In-depth Analysis of Seres (601127) 'After Adversity Comes Prosperity' Logic

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

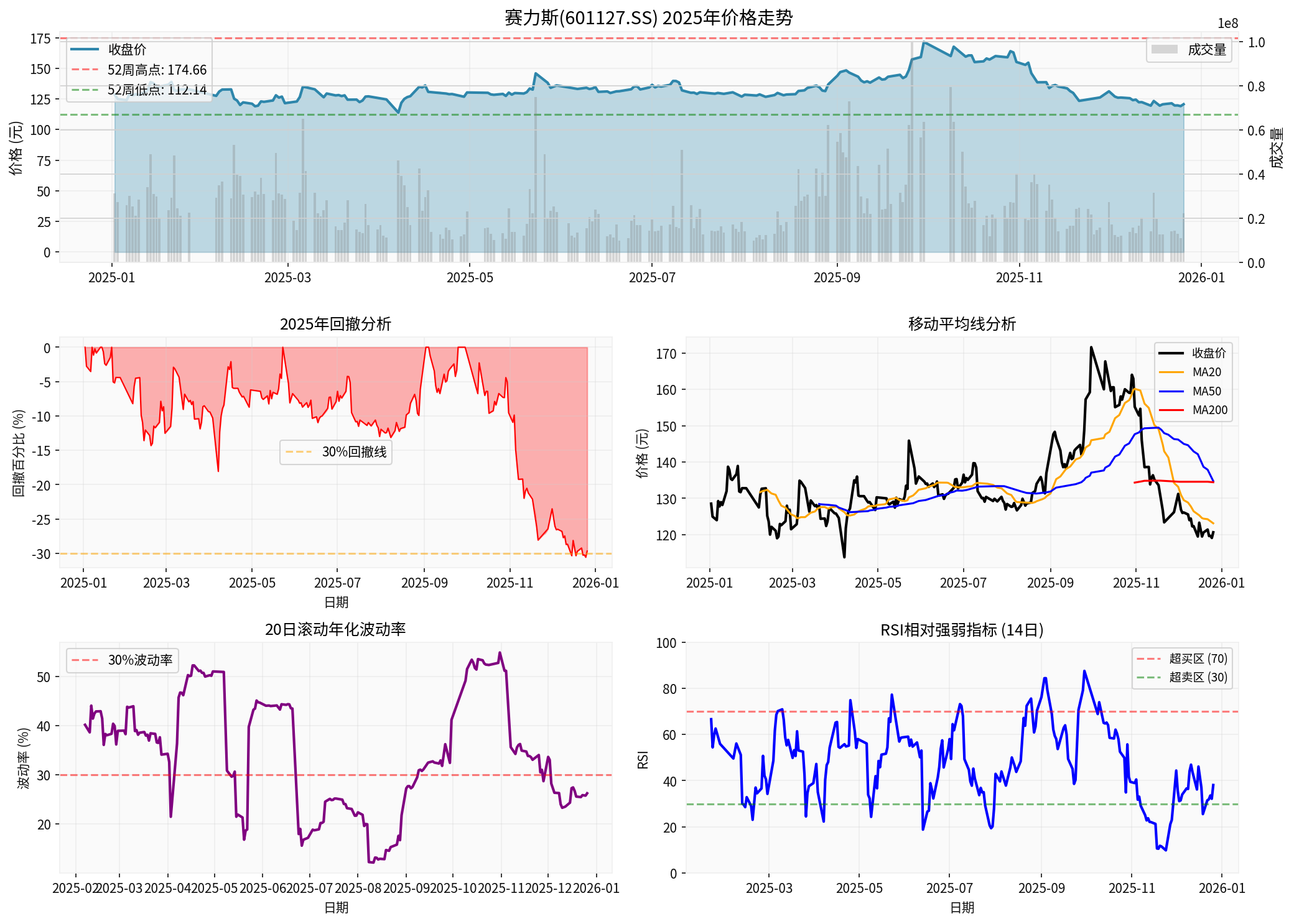

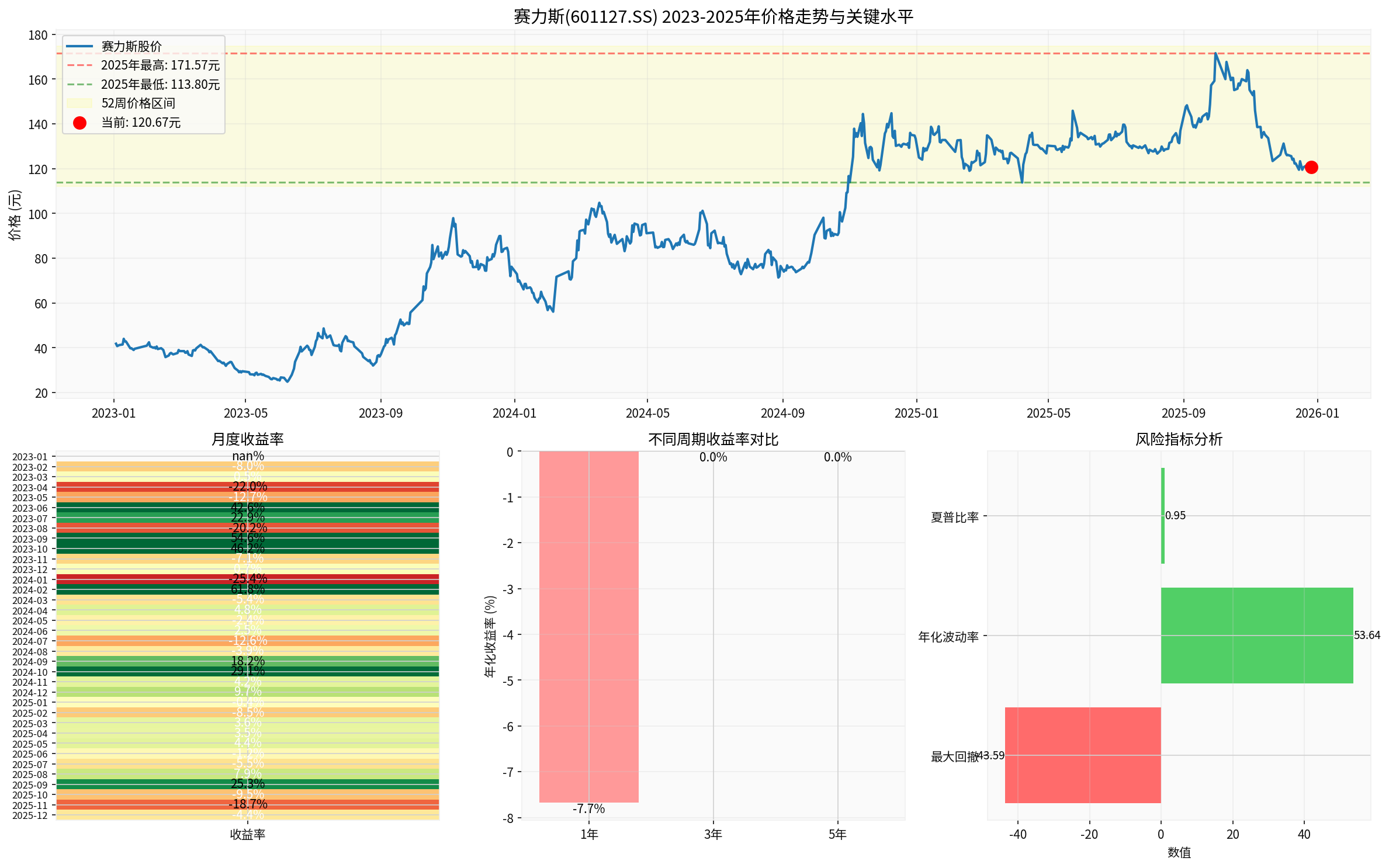

Based on the latest market data and financial analysis, Seres has indeed undergone a significant correction (down nearly 30% from its 2025 high) [0], but the 2025 performance expectations of ‘250 billion yuan in revenue and 12.5 billion yuan in net profit’ proposed in the article are

According to trading data, Seres’ current price is 120.67 yuan, with a

Chart shows: Seres experienced剧烈 fluctuations from high to low in 2025, and is currently in a sideways consolidation phase with support around 119 yuan and resistance around 123 yuan [0].

Technical indicators show that Seres is in a

- Support level: 119.15 yuan

- Resistance level: 123.14 yuan

- MACD: Bullish but no crossover formed

- KDJ: Bearish (K:22.8, D:23.9, J:20.5) [0]

- Beta coefficient: 0.94, slightly lower than market volatility

This is consistent with the “converging triangle” pattern mentioned in the article; the stock price is oscillating within a narrow range, waiting for a directional breakout.

