In-depth Analysis of Investment Value in Hong Kong Stock Market Consumer Sector (2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

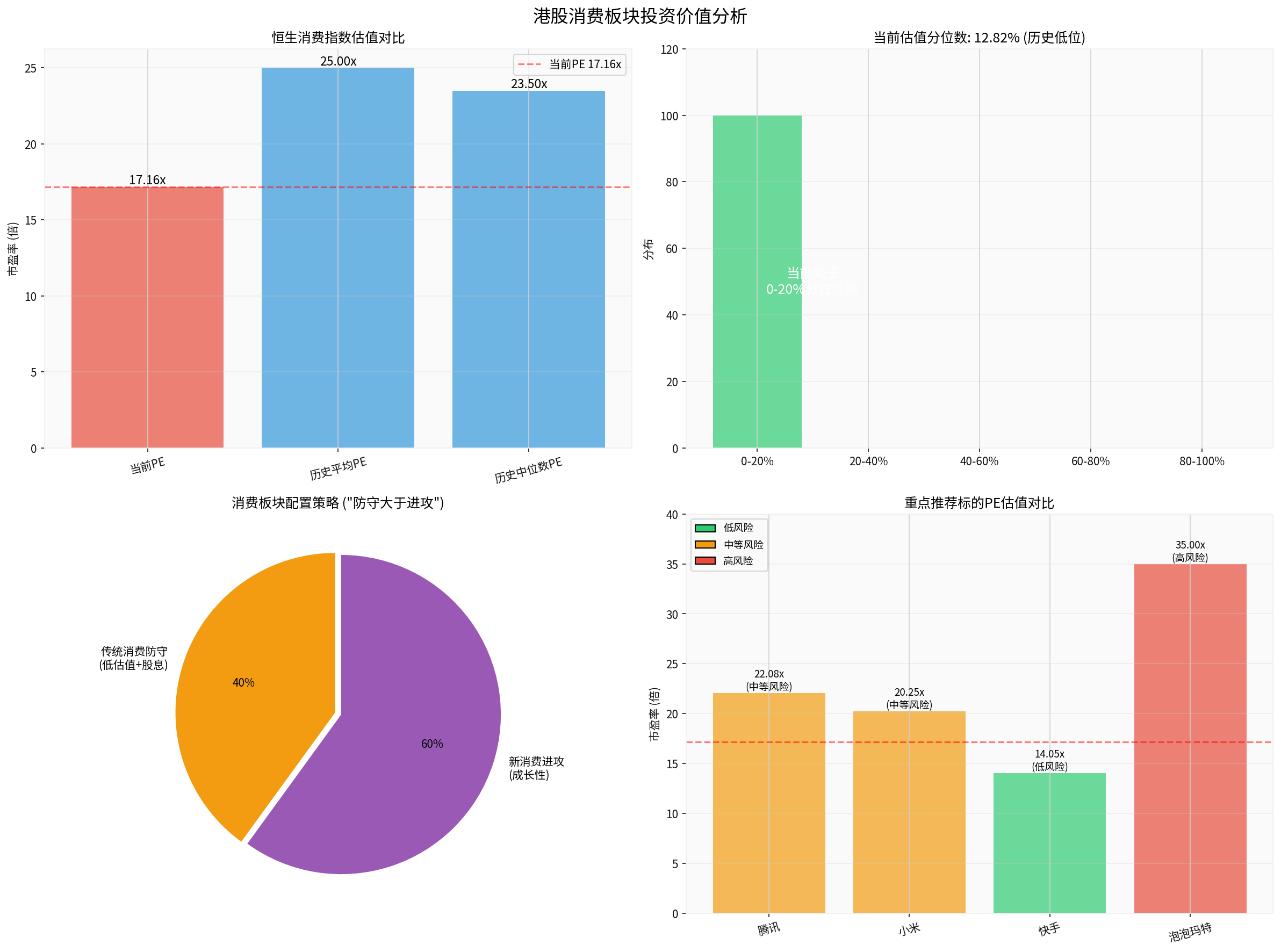

The current price-to-earnings (PE) ratio of the Hang Seng Consumer Index is approximately 17.16 times, at the 12.82% historical percentile, which is a clearly undervalued range. Compared to the historical mean and median, there is obvious room for valuation recovery [0].

