Sustainability of Cash Flow for Trendy Toy IPs and Construction of Pop Mart's IP Moat

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on an in-depth analysis of Pop Mart (9992.HK),

- ROE: 54.52%- Extremely high shareholder return rate, indicating excellent capital efficiency

- Net Profit Margin: 30.32%- Excellent profitability, far exceeding the traditional toy industry

- Operating Profit Margin: 40.58%- Strong pricing power and cost control capabilities

- Free Cash Flow: HK$4.537 billion- Real cash creation ability

- Current Ratio: 3.01- Low financial risk, stable operation

- Hidden item probability is only 0.69% (1/144), creating strong “gambler psychology” and collection impulse

- Members contribute 92.7% of sales, with an average order value of RMB 230

- Social currency attribute: Second-hand market premium of 10-20 times, enhancing IP value perception [1]

- As a nearly 20-year-old IP, Molly’s sales still maintain a 76% annual growth rate (user context)

- Labubu’s global attention has been comparable to top IPs such as Harry Potter and Star Wars (Google Trends data) [1]

- Extend lifecycle through series iterations rather than relying on a single hit product

- 401 direct stores (over RMB 7 million annual revenue per store)

- 2,300 robot stores covering sinking markets

- Revenue from online channels such as Douyin live streaming increased by 90.7% year-on-year [1]

| IP Type | Representative Characters | Revenue Contribution | Strategic Position |

|---------------|---------------------------|----------------------|-----------------------------------|---------------------------|----------------------|-----------------------------------|

| Exclusive IP | PUCKY, Dimoo | - | Lock scarce design resources |

| Non-exclusive IP | Disney co-branded etc. | - | Expand user coverage, reduce dependence |

| Dimension | Tencent Games Strategy | Pop Mart Strategy | Similarity |

|---|---|---|---|

IP Reserve |

Invest in studios (Riot, Supercell) + self-developed | Sign a large number of artists + internal incubation | ⭐⭐⭐⭐⭐ |

Hit Mechanism |

Internal horse race mechanism (multi-team PK) | IP hierarchical operation + horse race mechanism | ⭐⭐⭐⭐⭐ |

Long-term Operation |

“Honor of Kings” continuous update for 10 years | Molly continuous iteration for nearly 20 years | ⭐⭐⭐⭐ |

User Stickiness |

Social attribute + gameplay | Collection attribute + social currency | ⭐⭐⭐ |

Monetization Ability |

In-game purchases + ads | Blind box sales + licensing + parks | ⭐⭐⭐⭐⭐ |

- Multiple studios develop similar games, internal competition

- “Honor of Kings” won from multiple MOBA projects

- Diversify risks via investment, cover all tracks

- Sign a large number of artists: Do not bet on a single designer, maintain diversification of IP sources

- IP hierarchical operation: Head IPs (Molly, Labubu) get key resources, mid-tier IPs test market response

- Fast iteration and elimination: Decide whether to continue investment based on market feedback after new IP launch

- Data-driven decision: Collect real-time sales data through 401 direct stores and online channels [1]

This mechanism ensures:

- Reduce hit dependence risk: Even if an IP declines, there are always new IPs to take over

- Increase hit rate: Under the law of large numbers, the larger the IP base, the more absolute number of hits

- Maintain innovation vitality: Competition among artists drives creative evolution

- Citi Group: Target price HK$308 (+90.1%), maintain “Buy”, expect 2025 revenue growth of 95% and overseas market growth of 159%

- Morgan Stanley: Target price HK$302 (+35%), maintain “Overweight”, expect sales to jump from US$3.6 billion in 2025 to US$6 billion in 2027

- Market Cap: HK$266 billion

- P/E Ratio: 35.53x (dynamic P/E ratio about 108x, reflecting high growth expectations)

- P/B Ratio: 16.98x

- IP matrix continuous expansion: Plan to incubate 10+ new IPs annually

- Globalization deepening: Americas growth rate nearly 900% in Q1 2025 [1]

- New category放量: Plush toy revenue increased by 1,289%

- Technology cost reduction: Vietnam and Mexico factories put into production reduce transportation costs by 25%

- Valuation risk: Current valuation is at historical high, requiring continuous performance delivery

- IP lifecycle management challenge: How to maintain freshness of old IPs and avoid aesthetic fatigue

- Policy regulatory risk: EU’s new Toy Safety Directive may increase compliance costs

- Intensified competition: New players enter the trendy toy market, may compress profit margins

Pop Mart is replicating Tencent Games’ IP empire path but has its unique advantages:

- Manage hit uncertainty through horse race mechanism

- Establish multi-level IP matrix to reduce dependence risk

- Long-term operation ability (Molly for nearly 20 years, Honor of Kings for 10 years)

- Stronger monetization ability: 30.32% net profit margin vs game industry average of 15-20%

- Lower customer acquisition cost: Social transmission attribute of blind boxes

- Broader international space: Lower cultural barriers for trendy toys than games (policy, language)

The trendy toy IP business model has proven to generate

For investors focusing on IP economy and consumption upgrade, Pop Mart represents a scarce target of “Chinese IP globalization”. Although its valuation is high, if it can maintain revenue growth above 50% and net profit margin above 30%, the current market cap is still supported. Key observation indicators include: Overseas revenue proportion, new IP incubation success rate, and progress of new businesses such as theme parks.

