Deep Analysis of Fund Portfolio Strategy: Cycle Reversal, Sector Momentum Rotation, and Assessment of 2026 Investment Themes

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

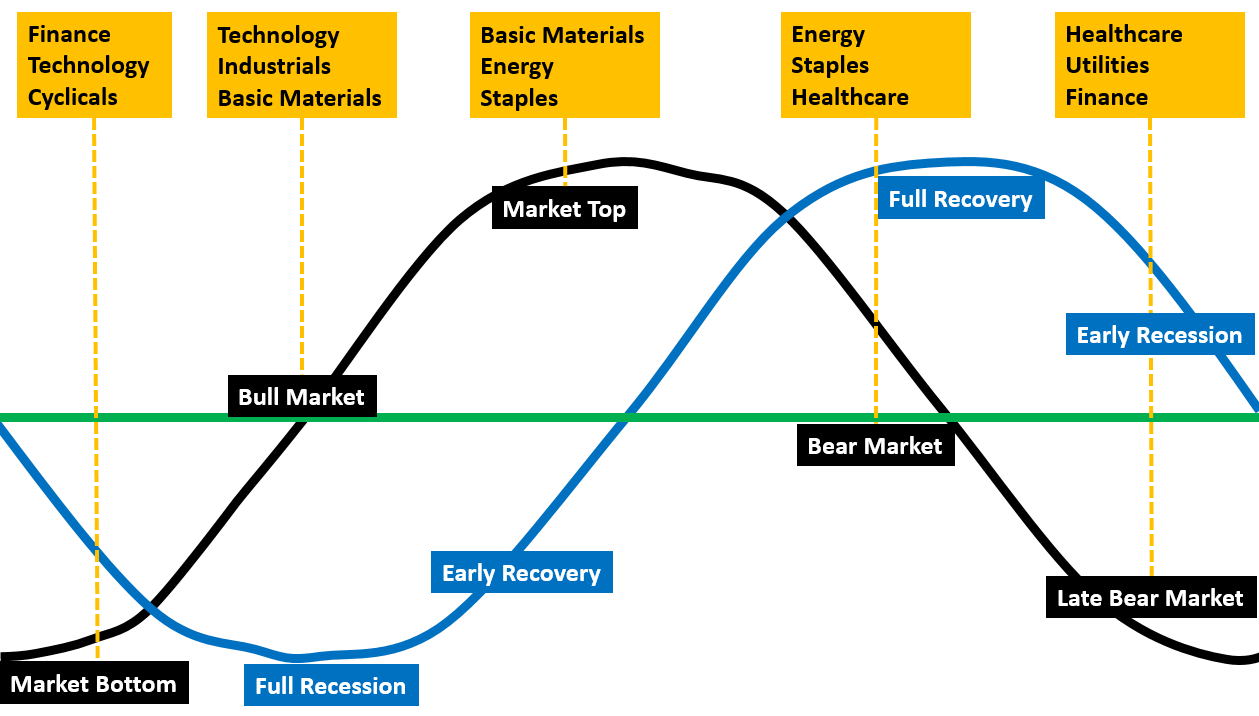

The essence of the cycle reversal strategy lies in grasping the critical inflection point of supply-demand patterns, and in the process of an industry evolving from excessive competition to supply-demand balance, early deployment of sectors with supply clearance and profit recovery [1].

- Scale judgment: Whether the policy prioritizes support, whether the industry contributes to GDP, whether it has strong thematic innovation

- Cycle position judgment: Whether the industry is in a demand release period or policy tightening period, demand accumulation period or policy easing period

- Target judgment: Company dynamics, valuation level, performance expectation gap

According to the brokerage research framework, the cycle reversal strategy usually follows the following path:

- Phase A (demand release + policy tightening): Prices rise but supply has not yet followed, the best equity investment interval

- Phase B (demand accumulation + policy tightening): Risk of supply-demand imbalance increases

- Phase C (demand accumulation + policy easing): Bond allocation is better than stocks [1]

The 2025 market showed clear momentum rotation characteristics, mainly including:

- Precious metals such as gold: Driven by geopolitical factors + inflation expectations, the annual increase exceeded 70%, hitting a record high [2]

- Non-ferrous metals such as rare earths: Benefiting from supply constraints of the “anti-involution” policy, supply-demand pattern improved [1]

- Travel chain such as aviation: Hard supply constraints (limited aircraft introduction) + demand recovery promoted supply-demand gap reversal [3]

