Analysis of Investment Opportunities in the Agricultural Technology Track and Cross-border Advantages of Automotive Teams

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

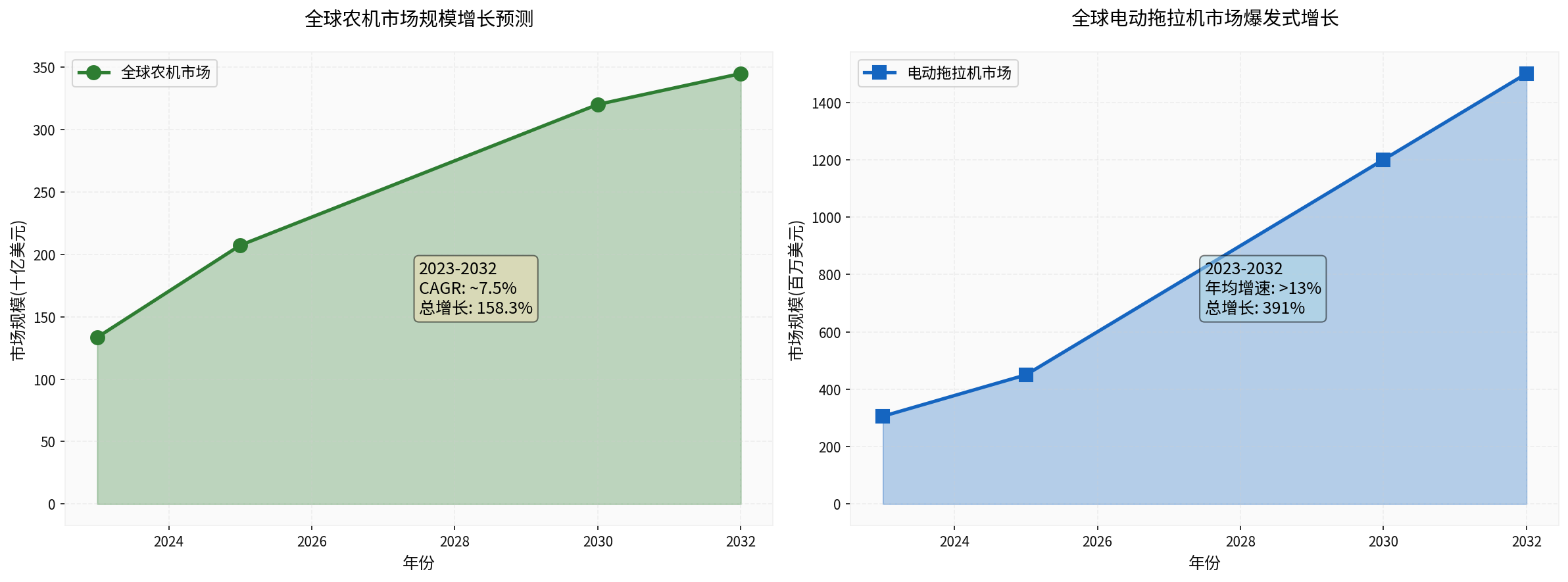

The global agricultural machinery market is in a period of rapid growth. According to the latest market research data:

- Global agricultural machinery market: 2024 market size is 133.46 billion USD, expected to reach 207.21 billion USD in 2025, and grow to 344.73 billion USD by 2032, with a compound annual growth rate (CAGR) of7.5%[1]

- Global tractor market: From 60.08 billion USD in 2024 to 88.95 billion USD in 2030, CAGR of6.5%[2]

- Electric tractor market: 2023 market size is 305.8 million USD, expected to achieve an annual growth rate of over13%by 2032 [3]

China’s agricultural machinery market was about 55 billion USD in 2024, being the world’s largest single market. The Asia-Pacific region accounts for 45.81% of the global agricultural machinery market share, with China as the main growth engine [2][3]. The Chinese government strongly promotes agricultural modernization and mechanization, providing policy dividends for industry development.

As can be seen from the chart, both the global agricultural machinery market and the electric tractor market show strong growth trends, with the growth rate of the electric tractor market significantly higher than that of the traditional agricultural machinery market, showing stronger investment attraction.

