In-depth Analysis of Valuation Logic Reconstruction for Xiaomi Group's 'Human-Vehicle-Home Full Ecosystem'

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me provide you with an in-depth analysis of the valuation logic reconstruction after Xiaomi Group’s ‘Human-Vehicle-Home Full Ecosystem’ strategic transformation.

Xiaomi’s valuation logic needs to shift from a

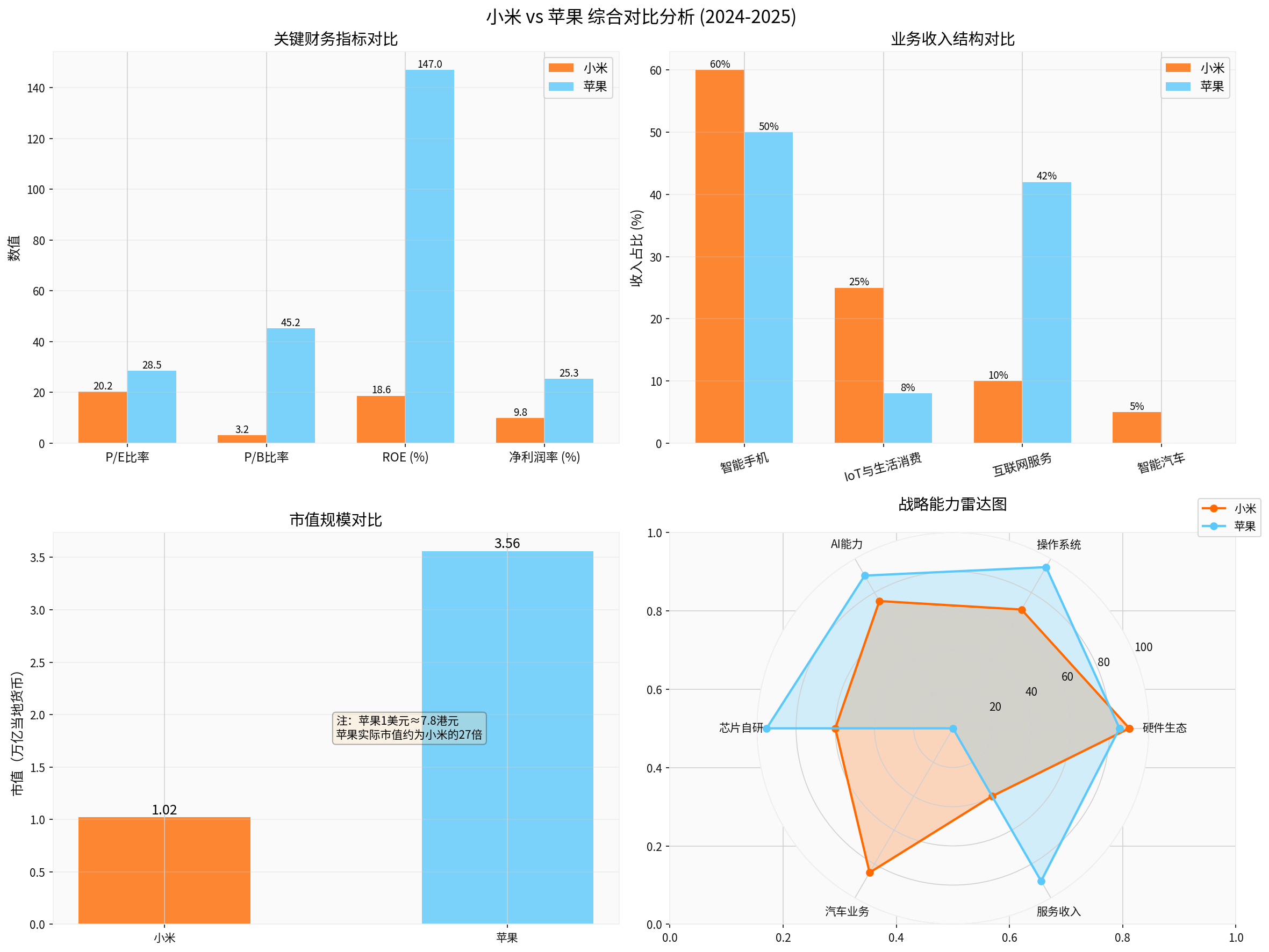

| Indicator | Xiaomi | Industry Comparison |

|---|---|---|

| Market Capitalization | HK$1.02 trillion (~US$131 billion) [0] | - |

| P/E Ratio | 20.25x [0] | Apple: 36.49x [0] |

| P/B Ratio | 3.16x [0] | Apple:55.43x [0] |

| ROE | 18.65% [0] | Apple:147% [0] |

| Net Profit Margin | 9.84% [0] | Apple:26.92% [0] |

Technical analysis indicates that it is currently in a

Chart 1: Comparison of Xiaomi and Apple in Key Financial Indicators, Business Structure, Market Capitalization Scale, and Strategic Capabilities