-

Strengthened supply-side constraints

- “Anti-involution” policy promotes capacity clearance, with 20% of supply in sub-sectors such as photovoltaics and lithium batteries cleared [1]

- Aircraft supply chain issues lead to actual capacity growth in the aviation industry continuing to be lower than planned, limiting effective capacity growth [3]

-

Optimized demand-side structure

- High-end consumption shows a “K-shaped recovery”, and the wealth effect is transmitted to sectors such as duty-free, luxury goods, and gaming [3]

- Manufacturing going overseas becomes a new growth pole, and the proportion of overseas revenue of A-share companies hits a record high [1]

-

Focused policy-side support

- Under the expectation of CPI recovery, service industry policies are intensified to support service consumption [4]

- PPI is expected to turn positive in the middle of the year (from -2.7% in 2025 to -0.3% in 2026), opening up valuation repair space for cyclical sectors [4]

- Driving logic: Rising geopolitical risks + continuous gold purchase by global central banks + expectation of dollar weakness

- Market verification: Spot gold rose more than 70% for the year, hitting a record high; Hong Kong stock gold stocks China Gold International surged more than 300%, Shandong Gold and Zhaojin Mining rose nearly 200% [2]

- Strategy key points: Grasped the safe-haven asset bull market under macro uncertainty, gold became the “hard currency consensus in the uncertain era” [2]

- Driving logic: Tariff policy adjustment + anti-involution policy expectation + supply-demand pattern improvement

- Market verification: Raw material sector rose nearly 160% in Hong Kong stocks for the year, non-ferrous metals performed prominently [2]

- Strategy key points: Switched from trade friction benefit theme to domestic demand policy support sector

- Driving logic: Fed interest rate cut expectation + global liquidity inflection point approaching

- Strategy key points: Grasped the second opportunity of precious metals under the expectation of liquidity easing

- Driving logic: Supply-demand gap reversal + ticket price stabilization and recovery + wealth effect transmission

- Market verification: The aviation industry ushered in a supply-demand gap reversal in 2025, different from the previous mainly driven by high-growth demand, it entered a new cycle where supply plays an important role [3]

- Strategy key points: Early deployment of cyclical bottom reversal sectors

-敏锐 grasp of macro variables such as dollar strength, Fed policy, geopolitical situation

- Flexible switching between hard currencies like gold and rare earths and cyclical sectors

- Deep understanding of the dual drive of “hard supply constraints + demand recovery” in the aviation industry

- Identified opportunities for revaluation of high-quality capacity under anti-involution policies

- Dare to hold heavy positions in a single sector at key moments to achieve alpha returns from concentrated positions

- Avoided mediocre returns caused by diversified positions

According to macro research institutions’ forecasts, China’s inflation in 2026 will show the following characteristics:

| Indicator | 2025E | 2026E | Change | Driving Factors |

|---|---|---|---|---|

| CPI | 0.0% | +0.7% | +0.7% | Tail-raising factor turns positive, service consumption policy intensified |

| Core CPI | 0.6% | +0.4% (new price increase factor) | - | Service pull increases, commodity pull weakens |

| PPI | -2.7% | -0.3% | +2.4% | Tail-raising drag weakens, non-ferrous metal price rise, anti-involution policy |

| GDP Deflator | -0.9% | 0% | +0.9% | Nominal GDP returns to real GDP [4] |

- 2026 is an inflection point year when inflation returns from the negative range to the positive range, but the recovery is mild

- Core CPI will show the characteristics of “core commodity pull weakening, service pull increasing” [4]

- PPI is expected to turn positive around the middle of the year, with a “rising first then stable” trend [4]

According to the macro strategy report, the policy focus will accelerate to tilt towards service consumption in 2026, mainly based on:

- Hedging the overdraft effect of durable goods consumption

- Leading by the “15th Five-Year Plan” goal of “significantly increasing the resident consumption rate” [4]

- Macro policies systematically tilt towards boosting consumption

High-end consumption in 2025 has shown “K-shaped recovery” characteristics:

- Capital market wealth effect: Rising stock and gold prices drive consumption willingness of high-net-worth groups

- Benefited sectors: Outbound tourism, hotels, gaming, duty-free, luxury goods, high-end beauty care, high-end real estate properties [3]