- Globally, agricultural labor continues to decrease, and the younger generation has lower willingness to engage in farming

- China’s rural labor force is transferring to cities, making agricultural mechanization an inevitable choice

- Automated agricultural machinery can significantly reduce dependence on labor and improve operation efficiency [4]

- Under the carbon neutrality goal, traditional diesel agricultural machinery faces emission pressure

- Electric tractors have advantages of zero emissions, low noise, and low operation costs

- Many governments provide subsidies and tax incentives for agricultural machinery electrification

- AI, 5G, and IoT technologies are deeply integrated with agriculture

- Demand for precision agriculture drives the popularization of intelligent agricultural machinery

- Data-driven agricultural management becomes a new trend [5]

- High-value agricultural scenarios such as orchards, greenhouses, and pastures, which Xizhong Zhizao focuses on, have huge market space

- 60% of China’s orchards are located in hilly and mountainous areas, with long-term lag in mechanization level and an industrial dilemma of ‘no available machinery’ [4]

- There is an urgent demand for small-scale and intelligent agricultural machinery equipment

- Operation robots, inspection robots, and picking robots form a collaborative matrix

- Edge-side agricultural AI models realize precise decision-making and autonomous operation

- 7×24-hour unmanned operation capability significantly improves efficiency [5]

Automotive teams have

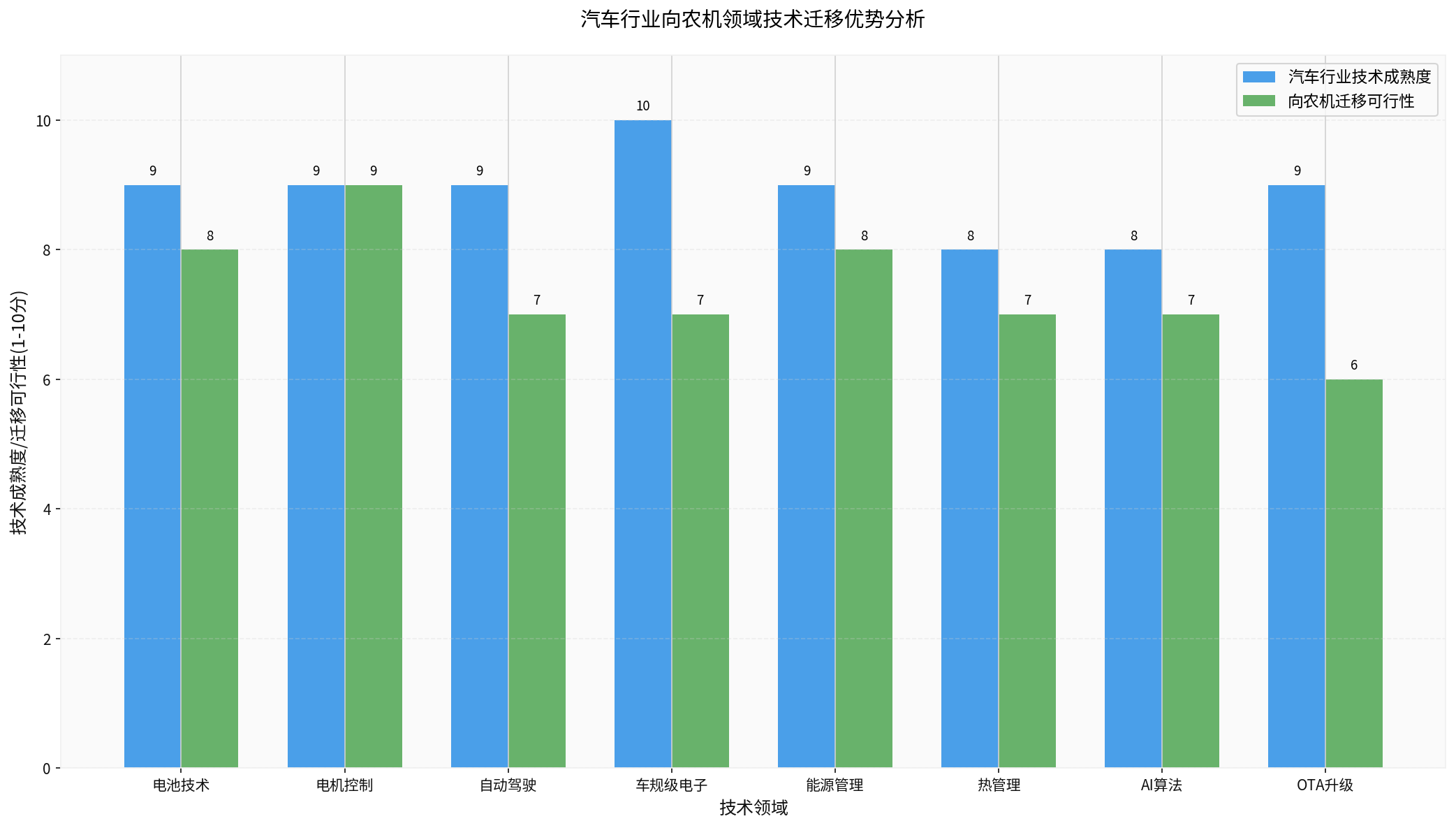

As can be seen from the chart, the maturity of the automotive industry in battery technology, motor control, autonomous driving, and other fields is generally 8-10 points, and the transfer feasibility score to the agricultural machinery field also reaches 7-9 points, indicating that most technologies can be effectively transferred.

-

Three electric systems (battery, motor, electronic control)

- The battery management system (BMS) of electric vehicles can be directly applied to electric agricultural machinery

- Permanent magnet synchronous motor control algorithms realize efficient power output

- Vehicle-grade power electronic devices meet the high reliability requirements of agricultural machinery

-

Autonomous driving technology

- Autonomous driving algorithms from Volvo, Jidu, and NIO can be transferred to agricultural machinery scenarios

- Perception systems such as lidar, millimeter-wave radar, and cameras are adapted to agricultural environments

- High-precision path planning and decision-making algorithms support unmanned operation

-

Intelligentization and vehicle-grade electronics

- Vehicle-grade chips and controllers meet the harsh working conditions of agricultural machinery

- OTA remote upgrade capability realizes software-defined agricultural machinery

- Digital cockpit and human-computer interaction experience can be reused

-

Thermal management and energy management