- Current valuation percentile: 12.82% (low)

- Significant valuation advantage over history provides a good safety margin for medium-to-long-term layout.

Since 2024, the Hang Seng Index has fluctuated upward from approximately 17135 points to around 25819 points, with an interval increase of about 50.7%, indicating structural opportunities in the market after valuation recovery [0].

In the same period, the Hong Kong stock market showed structural differentiation, with capital concentrating on high-quality assets. From an annual perspective, 380 stocks doubled their prices within the year, and 13 stocks rose by more than 10 times, mainly concentrated in three main lines: biomedicine, technological transformation, and new consumption, reflecting the market’s preference for segment leaders and high growth [1].

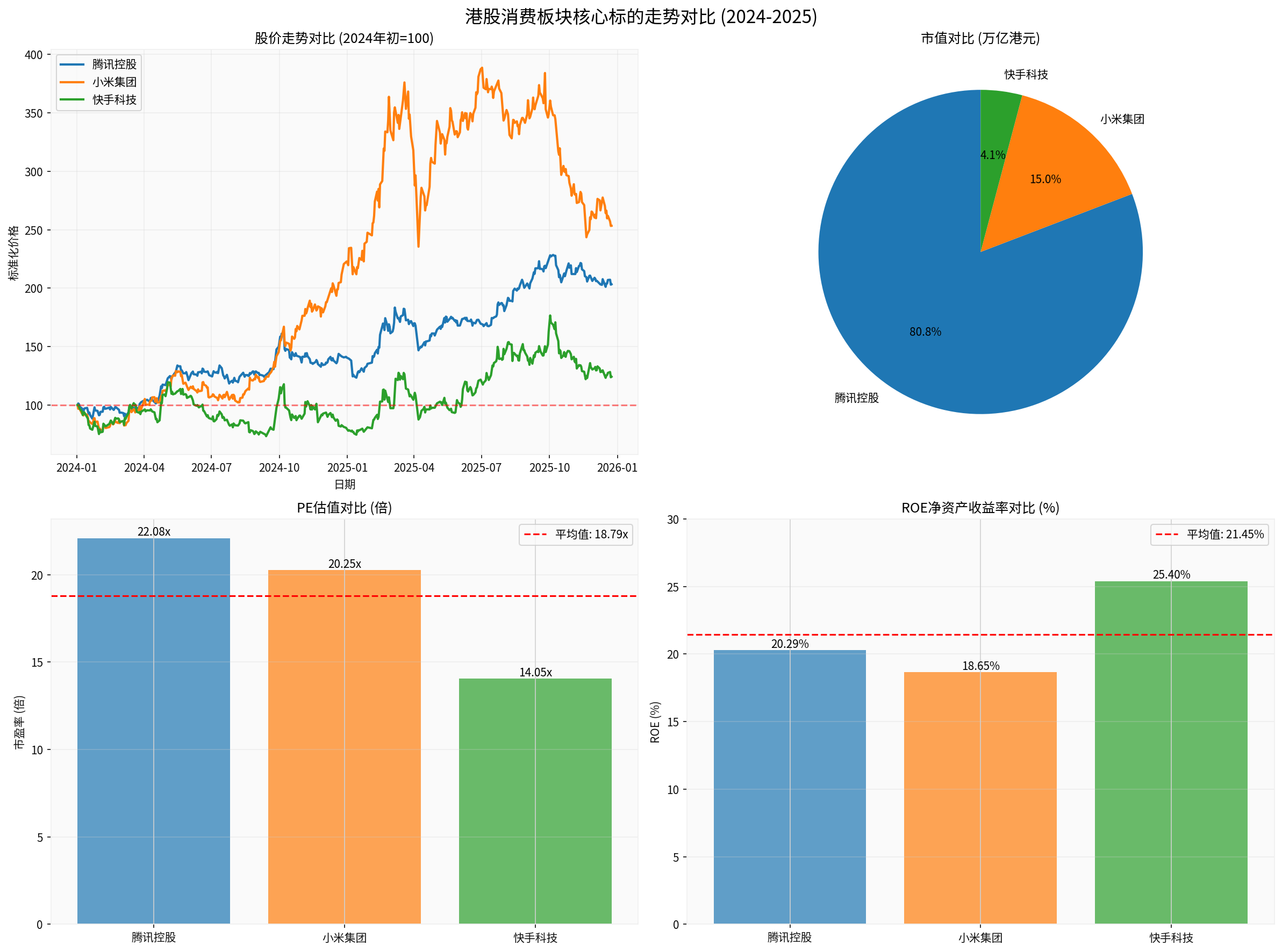

The above chart shows: Since the beginning of 2024, there have been significant differences in the trends of core targets related to Hong Kong consumer sector. Tencent (0700.HK) increased by over 100% in the interval, Xiaomi (1810.HK) increased by over 150% in the interval, and Kuaishou (1024.HK) performed relatively steadily. The internal differentiation of the sector highlights the elasticity of ‘new consumption’ and the defensive attributes of ‘traditional consumption’, which also provides a basis for subsequent allocation strategies.

Against the background of coexistence of current low valuation and structural opportunities, it is recommended to adopt a portfolio strategy of ‘defense over offense’:

- Defensive end (about 40%): Traditional consumption (low valuation + high dividend)

- Offensive end (about 60%): New consumption (growth-driven)

Traditional consumer enterprises have stable cash flow, high dividend yield, and defensive characteristics in economic uncertainty, making them suitable as ballast stones for the portfolio [2].

- Valuation advantage: The current PE (TTM) of the Hang Seng Consumer Index is still in the historically low range, providing a safety margin [0].

- Policy environment: Macro-level consumption support policies continue to be introduced, which helps restore consumption scenarios and repair corporate profits [2].