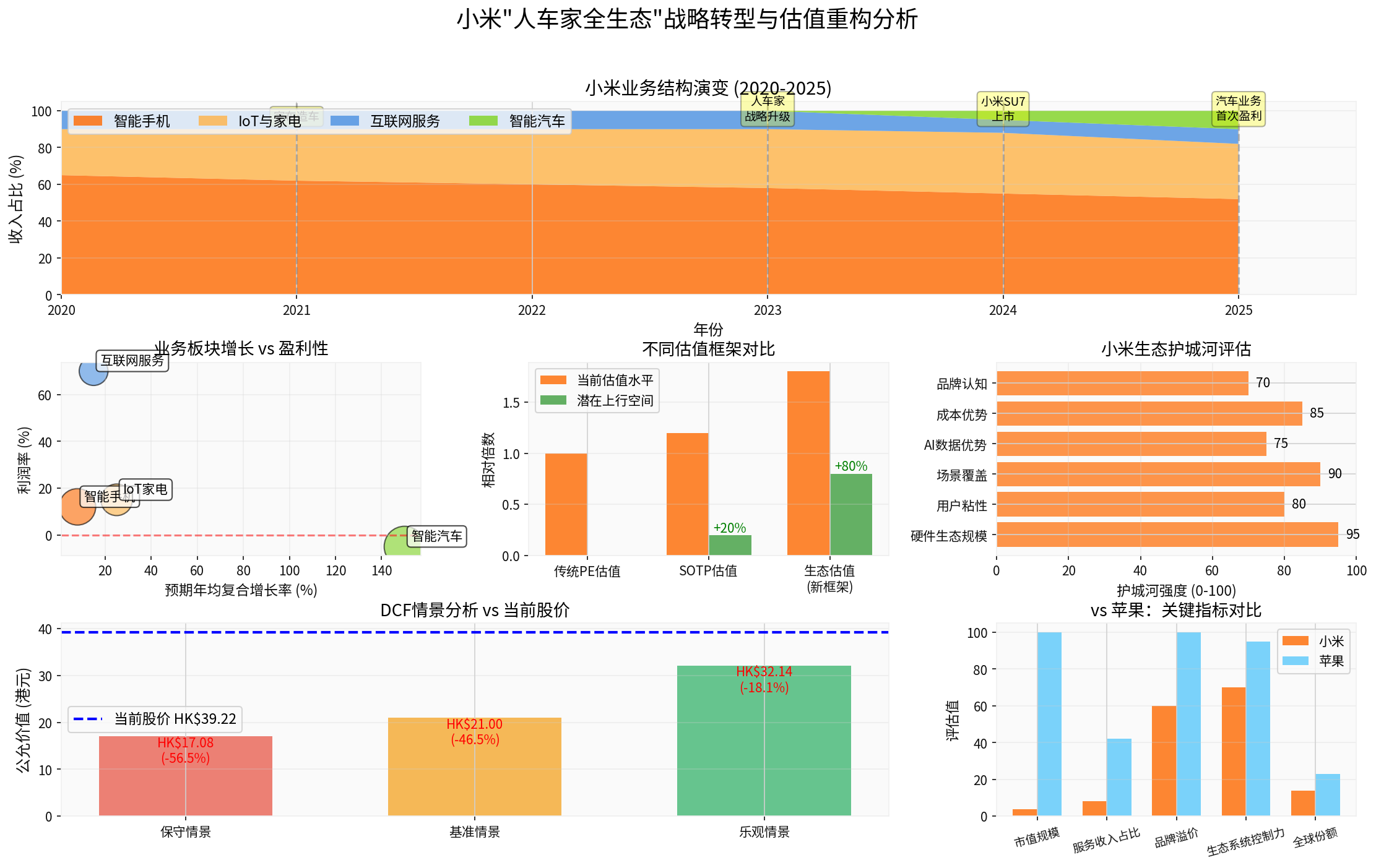

According to the broker API’s DCF analysis [0]:

| Scenario | Fair Value | vs Current Price (39.22HKD) |

|---|---|---|

| Conservative | 17.08 HKD | -56.5% |

| Base | 21.00 HKD | -46.5% |

| Optimistic | 32.14 HKD | -18.1% |

###3.2 Three Blind Spots of the Traditional Framework

- Scenario Missing: Does not consider the explosive growth potential of the smart car business (150% expected CAGR) [3]

- Synergy Discount: Cross-scenario data value between IoT devices, mobile phones, and cars is not quantified

- AI Value: The service revenue upgrade path brought by HyperOS + AI large model is underestimated

###4.1 Strategic Closed Loop Completed (2025 Key Milestones)

According to web search data, Xiaomi achieved three major breakthroughs in 2025 [1][2][3]:

- First Profit for Automotive Business: Smart electric vehicles and AI innovative businesses achieved their first profit in Q3, with a single-quarter profit of HK$29 billion

- YU7 Locked 240k Orders: Verified the execution capability of ‘Xiaomi Car Making’

- High Growth of IoT Business: IoT revenue increased by 34.6% YoY in the first three quarters of2025 [1]

Chart2: Evolution of Xiaomi’s Business Structure, Growth Potential of Each Segment, Comparison of Valuation Frameworks, and DCF Scenario Analysis

###4.2 Three Core Capability Pillars

According to Xiaomi’s official statement [1][2], it will invest

