2026 Cross-Market Asset Allocation and Industry Investment Outlook Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Congratulations on achieving an excellent return rate of 22% in 2025; the 11.55x cumulative return over ten years fully demonstrates your investment capabilities. Based on your current portfolio structure and investment strategy, I will conduct a systematic analysis from two dimensions: cross-market allocation and industry outlook.

- Obvious valuation depression effect: Currently, Hong Kong stock valuations are in a historically low range, with the Hang Seng Index P/E around 9-10 times, having significant room for valuation repair [1][2]

- Expectation of improved liquidity: The Federal Reserve is expected to cut interest rates 3 times in 2026, and the liquidity environment of Hong Kong stocks is expected to continue to improve [1]

- Concentration of scarce assets: Leading new economy companies in technology, consumption, etc., are clustered in Hong Kong stocks; high-quality assets like Tencent have scarcity [2]

- High dividend yield: State-owned enterprises in Hong Kong stocks generally offer a dividend yield of 5-8%, which is highly attractive to long-term funds such as insurance and insurance capital [1]

- Domestic demand market advantage: Consumption upgrading and industrial upgrading bring structural opportunities

- Obvious policy-driven nature: Domestic policies directly affect the A-share market with faster response speed

- Ample liquidity: Southbound funds continue to flow in, with an expected increment of HK$600 billion in 2026 [1]

- Severe valuation differentiation: There is a huge valuation gap between growth stocks and traditional sectors, with arbitrage opportunities

