In-Depth Analysis of Valuation Reshaping and Investment Value of Lithium Mining Enterprises After Lithium Carbonate Price Breaks Through 120,000 Yuan/Ton

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to Jinling API data [0], the latest share price of Zhongkuang Resources (002738.SZ) is 80.22 yuan, with a year-to-date increase of

According to industry data,

- Stricter Environmental Policies: A large mica lithium mine in Jiangxi conducted an environmental impact assessment public notice on December 18, and the resumption of production has been delayed again. There is no hope of resuming production in December, and there are also difficulties in resuming production within January [6]

- Decline in Capacity Utilization: Although the production of lithium from spodumene has increased slightly, the production of lithium from mica has fallen, leading to an overall supply contraction [3]

- Strengthened Cost Support: The comprehensive cost of lithium extraction from spodumene ranges from 60,000 to 100,000 yuan/ton, and the lowest cost of lithium extraction from salt lakes is about 32,000 to 35,000 yuan/ton [4][5]

- Explosive Growth in Energy Storage Market: From January to November 2025, domestic energy storage cell production increased by52%year-on-year, and some orders have been scheduled until 2026 [1]

- Structural Upgrade of New Energy Vehicles: Demand for mid-to-high-end long-range models has increased, and the delivery cycle for Li Auto and AITO has been extended to 19-22 weeks. These models have higher unit lithium consumption [1]

- Increased Policy Support: The 2025 new energy vehicle subsidy policy is expected to exceed expectations, and the growth rate of power batteries may exceed market expectations [1]

According to Shanghai Wenhua Finance data, the amount of funds locked in lithium carbonate futures contracts has surged from 6.7 billion yuan at the beginning of the year to

During the lithium price decline cycle (2024-H1 2025), leading lithium mining enterprises suffered huge losses:

- Ganfeng Lithium lost 2.07 billion yuan in 2024 [5]

- Tianqi Lithium lost 7.9 billion yuan in 2024 [5]