- Allocation value: Provides stable cash flow and defensive buffer in the portfolio.

New consumption represents the trend of consumption upgrading and innovation, including trendy play IP, smart hardware, content e-commerce, etc. Relevant leaders have brand awareness, product iteration, and channel integration capabilities, with clear growth paths [2].

- New consumption trends: The expansion of segmented tracks driven by the rise of national trends, IP economy, smart consumption, etc.

- Target examples: Pop Mart (trendy play IP economy), Xiaomi (smart hardware and IoT ecosystem), Kuaishou (content e-commerce and live broadcast ecosystem), etc., have leading advantages in their respective tracks.

The left side of the chart shows the sector valuation: the current PE of the Hang Seng Consumer Index is about 17.16x, which is lower than the historical average level and at the 12.82% percentile (historical low). The right side of the allocation strategy diagram shows ‘defense over offense’, achieving a balance between offense and defense with a combination of 40% traditional consumption +60% new consumption [0,2].

- Market value/price: Approximately HK$5.48 trillion, price about HK$603 [0].

- Valuation indicators: PE (TTM) about 22.08x, in a reasonable range [0].

- Financial quality: ROE about 20.29%, net profit margin about29.93%, abundant cash flow [0].

- Technical signals: Currently in a sideways consolidation stage, short-term support around HK$597, resistance around HK$609 [0].

- Financial analysis: Conservative financial attitude, low debt risk, strong free cash flow (about HK$181.8 billion) [0].

- Growth and trend: Interval increase of over100% since early2024, and relatively mild Beta (about0.85), showing stable characteristics [0].

- Market value/price: Approximately HK$1.02 trillion, price about HK$39.22 [0].

- Valuation indicators: PE (TTM) about 20.25x, relatively reasonable valuation [0].

- Financial quality: ROE about18.65%, net profit margin about9.84%, stable operation [0].

- Technical signals: Short-term indicators such as KDJ show oversold signs, support level around HK$38.6, resistance level around HK$41.1 [0].

- Financial analysis: Relatively active financial attitude, low debt risk, stable free cash flow (about HK$32 billion) [0].

