Analysis of Luzhou Laojiao's Strategic Transformation in Response to the 'Personal Consumption Era' and Challenges in 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

According to management research and market data, Q1 2026 will be a key test period for the baijiu industry:

- Demand Contraction Pressure: Mid-to-high-end baijiu faces an expected 30%-40% demand contraction, mainly due to the decline in official consumption scenarios [1]

- Weakening Peak Season Effect: The traditional Spring Festival peak season effect is expected to be only 4 times that of normal days, far below historical levels

- Pressure on Price System: The national baijiu wholesale price index fell 9.9% year-on-year in the first half of 2025, and the wholesale price of famous baijiu fell by 14.96% [2]

- In-depth Industry Adjustment: Of the 20 listed baijiu companies in A-share market in 2025, only 6 grew, 14 declined, and 3 suffered losses; many companies saw their Q3 revenue halved [3]

Baijiu consumption is undergoing a fundamental shift from ‘conspicuous consumption’ to ‘self-pleasing consumption’:

- Social Mode Change: Young people shift from ‘drinking at large tables’ to decentralized scenarios like ‘small gatherings or eating alone’

- Consumption Motivation Change: From business banquets and face-saving consumption to self-pleasure and emotional resonance

- Alcohol Degree Preference Shift: Post-95 Gen Z prefers low-alcohol baijiu, pursuing the experience of ‘slight intoxication without getting drunk’; over 70% of young people who first接触 baijiu choose products below 40 degrees [4]

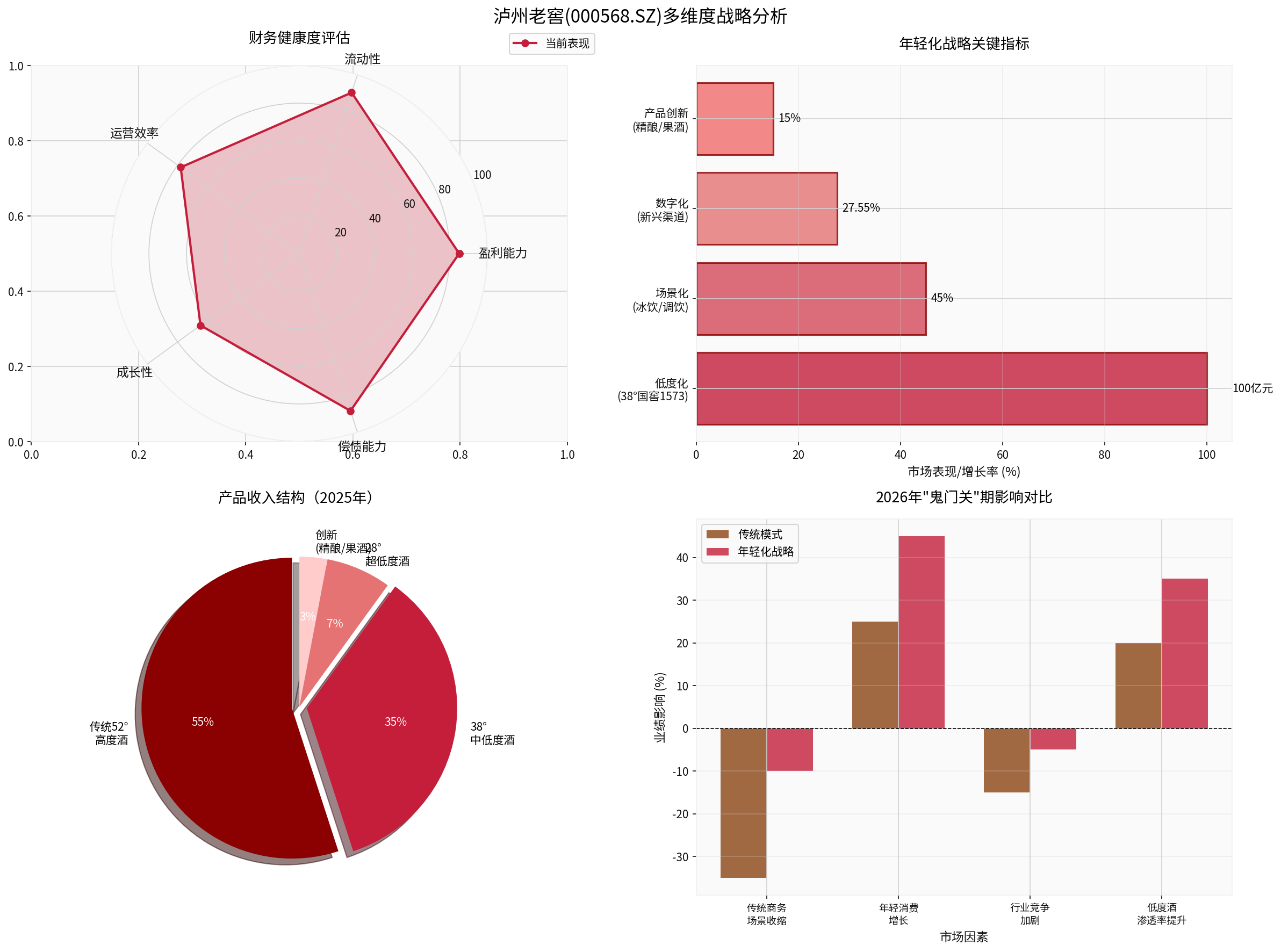

The chart shows Luzhou Laojiao’s comprehensive performance in financial health, core indicators of youth-oriented strategy, product structure, and response to 2026 challenges