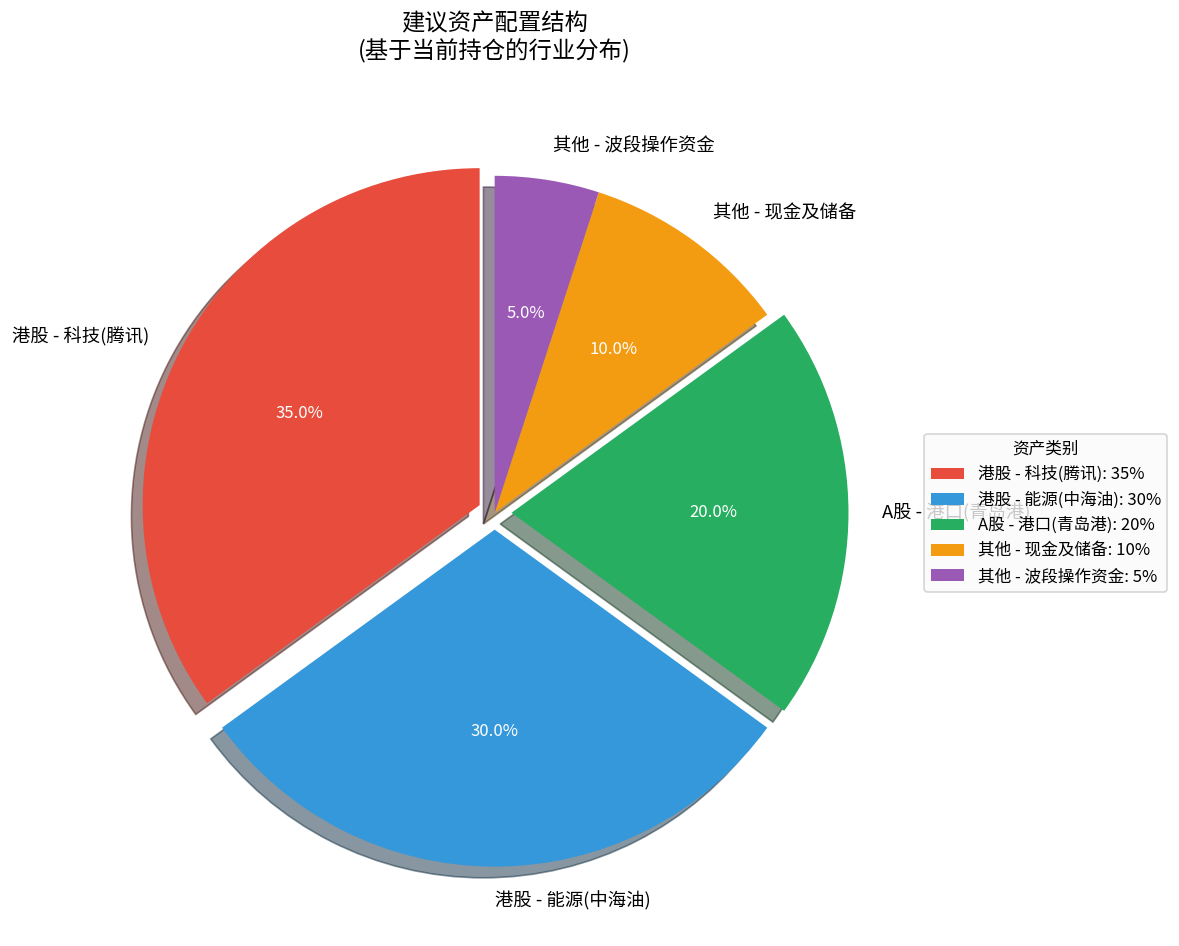

Based on your portfolio structure, it is recommended to adopt the allocation idea of

- Hong Kong Stock Market: 60-70% (your current core holdings)

- A-share Market: 25-35% (focus on ports, high-end manufacturing, etc.)

- Band Trading Funds:5-10% (for seizing short-term opportunities)

- Industry hedging: Hold growth-oriented technology stocks in Hong Kong and allocate value-oriented port stocks in A-shares to achieve risk diversification

- Exchange rate hedging: The correlation between Hong Kong stocks and A-shares is about 0.6-0.7, with a certain diversification effect [3]

- Liquidity complementarity: Use the liquidity differences between Stock Connect and A-shares for band trading