- New consumption logic: Continuous volume of automobiles and IoT, the strategy of ‘mobile phone × AIoT × automobile’ continues to advance, providing momentum for medium-to-long-term growth [2].

- Market value/price: Approximately HK$276.17 billion, price about HK$64.6 [0].

- Valuation indicators: PE (TTM) about14.05x, attractive valuation [0].

- Financial quality: ROE about25.40%, significant improvement in profitability [0].

- New consumption logic: Continuous expansion of content e-commerce penetration and live broadcast scenarios, with large room for improvement in user duration and commercialization efficiency.

- Market position and logic: Leader in the IP trendy play track, with strong brand awareness and channel capabilities; continues to benefit from the trend of younger consumption and ‘self-pleasure consumption’ [2].

- Research views: Some institutions regard it as a representative target in the direction of consumption and new consumption in 2026, prompting attention to the progress of its brand globalization and IP matrix expansion [1].

- Risk warning: Relatively high expected valuation, need to pay attention to store expansion, inventory, and IP sustainability.

- Market value/price: Approximately HK$2.71 trillion, price about HK$146 [0].

- Valuation indicators: PE (TTM) about19.81x, moderate valuation [0].

- Financial quality: ROE about12.16%, net profit margin about12.19%, healthy liquidity [0].

- Analyst rating: Overall consensus is ‘Buy’, most institutions give positive ratings [0].

- New consumption logic: Continuous advancement of cloud computing, digital commerce, and globalization layout, providing support for long-term growth.

- Large room for valuation recovery: The current PE (TTM) of the Hang Seng Consumer Index is about17.16x, at the12.82% historical percentile, with high safety margin [0].

- Policy and macro environment: Consumption stimulus policies continue to be introduced, and consumption scenarios and corporate profits are expected to gradually recover [2].

- Structural opportunities: New consumption tracks have outstanding growth, and traditional consumption provides stable returns [1,2].

###4.2 Allocation Recommendations

- Defensive end (about40%): Traditional consumption targets with low valuation + high dividend yield, providing defense and stable cash flow [2].

- Offensive end (about60%): New consumption growth targets, such as Xiaomi, Kuaishou, Pop Mart, etc., to grasp the dividends of consumption upgrading and innovation [1,2].

###4.3 Risk Warnings

- Macroeconomic fluctuations: If terminal demand recovery is less than expected, it may affect the pace of profit recovery of consumer enterprises [2].

- Geopolitical and policy risks: External uncertainties, regulatory and tax policy changes may disturb valuations and profits.

- Individual stock risks: Valuations and expectations of new consumption targets are volatile, so it is necessary to closely track performance fulfillment and IP/product iteration rhythm.

- Liquidity risk: Hong Kong stocks are affected by overseas interest rate and exchange rate environments, so it is necessary to pay attention to Fed policies and capital flow changes [2].

The Hong Kong consumer sector is overall in the undervalued range, with the Hang Seng Consumer Index at about12.82% valuation percentile, providing a good safety margin and recovery space for medium-to-long-term layout. Adopting a portfolio strategy of ‘defense over offense’, with traditional consumption providing defense and new consumption providing elasticity, is a relatively stable allocation idea at present.

- Short-term: Focus on structural opportunities brought by valuation recovery and policy catalysis, and select leading targets and those with stable cash flow [2].

- Medium-to-long-term: Layout new consumption tracks, grasp consumption upgrading and innovation trends, such as smart hardware, IP economy, content e-commerce, etc. [1,2].

[0] Jinling API Data

[1] Yahoo Finance Hong Kong - “Hong Kong Stocks Boom This Year! Guanggangwan Holdings Soars 32.71x to Become the Champion of Gains” (https://hk.finance.yahoo.com/news/港股大年-10倍股札堆-380隻翻倍股-最高漲幅近33倍-122004354.html)

[2] Asdaq Financial News - “China Merchants Securities International Expects Hong Kong Stocks to Move Toward Profit Growth-Driven, with Hang Seng Index Having10% to15% Upside Next Year” (https://hk.finance.yahoo.com/news/大行-招商證券料美國明年經濟保持溫和增長-港股將邁向盈利增長主導-021730564.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.