Military Metals Corp (MILIF) Strategic Antimony Investment Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis examines Military Metals Corp (MILIF), which gained attention on November 8, 2025, through a Reddit discussion highlighting it as a potential “MAGA Target for Investment” [Event source]. The company’s strategic positioning centers on antimony exposure, a critical metal facing significant supply chain disruptions dominated by China and Russia [1].

Military Metals currently trades at $0.2904 with a market capitalization of $19.29M [0]. The stock has declined 52.39% year-to-date from its 52-week high of $0.7515, though it showed recent positive momentum with a 3.71% gain in the latest session [0]. The company remains in the exploration stage with no current revenue generation, reporting a net loss of $4.30M over the trailing twelve months [0].

The investment thesis is supported by extraordinary antimony market conditions in 2025:

- Antimony prices reached $51,500 per tonne, with market speculation suggesting potential to reach $100,000 per ton [1]

- China’s export restrictions and environmental regulations have tightened global supply, while Russia’s production faces uncertainty [1]

- The global antimony market was valued at $1.08 billion in 2024 and is projected to reach $1.78 billion by 2032 (6.5% CAGR) [2]

- Rising demand from defense, solar, and battery sectors has intensified the supply-demand imbalance [1]

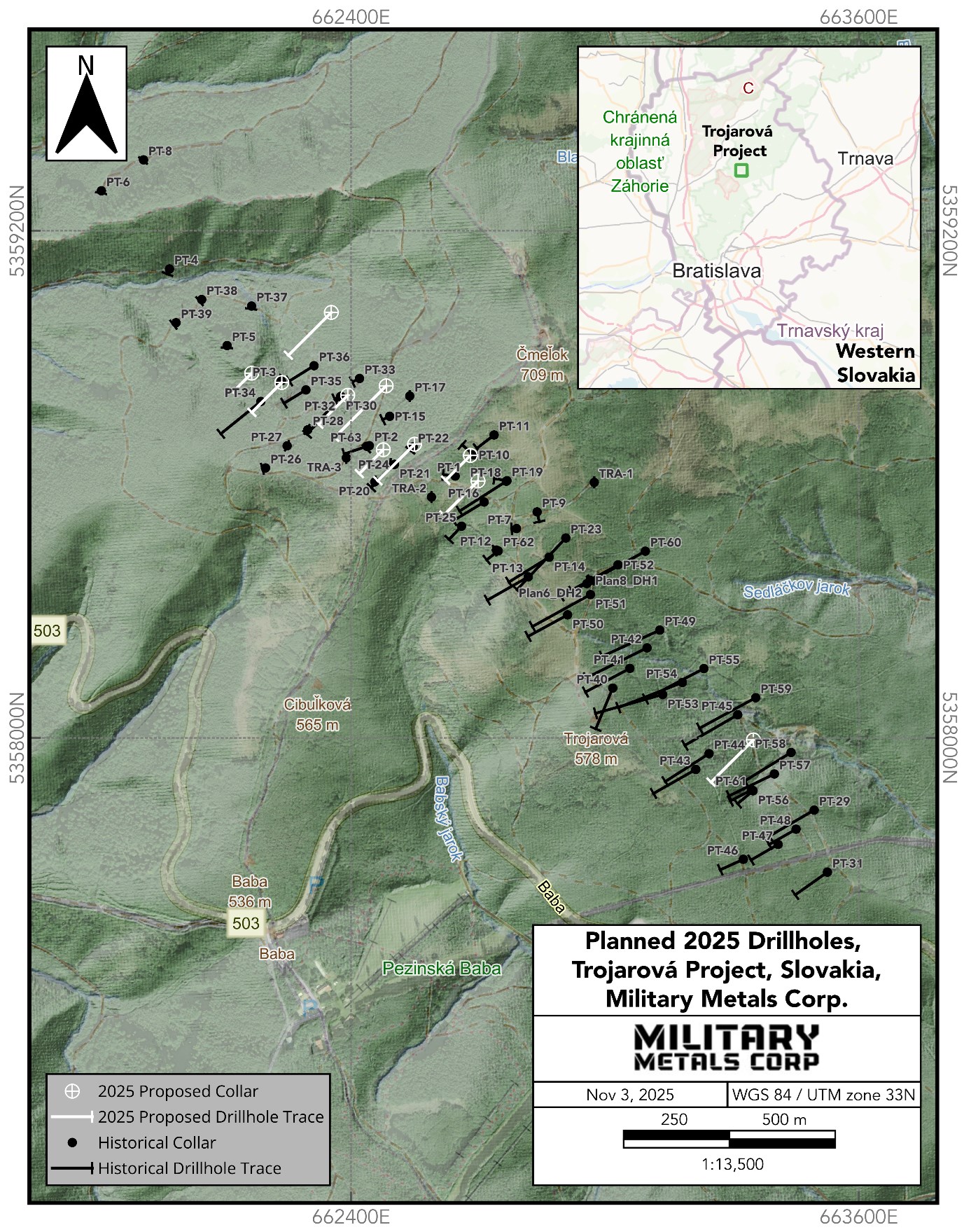

Military Metals controls several antimony-gold projects across Slovakia, Canada, and Nevada [0]. The company’s flagship Trojarová Antimony-Gold Project in Slovakia represents its cornerstone asset, with resource confirmation drilling commencing on November 4, 2025, through a 10-hole, 2,500-meter campaign [3]. Recent sampling at the West Gore project returned high-grade results of 11.45% and 6.58% antimony with significant gold values [4].

The “MAGA investment” framing connects to broader geopolitical trends, including global defense spending reaching $2.46 trillion in 2024 (up 7.4%) and U.S. government implementation of $2.5 billion for domestic critical minerals production [1][5]. The emphasis on Western sourcing of strategic minerals away from China/Russia dominance creates a compelling narrative for companies like MILIF [1].

The stock exhibits high volatility with a beta of -3.72, indicating inverse correlation with broader market movements [0]. The RSI of 40.30 suggests the stock is approaching oversold territory, while trading volumes of 102,971 shares remain below the average of 711,853, indicating limited liquidity [0].

