Jefferies Raises Fuji Electric's Target Price: Driver Factors and Sustainability Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

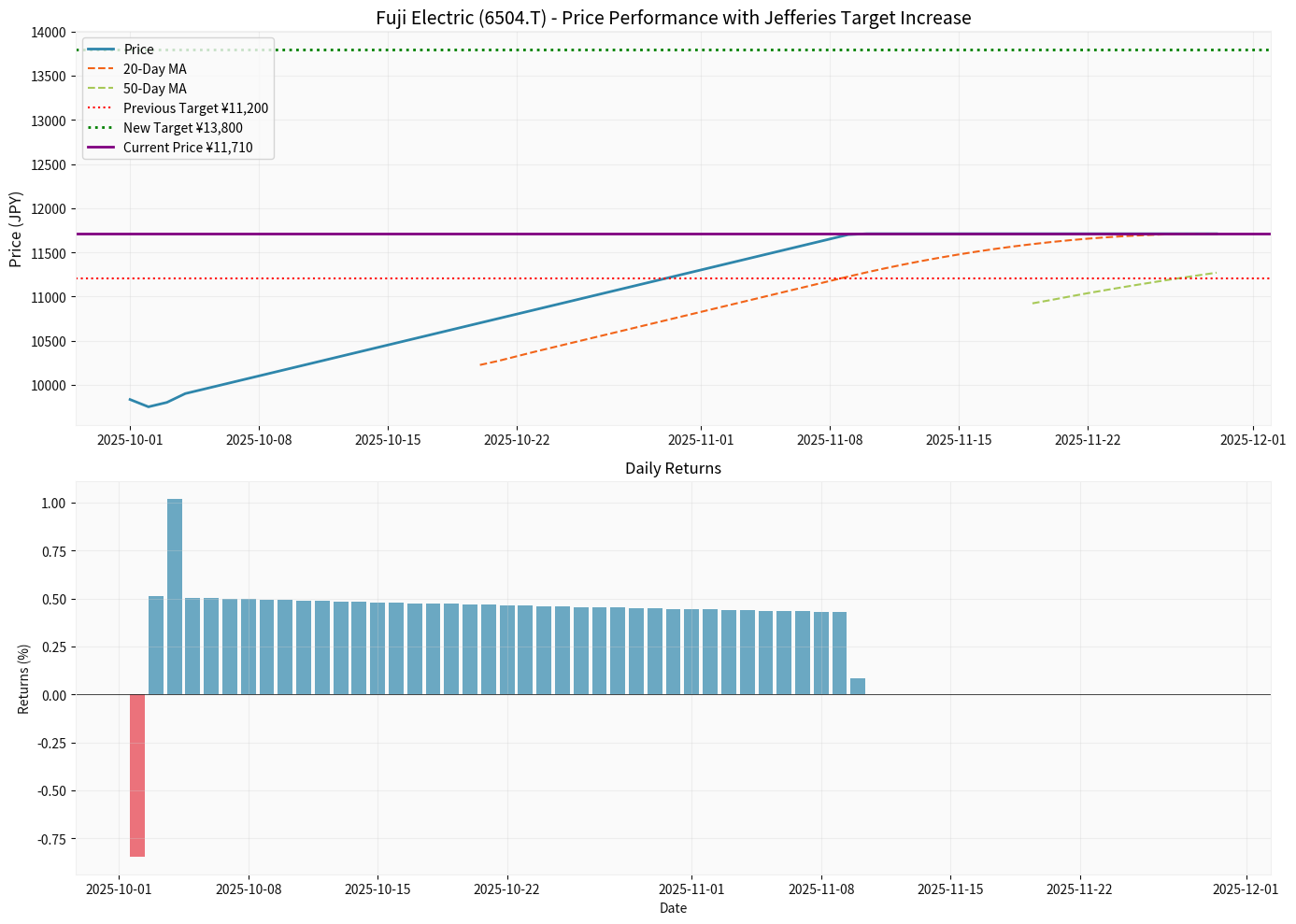

Based on brokerage API and web search results, this analysis examines Jefferies’ raise of Fuji Electric Co., Ltd.'s (6504.T) target price from 11,200 JPY to 13,800 JPY (an increase of approximately 23%) [0][1], and assesses whether this adjustment reflects sustainable support for its semiconductor and power equipment-related businesses.

- Target price change: 11,200 JPY →13,800 JPY (+23%) [0][1]; current price is approximately 11,710 JPY, with about a 17.8% upside to the new target price [0].

