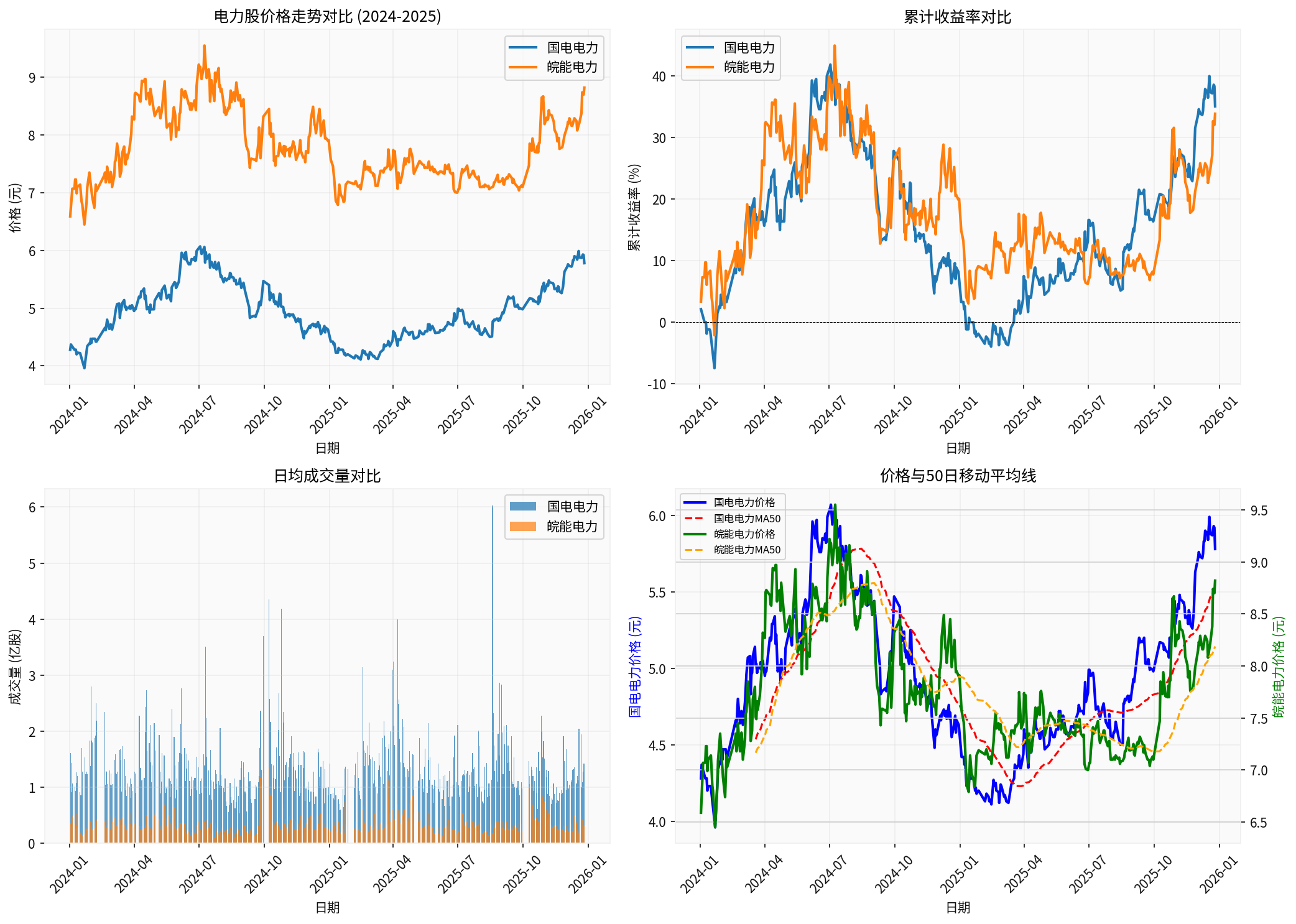

- Market Environment: Amid low interest rates and risk-averse sentiment, high-dividend assets are gaining attention. Guodian Power’s estimated dividend yield is about 4%, and Anhui Energy’s is about 4.5%, which are within the 3-5% dividend yield range of the power industry, making them somewhat attractive to Type A investors [4].

II. Strategy Differences Between Type A and Type B Investors

- Type A (Pursuing Stable Returns): Prefer low-valuation, high-dividend, low-volatility targets; focus on dividend yield and valuation safety margin. Anhui Energy has a PE of 8.38x, PB of 1.16x, ROE of 14.63%, relatively higher dividend yield, and annualized volatility of 30.87%, which is more in line with the “bond-like” positioning and suitable as a defensive allocation [0].

- Type B (Pursuing Growth Excess Returns): Focus on earnings growth, valuation improvement, and transformation opportunities. Guodian Power has a larger market capitalization (103.09 billion yuan), PE of 13.90x; if electricity prices are raised or new energy projects are put into operation, it has greater earnings elasticity and valuation repair space, but needs to bear higher capital expenditure and debt pressure [0].

III. Impact of Strategy Differences on Stock Price Trends

- Short-term: Type A funds provide support, buying when prices fall near support levels, forming range-bound fluctuations; Type B funds drive rapid rises under catalysts, amplifying volatility. Guodian Power’s maximum drawdown this year is -32.29%, and Anhui Energy’s is -28.90%, reflecting high volatility [0].

- Medium to Long-term: If electricity prices and earnings growth are stable, Type A funds will lock in dividend income to support stock prices; if growth potential is realized, Type B funds will drive valuation improvement. Current technical indicators show that the trend has not yet been established; both stocks are consolidating sideways, and we need to wait for fundamental or policy catalysts to break through [0].

- Correlation: The return correlation between the two stocks is about 60%; strategy differences and industry commonalities coexist, and industry policies and earnings cycles affect both [0].

IV. Investment Recommendations and Risk Warnings

- Conservative Investors: Hold Anhui Energy to obtain stable dividends, but need to pay attention to debt risk and dividend sustainability; control positions within the portfolio’s risk tolerance to avoid over-concentration.

- Active Investors: Position for Guodian Power’s growth opportunities, wait for policy or project catalysts; set stop-losses and manage positions to control volatility risk.

- Portfolio Allocation: Allocate proportions between the two based on risk preference, balancing income stability and growth potential; regularly track 10-year government bond yields, electricity price policies, capital expenditures, and earnings changes, and dynamically adjust positions.

References:

[0] Gilin API Data

[1] High Dividend Stocks 2025 | Selected 10 High Dividend Stocks with Up to Nearly 11% Yield, Minimum Investment 3000 Yuan… (https://hk.finance.yahoo.com/news/收息股2025-特別普回歸影響港股-精選10隻穩陣高息股-最高派逾8厘-1月22日更新-101700945.html)

[2] Catch Every “Quarterly Dividend Stock”! Rare in Hong Kong Market, Favorite of “Dividend Hunters” (https://hk.finance.yahoo.com/news/每季派息-每季收息-一年派四次息-港股-etf-季息-股息-中期息-高息-030650205.html)

[3] China’s 10-Year Government Bond Yield is About 1.892%-3% (Chart and Description) (https://hk.finance.yahoo.com/news/日網瘋傳拋售7兆日元中國債報復傳言-專家曬數據打臉-質光光也難撼陸經濟-061003164.html)

[4] Estimation of 3-5% Dividend Yield Range for the Power Industry (Based on Industry Average)

Chart Link:

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.