The company adopted a shareholder rights plan on October 23, 2025, to protect against undervalued takeovers [3]. Management has explicitly positioned the company within the critical minerals defense supply chain narrative, aligning with growing government and industry focus on strategic material security [4].

The analysis reveals several risk factors that warrant careful consideration:

- Exploration Stage Risk: As a pre-revenue exploration company, success is highly uncertain and capital-intensive

- Commodity Price Volatility: While antimony prices are currently high, commodity markets are notoriously cyclical

- Geopolitical Risk: Properties in Slovakia and Canada may face regulatory and permitting challenges

- Liquidity Risk: Low trading volumes and small market cap create potential for price manipulation

- Dilution Risk: Likely need for future equity financing could significantly dilute existing shareholders

- Antimony Supply Constraints: Ongoing China export restrictions create sustained supply pressure

- Defense Sector Demand: Growing military applications for antimony in ammunition, electronics, and armor

- Government Support: U.S. and allied nations’ critical minerals initiatives and funding programs

- Resource Development: Successful drilling results could significantly upgrade resource estimates

- Resource confirmation drilling results from the Trojarová project

- Sustainability of current elevated antimony prices

- U.S. and allied nations’ critical minerals policy developments

- Any announcements regarding path to commercial production

- Potential offtake agreements or joint ventures with major industrial users

Military Metals Corp represents a high-risk, high-reward investment opportunity in the strategic antimony sector. The company’s small market cap of $19M and current trading price of $0.29 (versus 12-month high of $0.75) reflects market uncertainty about its exploration success and path to production [0]. The strong antimony price environment and geopolitical supply chain concerns provide a compelling backdrop, but significant execution risks remain [1][3].

Critical information gaps include the absence of NI 43-101 compliant resource estimates, unclear production timeline, unknown capital requirements for development, and lack of announced offtake agreements [0]. The company’s recent drilling activities and high-grade sample results suggest potential, but investors should be aware of the speculative nature of exploration-stage mining investments [3][4].

The technical indicators show mixed signals with high volatility (beta -3.72) and approaching oversold conditions (RSI 40.30), while below-average trading volumes present liquidity considerations [0]. The shareholder rights plan adoption suggests management’s confidence in undervaluation but also reflects takeover protection concerns [3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.