- Chips: Self-developed SoC ‘Xuanjie’ chip to reduce dependence on external supply chains

- Operating System: HyperOS connects three scenarios of mobile phones, cars, and home appliances

- AI: AI large models empower full-scenario intelligent experiences

###5.1 Business Segment Valuation

| Business Segment | Current Revenue Share | Valuation Method | Valuation Multiple | Independent Valuation |

|---|---|---|---|---|

| Smart Phone | 52% | P/E15x | Conservative Hardware Valuation | HK$0.53 trillion |

| IoT & Home Appliances | 30% | P/E20x | Consider Ecosystem Synergy | HK$0.31 trillion |

| Internet Services | 8% | P/E30x | High Margin Business | HK$0.25 trillion |

| Smart Automotive | 10% | PS5x | High Growth Track | HK$0.51 trillion |

Sum of Parts |

100% |

- | - | HK$1.60 trillion |

Ecosystem Synergy Premium |

- | - | +30% | +HK$0.48 trillion |

Target Valuation |

- | - | - | HK$2.08 trillion |

Upside Potential |

- | - | - | +104% |

###5.2 Three Sources of Ecosystem Premium

- Data Flywheel: 1 billion-level hardware devices generate full-scenario data to train AI models, improving service experience and monetization efficiency

- Cross-selling: Mobile phone users convert to car/home appliance users, reducing customer acquisition costs by over30%

- Subscription Revenue: High-margin businesses such as AI cloud services and smart home subscriptions increase in proportion, targeting from 8% to20%