Long-term data shows: Seres has a 3-year gain of 174.25% and a 5-year gain of 625.62% [0], but is accompanied by extremely high volatility (annualized volatility of 53.64%) and a maximum drawdown of -43.59% [0].

The third quarter of 2025 (latest financial report) shows:

- Revenue: 48.13 billion yuan,74.70% better than expected(expected 27.55 billion yuan) [0]

- EPS: 1.45 yuan,9230.76% better than expected(expected 0.02 yuan) [0]

- Significant year-on-year growth, but partially due to the low base effect in the same period last year (Q1 2025 still had a loss of 0.34 yuan per share) [0]

- Latest quarterly revenue (Q3 2025): 48.13 billion yuan

- Full-year estimate based on Q3: 48.13 ×4 =192.5 billion yuan

- Target revenue in the article: 250 billion yuan

- Gap: 57.5 billion yuan (requires Q4 year-on-year growth of219.4%)

Based on the current net profit margin of 4.84% [0]:

- Revenue of 192.5 billion yuan→ Net profit of about9.3 billion yuan

- To achieve 12.5 billion yuan net profit→ Need net profit margin to rise to6.5%, or revenue to reach258.3 billion yuan

Considering Seres is in a period of fierce price competition and R&D investment, it is

- ROE (Return on Equity): 32.11% -Very excellent[0]

- Net profit margin: 4.84% - Reasonable level [0]

- Operating profit margin:4.96% [0]

⚠️

- Current ratio:0.91 (below the 1.0 safety line)

- Quick ratio:0.87 (below the 1.0)

- Debt risk level: High risk

This indicates that Seres faces

- P/E (Price-to-Earnings ratio):27.30x [0]

- P/B (Price-to-Book ratio):7.09x [0]

- P/S (Price-to-Sales ratio):1.32x [0]

- Market capitalization:197.1 billion yuan [0]

For growth-oriented new energy vehicle enterprises, the current valuation is in a

The new products mentioned in the article (M6, M9L, M9 high-end customized version, etc.) are indeed potential growth points:

- Aito M9: Flagship product in the high-end market, has achieved success

- New product iteration: Helps improve brand premium and gross profit margin

The plans for factories in Indonesia, Mexico, and Hungary (to start production in 2026-2027) are correct strategic layouts, but:

- Hard to contribute revenue in 2025(factories are still under construction/ramp-up phase)

- Capital expenditure pressure: Overseas factory construction requires large capital investment

- Geopolitical risk: Uncertainty in EU and US policies towards Chinese electric vehicles

- L3 autonomous driving progress: Deep cooperation with Huawei, has technical advantages

- New businesses like robots: Long-term valuation enhancement factors

These businesses

Currently, the

- Intensified price competition: Leading companies like BYD and Tesla continue to cut prices

- Policy withdrawal expectations: Subsidy policies are gradually exiting

- Slowing demand growth: Growth naturally slows after penetration rate increases

- ✅ Valuation has corrected significantly: Down 30% from the high, risk partially released

- ✅ Performance better than expected: Q3 performance is outstanding, proving profitability

- ✅ Long-term growth logic: Huawei cooperation, new products, overseas expansion still hold

- ❌ Short-term performance targets are overly optimistic: 250 billion yuan revenue/12.5 billion yuan net profithard to achieve

Based on data analysis,

- Sales volume:500,000-550,000 units (instead of 650,000 units)

- Revenue:180-200 billion yuan (instead of 250 billion yuan)

- Net profit:8-10 billion yuan (instead of12.5 billion yuan)

- Strategy: Wait-and-see mainly, wait for directional breakout

- Key prices: Stop loss if it breaks below 112 yuan; consider adding positions if it breaks above125 yuan with volume

- Risk tips: Liquidity pressure, industry price war, overseas policy risk

- Strategy: Phased positioning, focus on new product progress and Q4 performance

- Catalysts: Aito M9 sales exceed expectations, overseas factory progress, L3 autonomous driving launch

- Target price: Based on reasonable valuation (30x PE), target price140-150 yuan

- Suitable for investors with strong risk tolerance

- Recommended position control within 10-15%of total funds

[0] Gilin API Data (Real-time quotes, financial data, technical analysis, Python calculation analysis)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.