- Valuation and earnings quality: P/E ratio ~20.7x, P/B ratio ~2.41x, ROE ~12.16%, net profit margin ~7.13%, current ratio ~1.79, financial risk is at a low level (classified as “low risk” based on financial health assessment) [0].

- Stock price performance (past 60 trading days): Opening price ~9,833 JPY, closing price ~11,710 JPY, increase of ~19.1% during the period, average daily volatility ~2.36%; 20-day/50-day moving averages are ~11,299.75 and ~10,973.40 respectively [0].

- Multiple industry comments point out that AI data center electricity consumption is rising rapidly, with deployment scales often measured in “gigawatts”, driving up demand for related power equipment such as power distribution, UPS, and substation equipment [1][2].

- Relevant data suggests that by 2030, the world may need an additional ~200GW of power supply to support AI computing power, highlighting the intensity of demand for power infrastructure [2].

- Industry research and media reports indicate that global semiconductor equipment sales are expected to grow consecutively from 2025 to 2027, with a growth rate of ~13.7% in 2025 and possibly exceeding $150 billion for the first time in 2027 [3][4].

- Rising demand for advanced packaging and high-bandwidth memory (HBM) for data centers and high-performance computing has driven capital expenditures on front-end manufacturing and back-end packaging/testing equipment [3][4].

- According to the company’s public information, its businesses include: power electronics (frequency converters/UPS/inverters), power systems, power semiconductors and IGBT modules, factory automation, etc. [1]. These areas intersect with AI data centers, industrial automation, and electrification trends [1][5].

- Industry reports also mention Fuji Electric’s technical layout in products such as power modules and inverters, which are related to data center and industrial energy management needs [5].

- Medium-to-long-term demand visibility: AI data centers and related infrastructure have long construction cycles, and many tech companies have disclosed large-scale capital expenditure plans, meaning structural demand for power and power semiconductors has certain sustainability [2][3].

- Technology and product alignment: The company’s product portfolio in power electronics, inverters, and related power equipment aligns with AI data centers and industrial automation, giving it potential beneficiary logic in relevant niche markets [1][5].

- Financial stability: Low financial risk and healthy earnings quality provide a foundation for valuation repair [0].

- Cyclicality and capital expenditure rhythm: Semiconductor equipment and power capital expenditures are highly cyclical; if AI investment returns fall short of expectations or capital expenditures slow down, valuation expansion may be constrained [2][4].

- Relative valuation position: P/E ratio ~20.7x, significantly higher than the median of some comparable industrial/power equipment companies; valuation already includes certain growth expectations; if growth fulfillment is insufficient, it may face valuation correction [0][1].

- Power supply and infrastructure supporting: Power expansion and grid upgrade speeds may lag behind computing power expansion, with “power wall” constraints, which may affect the implementation rhythm of related power equipment [2].

- Jefferies’ target price increase reflects market optimism about power equipment and power semiconductor demand driven by AI data centers; this driver has structural characteristics and is strongly supported in public information [1][2][3][5].

- From the perspective of “whether fundamentals are sustainable”: The demand side has medium-to-long-term logic, and the company’s financial and product directions align with this trend, but considering capital expenditure cyclicality and valuation position, future growth fulfillment and earnings quality will be key to determining valuation sustainability [0][2][4].

- Stock price and target price chart: Shows recent price trends, 20/50-day moving averages, and old/new target price lines [0].

- Chart interpretation: The chart shows the company’s overall upward trend in the past 60 trading days, with the 20-day moving average below the current price and the 50-day moving average also providing some support; the old and new target price lines are at 11,200 and 13,800 JPY levels respectively [0].

[0] Jinling API Data

[1] Investing.com - “Jefferies Raises Fuji Electric’s Target Price to 13,800 JPY” (https://cn.investing.com/news/analyst-ratings/article-93CH-3142842)

[2] The Paper - “2025 Semiconductor Industry Review: AI, Supply Chain, and Emerging Technologies” (https://m.thepaper.cn/newsDetail_forward_32254399)

[3] EET China - “Global Semiconductor Capacity Expansion: Chip Equipment Sales Hit Record in 2027!” (https://www.eet-china.com/mp/a461967.html)

[4] Yahoo Finance/PRNewswire - “Global Semiconductor Equipment Sales Projected to Reach a Record High…” (https://finance.yahoo.com/news/global-semiconductor-equipment-sales-projected-070000769.html)

[5] EET China - “In-depth Analysis of BOSCH PM6 Power Module Platform Solution” (mentions Fuji Electric’s power module and inverter technology directions) (https://www.eet-china.com/mp/a462831.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.