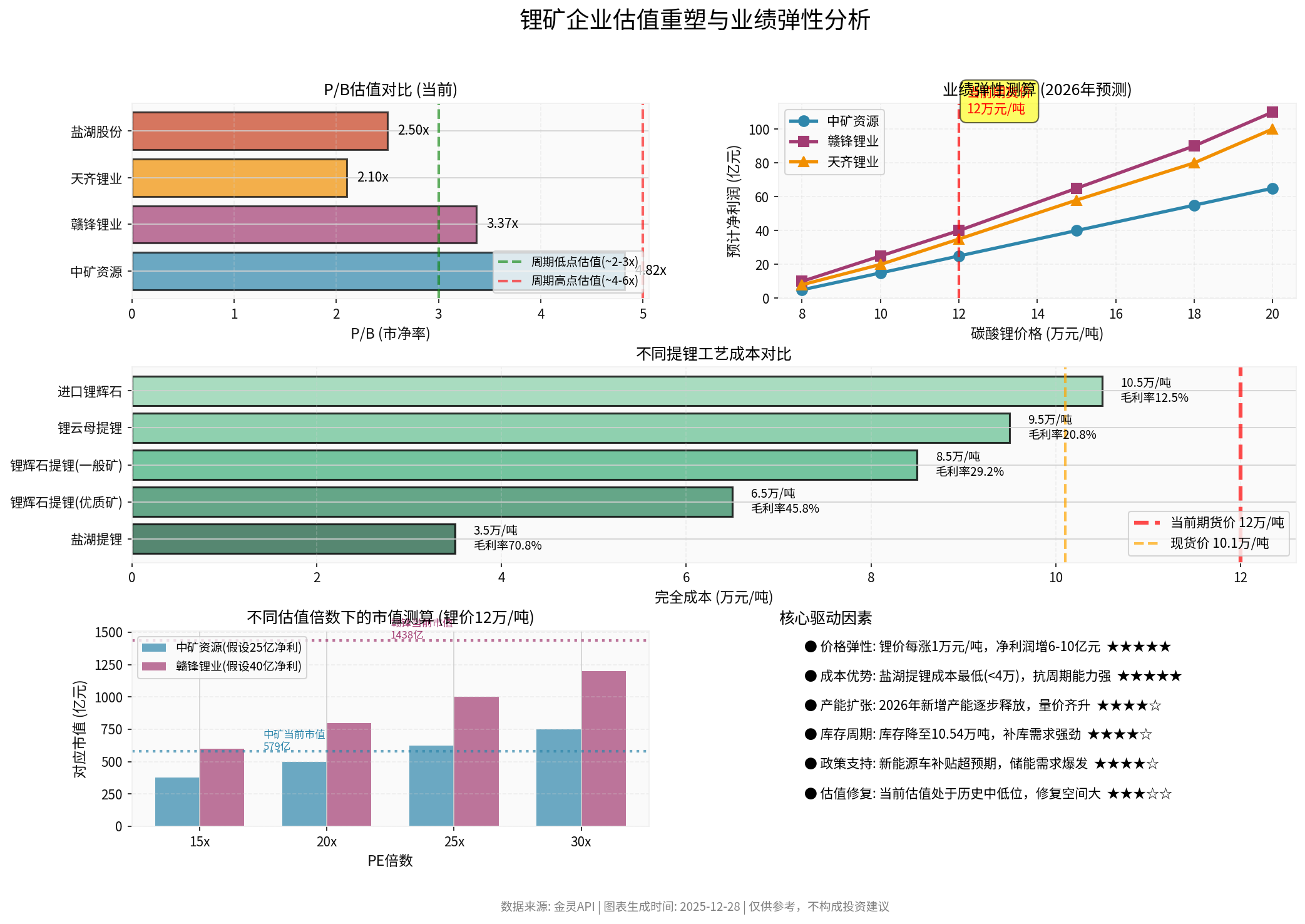

Negative profits have rendered PE valuation meaningless, and the market has shifted to

Sensitivity analysis based on web search data shows [4]:

| Lithium Carbonate Price | Lithium Carbonate Gross Profit | Potash Fertilizer Gross Profit | Total Gross Profit | Expected Net Profit Attributable to Parent | Reasonable Market Value (22x PE) |

|---|---|---|---|---|---|

| 101,000 yuan/ton | 5.331 billion yuan | 5.39 billion yuan | 10.72 billion yuan | 7.5-8.0 billion yuan | 160-180 billion yuan |

| 123,000 yuan/ton | 6.981 billion yuan | 5.39 billion yuan | 12.37 billion yuan | 9.0-9.5 billion yuan | 190-210 billion yuan |

| Indicators | Zhongkuang Resources (002738.SZ) | Ganfeng Lithium (002460.SZ) |

|---|---|---|

Current Share Price |

80.22 yuan [0] | 68.57 yuan [0] |

Year-to-Date Increase |

+130.45% [0] | +101.26% [0] |

Total Market Value |

57.88 billion yuan [0] | 143.77 billion yuan [0] |

P/B Ratio |

4.82x [0] | 3.37x [0] |

P/E Ratio |

138.31x [0] | -99.60x (Loss) [0] |

ROE |

3.43% [0] | -3.41% [0] |

Current Ratio |

2.98 (Excellent) [0] | 0.73 (Weak) [0] |

Financial Risk |

Low Risk [0] | High Risk [0] |

Expected 2026 Net Profit (120k yuan/ton) |

Approx.2.5 billion yuan [Estimated] | Approx.4.0 billion yuan [Estimated] |

Performance Elasticity |

★★★★☆ (Medium Market Value, High Elasticity) | ★★★★☆ (Leading Scale, Moderate Elasticity) |

Risk Resistance Ability |

★★★★★ (Financially Healthy) | ★★★☆☆ (Debt Ratio 58.55%) |

- Financially Stable: Current ratio of2.98, far higher than the industry average, with a financial risk rating of “Low Risk” [0]

- High Performance Elasticity: Medium market value (57.9 billion yuan), with prominent performance elasticity driven by lithium price increases

- Strong Performance This Year: 6-month increase of149.05%, outperforming Ganfeng Lithium (100.79%) [0]

- Cost Advantage: Relying on its own mines, it has cost control capabilities

- Current P/B ratio of4.82x, at the valuation center of cyclical stocks [0]

- If lithium price remains at120,000 yuan/ton in 2026, expected net profit is 2.5 billion yuan, given25x PE, target market value is 62.5 billion yuan, upside potential of about8%

- If lithium price rises to150,000 yuan/ton, expected net profit is 4.0 billion yuan, target market value is100 billion yuan, upside potential of about73%

- Industry Leader: Global leading lithium enterprise with the largest production capacity and the widest resource layout