Luzhou Laojiao has

| Product Line | Market Position | Revenue Contribution | Strategic Significance |

|---|---|---|---|

| 52° Guojiao 1573 | High-end Benchmark | ~55% | Maintain Brand Premium Capability |

| 38° Guojiao 1573 | Industry’s First 10-Billion-Yuan Low-Alcohol Blockbuster |

~35% | Core Pillar of Youth-oriented Strategy [4] |

| 28° and Below | Ultra-low Alcohol Innovation | ~7% | Lower Trial Threshold |

| Craft Beer/Fruit Wine/Derivatives | Emerging Track | Cultivate Future Growth [5] |

Luzhou Laojiao is reconstructing the connection with young consumers:

- Drinking Mode Innovation: Promote new consumption methods like iced drinking and mixed drinking to integrate baijiu into young people’s daily lives

- Cultural Landmark Construction: Build immersive museums and experience centers, reconstructing baijiu narratives through aesthetic language

- Cross-border Integration Exploration: Research and develop derivatives like craft beer, Chinese fruit wine, bio-fermented masks, and perfumes [5]

- Channel Digitalization: In the first half of 2025, revenue from emerging channels surged 27.55% year-on-year, with gross margin increasing by 4.52 percentage points [4]

Management clearly stated in the institutional research in December 2025 that during the ‘15th Five-Year Plan’ period, it will fully upgrade and implement the

- Internal: Focus on deepening core capabilities, optimizing resource allocation and synergy efficiency

- External: Strengthen core competitiveness, seize the strategic window of industrial structure adjustment and consumption change

- Positioning Transformation: Promote systematic transformation of strategic positioning, business layout, and operation mode

Luzhou Laojiao shows strong financial strength, providing solid support for strategic transformation:

- Excellent Profitability: ROE reaches 26.10%, net profit margin is as high as 42.11%, leading in the consumer goods industry [0]

- Healthy Financial Status: Current ratio is 3.61, quick ratio is 2.57, debt risk rating is ‘low risk’ [0]

- Relatively Reasonable Valuation: P/E ratio is 13.88x, P/B ratio is 3.53x, with certain safety margin [0]

- Adequate Cash Flow: Free cash flow reaches 18 billion yuan level, providing ammunition for product research and development and channel investment [0]

Despite stable fundamentals, the stock price has already reflected pessimistic industry expectations in advance:

- Short-term Pressure: Fell 11.57% in 1 month, 7.84% in 1 year, and 46.34% cumulatively in 3 years [0]

- Low Valuation: Current stock price is 119.39 yuan, far below the 52-week high of 146.72 yuan [0]

- Market Wait-and-see Sentiment: Average daily trading volume is 7.34 million shares, lower than the average level of 9.12 million shares [0]

Based on current product structure and market trends, we conduct scenario analysis on the impact of the 2026 ‘critical juncture’ period:

| Driving Factor | Impact of Traditional Mode | Hedge from Youth-oriented Strategy | Net Impact |

|---|---|---|---|

| Contraction of Traditional Business Scenarios | -35% |

- | -35% |

| Growth of Young Consumer Groups | +25% |

+20% |

+45% |

| Intensified Industry Competition | -15% |

+10% |

-5% |

| Increase in Low-Alcohol Wine Penetration | +20% |

+15% |

+35% |

Comprehensive Impact |

-5% to -10% |

+45% to +50% |

+40% or so |

- Q4 2025: Customer accumulation period before the traditional peak season; emerging channels and low-alcohol products enter the peak stocking season

- Q1 2026 ‘Critical Juncture’: Peak pressure period for the industry’s traditional mode; low-alcohol products welcome the verification window

- Q2-Q3 2026: Industry adjustment and bottoming period; leading baijiu companies are expected to increase market share [1]

- Second Half of 2026: Potential inflection point for industry bottoming and recovery; leading enterprises recover first [2]

| Enterprise | Youth-oriented Strategy | Progress and Effectiveness |

|---|---|---|

Luzhou Laojiao |

Low-alcoholization + Scenario-based + Digitalization | 38° product reaches 10-billion-yuan scale; emerging channels grow by 27.55% |

| Guizhou Moutai | Cross-border co-branding of ice cream and coffee | Marketing becomes popular but contributes little to performance |

| Wuliangye | 29° ‘Love at First Sight’ | Sales exceed 100 million yuan two months after launch, but Q3 performance fails |

| Shanxi Fenjiu | Set up special funds to support emotional consumption | Will increase resource investment in 2026 [3] |

- Homogeneous Competition: Enterprises like Wuliangye,古井贡, and Shede collectively increase investment in low-alcoholization; the industry needs to be alert to ‘homogeneous internal friction caused by rushing in’ [6]