- Electric vehicle thermal management technology ensures stable operation of the battery system

- Energy recovery technology improves the endurance of agricultural machinery

- Intelligent power management system optimizes energy consumption

- John Deere: A global agricultural machinery giant transforming into a technology company, its See & Spray Ultra system realizes centimeter-level precision targeted spraying, reducing herbicide usage by two-thirds [5]

- Kubota: A king in paddy field agricultural mechanization, the latest generation of unmanned transplanters and harvesters integrate Beidou navigation and agronomic knowledge [5]

- Weichai Lovol: The 340-horsepower CVT intelligent tractor is priced at nearly 2 million yuan, equipped with unmanned driving and intelligent electronic control hydraulic systems, with overseas sales exceeding 1.3 billion yuan in 2024 [6]

- Fengjiang Intelligence: Provides autonomous driving modification kits for existing agricultural machinery, deploying quickly with high cost performance and achieving success in the European market [5]

- Both agricultural machinery and automobiles belong to heavy machinery, with similarities in structural design, manufacturing processes, and quality control

- Electrification platforms are universal, and battery, motor, and electronic control systems can be directly reused

- Software-defined development mode allows algorithms to quickly adapt to new scenarios

- ET11 platform: 30kW small multi-functional electric intelligent tractor, filling market gaps

- Edge-side AI model: Agricultural-grade autonomous driving capability, able to cope with complex orchard scenarios

- High-value scenario focus: Avoiding the red ocean of large fields, focusing on segmented markets such as orchards and greenhouses

- Automotive genes: The team comes from leading car companies such as Volvo, Jidu, Volkswagen, and NIO

- Cross-border capability: The combination of automotive engineering experience and agricultural scenario cognition is scarce

- Productization capability: Strict quality control system from the automotive industry is transferred to agricultural machinery products

- Q1 2026 testing: Planned time is ahead of most competitors

- Pre-A round financing of tens of millions of yuan: Recognized by the capital market

- Scenario definition capability: Early entry into high-value scenarios, accumulating data and experience

-

Technology transfer window period

- Traditional agricultural machinery manufacturers are slow in electrification transformation

- There are few cases of automotive teams entering agricultural machinery, and the competitive pattern is relatively loose

- Brand awareness and technical barriers can be quickly established

-

Policy dividend period

- China’s ‘14th Five-Year Plan’ clearly states ‘accelerate the development of intelligent agricultural machinery equipment’ [4]

- Local governments have subsidy policies for agricultural science and technology innovation