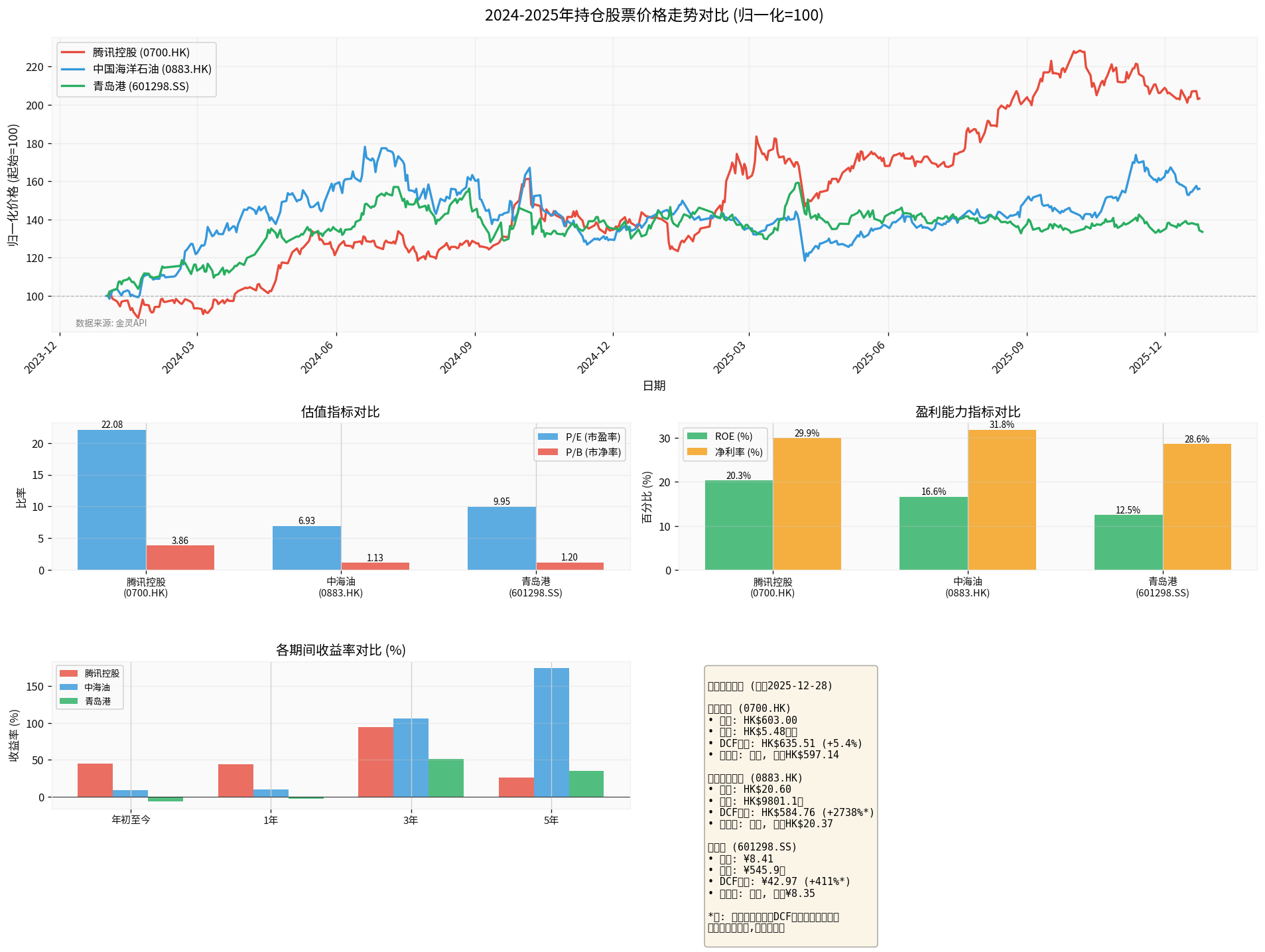

- Valuation level: P/E 22.08x, P/B 3.86x, in a historically reasonable range [0]

- Profitability: ROE 20.29%, net profit margin 29.93%, excellent profit quality [0]

- Financial health: Conservative accounting policies, low debt risk, abundant free cash flow [0]

- DCF valuation: Neutral scenario HK$635.51, with a 5.4% upside potential from the current price of HK$603 [0]

Currently in a sideways consolidation phase, support level HK$597.14, resistance level HK$608.86 [0]. Cumulative increase of 101% since 2024, YTD increase of 44.95%, strong performance [0].

- Accelerated AI commercialization: Tencent has in-depth layout in AI applications and cloud computing, and is expected to benefit from the commercialization of AI [1][2]

- Recovery of game business: Version number issuance is normalized, and overseas expansion continues to advance

- Stable fintech: WeChat Pay business grows steadily, and compliance risks are alleviated

- Recovery of advertising business: Economic recovery drives the rebound of advertising demand

- Regulatory policy uncertainty

- Macroeconomic fluctuations affect advertising and payment businesses

- Intensified competition in the internet industry

- Valuation attractiveness: P/E only 6.93x, P/B 1.13x, significantly undervalued [0]

- Profitability: Net profit margin 31.83%, ROE 16.65%, strong cash flow [0]

- Dividend advantage: Historical dividend yield of about 6-8%, with defensive value

- **3-year increase of 106.41%, 5-year increase of 174.67%, excellent long-term performance [0]

Sideways consolidation, support level HK$20.37, resistance level HK$21.03 [0]. Moderate volatility, suitable for band trading.

- Oil price center moves up: Global economic recovery, OPEC+ production cuts continue, Brent crude oil is expected to be 70-85 USD/barrel [4]

- Energy security demand: China increases oil and gas reserves, and CNOOC, as a leading offshore oil and gas company, benefits first

- Obvious cost advantage: Barrel oil cost is about 30 USD, and it can be profitable when oil price is above 40 USD

- Growth of natural gas business: Clean energy transformation drives natural gas demand, and CNOOC’s LNG business expands rapidly

- Global economic recession leads to a sharp drop in oil prices

- Accelerated replacement by new energy

- Geopolitical risks

- Valuation safety margin: P/E 9.95x, P/B 1.20x, in a historically low position [0]

- Stable dividends: Dividend yield of about 3-4%, suitable for long-term holding

- Financial stability: ROE 12.48%, net profit margin 28.56%, abundant cash flow [0]

- **3-year increase of 51.53%,5-year increase of 35.21%, stable performance [0]

Sideways consolidation, support level ¥8.35, resistance level ¥8.61 [0]. Technical indicators show oversold, with rebound opportunities [0].

- Foreign trade recovery expectation: Global economic repair drives the rebound of container throughput

- RCEP dividend release: Regional trade agreements bring long-term increments

- Accelerated port integration: Industry concentration increases, and leading companies benefit

- Belt and Road advancement: Qingdao Port, as an important northern port, has a prominent strategic position

- Rise of global trade protectionism

- Slowdown of domestic economic growth affects import demand

- Homogeneous competition between ports

- Improved supply-demand pattern: High execution rate of OPEC+ production cuts, slowdown of U.S. shale oil production increase

- Energy security strategy: China increases oil and gas reserves, and upstream exploration and production companies benefit [4]

- Valuation repair space: Currently, the P/E of the oil and gas sector is generally below 10x, with a safety margin

- CNOOC (0883.HK): Offshore oil and gas leader, obvious cost advantage

- PetroChina (0857.HK): Onshore oil and gas leader, natural gas business proportion increases