- Consumer Education Cost: Changing young people’s stereotyped impression of baijiu requires long-term investment, with limited short-term results

- Channel Conflict: There is interest game between emerging channels (e-commerce, instant retail) and traditional distribution systems

- Economic Recovery Less Than Expected: If the macroeconomy continues to be weak in 2026, mass consumption capacity may be limited

- Extended Industry Adjustment Cycle: Experts believe that baijiu prices may not really stabilize until Q2 2026, and adjustment is still in the ‘bottoming’ stage [1]

- Exceeding Expected Degree of ‘Critical Juncture’ Period: If demand contraction reaches more than 50%, the hedge effect of the youth-oriented strategy may be weakened

- Trap of ‘Youth-oriented for Youth-oriented Sake’: Moutai emphasizes ‘cannot be youth-oriented for youth-oriented sake’; there are significant differences in demand levels among groups aged 18-25, 26-30, and 31-35 [3]

- Profitability of Innovative Categories: Business models of innovative businesses like ice cream, coffee, and craft beer are yet to be verified

- Brand Dilution Risk: Excessive cross-border may damage the brand premium capability of high-end baijiu

- Short-term (1-6 months): Stock price may be under pressure; it is recommended to pay attention to Spring Festival sales data and Q1 financial report in 2026

- Mid-term (6-12 months): If the youth-oriented strategy continues to be verified, it is expected to usher in a valuation repair market

- Long-term (1-3 years): After industry clearing, concentration will increase, and leading enterprises are expected to further expand market share

| Monitoring Dimension | Key Indicator | Ideal Threshold |

|---|---|---|

Product Structure |

Revenue share of products at 38° and below | >40% |

Channel Health |

Revenue growth rate of emerging channels | >20% |

Sales Situation |

Year-on-year growth rate of Spring Festival peak season | >10% |

Price System |

Stability of Guojiao 1573 wholesale price | Fluctuation <5% |

Market Share |

Change in market share in mid-to-high-end market | Increase by 1-2 percentage points |

- Pessimistic Scenario: Revenue declines by 20% in Q1 2026, and by 5-10% for the whole year; current valuation is reasonable, and stock price remains volatile

- Neutral Scenario: Revenue declines by 10-15% in Q1 2026, and remains flat or slightly grows for the whole year; valuation repairs to 15-16x PE

- Optimistic Scenario: Revenue remains flat or grows in Q1 2026, and grows by 5-10% for the whole year; valuation repairs to 18-20x PE, with 20-30% upside potential

Luzhou Laojiao’s youth-oriented strategy

- Deterministic Factors: First-mover advantage in low-alcoholization, rapid growth of emerging channels, strong financial strength

- Uncertain Factors: Length of industry adjustment cycle, macro recovery rhythm, intensified peer competition

- Expected Result: The performance decline in Q1 2026 may narrow to 10-15%, significantly better than the industry average of 30-40%

- Product Side: Accelerate the marketization of 28° and ultra-low alcohol products to seize the mindshare of young people’s ‘entry wine’

- Channel Side: Increase investment in instant retail, live-streaming e-commerce, and private domain traffic operation to cope with the shrinkage of traditional channels

- Brand Side: Deepen the positioning of ‘spiritual service’, build emotional connections with young people, and avoid marketing gimmicks

- Internationalization: The ‘global layout and standard output’ mentioned by management may provide a hedge against domestic growth pressure [1]

The transformation of the baijiu industry to the ‘personal consumption era’ is an

[0] Gilin API Data (Luzhou Laojiao stock price, financial indicators, company overview)

[1] China Merchants Food | Baijiu Annual Strategy - Sina Finance, December 25, 2025

https://finance.sina.com.cn/stock/stockzmt/2025-12-25/doc-inhcymnt3777920.shtml

[2] Scholar Foresees 2026 | Xiao Zhuqing: Where are the Opportunities in the Baijiu Adjustment Period? - Sina Finance, December 24, 2025

https://finance.sina.com.cn/roll/2025-12-24/doc-inhcwxmi9816676.shtml

[3] In 2026, Baijiu Enterprises Still Stuck in ‘Youth-oriented’ - Sina Finance, December 16, 2025

https://finance.sina.com.cn/jjxw/2025-12-16/doc-inhaywri8391372.shtml

[4] Luzhou Laojiao’s ‘Steady’ and ‘Practical’ Path: Building a Low-Alcohol Wine Matrix to Activate Gen Z Market

https://caifuhao.eastmoney.com/news/20251225084612997494440

[5] Luzhou Laojiao Receives Research from 28 Institutions Including CICC: Focus on Ecological Chain Strategy in ‘15th Five-Year Plan’

https://finance.sina.com.cn/stock/aigc/jgdy/2025-12-26/doc-inhecwez7827273.shtml

[6] Luzhou Laojiao’s 38° Guojiao 1573 Makes a New Appearance, Anchoring the Development Model of Low-Alcohol Baijiu

https://www.163.com/dy/article/KHKB0H0K0553ANUE.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.