###6.1 Core Gaps vs Apple

| Dimension | Xiaomi | Apple | Gap |

|---|---|---|---|

Market Cap Scale |

US$131 billion [0] | US$4.04 trillion [0] | 30x |

Service Revenue Share |

~8% [2] | 26.2% [0] | 18.2 percentage points |

Brand Premium |

Mid-to-high end | Luxury level | Significant Gap |

Global Phone Share |

14% (3rd) [2] | 23% (1st) [0] | 9 percentage points |

Ecosystem Control |

Open Ecosystem | Closed Loop | Model Difference |

###6.2 Xiaomi’s Unique Advantages

- More Comprehensive Scenario Coverage: Apple lacks an automotive business; Xiaomi is the only tech giant with full coverage of ‘Human+Vehicle+Home’

- Wider Price Range: Covers the full price range from 1,000 yuan to 10,000 yuan, with a larger user base (MAU over600 million)

- Stronger Execution: Completed car-making from 0 to1 in 3 years, proving ‘Xiaomi Efficiency’

###6.3 Three Paths to Catch Up with Apple

- High-end Strategy: Mobile phone ASP increases from 1,100 yuan to over1,500 yuan

- Automotive Business Scale: From 240k units/year to 1 million units/year

- IoT Home Appliances High-endization: Large home appliances account for over50%

- AI Cloud Services: Cross-device AI assistant subscriptions

- Financial Technology: Payment, credit, insurance

- Content Services: Video, music, game distribution

- European Automotive Market: Leverage Xiaomi’s mobile phone channel advantages

- India, Southeast Asia: Localized manufacturing of IoT home appliances

- Latin America, Africa: Cost-effective mobile phone + IoT combination

###7.1 Investment Recommendations

- Expectation Gap: The market still uses hardware company valuation (P/E20x) and ignores ecosystem value

- Catalysts: Large-scale profitability of the automotive business in2026, commercialization of AI large models

- Safety Margin: Current price has corrected by 28%, close to the DCF base scenario valuation of HK$21

###7.2 Key Risks

- Automotive Business Underperforming: YU7 delivery volume below target, gross margin difficult to turn positive

- Mobile Phone Business Decline: Global smartphone market saturation, intensified domestic competition (e.g., Huawei)

- Geopolitical Risks: Policy changes in the Indian market, access restrictions in European and American markets

- Valuation Bubble Risk: Current price is higher than the DCF optimistic scenario of HK$32.14 [0]

###7.3 Investment Rhythm Suggestions

| Time Window | Key Observation Indicators | Investment Strategy |

|---|---|---|

| 2025 Q4 | Monthly car delivery volume, IoT growth rate | Batch position building, add on dips |

| 2026 H1 | Annual profit of automotive business, AI service revenue | Hold mainly, focus on fulfillment |

| 2026 H2 | Global market share, service revenue proportion | Evaluate fulfillment after valuation repair |

Considering the complexity of Xiaomi’s ‘Human-Vehicle-Home Full Ecosystem’ strategy, it is recommended to enable the

- Xiaomi vs Huawei vs Apple Ecosystem Comparison: Scenario coverage, user stickiness, monetization efficiency

- Smart Automotive Industry Analysis: Xiaomi SU7/YU7 vs Tesla Model3/Y vs BYD Han/HaiBao

- IoT Home Appliance Industry Chain Research: Xiaomi supply chain, self-developed chips, intelligent manufacturing capabilities

- AI Large Model Commercialization Path: HyperOS AI function user penetration rate, payment willingness survey

[0] Gilin API Data (Xiaomi Group 1810.HK and Apple AAPL financial data, stock price, DCF analysis, technical analysis)

[1] Tencent News - ‘Giants Battle for ‘Human-Vehicle-Home’: Xiaomi to Invest 200 Billion Yuan in Next5 Years’ (https://news.qq.com/rain/a/20251217A06WEG00)

[2] Xueqiu Column - ‘Annual Investment Review: When Xiaomi’s ‘Human-Vehicle-Home Full Ecosystem’ Meets AI New Starting Point’ (https://xueqiu.com/9210717241/367934587)

[3] NetEase News - ‘Annual Investment Review: When Xiaomi’s ‘Human-Vehicle-Home Full Ecosystem’ Meets AI New Starting Point’ (https://www.163.com/dy/article/KHPCSS9205394MBC.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.