- U.S. Oil and Gas ETF (XOP): Diversify geopolitical risks

**Allocation Recommendation:**15-20% position, as a defensive high-dividend allocation of the portfolio

- Normalized regulation: Platform economy policy shifts to support, compliance risks are reduced [1][2]

- AI commercialization: Large model applications are implemented, and internet companies have data and application scenario advantages

- Valuation repair: Currently, the P/E of Chinese concept internet stocks is about 15-25x, in the historical middle and low position

- Tencent (0700.HK): Social + Game + Fintech, complete ecosystem

- Alibaba (9988.HK): E-commerce + Cloud Computing, rich AI application scenarios

- Meituan (3690.HK): Local life service leader, in-store business recovery

**Allocation Recommendation:**25-30% position, as the core growth allocation of the portfolio

- Foreign trade recovery expectation: Global trade is expected to recover by 2-3% in 2026

- Industry integration: Port resource integration accelerates, and leading companies’ bargaining power increases

- Belt and Road: Investment in ports along the route brings long-term growth space

- Qingdao Port (601298.SS): Northern port leader, diversified business

- Shanghai International Port (600018.SS): World’s largest container port, stable performance

- China Merchants Port (00144.HK): Port operation leader, global layout

**Allocation Recommendation:**10-15% position, as the value-type defensive allocation of the portfolio

- Energy security bottom line: Coal still accounts for more than 50% of China’s energy consumption

- Supply contraction: New capacity is limited, and supply-side constraints are obvious

- High dividend feature: Coal enterprises generally offer an 8-12% dividend yield

- China Shenhua (1088.HK): Coal-electricity integration leader, stable dividend rate

- Shaanxi Coal Industry (601225.SS): High-quality coal type, low cost

**Allocation Recommendation:**5-10% position, mainly for band trading

- Tencent Holdings (35%): Long-term holding, add positions on dips

- CNOOC (30%): Base position holding + band trading

- Qingdao Port (20%): Value investment, gradually add positions

- Cash Reserve (15%): Wait for the opportunity to add positions after market adjustment

- Focus on oil price fluctuations, trade CNOOC

- Focus on policy expectations of the internet sector, trade Tencent

- Focus on recovery signals of the port industry, trade Qingdao Port

- Exchange rate risk: Fluctuations in the exchange rate between Hong Kong dollars and RMB, it is recommended to pay attention to RMB asset hedging

- Policy risk: Changes in internet regulation and energy policies need to be tracked in time

- Market volatility: Hong Kong stocks have higher volatility than A-shares, control the proportion of a single position not exceeding 40%

- Liquidity risk: Keep 15-20% cash to deal with extreme market conditions

Based on current valuations and industry prospects, the expected portfolio return rate in 2026 is

- Tencent Holdings: Target return 20-30%

- CNOOC: Target return15-25% (including dividends)

- Qingdao Port: Target return10-15% (including dividends)

##5. Summary and Recommendations

Your portfolio already reflects the balanced strategy of

- Maintain the current allocation framework and make minor adjustments to weights

- Hong Kong stocks as the main focus, A-shares as a supplement, fully grasp the structural opportunities of the two markets

- Focus on the opportunities and risks of the three major industries: oil and gas, internet, and ports

- Adhere to disciplined operations, do not preset return targets, and maintain flexibility

Your 11.55x result over ten years proves that your investment strategy is effective; in 2026, based on maintaining the continuity of the strategy and moderately optimizing the allocation ratio, you are expected to continue to obtain stable returns.

[0] Gilin API Data - Stock Quotes, Financial Analysis, Valuation, Technical Analysis

[1] Securities Times - Four Main Lines Decode 2026 Investment Landscape: A-share Structural Opportunities Continue (https://www.stcn.com/article/detail/3531112.html)

[2]21 Finance - Industrial Securities: Optimistic about the 2026 A-share Market, Mining Four Structural Investment Opportunities (https://www.21jingji.com/article/20251218/herald/7b57f458db655bc2008a884e26ef1570.html)

[3] Securities Times - Six Private Equity Firms Look Forward to 2026: The Stock Market Still Has Good Opportunities, Growth and Value Styles Tend to Be Balanced (https://www.stcn.com/article/detail/3550076.html)

[4] Deloitte China Research -2026 Economic and Industry Outlook “Monthly Economic Overview” Issue101 (https://www.deloitte.com/cn/zh/our-thinking/research//issue101.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.