- Rich Resource Reserves: Owns Argentina’s Mariana Lithium Salt Lake, Cauchari-Olaroz Lithium Salt Lake, Mali’s Goulamina Spodumene Project, etc. [3]

- Continuous Capacity Expansion: Lithium salt production capacity continued to be released in the fourth quarter, and substantial turnaround is expected in2026 [2]

- Continuous Recovery of Lithium Salt Prices: Combined with other business income, the profit scale in the fourth quarter may exceed market expectations [2]

- Financial Pressure: Asset-liability ratio of58.55%, sum of short-term and long-term loans exceeds18 billion yuan, while monetary funds are only9.9 billion yuan [5]

- Liquidity Risk: Current ratio of0.73, quick ratio of0.46, with relatively large short-term debt repayment pressure [0]

- Current P/B ratio of3.37x, at the historical middle-low level [0]

- Lost 2.07 billion yuan in 2024, but expected to turn around to profit in 2026 with net profit of about4.0 billion yuan (lithium price120k yuan/ton) [2][4]

- Given 25x PE, target market value is100 billion yuan, current market value of 143.8 billion yuan has certain bubbles

- In the long run, if lithium price stabilizes at150k yuan/ton, net profit can reach6.5 billion yuan, target market value is 162.5 billion yuan, upside potential of about13%

- Significant Cost Advantage: The average grade of Australia’s Greenbushes spodumene mine is 2.4%, with a cash cost of only about 20k yuan/ton and a comprehensive cost of about60k yuan/ton [5]

- Capacity Expansion: The third phase expansion project of Greenbushes mine has officially started feeding and trial production, adding520k tons/year capacity [5]

- Lost 7.9 billion yuan in 2024, but has turned around to profit in the first three quarters of 2025 with net profit of180 million yuan [2]

- Lowest Cost: The full cost of lithium extraction from salt lakes is 32k-35k yuan/ton, and cash cost is <30k yuan/ton [4]

- Strong Anti-Cyclical Ability: Potash fertilizer business contributes basic profit of 3-4 billion yuan/year, while lithium business contributes elastic profit [4]

- Capacity Release: 40k tons of lithium salt capacity was put into production at the end of September2025, with total capacity reaching 80k tons, and2026 will enter the volume release period [5]

- Lithium carbonate price rose from 59k yuan/ton to120k yuan/ton, an increase of over100% [1]

- The market confirmed that the supply-demand pattern has shifted from “surplus” to “tight balance”

- The lithium battery sector has corrected20-25% from its October high, and valuation has returned to a reasonable range [6]

- The valuation of mainstream lithium battery companies in 2026 is less than 20x, significantly lower than the reasonable valuation (30-35x) corresponding to the demand growth rate of over30% [6]

- Currently in this stage

- Lithium price remains at a high level of120k-150k yuan/ton

- Enterprise performance improves significantly, turning from loss to profit

- EPS growth drives share price increases

- The industry enters a normalized “tight balance”

- Leading enterprises obtain valuation premium (30-35x PE)

- Similar to the lithium mining super cycle of 2019-2021

- Price Elasticity (★★★★★)

- For every10k yuan/ton increase in lithium carbonate, the net profit of leading lithium enterprises increases by600-1000 million yuan

- Current lithium price is120k yuan/ton; if it rises to 150k yuan/ton, performance elasticity reaches 50-100%

- Cost Advantage (★★★★★)

- Lithium extraction from salt lakes has the lowest cost (<40k yuan/ton), with gross margin up to 70%+

- Lithium extraction from spodumene (high-quality ore) costs65k yuan/ton, with gross margin of 45%+

- The cost curve is steep, and leading enterprises have strong anti-cyclical capabilities

- Capacity Expansion (★★★★☆)

- New capacity in2026 will be gradually released, with both volume and price increasing

- Zhongkuang Resources, Ganfeng Lithium, etc. all have expansion plans

- Inventory Cycle (★★★★☆)

- Inventory dropped to105,400 tons, with strong restocking demand

- Reasonable inventory is169,000 tons, with a gap of63,600 tons

- Policy Support (★★★★☆)

- New energy vehicle subsidies exceed expectations

- Explosive growth in energy storage demand

- The state promotes large-scale construction of new energy storage, with a target of over180 million kilowatts of installed capacity by the end of 2027

- Valuation Repair (★★★☆☆)