- Empirical case: Off-island duty-free sales turned positive year-on-year from September to November with an expanding growth rate, and the trend of stabilization and recovery was established [3]

| Sub-track | Core Logic | Catalyst | Elasticity Ranking |

|---|---|---|---|

| Aviation/Airport | Hard supply constraint + supply-demand gap reversal + ticket price elasticity | Three major airlines achieved annual profit for the first time after the pandemic in 2025 | ★★★★★ |

| Duty-free/Retail | Hainan closure + expansion of departure tax refund + wealth effect | Hainan closed operation in December 2025 | ★★★★ |

| Hotel/Tourism | Scarcity of high-end supply + peak season elasticity | Service consumption policy intensified | ★★★★ |

| Education/Medical | Demographic structure change + consumption upgrade | Improvement of residents’ “employment-income” cycle | ★★★ |

According to the industry in-depth report, the aviation industry ushered in a new cycle starting point in 2025:

- Hard supply constraints continue: Aircraft introduction delay, long engine maintenance cycle, shortage of aviation materials, limiting actual capacity growth [3]

- Demand structure optimization: Revenue of international long-haul routes has been comparable to domestic routes, diluting unit costs [3]

- Industry self-discipline formed: Airlines began to pay attention to ticket prices and revenue management, promoting the conversion of high load factors into ticket price elasticity [3]

- Performance elasticity release: The aviation RPK growth rate is expected to be 6.2%-7.75% from 2025 to 2029 (1.55 times elasticity of GDP growth rate of 4-5%) [3]

With the increasing expectation of PPI turning positive in the middle of the year, the following sectors are expected to benefit:

- Non-ferrous metals (copper, aluminum, lithium, etc.): Anti-involution policy supply constraints + new energy demand [1]

- Basic chemicals: Supply clearance + demand repair, with Alpha logic [1]

- Midstream manufacturing: Sub-sectors with 20% supply clearance in photovoltaics, lithium batteries, and mechanical equipment [1]

| Field | Source of Price Elasticity | Related Sectors |

|---|---|---|

| Agricultural Products | Bottom recovery of pig cycle, repair of CPI food items | Pig breeding, feed |

| Energy | Oil price stabilization and recovery | Petrochemical |

| Service | Pull of core CPI service items | Tourism, education, medical |

- Banks: Interest margin pressure relief + asset quality improvement

- Insurance: Investment yield increase + equity assets benefit

- Real estate: Housing price stabilization + sales recovery expectation

According to the brokerage strategy report, the “anti-involution” theme will move from policy expectation to performance verification in 2026:

- Core logic: China’s manufacturing industry transforms from cost advantage to technology and supply chain advantage

- Key directions: Construction machinery, power equipment, home appliances, chemicals, medical devices [1]

- Valuation reassessment space: The profitability of overseas enterprises is significantly better than the full caliber, with a basis for valuation reassessment [1]

- Photovoltaics, lithium batteries: Sub-sectors with 20% supply clearance, cyclical rebound in profitability [1]

- Industrial metals: First-mover advantage of high-quality resources, asset reassessment of leading enterprises [1]

- Domestic computing power chain: Has late-mover advantage under the background of independent control [1]

- Semiconductor equipment: Domestic substitution acceleration

Based on the successful experience in 2025 and macro judgment for 2026, the following portfolio framework is recommended:

| Theme | Allocation Weight | Core Sectors | Allocation Rhythm |

|---|---|---|---|

| Service Consumption | 40% | Aviation, duty-free, hotels, high-end retail | Key in the first half of the year, verified by Spring Festival travel data |

| CPI Recovery | 30% | Non-ferrous metals, basic chemicals, agricultural products | Strengthened around the middle of the year when PPI turns positive |

| Anti-involution Assets | 30% | Overseas manufacturing, high-quality capacity, independent control | Held throughout the year, performance verification period |

- Core observation: Spring Festival travel data, aviation ticket prices, duty-free sales

- Operation focus: If data verification is strong, increase positions in aviation travel chain; If not as expected, retain cash and wait for the CPI theme

- Core observation: PPI month-on-month trend, non-ferrous metal prices, policy implementation

- Operation focus: PPI turning positive expectation promotes pro-cyclical asset performance, increase positions in industrial metals and basic chemicals

- Core observation: Mid-year report performance, overseas orders, capacity utilization rate

- Operation focus: Shift from expectation game to performance realization, select real growth targets