[0] Gilin API Data - Pop Mart (9992.HK) Company Profile, Financial Analysis, Stock Price Data

[1] Yahoo Finance Hong Kong - “In-depth Analysis of Investment Value of Pop Mart After Surge of Over 200%” (https://hk.finance.yahoo.com/news/深度分析泡泡瑪特爆升逾200-後投資價值-020500304.html)

[2] Yahoo Finance Hong Kong - “Hidden Worries Behind HK$430 Billion Market Cap! Pop Mart’s Quarterly Revenue Surges 204%” (https://hk.finance.yahoo.com/news/4300億市值背後的隱憂-泡泡瑪特單季營收暴漲204-但焦慮更重了-020022533.html)

[3] Zhihu - “How to Evaluate Pop Mart?” (https://www.zhihu.com/question/314026442)

[4] Zhihu - “What Do You Think of Pop Mart’s IPO?” (https://www.zhihu.com/question/399192627)

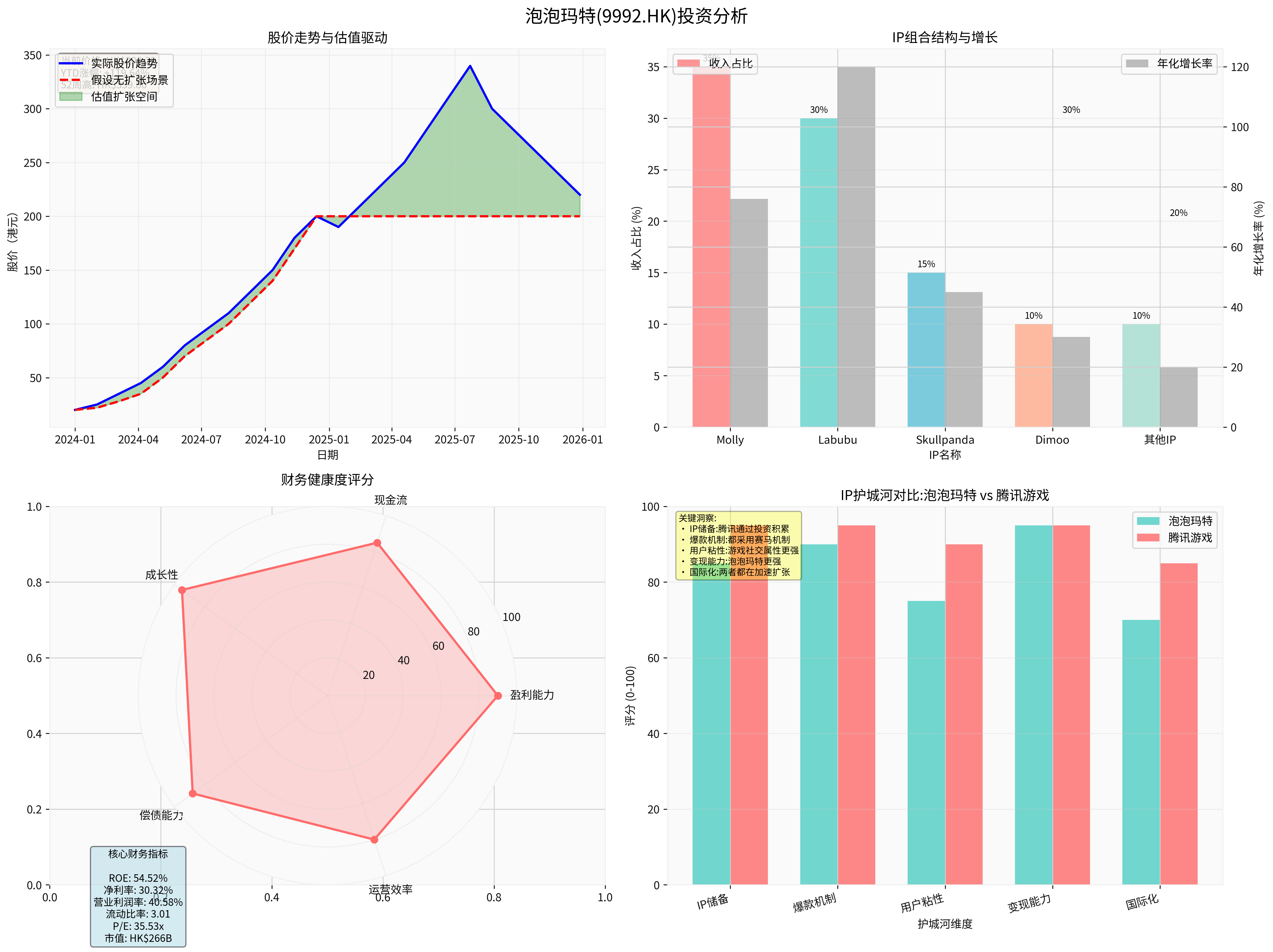

- Top left: Stock price trend and valuation drivers, showing rise from HK$20 at the start of 2024 to current HK$200.20, YTD increase of 119.64%

- Top right: IP portfolio structure, Molly and Labubu as top IPs contributing main revenue, Molly maintaining 76% annual growth

- Bottom left: Financial health radar chart, ROE 54.52%, net profit margin 30.32% etc. perform excellently

- Bottom right: Moat comparison with Tencent Games, Pop Mart stronger in monetization ability, Tencent stronger in user stickiness and IP reserve

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.