- Carbon neutrality goal promotes agricultural machinery electrification process

-

Data accumulation and model iteration

- Agricultural scenario data accumulation forms AI model advantages

- Continuous iteration and optimization of autonomous driving algorithms

- Deep integration of agronomic knowledge base

-

Ecosystem construction

- Smart agricultural management platform + SaaS services

- Connection with agricultural materials and agricultural product sales channels

- Formation of integrated solutions of hardware + software + services

-

Scale effect and cost advantage

- Automotive supply chain system reduces procurement costs

- Modular design realizes rapid product iteration

- Brand influence improves bargaining power

- Farmer acceptance: Traditional farmers need time to accept new technologies, and education costs are high

- Price sensitivity: Agricultural machinery has high price sensitivity, and high-cost technologies are difficult to popularize quickly

- Cyclical demand: Agriculture is affected by seasonality and economic cycles, leading to large demand fluctuations

- Scenario complexity: Agricultural scenarios are more complex than urban roads, and factors such as mud, rain, and crop遮挡 increase technical difficulty

- Reliability requirements: Agricultural machinery works in harsh environments, requiring extremely high product reliability

- Technology iteration: Continuous large R&D investment is needed to maintain technical leadership

- Traditional agricultural machinery giants: John Deere, Kubota and other giants accelerate electrification transformation

- Cross-border competitors: Other automotive enterprises and technology companies may enter

- Domestic competitors: Traditional agricultural machinery enterprises such as Weichai Lovol and Yituo Co., Ltd. are also intelligentizing

- Market size: The global agricultural machinery market will reach 344.7 billion USD by 2032, with huge space [1]

- Growth rate: Electric tractors have an annual growth rate of over 25%, far exceeding traditional agricultural machinery [3]

- Technology dividend: Window period for automotive technology transfer to agricultural machinery, with first-mover advantages

- Policy support: Dual-drive of agricultural modernization and carbon neutrality

- Technology-leading type: Teams with core technologies such as autonomous driving and AI algorithms

- Scenario-focused type: Companies deeply engaged in high-value segmented markets (such as orchards, greenhouses)

- Automotive gene type: Teams from leading car companies with complete automotive R&D experience

- Ecosystem-building type: Not only providing hardware but also building smart agricultural ecosystems

- ✅ Team from leading car companies such as Volvo and NIO, with strong technical strength

- ✅ Focus on high-value scenarios such as orchards, with clear market positioning

- ✅ ET11 product has moderate power (30kW), in line with small-scale and intelligent trends

- ✅ Has obtained tens of millions of yuan in financing, recognized by the capital market

- ⚠️ Testing will start in Q1 2026, commercialization time is relatively late

- ⚠️ Need to prove reliability and economy in agricultural scenarios

- ⚠️ Face competitive pressure from traditional agricultural machinery giants such as Weichai Lovol

- ⚠️ Need to establish a sound after-sales service system

- Next 1 year: Pay attention to the company’s Q1 2026 test results to verify technical feasibility

- 2-3 years: Observe market acceptance and mass production capacity to confirm that the business model is running smoothly

- 3-5 years:介入 during the large-scale expansion stage to enjoy the industry explosion dividend

The agricultural technology track is迎来 a

Innovative companies like Xizhong Zhizao, relying on strict engineering standards from the automotive industry and in-depth understanding of agricultural scenarios, are expected to establish sustainable competitive advantages in the

[0] Jinling API Data - Deere & Company (DE), CNH Industrial, Zoomlion Heavy Industry Science & Technology Co., Ltd. (000157.SZ) stock price and market value data

[1] Fortune Business Insights - “Agricultural Equipment Market Size, Share | Outlook Report, 2032” (https://www.fortunebusinessinsights.com/zh/agriculture-equipment-market-102665)

[2] Fortune Business Insights - “Agricultural Tractor Market Size, Share | Global Report [2030]” (https://www.fortunebusinessinsights.com/zh/agriculture-tractor-market-106971)

[3] Global Market Insights - “Electric Tractor Market 2024-2032” (electric tractor market data)

[4] China Daily - “Building AI Smart Agricultural Systems to Help Rural Industrial Revitalization and Sustainable Development” (https://tech.chinadaily.com.cn/a/202512/18/WS6943beeda310942cc49975fb.html)

[5] Tencent News - “Who Will Solve the Problems of Operation, Inspection, and Picking? 2025 Agricultural Robot Brand First Choice Recommendation Guide” (https://news.qq.com/rain/a/20251223A04CD800)

[6] China Daily - “An Upgrade Sample of an Industrial Province” - Weichai Lovol Intelligent Tractor Case (http://cn.chinadaily.com.cn/a/202512/26/WS694e8caea310942cc4998db5.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.