- Core observation: 2027 policy expectation, valuation switch

- Operation focus: Cash out gains at high positions, layout next year’s themes

- The upper limit of single sector allocation does not exceed 40%

- Maintain dynamic balance between the three major themes to avoid excessive exposure to single risk

- Growth and value matching: Service consumption is growth-oriented, CPI theme is value-oriented

- Domestic and overseas matching: Overseas enterprises provide external demand hedging

- Retain 10-15% cash position to deal with black swan events

- Flexible position adjustment at key inflection points (such as PPI turning positive, performance disclosure period)

| Risk Type | Specific Risk | Impact Degree | Probability |

|---|---|---|---|

| Macro Risk | Fed interest rate cut less than expected, dollar strengthening | ★★★★ | ★★★ |

| Policy Risk | Anti-involution policy implementation intensity less than expected | ★★★ | ★★★★ |

| Demand Risk | Slow improvement of residents’ “employment-income” cycle | ★★★★ | ★★ |

| Supply Risk | Aircraft delivery exceeding expectation, photovoltaics capacity clearance delay | ★★★ | ★★★ |

| Valuation Risk | Sector overdraws expectation in advance | ★★★★ | ★★★ |

- If the dollar strengthens beyond expectation: Reduce positions in gold and non-ferrous metals, increase allocation to defensive sectors (public utilities, essential consumption)

- If domestic recovery is less than expected: Reduce pro-cyclical positions, increase cash and bond-like assets

- Closely track the details of the “anti-involution” policy, avoid gaming sectors without policy support

- Prioritize areas with strong policy certainty (such as military industry, national strategic resources)

- Focus on high-net-worth group consumption (upper part of K-shaped recovery), reduce dependence on mass consumption

- Focus on sub-sectors supported by policy subsidies

- Accurate grasp of supply-demand gap inflection point (such as aviation supply-demand gap reversal in 2025)

- Early identification of hard supply constraints (such as gold scarcity, aviation capacity constraints)

- Effective combination of macro drivers and industry prosperity

- Service consumption: Strongest certainty (policy support + supply constraints + wealth effect), but valuation is not cheap

- CPI recovery: Largest elasticity (valuation repair space brought by PPI turning positive), but needs to verify demand cooperation

- Maintain in-depth research on supply-demand patterns

- Balance between certainty (service consumption) and elasticity (CPI theme)

- Avoid chasing high prices, focus on left-side layout

- Over-allocate travel chain such as aviation and duty-free

- Low-suction pro-cyclical sectors such as non-ferrous metals and basic chemicals

- With the verification of PPI turning positive, increase the weight of the CPI theme

- Pay attention to the performance realization opportunities of anti-involution assets

- Set stop-profit and stop-loss positions for single sectors (such as ±20%)

- Flexible position adjustment at key data verification points (Spring Festival travel, PPI, mid-year report)

- Maintain 10-15% cash position to deal with uncertainty

- Combine top-down and bottom-up approaches to build a three-in-one stock selection system of supply-demand, valuation, and policy

- Establish a quantitative tracking system for industry prosperity to improve inflection point identification accuracy

- Establish multi-dimensional risk monitoring such as industry concentration, style exposure, and regional diversification

- Formulate stress test plans to simulate portfolio performance under extreme market environments

- Obtain alpha from cycle rotation, expand to individual stock selection and cross-market allocation

- Explore derivative hedging tools to reduce portfolio volatility

[1] Cycle relay, slow bull to full bull… How will A-shares go in 2026? Ten major brokerage strategies are here - Wall Street News (https://wallstreetcn.com/articles/3761418)

[2] Year-end review | Golden moments of 2025 - Sina Finance (https://finance.sina.com.cn/money/nmetal/hjzx/2025-12-26/doc-inhecmri2630649.shtml)

[3] High-end consumption recovery: Weak reality under strong expectation - Finding certainty in differentiation - Sina Finance (https://finance.sina.com.cn/stock/stockzmt/2025-12-17/doc-inhcaekt7774179.shtml)

[4] Moving towards new balance - 2026 annual macro strategy outlook (fundamentals) - Sina Finance (https://finance.sina.com.cn/stock/marketresearch/2025-12-22/doc-inhcsexf4554863.shtml)

[0] Jinling API data (market index, sector performance, industry analysis, etc.)

This analysis is based on public information and market data and does not constitute investment advice. Actual investment should be combined with personal risk tolerance and investment objectives.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.