- Current valuation is at historical middle-low level

- The PE of mainstream lithium battery companies in 2026 is less than 20x

- Valuation and performance growth are mismatched, with large repair space

- Salt Lake Co., Ltd. ★★★★★

- Lowest cost (32k-35k yuan/ton), strongest anti-cyclical ability

- Potash fertilizer business provides stable cash flow

- Largest performance elasticity in2026, sufficient valuation repair space

- Zhongkuang Resources ★★★★☆

- Financially stable (current ratio of 2.98), low risk

- Medium market value, high performance elasticity

- 130% increase this year, high market recognition

- Tianqi Lithium ★★★★☆

- Significant cost advantage (comprehensive cost of60k yuan/ton)

- High-quality resource reserves, capacity expansion in progress

- Strong expectation of performance reversal after huge loss in2024

- Ganfeng Lithium ★★★☆☆

- Industry leader, richest resource reserves

- However, high debt ratio (58.55%), large financial pressure

- Current market value of 143.8 billion yuan has certain bubbles; need to wait for performance realization

- Price Volatility Risk

- If lithium carbonate price falls below 80k yuan/ton, Salt Lake Co., Ltd.'s net profit will drop to about 6 billion yuan, corresponding to a market value of about132 billion yuan [4]

- Futures price volatility intensifies; on December 24, Guangzhou Futures Exchange has taken measures to strengthen risk control and adjust trading limits [1]

- Capacity Release Below Expectations

- Delayed production of new projects may affect2026 performance

- Resumption of production of Jiangxi mica lithium mine is delayed, but sudden resumption may increase supply in the future [6]

- Intensified Industry Competition

- Capacity expansion of South American salt lakes and domestic mica lithium may suppress price increase space

- Global supply surplus may still reach about100k tons of LCE in 2026 [5]

- Policy Change Risk

- New energy subsidy retreat

- Stricter environmental policies increase costs

- Geopolitical factors affect overseas resource acquisition

- Demand Below Expectations

- Slowdown in new energy vehicle sales growth

- Energy storage installed capacity below expectations

- Neutral Scenario: Lithium carbonate price remains at 100k-120k yuan/ton

- Optimistic Scenario: Supply disturbances continue, price hits150k yuan/ton

- Pessimistic Scenario: Capacity is released centrally, price falls back to 80k-100k yuan/ton

- Short-term (1-3 months): Focus on inventory data and progress of mid-stream production suspension to support prices; if inventory accumulation in the off-season is below expectations, lithium price is expected to continue to rise

- Medium-term (3-12 months): Focus on tracking2026Q1 performance forecasts and layout targets with performance exceeding expectations

- Long-term (1-3 years): Shift from “competing for output” to “competing for resources, technology, and products”; leading enterprises with cost advantages and resource reserves will stand out

- Aggressive Investors: Allocate30-40% of positions to lithium mining sector, focusing on Zhongkuang Resources and Salt Lake Co., Ltd.

- Conservative Investors: Allocate15-25% of positions to lithium mining sector, preferring financially stable Zhongkuang Resources

- Conservative Investors: Allocate 10-15% of positions, focusing on Salt Lake Co., Ltd. with prominent cost advantages

[0] Jinling API Data - Real-time Market, Financial Data, Technical Analysis

[1] Auto Man Media - “Half-Year Surge of117%, Why Did Lithium Price Suddenly Take Off?” (2025-12-25)

https://chejiahao.autohome.com.cn/info/24601648

[2] Tencent News - “Lithium Battery Stocks, Highlight Return” (2025-12-23)

https://news.qq.com/rain/a/20251223A05QXT00

[3] Caixin.com - “Lithium Industry: From "Weak Balance" to "Tight Balance"” (2025-12-24)

https://opinion.caixin.com/m/2025-12-24/102396734.html

[4] Fortune Account - “Based on Lithium Carbonate Spot Price of101k Yuan/Ton and Futures Price of123k Yuan/Ton on December24,2025…” (2025-12-24)

https://caifuhao.eastmoney.com/news/20251224181816727583100

[5] Finance Account - “Double! Is the Super Lithium Cycle Coming Again?”

http://mp.cnfol.com/50789/article/1766627603-142184228.html

[6] FX168 Finance - “Lithium Battery Stocks, Highlight Return” (2025-12-23)

https://www.fx168news.com/article/978435

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.